Homebuyers shopping for new homes can be excited about getting their proposed monthly mortgage payment in seconds with complete accuracy using the South Carolina Mortgage Calculator with PITI, PMI, MIP, and HOA powered by Gustan Cho Associates. The housing market in South Carolina is booming despite the skyrocketing inflation numbers and surging mortgage rates. Mortgage rates in South Carolina have skyrocketed from a low of 2.375% before Joe Biden got elected to a record high in recent years of 7.25%.

- Conv

- FHA

- VA

- Jum/Non

- USDA

Even with the incompetency of the Biden administration in crashing the economy, the South Carolina housing market seems stronger than ever. Demand for homes still remains strong with still low housing inventory throughout all counties of the state. In the following paragraphs, we will cover the South Carolina mortgage calculator.

South Carolina Housing Market Booming Despite Uncertainty in the Economy

Inflation has been the highest in 40 years. Unemployment numbers are beginning to drop at a fast pace. Despite all of the doom and gloom economic news, it is not making a dent in the South Carolina housing market. People need to live. John Strange, a senior loan officer and an associate contributing editor at GCA Forums News, says the following about the South Carolina housing market.

Rent prices in South Carolina are surging to ten-year highs. Renters are deciding that buying a home makes more sense than renting and are hitting the pavement to get pre-approved.

The South Carolina Mortgage Calculator will give you a more accurate mortgage payment than any other online mortgage approval calculator. We will explain why. We will also show you why you will get the most accurate mortgage payment using the South Carolina Mortgage Calculator powered by Gustan Cho Associates more than any other mortgage calculator in the nation.

Low Down Payment? First-Time Buyer? Explore Your Best Mortgage Options in South Carolina

Apply Online And Get recommendations From Loan Experts

Are Online Mortgage Calculators Accurate?

The team at Gustan Cho Associates launched the South Carolina Mortgage Calculator because there was not a single online mortgage calculator that was accurate. Not a single online mortgage approval calculator ever came close to being accurate on a housing payment based on a certain loan amount. Most online mortgage calculators only gave you principal and interest. Margarett Jurilla, the executive assistant at Gustan Cho Associates, says the following about the South Carolina mortgage calculator:

These online mortgage calculators had no regard for the type of loan program but did not include the PMI, MIP, VA funding fee, the property taxes, and homeowners insurance component of the mortgage payment, and total disregard for the homeowners association dues (HOA dues).

What good is a mortgage calculator when it only gives you the principal and interest and you need to do the other calculations manually? Why not just do everything manually? Mortgage calculators are not toys. They are tools to simplify the calculations of your monthly mortgage payment and debt-to-income ratio during the home shopping process. Once you see how the South Carolina mortgage calculator works, you will realize why the South Carolina mortgage calculator is different than the competition.

How To Use The South Carolina Mortgage Calculator

The South Carolina Mortgage Calculator is so simple to use. First, mark the particular loan program you want to apply for. Then enter the purchase price, down payment, and interest rate. You will then get your principal and interest. Enter the term of the loan. The South Carolina mortgage calculator differs from the competition because it has all the components of the housing payment, such as PITI, mortgage insurance, homeowners insurance, and HOA if applicable, and property tax.

The most common are 30-year fixed-rate mortgages and 15-year fixed-rate mortgages. You can manually enter any term of your mortgage. Continue by entering the property tax and homeowners insurance information and the homeowners association dues if it applies to your property.

The private mortgage insurance, mortgage insurance premium, and/or VA funding fee will automatically populate when you enter the loan program when you first start using the calculator. You will not get the full, most accurate monthly mortgage payments with all the components listed below. Component breakdowns include PITI, PMI/MIP, and HOA.

Why Is The South Carolina Mortgage Calculator The Best Online Calculator?

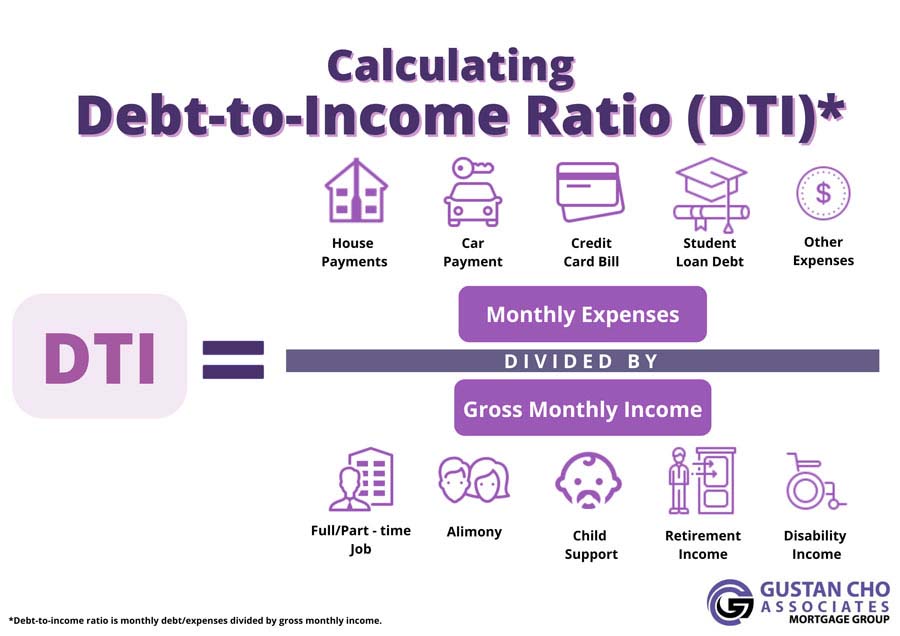

Unlike any other online mortgage calculators, the South Carolina Mortgage Calculator will not just give the principal and interest portions of your mortgage payments. It will give you a complete overview of your mortgage payment, including the breakdown of each component. It will give you the specific mortgage payment with all its components on the particular mortgage loan program you specify. The South Carolina Mortgage Calculator takes it a little step further. It has a debt-to-income ratio mortgage calculator component to the South Carolina Mortgage Calculator where once you have the housing payment, in two steps you can compute your front-end and back-end debt-to-income ratio. By knowing your front-end and back-end debt-to-income ratio, you will be able to determine whether or not you meet the agency DTI mortgage guidelines.

How To Compute My Front-End and Back-End Debt-To-Income Ratio

Once you get your monthly mortgage payment, that number will transfer to the debt-to-income ratio mortgage calculator. Enter the sum of all of your minimum monthly debt payments, such as a mortgage, auto, and student loans, and the sum of all of the minimum payments of all of your credit cards. Enter the total in the box that says Minimum Monthly Debt Payments. Then enter your monthly or annual gross income. You now have your front-end and back-end debt-to-income ratio. Check to see what mortgage loan program you qualify for. Several factors unique to South Carolina must be considered when purchasing a new property or refinancing an existing mortgage. A few of the common queries asked to help you manage through the given process have been listed below:

Your South Carolina Homeownership Journey Starts Here

Apply Online And Get recommendations From Loan Experts

What Do I Need to Purchase a House in South Carolina?

In South Carolina, a down payment is required, along with a certain credit score that the lender must meet. However, a higher credit score opens doors for better loan offerings. Thanks to many programs, buyers from other financial strata can also expect to be catered to.

What is the Appropriate Amount for a Down Payment?

The down payment amount will depend upon the type of loan and the lender. Although a 20% down payment will eliminate the need for private mortgage insurance (PMI), other low down payment options exist. For example, some FHA loans only require 3.5% down.

Do You Offer Any Particular Mortgage Assistance Programs in South Carolina?

Yes, some programs exist to help South Carolina homebuyers and are funded by the South Carolina State Housing Finance and Development Authority, which helps qualified individuals with affordable loans and down payment assistance. In addition, those living in qualified rural areas are also offered USDA loans, which help increase an applicant’s ability to pay back the loan.

What Does a Realtor Do in the Home-Buying Process?

Fill in with the right answer: A realtor works with you throughout the entire process:

- Custodianship for cars

- Assisting you in property searches

- Maneuvering bids

- Providing documents for validation.

- You may need their help, especially if you are a first-time buyer, because they greatly understand the market.

- Input additional information

Is home inspection mandatory in SC?

Answer: Home inspection in SC is recommended but not mandated. However, we would like to wisely understand what resides in a cold, dark, false wall or how long crooked plaster will hold on before something gives. It’s nice to be once and done instead of bedeviled into returning to ensure the seller has revealed reasons to negotiate further.

- Delusion of additional bits.

- Could you keep it on an upbeat note?

How Long Does Closing Take SC?

Answer: South Carolina takes an average of a month but can vary from 30 to 60 days. There are many moving parts, such as getting loans, inspections, and negotiations, and with the assistance of the realtor and lender, timely closing can be facilitated.

What is the best way to refinance a home in SC?

Answer: This greatly differs by lender, but the general rule refers to scores closer to 620. Higher scores qualify for interest loans with lower percentages.

It is best to contact several lenders to learn about their specific requirements.

Are There Programs That Assist With Closing Costs for Refinancing?

Even though most programs assist with purchasing a new home, some lenders offer incentives or assistance with refinancing. Be sure to speak to your lender or financial advisor about available options.

Where Can I Find the Best Mortgage Calculator for South Carolina?

Many online resources allow you to estimate the monthly mortgage payments in South Carolina. Gustan Cho Associates has a South Carolina Mortgage Calculator that lets you provide the home price, down payment, interest rate, and loan term to calculate the monthly payments. Preferred Mortgage Rates (https://www.preferredmortgagerates.com/) has a user-friendly mortgage calculator tailored for South Carolina residents.

What Should I Keep in Mind When Selecting a South Carolina Mortgage Calculator?

While selecting a mortgage calculator, consider one that allows you to adjust mortgage payment parameters such as loan amount, interest rate, loan term, property tax, homeowners insurance, and PMI. This will guarantee a more accurate estimate of your payments. Additionally, consider those that provide an amortization schedule and allow for extra payments.

Although there are many components to consider, knowing a few specifics can make the home purchase or refinance in South Carolina easier. It is strongly suggested that you contact real estate or loan specialists to help guide your process.

FHA, VA, or Conventional? See Which Mortgage Loan Works Best for You in South Carolina

Apply Online And Get recommendations From Loan Experts: Use the South Carolina Mortgage Calculator: