There is a wide variety of conventional mortgages that are catered to each individual’s needs. Conventional loans are private mortgage loans not backed by any government agency. Unlike FHA, VA, and USDA, conventional mortgages are not insured by the government. HUD, VA, and USDA insures FHA, VA, and USDA loans. This is not the case with conventional mortgages:

Private mortgage insurance companies are contracted on conventional loans for borrowers with less than 20% equity.

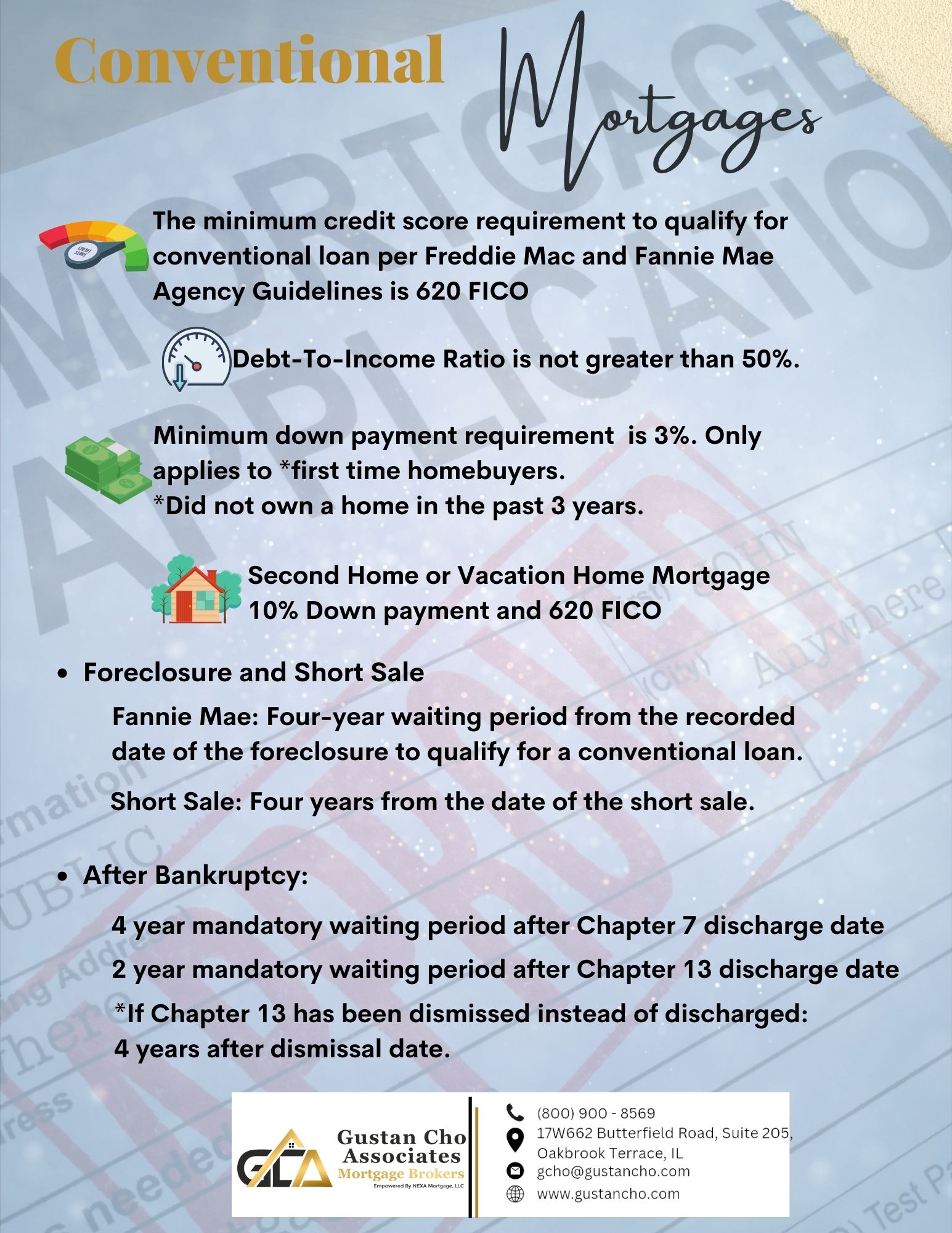

Borrowers are eligible to finance primary homes, second homes, and investment properties with conventional mortgages. The minimum credit score requirement to qualify for conventional mortgages per Fannie Mae and Freddie Mac Agency Guidelines is 620 FICO.

Down Payment Requirements on Conventional Mortgages

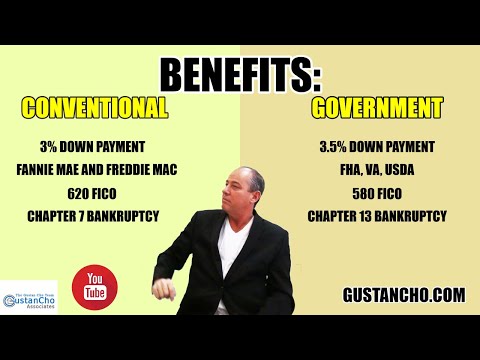

A conventional purchase loan’s minimum down payment requirement is a 3% down payment for first-time homebuyers with Fannie Mae and Freddie Mac. The 3% down payment only applies to homebuyers for first-time homebuyers.

A first-time homebuyer is a buyer who did not own a home in the past three years. 5% down payment if they owned a home in the past three years.

Fannie Mae launched the 3% down payment conventional mortgage program to compete with HUD’s 3.5% down payment program on FHA loans. With HUD’s recent reduction in FHA annual mortgage insurance premiums from 0.85% to 0.55% and 3.5% down payment,

Comparison of FHA Versus Conventional Mortgages

Fannie Mae and Freddie Mac developed the 3% down payment loan program for first-time homebuyers or borrowers with no property ownership in the past three years.

Borrowers with over 80% loan-to-value require annual private mortgage insurance, paid monthly until the home’s value falls to 78% LTV.

Homebuyers with less than 20% down payment can qualify for conventional loans with no monthly PMI if they pay the one-time upfront lender-paid mortgage insurance.

Lender Paid Mortgage Insurance on Conventional Mortgages

Borrowers have the option to pay one-time lender-paid mortgage insurance on a conventional loan and not pay monthly mortgage insurance. With LPMI, you pay one lump mortgage insurance just like FHA’s upfront MIP. The cost of private mortgage insurance is not a fixed rate like FHA loans.

Paying the LPMI conventional mortgages does not require the borrower to pay separate private mortgage insurance. The premium on mortgage insurance depends on the credit score and other risk factors of the borrower.

The no private mortgage insurance requirement is offered to borrowers who take advantage of the lender-paid mortgage insurance on conventional loans. LPMI ( Lender Paid Mortgage Insurance) is a one-time private mortgage insurance premium offered to borrowers of conventional loans. This is a one-time upfront private mortgage insurance program that eliminates the monthly mortgage insurance.

Second Homes And Investment Property Conventional Mortgages

Second Homes And Investment Property Conventional Mortgages

To qualify for a second home or vacation home mortgage, a 10% down payment and a 620 FICO credit score are required. The minimum down payment requirement for an investment home mortgage loan is a 15% down payment. However, if the investment home borrower can use 75% of the potential rental income from the subject investment home purchase in order. To do so, the borrower must put a 25% down payment on an investment home property.

HomePath Mortgage Conventional Loans

Unfortunately, Fannie Mae has discontinued the HomePath Loan and HomePath Renovation Mortgage program. Homebuyers can still purchase a HomePath property. However, the HomePath mortgage program has been discontinued. Alternative financing for HomePath properties includes a 3% down payment conventional loan and a 3.5% down payment FHA Loan. 0% down payment VA loan if you are a veteran. Or 0% down payment USDA loan if the property is in a USDA-approved area and you qualify for a USDA loan.

Qualifying For Conventional Mortgages After Bankruptcy And Foreclosure

Fannie Mae recently changed the waiting periods after a deed-in-lieu of foreclosure and short sale. Fannie Mae treats deed-in-lieu of foreclosure and short sale differently than a standard foreclosure versus other mortgage programs.

HUD treats a deed-in-lieu of foreclosure and short sale like a standard regular foreclosure.

The waiting period to qualify for an FHA loan after a deed-in-lieu of foreclosure or a short sale is the same as a standard foreclosure: three years after the short sale date. The waiting period start date is reflected on the HUD-1 Settlement Statement. 3 years after the recorded date reflected on public records for a deed-in-lieu of foreclosure and standard foreclosure.

Fannie Mae and Freddie Mac Waiting Period After Short Sale and Deed-in-Lieu Versus Standard Foreclosure

Fannie Mae and Freddie Mac have different waiting period requirements on a short sale and deed-in-lieu of foreclosure versus a standard foreclosure. The waiting period to qualify for conventional loan rules differs from a standard foreclosure. There is a four-year waiting period to qualify for a conventional loan after a deed-in-lieu of foreclosure.

The start of the waiting period on conventional loans is the date the property was recorded by the new owner. The borrower needs to have the deed out of their names for the waiting period to start.

The waiting period start date is four years from the recorded foreclosure date. To qualify for a conventional loan after a short sale is four years from the short sale date. The waiting period clock to qualify for a conventional loan after a short sale starts from the date shown on the HUD-1 Settlement Statement of your short sale.

Fannie Mae and Freddie Mac Waiting Period After a Standard Foreclosure

The waiting period to qualify for a conventional loan after a standard regular foreclosure is seven years from the recorded foreclosure date. The waiting period start date is the recorded and stamped date by the county recorder of the deeds office. The recorded date is reflected in public records. Gustan Cho Associates has no lender overlays on conventional loans.

Qualifying For Conventional Loans After Bankruptcy

Fannie Mae has minimum waiting period requirements for borrowers to qualify for a conventional loan after a bankruptcy discharge date. There is a four-year mandatory waiting period after a Chapter 7 discharge date to qualify for a conventional loan. There is a mandatory 2-year waiting period after a Chapter 13 discharge date to qualify for a conventional loan. If your Chapter 13 has been dismissed instead of discharged, the waiting period is four years after a Chapter 13 dismissal date. Conventional Lenders want to see those with a prior bankruptcy not have been late with any payments and like to see a re-established credit history.

Fannie Mae Guidelines on Prior Mortgage Included in Bankruptcy

If you have a prior mortgage included in Chapter 7 bankruptcy, the waiting period is four years from the bankruptcy discharge date to qualify for a conventional mortgage. This holds true even though the deed of your home has not been transferred after the discharge date of Chapter 7 bankruptcy. This is a new Fannie Mae mortgage lending guideline. Before this new regulation, homeowners with a prior mortgage included in Chapter 7 bankruptcy could not qualify until they met the proper waiting period after foreclosure, deed-in-lieu of foreclosure, or short sale.

The waiting period clock did not start until the recorded date of the housing event. The waiting period start date was when the lender transferred the deed from the borrower’s name to the bank’s.

The foreclosure or deed-in-lieu of foreclosure had to be reflected on public records. Now, the waiting period clock starts from the discharge date of the Chapter 7 bankruptcy. This holds true regardless of when the actual deed was transferred out of the homeowner’s name. The deed needs to be finalized and out of the homeowner’s name to determine the waiting period start date. Gustan Cho Associates offers non-QM loans on primary owner-occupant, second homes, and investment properties.

I was approved for my mortgage loan but now my underwriter said that he won’t use my RSU income. I am closing my loan in next 45 days. Is there anything I can do now? I do want to lose that home since my sub lease ending in end of the November.