Check out First-Time Homebuyer Programs in North Dakota below.

What are the North Dakota Mortgage Loan Programs for First-Time Homebuyers?

- Below Are Some of the Mortgage Loan Programs in North Dakota That Will Assist First-Time Homebuyers:

- FirstHome Program: This program offers sufficient mortgage loans to first-time buyers who satisfy the income and purchase price restraints.

- HomeAccess Program: Assists single parents, veterans, disabled, and senior citizens in getting affordable financing.

- North Dakota Roots Program: This program is aimed at buyers who earn more than the FirstHome income limit but require some affordable homeownership aid.

- Down Payment and Closing Cost Aid: Provides monetary aid to pay for initial expenses needed in home buying.

- Conv

- FHA

- VA

- Jum/Non

- USDA

What Are the Eligibility Requirements for First-Time Homebuyer Programs?

Every program has unique requirements, but general eligibility includes:

- Neither a co-borrower (or owning a home in the last three years) qualifies as a first-time homebuyer.

- Being within certain income thresholds.

- Buying a primary residence within the purchase price limits set for the state.

- Taking a homebuyer education class (mandatory for some programs).

- Completing the work with an NDHFA-approved lender.

How Does One Apply for a First-Time Homebuyer Program in North Dakota?

The following steps should be undertaken:

- Find a participating lender: Check the NDHFA website for approved lenders.

- Complete a homebuyer education class. As mentioned earlier, the class is a requirement for some of the programs.

Submitting your application:

- Partner with your lender to prepare the required financial documentation for pre-approval.

- Obtain and finally close your home.

- After receiving prior approval, proceed with purchasing a house.

Buying Your First Home in North Dakota?

Apply Now And Get Pre-Approved for a Mortgage Today!

Are Any Other Tax Deductibles or Benefits Available for First-Time Homebuyers in North Dakota?

Yes, homebuyers in North Dakota may receive:

- Mortgage Credit Certificate (MCC): Deducts the liability for paying federal taxes.

- First-Time Homebuyers Savings Account: Enables losing savings as a tax deduction for purchasing the home.

- Property Tax Relief Programs: These programs are available in eligible counties for homeowners.

What is the North Dakota Mortgage Calculator, and in What Ways Does It Assist Prospective Home Buyers in the Region?

- The North Dakota Mortgage Calculator Powered by Gustan Cho Associates is a sophisticated tool that accurately estimates your monthly mortgage payment.

It goes beyond the standard mortgage calculators by also including:

- PITI (Principal, Interest, Taxes, and Insurance).

- PMI (private mortgage insurance).

- HOA Fees.

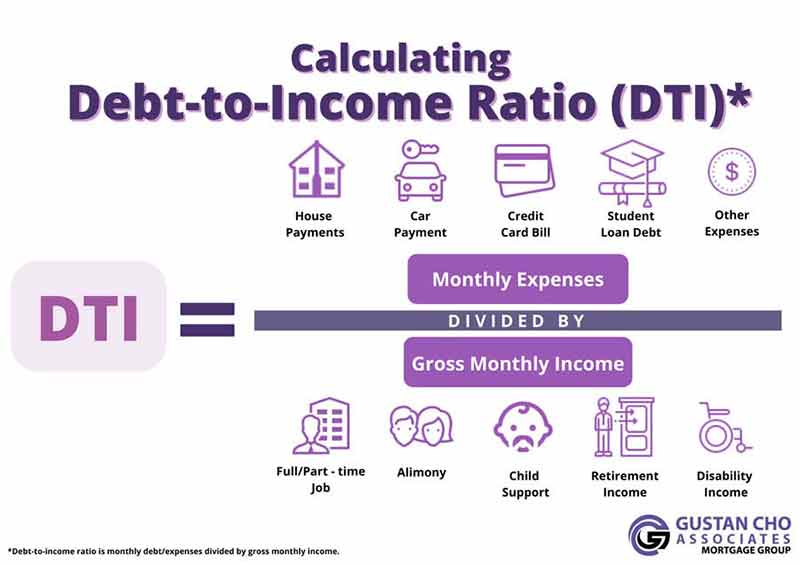

- Front-end and back-end debt-to-income (DTI) ratios.

- It gives an accurate estimate that allows home buyers to plan their housing costs appropriately.

North Dakota Mortgage Calculator Features

How does the North Dakota Mortgage Calculator stand out from the other calculators?

Unlike the standard online calculators that only give a quote of the principal and interest, the North Dakota Mortgage Calculator includes:

- ✅ Estimates of full payments (PITI, PMI, HOA) and not just a quote.

- ✅ Analysis of debt-to-income ratio for qualification of loans.

- ✅ Ease of use in making estimates and calculations.

- ✅ The most detailed results, which students prefer, as far as lenders are concerned.

In What Way Does the North Dakota Mortgage Calculator Enhance Mortgage Planning?

By factoring in property tax, homeowners insurance, HOA payments, and even PMI, the calculator gives a better picture of what the buyer can afford to spend without creating surprise financial roadblocks later on.

How Do I Utilize the North Dakota Mortgage Calculator?

Just enter:

- Home Cost.

- Down Payment.

- Loan Term (for example, 30 years).

- Interest percentage.

- Estimates of property tax and homeowner’s insurance.

- HOA fees (if included).

Your estimated monthly mortgage payment will be presented in the calculator.

First-Time Homebuyer in North Dakota?

Apply Now And Find Out What Programs & Assistance You Qualify For!

Can I utilize the North Dakota Mortgage Calculator for different types of loans?

Definitely! The calculator accommodates:

- Conventional Loans

- FHA Loans

- VA Loans

- USDA Loans

- Jumbo Loans

- Non-QM Loans

You can modify the interest rates and terms to analyze other mortgage alternatives.

Where Can I Find the North Dakota Mortgage Calculator?

You can find the North Dakota Mortgage Calculator Powered by Gustan Cho Associates on:

- https://www.gustancho.com/north-dakota-mortgage-calculator

With the right tools and mortgage loan programs, first-time home buyers in North Dakota can leverage the North Dakota mortgage calculator to make owning a home more accessible and straightforward.

Homebuyers buying a home in North Dakota can calculate their estimated monthly mortgage payment using the North Dakota Mortgage Calculator Powered by Gustan Cho Associates. Unlike other online mortgage calculators, the North Dakota Mortgage Calculator is the best user-friendly mortgage calculator with the most accurate data. Most online mortgage calculators will only give you the principal and interest portions of the monthly mortgage payment. The North Dakota Mortgage Calculator gives you the PITI, PMI, HOA, and the front-end and back-end debt-to-income ratio.

What Are the Features of the North Dakota Mortgage Calculator?

The North Dakota Mortgage Calculator gives you every component of the monthly mortgage payment. There are more components to the monthly mortgage payment than just the principal and interest. What happened with the property taxes, private mortgage insurance, mortgage insurance premium, homeowners insurance, and homeowners association dues?

The missing portions of the mortgage payments can add up to a lot of money and affect your calculations. There is no other mortgage calculator that is as accurate as the North Dakota Mortgage Calculator.

There is no other mortgage calculator in North Dakota that is as user-friendly and as accurate as the North Dakota Mortgage Calculator powered by Gustan Cho Associates.

Get The Most Accurate Mortgage Payment With PITI, PMI, HOA, and DTI

The North Dakota Mortgage Calculator will calculate every component of your mortgage payment. It will break down the principal, interest, property taxes, homeowners insurance, private mortgage insurance, homeowners insurance premium, and homeowners association dues. On VA loans, the North Dakota Mortgage Calculator will include the VA funding fee for exempt status, first-time users, and second-time users.

As an added feature and bonus for our users, the North Dakota Mortgage Calculator has the front-end and back-end debt-to-income ratio feature for conventional, FHA, VA, Jumbo, and non-QM loans. Every mortgage loan program has its own agency front-end and back-end debt-to-income ratio guidelines.

Borrowers with a high debt-to-income ratio can now compute the front-end and back-end debt-to-income ratio when shopping for homes in North Dakota with high property taxes. Property taxes can make or break a deal for homebuyers with high debt-to-income ratios.

How To Use The North Dakota Mortgage Calculator

Users first need to check the type of loan program they are applying for. Selections include conventional, FHA, VA, Jumbo, and non-QM loans. Each particular loan program has its own debt-to-income ratio requirement. Then enter the purchase price, down payment, interest rate, property tax information, and homeowners insurance premium.

Condos, PUDs, and homes in subdivisions have homeowners association dues (HOAs). If the subject property has HOA dues, enter it in the box that says HOA. In a matter of seconds, you will have all the total monthly mortgage payments.

Below the monthly mortgage payment, you have the breakdown of each component that makes up the mortgage payment. The next step is to compute your front- and back-end debt-to-income ratio.

Front-End and Back-End Debt-To-Income Ratio Mortgage Calculator

In a few more steps, you will now know your front-end and back-end debt-to-income ratio using the North Dakota Mortgage Calculator. Your mortgage payment will automatically populate the DTI mortgage calculator and will be in the top box. Enter the sum of all of your monthly minimum debt payments. This includes all monthly minimum payments, including child support payments, minimum credit card payments, and any other obligations you are responsible for. It also includes items that you have co-signed for. Once you enter the total, the next and final step is to enter your monthly gross income before taxes are taken out. Within a matter of seconds, you will get your front-end and back-end debt-to-income ratio.

Need Guidance on Buying Your First Home?

Apply Now And Talk to a Mortgage Expert in ND Now!