Reverse Mortgage Loans: Complete 2026 Guide for Seniors (Age 62+)

Thinking about a reverse mortgage? If you’re 62 or older and own a home, a reverse mortgage can let you turn part of your home equity into cash—without required monthly mortgage payments.

This guide explains how reverse mortgages work, who qualifies, the pros and cons, and the most common option (the FHA-insured HECM). You’ll also learn what can cause problems (like property taxes, insurance, or moving out for an extended time) so you can make a confident decision.

Updated for 2026: This page reflects current reverse mortgage basics, common lender requirements, and what borrowers should ask before applying.

What Is a Reverse Mortgage Loan?

A reverse mortgage is a loan for homeowners age 62 or older. It allows you to use the money you have built up in your home. Instead of paying a monthly mortgage, the amount you owe usually goes up over time because of added interest and fees.

You keep the title to your home. The loan is usually repaid when you:

- sell the home,

- move out permanently, or

- pass away.

Most reverse mortgages are non-recourse, meaning you (or your heirs) generally won’t owe more than the home’s value when the loan is due (as long as loan requirements are met).

How Reverse Mortgages Work (Simple Step-By-Step)

- Your home equity is the “collateral.” The amount available depends on age, rates, and home value.

- You can get your money all at once, in monthly payments, or through a line of credit, depending on the program.

- No required monthly mortgage payment is due while you live in the home as your primary residence.

- You still need to take care of property taxes, homeowners’ insurance, any HOA fees, and make sure the place is kept up.

- When you sell your place, move out for a long time, or pass away, that’s when the loan needs to be paid off. Usually, heirs can either sell the house, refinance it to keep living there, or find another way to pay off what’s owed.

Why Seniors Use Reverse Mortgages

Many retirees are “house rich, cash tight.” A reverse mortgage can help:

- cover monthly living expenses on a fixed income

- pay for healthcare or in-home care

- create a financial buffer for emergencies

- fund home improvements to age in place

Important: A reverse mortgage is not “free money.” It’s a loan that uses home equity, so it reduces the equity left in the home over time.

Types of Reverse Mortgage Loans

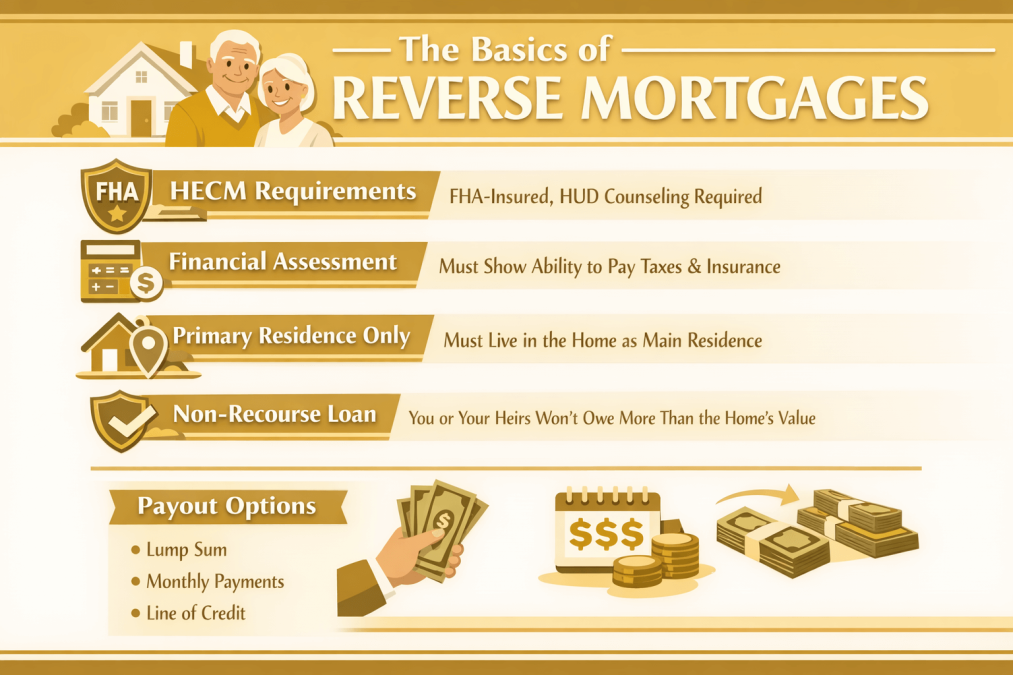

1) HECM (FHA-Insured Reverse Mortgage)

The most common reverse mortgage is the Home Equity Conversion Mortgage (HECM), insured by the Federal Housing Administration. HECM loans include consumer protections and require HUD-approved counseling before you can close.

2) Proprietary (Jumbo) Reverse Mortgages

Private reverse mortgages (often called jumbo reverse mortgages) may be a good fit for homeowners with higher-value homes. Terms and fees vary by lender, so comparing options is critical.

3) Single-Purpose Reverse Mortgages

Some state/local programs offer low-cost reverse mortgages for specific needs, such as property taxes or home repairs. Availability varies by location.

Who Qualifies for a Reverse Mortgage?

In general, you’ll need:

- Age 62+ (for the main reverse mortgage programs)

- A home that is your primary residence

- Enough equity (or a small mortgage balance that can be paid off at closing)

- The ability to keep up with taxes, insurance, HOA dues, and maintenance

Married couples note: If one spouse is younger than 62, there are special considerations to discuss before moving forward.

Feel Secure With a Reverse Mortgage Loan

Turn your home equity into cash flow for retirement. With a Reverse Mortgage Loan, you can enjoy financial freedom while staying in your home.

How Reverse Mortgages Work: Understanding the Mechanics

The mechanics of reverse mortgages differ significantly from traditional lending products, so understanding how these loans function is essential before considering them as part of your retirement strategy. When you obtain a reverse mortgage, the lender makes payments to you instead of you making payments to the lender. The loan amount you can receive depends on your age, current interest rates, and your home’s appraised value.

Older borrowers typically qualify for larger loan amounts because they have shorter life expectancies, reducing the lender’s risk. The loan balance grows as interest and fees accumulate, but you never owe more than your home’s value when the loan becomes due.

One of the most important aspects of reverse mortgages is that the loan doesn’t become due until you permanently move out of the home, sell the property, or pass away. This means you can live in your home for the rest of your life without making mortgage payments, as long as you maintain the property and pay property taxes and homeowners’ insurance.

Types of Reverse Mortgage Loans Available

Understanding the different types of reverse mortgage loans helps you choose the option that best fits your financial needs and retirement goals.

Each type offers unique features and benefits for different situations and borrower preferences. Your home secures the loan, and when it becomes due, you or your heirs can repay the loan balance to keep the home or sell it to pay off the loan.

If the home sells for more than the loan balance, you or your heirs keep the difference. Suppose the home is worth less than the loan balance. In that case, the mortgage insurance covers the difference, ensuring you or your heirs are never responsible for the shortfall.

Home Equity Conversion Mortgage (HECM)

The Home Equity Conversion Mortgage, commonly known as HECM, represents the most popular type of reverse mortgage, accounting for approximately 90% of all reverse mortgages originating in the United States. The Federal Housing Administration insures these loans and offers strong consumer protections and standardized terms.

HECM loans are available for homes valued up to the FHA lending limits, which vary by county but range from approximately $400,000 to over $1 million in high-cost areas.

The FHA insurance protects borrowers by guaranteeing they’ll never owe more than the home’s value. It ensures loan proceeds will be available even if the lender experiences financial difficulties. Before obtaining the loan, all HECM borrowers must complete mandatory counseling with a HUD-approved counseling agency. This counseling session covers loan terms and alternatives to reverse mortgages and helps ensure borrowers understand the implications of their decision.

Proprietary Reverse Mortgage Loans

Proprietary reverse mortgages, also called jumbo reverse mortgages, are private loans not insured by the FHA. They are designed for homes worth more than the FHA lending limits and can provide access to larger loan amounts for homeowners with high-value properties.

While proprietary reverse mortgages don’t have the same government oversight as HECM loans, they offer greater flexibility in loan amounts and may have different qualification requirements. Interest rates and fees may vary more significantly between lenders offering proprietary products.

Single-Purpose Reverse Mortgages

Some state and local government agencies and nonprofit organizations offer single-purpose reverse mortgages. These loans typically offer the lowest costs but restrict how loan proceeds can be used, usually limiting funds to specific purposes such as home repairs, improvements, or property taxes.

The most important step is becoming fully informed about your options and consulting with qualified professionals to help you make the best decision for your unique circumstances and retirement dreams.

Availability of single-purpose reverse mortgages varies significantly by location, and they typically serve homeowners with lower to moderate incomes. While the restrictions on fund usage seem limiting, these loans can provide valuable assistance for homeowners who need help with specific expenses.

Eligibility Requirements for Reverse Mortgage Loans

Understanding reverse mortgage eligibility requirements helps determine whether this financial tool aligns with your situation and retirement planning goals. Meeting these requirements ensures you can access this valuable resource to enhance your retirement security and happiness.

Age Requirements and Borrower Qualifications

The primary borrower must be at least 62 years old to qualify for a reverse mortgage. If you’re married and both spouses will be on the loan, both must meet the age requirement.

If one spouse is under 62, special provisions may apply that allow the loan while protecting the younger spouse’s rights to remain in the home.

All borrowers must demonstrate the mental capacity to understand the loan terms and implications. This doesn’t require extensive testing but ensures borrowers can make informed decisions about their financial future. Lenders may require additional documentation if there are concerns about cognitive ability.

Homeownership and Property Requirements

You must own your home outright or have a low existing mortgage balance that can be paid off with proceeds from the reverse mortgage. The property must be your primary residence where you live most of the year. Eligible property types include single-family homes, townhomes, condominiums approved by FHA, and manufactured homes that meet FHA requirements. Some cooperative housing units may qualify, though additional restrictions often apply.

Financial Assessment and Obligations

While reverse mortgages don’t require monthly mortgage payments, borrowers must demonstrate the ability to pay ongoing property taxes, homeowners’ insurance, HOA fees, and property maintenance costs. Lenders conduct financial assessments to ensure borrowers can meet these ongoing obligations.

Whether you want to eliminate mortgage payments, fund healthcare expenses, enhance your lifestyle, or create a financial safety net, reverse mortgages can provide the resources needed to feel secure and live happily in retirement.

The financial assessment examines income sources, credit history, and financial stability. Suppose the assessment reveals concerns about your ability to meet property obligations. In that case, the lender may require setting aside loan proceeds in an escrow account to cover future expenses.

Property Condition and Maintenance Standards

Your home must meet FHA property standards, which include basic safety, security, and structural integrity requirements. A professional appraisal will identify any necessary repairs that must be completed before loan closing or funded through loan proceeds. You remain responsible for maintaining the property well throughout the loan term. This includes routine maintenance, necessary repairs, and keeping the property safe and habitable. Failure to maintain the property could result in loan default.

Financial Benefits of Reverse Mortgages in Retirement

Reverse mortgages offer numerous financial benefits that can significantly improve your retirement lifestyle and provide the security needed to live happily during your golden years. Understanding these benefits helps you evaluate whether a reverse mortgage aligns with your retirement goals.

Elimination of Monthly Mortgage Payments

One of the most immediate and impactful benefits of reverse mortgages is the elimination of monthly mortgage payments. Removing this major monthly expense can free up hundreds or thousands of dollars each month for other needs and desires for retirees struggling with fixed incomes.

Eliminating mortgage payments provides immediate cash flow relief and can make the difference between financial stress and financial comfort in retirement. Many retirees find that eliminating mortgage payments allows them to afford better healthcare, travel, home improvements, or a more comfortable lifestyle.

Tax-Free Income Stream

Reverse mortgage proceeds are generally considered loan advances rather than income, making them tax-free to recipients. This tax advantage can be particularly valuable for retirees who want to supplement their income without pushing themselves into higher tax brackets or affecting Social Security and Medicare benefits.

The tax-free nature of reverse mortgage proceeds makes them especially attractive compared to withdrawing money from tax-deferred retirement accounts like 401(k)s and traditional IRAs, which generate taxable income and may have required minimum distribution requirements.

Flexible Payment Options

Reverse mortgages offer multiple payment options to meet different financial needs and preferences. You can receive funds as a lump sum, monthly payments for life, monthly payments for a specific period, or maintain a line of credit that you can access as needed.

The guaranteed nature of reverse mortgage funds helps create a more stable retirement income foundation. It can reduce the need to sell investment assets during unfavorable market conditions.

The line of credit option is particularly popular because unused credit lines grow at the same rate as loan interest plus mortgage insurance premiums. This growth feature means your available credit increases even if home values decline, providing a valuable financial safety net.

Protection Against Market Volatility

Unlike retirement accounts that fluctuate with stock market performance, reverse mortgage proceeds provide stable, predictable access to funds regardless of market conditions. This stability can be particularly valuable during market downturns when traditional retirement accounts may lose significant value.

Don’t Wait—Enjoy a Stress-Free Retirement

Reverse Mortgages are helping seniors secure income and peace of mind. At Gustan Cho Associates, we guide you every step of the way.

Using Reverse Mortgage Proceeds to Enhance Retirement Happiness

The flexibility of reverse mortgage proceeds allows retirees to address various financial needs and lifestyle goals, contributing to a more secure and happy retirement. Understanding these potential uses helps maximize the benefits of accessing your home equity.

Healthcare and Long-Term Care Expenses

Rising healthcare costs represent one of the biggest financial challenges in retirement, and reverse mortgage proceeds can help address these expenses without depleting other retirement savings.

Whether covering insurance premiums, prescription medications, dental care, or long-term care services, reverse mortgage funds provide financial flexibility when health needs arise.

Many retirees use reverse mortgage proceeds to make home modifications that allow them to age in place safely and comfortably. These modifications might include installing wheelchair ramps, walk-in showers, stairlifts, or other accessibility improvements that extend independent living.

Travel and Lifestyle Enhancement

After decades of working and saving, many retirees want to enjoy their golden years through travel, hobbies, and lifestyle experiences. Reverse mortgage proceeds can fund these dreams without requiring you to sell your home or deplete other retirement accounts. Whether taking that long-awaited European vacation, visiting grandchildren across the country, pursuing expensive hobbies, or simply enjoying restaurant meals and entertainment, reverse mortgage funds can make retirement dreams a reality.

Home Improvements and Maintenance

Maintaining and improving your home becomes increasingly important for safety and enjoyment as you age. Reverse mortgage proceeds can fund kitchen and bathroom renovations, HVAC system updates, roof repairs, landscaping improvements, and other projects that enhance your living environment. These improvements make your home more comfortable and enjoyable. They may also help maintain or increase their value over time, benefiting you and your heirs in the long run.

Emergency Fund Creation

Unexpected expenses can quickly derail retirement budgets, making emergency funds crucial for financial security. Reverse mortgage lines of credit can serve as excellent emergency funds because they’re guaranteed to be available when needed, and unused credit grows over time.

Having access to substantial emergency funds provides peace of mind. It reduces financial stress, contributing significantly to overall retirement happiness and security.

While reverse mortgages offer significant benefits, it’s important to understand potential drawbacks and considerations to decide whether this financial tool suits your situation.

Loan Costs and Fees

Reverse mortgages typically involve higher upfront costs than traditional mortgages, including origination fees, mortgage insurance premiums, appraisal fees, and closing costs.

While the costs are significant, they must be weighed against the benefits of accessing home equity without monthly payments and the long-term value the loan provides throughout retirement.

These costs can total several thousand dollars and are usually financed as part of the loan, reducing the net proceeds available to borrowers.

Impact on Inheritance

Because reverse mortgages use home equity to provide current benefits, they reduce the inheritance value of your home. The outstanding balance must be repaid when the loan becomes due, typically through home sale proceeds. However, many financial advisors argue that using home equity to enhance the current quality of life and reduce the need to spend other retirement assets may preserve more overall wealth for heirs than leaving home equity untouched.

Ongoing Responsibilities and Requirements

Borrowers must meet property tax, insurance, and maintenance obligations throughout the loan term. Failure to meet these responsibilities can result in loan default and potential foreclosure.

Changes in home values also affect the loan dynamics. However, mortgage insurance protects borrowers from owing more than the home’s value when the loan becomes due.

Additionally, the home must remain your primary residence. Extended absences or moves to care facilities may trigger loan repayment requirements, though some flexibility exists for temporary absences.

Interest Rate and Market Risks

Like all loans, reverse mortgages are subject to interest rate fluctuations that affect loan costs and available proceeds. While borrowers don’t make monthly payments, interest accumulates and compounds over time, potentially consuming significant home equity.

Alternatives to Reverse Mortgages for Retirement Income

Before deciding on a reverse mortgage, it’s wise to consider alternative strategies for accessing retirement income and enhancing financial security. Understanding these alternatives helps you choose the best approach for your situation.

Home Equity Loans and Lines of Credit

Traditional home equity loans and lines of credit provide access to home equity while allowing you to remain in your home. However, these products require monthly payments and income qualification, which may not be suitable for all retirees. Home equity products offer lower overall costs than reverse mortgages for retirees with sufficient income to make monthly payments. However, they don’t provide the payment-free benefits that make reverse mortgages attractive.

Downsizing and Relocation

Selling your current home and purchasing a less expensive property can free up equity while potentially reducing ongoing housing costs. This strategy works well for retirees ready to move to smaller homes, different locations, or lower-cost areas.

Retirement should be enjoyable and fulfilling after decades of hard work and saving. Suppose your home equity can contribute to that happiness and security through a reverse mortgage.

In that case, it may be a serious part of your comprehensive retirement strategy. Downsizing provides immediate access to home equity and may reduce property taxes, insurance, and maintenance costs. However, it requires giving up your current home and community connections.

Rental Income Strategies

Converting part of your home to rental space or purchasing rental properties can generate ongoing income while preserving homeownership. This approach requires landlord responsibilities and may involve significant initial investments or home modifications.

Investment Account Withdrawals

Drawing from retirement accounts like 401(k)s, IRAs, and investment portfolios provides access to funds but may involve tax consequences and reduce future financial security. Market volatility can also affect the sustainability of this approach.

Steps to Obtain a Reverse Mortgage Loan

Understanding the reverse mortgage application process helps ensure smooth loan origination and sets appropriate expectations for timing and requirements. The process involves several important steps to protect borrowers and ensure informed decision-making.

Initial Research and Counseling

Begin by researching reverse mortgage options and consulting with qualified professionals, including financial advisors, estate planning attorneys, and family members.

This initial research helps determine whether a reverse mortgage aligns with your retirement and estate planning goals.

All HECM borrowers must complete mandatory counseling with a HUD-approved counseling agency. This counseling covers loan terms, alternatives, and implications, ensuring you understand your decision. The counseling session typically lasts one to two hours and can be completed in person, by phone, or online.

Lender Selection and Application

Research multiple reverse mortgage lenders to compare interest rates, fees, loan terms, and service quality. Different lenders may offer varying terms and service levels, making comparison shopping valuable for finding the best deal. Once you select a lender, complete the loan application and provide the required documentation, including identification, property documents, and financial information for the financial assessment.

Property Appraisal and Underwriting

The lender will order a professional appraisal to determine your home’s current market value, which affects the loan amount available. The appraiser will also identify any necessary repairs that must be completed before closing. During underwriting, the lender reviews your application, financial assessment, property appraisal, and other documentation to make a final loan decision. This process typically takes several weeks.

Loan Closing and Fund Disbursement

If approved, you’ll attend a loan closing similar to other real estate transactions, where you’ll sign loan documents and receive your funds according to the payment option you selected. The lender will explain all documents and answer questions during the closing process.

After closing, you’ll receive loan proceeds according to your chosen payment method, whether as a lump sum, monthly payments, or available line of credit.

Deciding whether a reverse mortgage is right for your retirement involves careful consideration of your financial situation, goals, and family circumstances. You should make this decision fully understanding the benefits, costs, and long-term implications.

Evaluating Your Financial Needs

Assess your current and projected retirement income and expenses to determine whether additional funds would significantly improve your quality of life and financial security. Consider both immediate needs and potential future expenses like healthcare and long-term care.

Family Discussions and Estate Planning

Discuss your reverse mortgage consideration with family members who may be affected, including potential heirs. While the decision is yours, family input can provide valuable perspectives and help avoid future misunderstandings.

Consider how a reverse mortgage fits your overall estate planning goals and whether the benefits to your current quality of life outweigh potential impacts on inheritance values.

Consult with qualified professionals, including financial advisors, estate planning attorneys, and tax professionals, who can provide objective advice based on your specific situation and help model different scenarios and outcomes.

Long-Term Perspective

Consider your long-term housing plans and whether you want to remain in your current home for many years. Reverse mortgages work best for borrowers who plan to stay in their homes long-term, maximizing the value of eliminating monthly mortgage payments.

Securing Your Happy Retirement with Reverse Mortgages

Reverse mortgage loans represent a powerful financial tool that can transform retirement for homeowners aged 62 and older who want to live more securely and happily during their golden years.

By converting home equity into tax-free income without requiring monthly payments or forcing you to move, reverse mortgages address one of retirement’s biggest challenges: being house rich but cash poor.

The key to successful reverse mortgage use lies in understanding how these loans work, carefully evaluating whether they fit your specific situation, and choosing the right loan type and payment options for your needs. While reverse mortgages involve costs and considerations, the benefits of enhanced cash flow, financial flexibility, and peace of mind often far outweigh the drawbacks for appropriate candidates.

How Reverse Mortgage Loans Work

Here’s they work step-by-step:

- Equity-Based Borrowing: You borrow money based on your home’s equity. The more equity you have, the more you can borrow.

- No Monthly Payments: You don’t need to make any monthly mortgage payments. Interest gets added to the loan balance each month.

- Property Taxes and Insurance: If applicable, you still pay property taxes, insurance, and HOA fees.

- Loan Repayment: The loan gets repaid when the home is sold, the homeowner moves, or passes away. If your heirs sell your home for a lower value than the loan balance, they’re not responsible for the difference—HUD covers that.

Reverse mortgage loans are perfect for seniors who need extra income without monthly financial stress.

Who Qualifies for Reverse Mortgage Loans?

To qualify, you need to remember a few important things. First, you must be at least 62 years old. Second, you must own your home completely or have a lot of equity in it. This means that you either paid off your house or have paid down a big part of the loan. Additionally, you need to use the home as your primary residence, which means you live there most of the time. You must keep paying your property taxes and homeowner’s insurance to maintain the property. If you meet these requirements, you can get reverse mortgage loans.

Ready to Save Money on Your Mortgage? Explore Refinance Options Today!

Refinancing your mortgage could lower your interest rate and reduce your monthly payments. Contact us now to explore your refinancing options and see how much you could save!

Benefits of Reverse Mortgage Loans

Many seniors use reverse mortgage loans to:

- Increase Retirement Income: Get a lump sum, monthly payments, or a line of credit.

- Cover Unexpected Expenses: Have funds available to cover emergencies or sudden expenses.

- Invest in Home Repairs: Use the funds to renovate or repair your home.

- Financial Freedom: Enjoy retirement without worrying about monthly mortgage payments.

Updated Reverse Mortgage Guidelines for 2026

Reverse mortgages can be a strong retirement tool—but only if you understand the rules that keep the loan in good standing. Here are the reverse mortgage guidelines that matter most in 2026, especially for FHA-insured HECM reverse mortgages.

1) HECM Basics (FHA-Insured Reverse Mortgages)

The most common reverse mortgage is the Home Equity Conversion Mortgage (HECM), which is insured by the Federal Housing Administration (FHA). This FHA insurance includes important consumer protections, including the non-recourse feature explained below.

HUD counseling is required for HECM borrowers before you can close. The goal is to make sure you understand how the loan works, the costs, and the alternatives.

2) Financial Assessment (Ability to Pay Taxes + Insurance)

A reverse mortgage means you don’t need to make monthly mortgage payments, but there are still some things you need to take care of.

- property taxes

- homeowners insurance

- HOA dues (if applicable)

- basic home maintenance

Lenders review your finances to confirm you can reasonably keep up with these ongoing housing expenses. If there’s concern, a lender may require a set-aside (reserving part of your available proceeds) to help cover future taxes/insurance.

3) Primary Residence Rule (You Must Live in the Home)

A reverse mortgage is designed for your primary residence—the home you live in most of the year. If you permanently move out, sell the property, or pass away, the loan typically becomes due.

4) Non-Recourse Protection (Important for Heirs)

Most reverse mortgages are non-recourse. That means when the loan is due, you (or your heirs) generally do not owe more than the home’s value at the time of sale. If the house sells for less than the loan balance, FHA insurance covers the difference on an FHA-insured HECM (as long as program rules were followed).

5) 2026 HECM Maximum Claim Amount (Loan Limit)

For calendar year 2026, the HECM nationwide maximum claim amount is $1,249,125, effective for FHA case numbers assigned on or after January 1, 2026.

What this means in plain English: If your home is worth more than the limit, the HECM calculation uses the limit—not the full value—when determining how much may be available.

Risks and Considerations

Before applying, it’s important to know the possible downsides:

- Interest Accumulates: Interest adds up when you take out reverse mortgage loans, which means the amount you owe gets bigger as time goes on.

- Inheritance Impact: If you have a reverse mortgage loan, your heirs may get less money when you pass away. That’s because the loan needs to be paid back when the house is sold.

- Home Maintenance: If you have reverse mortgage loans, you need to take care of your home. This includes keeping it in good shape and paying property taxes and insurance on time.

At Gustan Cho Associates, we help you understand the good and the bad before deciding.

Key Features of Reverse Mortgages

- Available to homeowners 62 years or older

- Loan amounts based on home equity, age, and interest rates

- No required monthly mortgage payments

- Borrowers retain ownership and can live in the home as long as they maintain it and pay taxes/insurance

Reverse Mortgage Loans vs. Home Equity Loans

Let’s look at how reverse mortgage loans and home equity loans are different:

Reverse Mortgage Loans

You don’t have to make monthly payments on these loans. You pay back the loan when you sell your house, move somewhere else, or after you pass away. This helps older homeowners stay in their homes without worrying about monthly bills.

Home Equity Loans

These loans do require you to make monthly payments. If you can’t make those payments, you could lose your home through foreclosure. This means you have to be more careful with these loans.

In short, reverse mortgage loans can be better for retired homeowners because they have fewer payments and allow for more freedom.

Real-Life Examples: How Seniors Use Reverse Mortgage Loans

Here are a few simple examples of how homeowners use reverse mortgage funds in retirement:

Mary (67) — Uses a Line of Credit for Medical Bills

Mary had unexpected medical expenses. Instead of draining her retirement savings, she opened a reverse mortgage line of credit and used it only when needed. This gave her flexibility while keeping her other savings intact.

John and Susan (74) — Choose Monthly Disbursements

John and Susan wanted a steady extra income each month. Instead of taking a lump sum, they chose monthly disbursements from their reverse mortgage—either:

- People can receive monthly payments as long as they live in their home as their primary residence.

- Term payments (monthly payments for a set number of years)

This created a predictable stream of funds to help with everyday expenses and improve their monthly cash flow.

Robert (72) — Uses Proceeds for Home Upgrades to Age in Place

Robert used part of his reverse mortgage proceeds to install a walk-in shower, improve lighting, and repair a roof issue—upgrades that helped him stay safe and comfortable at home.

Note: Reverse mortgages don’t require monthly mortgage payments while you live in the home and meet loan obligations. You are still responsible for property taxes, homeowners’ insurance, HOA dues (if any), and basic maintenance.

How to Get Started With Reverse Mortgage at Gustan Cho Associates

At Gustan Cho Associates, we make applying for reverse mortgage simple. Here’s our straightforward process:

- Contact Us: Call 800-900-8569, email gcho@gustancho.com, or text us for a fast response.

- Free Consultation: Speak with one of our reverse mortgage specialists to understand your options clearly.

- HUD Counseling Session: Complete mandatory counseling with an approved counselor.

- Application and Approval: Submit an easy application with our expert guidance.

- Get Your Funds: Receive your money in a lump sum, monthly payments, or a flexible line of credit.

Our reverse mortgage experts are available seven days a week, evenings, weekends, and holidays to answer your questions and guide you every step of the way.

Unlock Financial Freedom With Reverse Mortgage Today

Reverse mortgage provides older adults financial freedom, safety, and reassurance in their retirement years. At Gustan Cho Associates, we are dedicated to helping you determine whether a reverse mortgage loan suits your needs.

Contact Gustan Cho Associates today at 800-900-8569 or email us at gcho@gustancho.com. Your financial freedom is just a call away!

Unlock the Equity in Your Home

Your home can do more for you. With a Reverse Mortgage, you can access your equity and live more comfortably in retirement.

Common Myths About Reverse Mortgages

Myth 1: The Bank Owns Your Home

- Fact: Borrowers retain full ownership of the property. The lender only places a lien for repayment.

Myth 2: Heirs Will Be Burdened with Debt

- Fact: Reverse mortgages are non-recourse loans. Heirs never owe more than the home’s value.

Myth 3: Reverse Mortgages Are Only for Desperate Borrowers

- Fact: Many financially stable retirees use reverse mortgages to enhance retirement income and plan for the future.

Alternatives to Reverse Mortgage Loans

Before committing, consider these options:

- Home equity loan or HELOC

- Downsizing to a smaller home

- Renting part of your property for supplemental income

- Government assistance programs for seniors

A Tool for a Secure, Happy Retirement

A reverse mortgage can be a powerful financial strategy for retirees who want to remain in their homes while enjoying the freedom of extra income, but it’s not for everyone. However, the right guidance can unlock a stress-free, secure retirement.

At Gustan Cho Associates, we specialize in helping seniors explore reverse mortgage options with no overlays, no unnecessary roadblocks, and full transparency.

Call us today at 800-900-8569 or click “Apply Now” to see how a reverse mortgage can help you feel secure and live a happy retired life.

Frequently Asked Questions About Reverse Mortgage Loans

Are Reverse Mortgages a Good Idea for Seniors?

They can be a good fit if you’re 62+, plan to stay in the home long-term, and need better monthly cash flow or a safety net. They’re often a poor fit if you may move soon, can’t reliably pay taxes/insurance/HOA, or want to preserve as much home equity as possible for heirs.

How Much Money Can You Get from a Reverse Mortgage?

The amount depends mainly on your age, interest rates, your home’s appraised value, and the program limit (for HECM/FHA). Your lender will run the numbers and present options such as a lump-sum payment, monthly disbursements, or a line of credit.

Do You Still Own Your Home with a Reverse Mortgage?

Yes—you keep the title as long as you meet the loan requirements (live in the home as your primary residence, pay taxes/insurance, and maintain the property). The lender places a lien, similar to a regular mortgage.

What Happens When the Homeowner Dies?

When the last person borrowing the money dies or leaves the house for good, it’s time to pay off the loan. Heirs can typically sell the home and use the proceeds to repay the loan, refinance to keep the home, or pay off the balance another way. For non-recourse reverse mortgages, heirs generally don’t owe more than the home’s value.

Can You Lose Your Home with a Reverse Mortgage?

You can if you don’t follow the rules—most commonly by falling behind on property taxes, homeowners insurance, HOA dues, or letting the home fall into serious disrepair. The key is budgeting for those ongoing costs even though there’s no required monthly mortgage payment.

Is Money from a Reverse Mortgage Taxable, and Does it Affect Social Security/Medicare?

Reverse mortgage proceeds are generally not taxable because they’re loan advances, not income. They typically don’t affect Social Security or Medicare, but they can impact certain means-tested benefits (like SSI/Medicaid) if you keep large amounts of cash unspent past month-end.

This article about “Reverse Mortgage Loans: Feel Secure, Live Happy Retired Life” was updated on February 26th, 2026.

Looking to Refinance Your Mortgage? We Can Help You Find the Best Options!

Whether you’re looking to lower your rate or tap into your home’s equity, refinancing can offer great benefits. Reach out today to see which refinance mortgage option is right for you.

Are there currently income requirements to re-fi an existing reverse mortgage? There were not when I got mine, but now my house has increased in value by about $250K.

There are no credit or income requirements. You just need to show how you are going to pay for taxes and insurance. Please contact us at gcho@gustancho.com with your contact information. What state are you in?