Ginnie Mae Bailout For Servicers To Stabilize Mortgage Industry

BREAKING NEWS: Ginnie Mae Bailout For Servicers To Stabilize Mortgage Industry

Ginnie Mae Bailout For Servicers To Stabilize Mortgage Industry on homeowners who take advantage of forbearance:

- Included in the $2.2 Coronavirus Stimulus package is homeowners allowing to take advantage of forbearance on federally-backed mortgages

- What this means is unemployed homeowners with mortgages that is backed by FHA, VA, USDA, Fannie Mae, and Freddie Mac can get mortgage relief through forbearance

- Forbearance does not mean forgiveness

- Forbearance means homeowners who are impacted financially by the coronavirus pandemic can skip their mortgage payment for a certain period of time

- After the forbearance period is over, the homeowner needs to come up with the missed payments

When the term is over, lenders may over a six to twelve months window to spread out the missed mortgage payments. Accrued interest and escrow shortage needs to be paid as well.

Ginnie Mae Bailout For Servicers Stabilizes Mortgage Markets

There is a difference between forbearance and a loan modification. A forbearance is not a loan modification.

- The mortgage markets have turned upside down and is in chaos due to the coronavirus pandemic

- Mortgage lenders are nervous and shaken up due to the forbearance option for homeowners

- When mortgage borrowers do not make their monthly scheduled mortgage payments to mortgage servicers, the service still need to make payments to their investors

- This is why the whole mortgage industry was turned upside down and in chaos

- With Ginnie Mae Bailout For Servicers, this will relieve some pressure from lenders and somewhat stabilize the mortgage markets

Will Ginnie Mae Bailout For Servicers To Stabilize The Housing And Mortgage Markets?

The mortgage markets are in chaos due to the coronavirus pandemic impact on the economy.

- As mentioned earlier, lenders need to offer forbearance to homeowners impacted by the pandemic

- However, lenders are still liable to pay investors

- With no mortgage payments coming in by borrowers, how can lenders pay their investors and bondholders?

- This can bankrupt countless lenders and create a major mortgage meltdown

- The good news is Ginnie Mae Bailout For Servicers may rescue the mortgage industry

See the video below:

HUD, VA, USDA, Fannie Mae, Freddie Mac has not changed any of its Agency Mortgage Lending Guidelines. However, most lenders have have increased their lending requirements on all government and conventional loans. Jumbo loans and non-QM loans have been suspended until further notice.

Lenders Increasing Overlays And Suspending Mortgage Programs Due To Liquidity Issues

Lenders are concerned with the potential flood of forbearance request by their borrowers.

- With forbearance, borrowers can skip up to 12 months of mortgage payments

- However, they are still liable to pay their investors

- This will no doubt bankruptcy many mortgage companies

- Analysts expect as many as 25% of federally-backed mortgage borrowers may take up forbearance

- Today’s unemployment numbers came in at another 3 million

- 33 million Americans filed unemployment claims in the past seven weeks

- Unemployment rates can hit as much as 20% by year end

- Due to the liquidity issues on the secondary mortgage bond market, most lenders will not do any mortgages for borrowers with under 680 credit scores

- The good news is Gustan Cho Associates did not implement any lender overlays during the coronavirus pandemic

- We still do 3.5% down payment FHA loans with 580 credit scores

- Gustan Cho Associates can also do FHA loans under 580 FICO down to 500 credit scores with 10% down payment

- Many lenders have stopped doing manual underwriting and FHA 203k loans

- The good news is Gustan Cho Associates still approve manual underwriting and 203k mortgages with no lender overlays

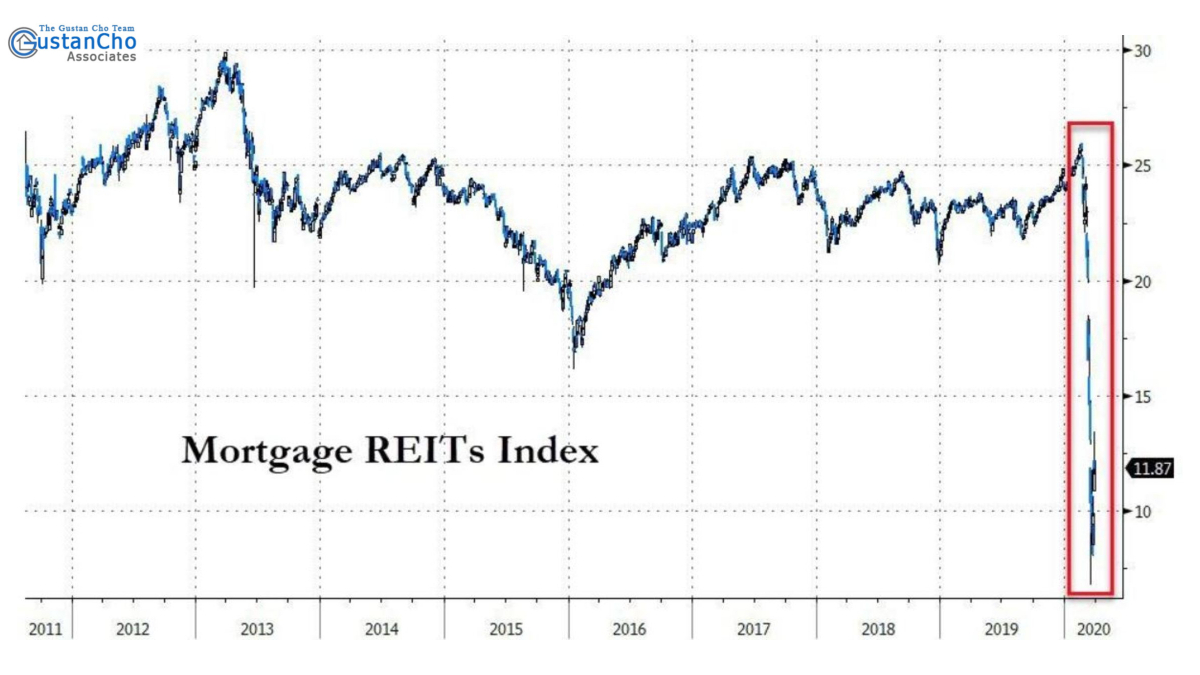

Look at the chart below:

The Volatile Mortgage Markets And Illiquidity

The coronavirus pandemic sent the stock market plummeting. The yield on the 10-year U.S. Treasuries went below 1.0% sending mortgage rates to all-time lows. However, with mortgage rates at historic lows, lenders are not lending for borrowers with under 700 credit scores. This is because there is no liquidity on the secondary mortgage bond market. There is no appetite for borrowers with lower credit scores. A few lenders such as Gustan Cho Associates did not implement any lender overlays and still aggressively approve mortgages with lower credit scores.

Non-QM lenders have suspended all mortgage operations. DeepHaven Mortgage, one of the largest non-QM lenders has gone bankrupt. Many non-QM lenders have ceased mortgage operations until further notice. Jumbo Loans have been suspended by most lenders until further notice.

Non-QM And Alternative Mortgage Products Affected By The Coronavirus Pandemic

As mentioned earlier, most non-QM lenders have ceased operations until further notice. What this means are loan programs such as bank statement loans for self-employed borrowers are suspended. The non-QM mortgage markets are expected to go through major changes. Non-QM loans are portfolio loan programs that cannot be sold to Fannie Mae and/or Freddie Mac. Changes such as higher credit scores and larger down payment will most likely be implemented. Angel Oak Cos., one of the largest non-QM lenders laid off 90% of its workforce. Angel Oak has a national brand for its riskier lending mortgage platform. Angel Oak Mortgage Solutions funded over $3.3 billion mortgage loans in 2019. The company’s 2020 forecast was $8 billion. However, this projection was halted due to the coronavirus pandemic. Jumbo loans has been suspended until further notice. Most lenders also halted manual underwriting on VA and FHA loans as well as FHA 203k loans.

Non-QM loans and alternative loan programs is expected to return in the coming weeks. So are Jumbo mortgages and other alternative loan programs. Over 20 states have reopened the economy in May. It is not a question of whether or not the economy will recover but how long will it take. The longer the economy is closed, there will be more negative impact for Americans. Millions of closed businesses is expected not to reopen. The housing market is expected to be strong once the economy reopens. The proactive actions taken by President Trump and his Administration will most likely not affect the housing market from collapsing. The mortgage markets is expected to stabilize and return to normal in the coming weeks. This is a breaking story. Gustan Cho Associates will keep our viewers updated on new developments in the coming days and weeks.