Gustan Cho Associates are experts in guiding home buyers and homeowners with boosting their credit scores fast and on how to rebuild credit for mortgage approval. Having poor and bad credit is not permanent. Having bad credit and low credit scores is like having a bad hangover. With time, it heals. John Grimaldi of Superior Lending of Las Vegas, Nevada, and associate contributing editor at Gustan Cho Associates says the following about fixing your credit fast to buy a house:

The easiest and fastest way to rebuild your credit to get qualified and approved for a mortgage is to get three to four secured credit cards and two credit rebuilder accounts.

The team at Gustan Cho Associates can help borrowers to maximize their credit scores at no charge. As time pass, your bad credit will have less of an impact on your credit scores. Over 30% of American consumers have credit scores lower than 620 FICO. In the following paragraphs, we will cover how to rebuild credit for mortgage approval. We will show you some quick tricks of the trade in rebuilding your credit and boosting your credit scores.

How To Rebuild Credit For Mortgage Approval To Buy a House

If you want to improve your credit and increase your credit scores, you may be tempted to hire a credit repair service that promises to fix your credit problems for a hefty fee. However, you can achieve the same results or even better by taking some simple steps. Most loan officers are experts in helping borrowers rebuild credit for mortgage approval.

Experian, Transunion, and Equifax are the three major credit bureaus in the nation. You do not need to hire an expensive credit repair consultant to rebuild credit for mortgage approval.

We will guide you on how to rebuild credit for mortgage approval to buy a house. Consumers should monitor their credit scores like they monitor their bank accounts. Check your credit scores regularly. You can access all your credit scores by paying a $30 monthly fee for credit monitoring to all three credit bureaus.

Experian Credit Boost

We highly recommend you sign up for the three bureaus” credit monitoring service at Experian and start with the Experian Credit Boost. Go to www.experian.com and sign up for the Experian Credit Boost. You can track your credit scores and see how they change over time. You will also be able to simulate and improve your Experian credit scores and easily dispute any errors on your credit report.

Ready to Rebuild Your Credit and Buy a Home?

Rebuilding your credit is key to securing mortgage approval. Contact us today to learn how we can help you improve your credit score and get you one step closer to homeownership.

Mortgage Approval With Credit Scores Down To 520 FICO

The team at Gustan Cho Associates has helped thousands of people boost their credit scores and rebuild their credit. We are experts in helping people rebuild credit after bankruptcy or foreclosure. Most of our borrowers with a recent bankruptcy have boosted their credit scores to over 700 FICO less than one year after the Chapter 7 Bankruptcy discharge date. In the following paragraphs, we will guide you on a step-by-step journey on how to rebuild credit for mortgage approval.

Mortgage Approval With Collection Accounts

Gustan Cho Associates gets countless inquiries daily on how to rebuild credit for mortgage approval. Mortgage loan applicants do not have to hire expensive credit repair companies, says John Strange of Gustan Cho Associates. John continues by advising the following:

The team at Gustan Cho Associates has helped thousands of borrowers re-establish and rebuild their credit so they can qualify for a mortgage with the lowest possible rates.

There are minimum credit score requirements to qualify for a mortgage. You do not need to hire a credit repair company to qualify for a mortgage. Credit repair companies can do more damage than good. You cannot have credit disputes during the mortgage process. Before you try to repair your credit to qualify for a mortgage, contact us, and we will guide you on rebuilding your credit for mortgage approval.

Guide on How To Rebuild Credit For Mortgage Approval

We have prepared this guide on how to rebuild credit for a mortgage approval to help borrowers with bad credit and lower credit scores. According to John Strange of Gustan Cho Associates, any derogatory credit tradelines older than two years old do not affect your credit scores.

Old derogatory credit tradelines do not hurt your credit scores. When you first are late or get derogatory credit, it will drop your credit scores. However, as your derogatory credit age, it will have less impact on your credit scores.

You can qualify for a mortgage with late payments, collections, charged-off accounts, repossession of auto, and other derogatory credit if you are a year old or older. We have created a step-by-step guide on boosting your credit scores and rebuilding credit for mortgage approval.

How To Improve Credit To Qualify For a Mortgage With Bad Credit?

Rebuilding and re-establishing credit requires patience and commitment. We will show you a user-friendly, easy guide to the road to great credit so you can qualify for a mortgage at a great rate. Mike Kortas, President and CEO of NEXA Mortgage, advises the following to consumers with bad credit who want to qualify for a mortgage:

The focus bad credit borrowers need to focus on going forward. They need to monitor their credit reports, like their bank accounts. Credit repair is not required on the road for great credit. Whatever a credit repair company does, you can do it yourself, but better. The foundation of great credit starts with the fundamentals and changes in your habit.

Gustan Cho Associates have helped thousands of borrowers increase their credit scores to over 700 FICO just one year after bankruptcy. Having low credit scores is not permanent. Just think of going over a hangover. Bad credit is like having a hangover. With time, your credit scores will re-establish, and your scores will increase even if you do not do anything about it.

Monitoring Your Credit through Free Credit Report

Consumers should get into the basic habit of monitoring their credit reports like they monitor their bank accounts. Monitor your credit report by signing up for a credit reporting service like Credit Karma. Angie Torres, the national operations director of Gustan Cho Associates, explains the importance of monitoring your credit reports: Credit Karma and other credit report providers will alert you if there are any changes on the credit profile of your credit report.

Outstanding collection and charged-off accounts do not have to be paid to qualify for owner-occupant primary residence home mortgages.

You do not have to pay outstanding collection or charged-off accounts to qualify for a mortgage unless you are threatened with a lawsuit. You do not want a judgment entered against you (See the useful link on a mortgage with outstanding judgments). Review your credit reports regularly and know your different types of debts. Not all types of debt have the same impact on your credit scores. For example, having a car loan worth more than your car’s value will not hurt your credit scores.

Mortgage Guidelines on Credit Disputes

Credit disputes must be removed during the mortgage process to qualify for FHA loans (See the useful link below). However, many lenders have lender overlays on VA, USDA, and conventional loans with credit disputes and require borrower to have all disputes removed. Always set aside a portion of your earnings for reserves. Alex Carlucci explains how to start a strong credit profile with different types of credit tradelines:

Have a series of different types of credit tradelines. Your credit report comprises the different kinds of credit you have. Secured credit cards are the easiest and fastest way to increase your credit scores and rebuild your credit profile.

Check your credit report for errors, and ensure it is updated. Never close out an open revolving credit tradeline even though you may not use it. Credit bureaus base their credit scoring model on the number of aged credit tradelines you have. As your credit tradelines age, the stronger your credit profile and the higher your credit score.

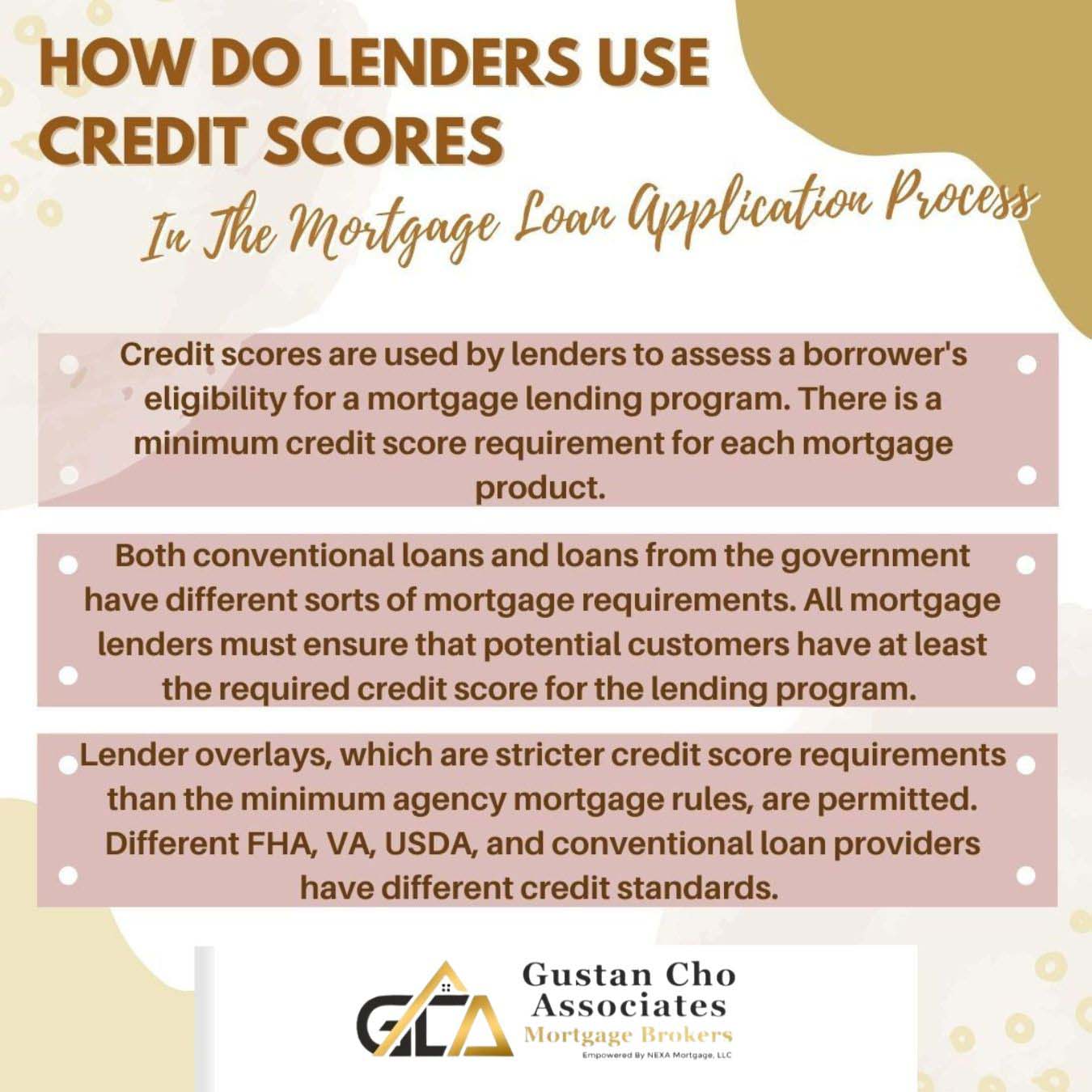

How Do Lenders Use Credit Scores In The Mortgage Loan Application Process

By reading this guide on how to rebuild credit for mortgage approval, you will realize the step-by-step process to the road to great credit is easy and simple. This guide was carefully created to make the steps of rebuilding your credit as practical as possible to make the steps in this guide part of your lifestyle. If you read this guide and are committed to rebuilding your credit, you will religiously monitor your debts like you do your bank account.

How Late Payments Can Disqualify From Getting Mortgage Approval

Whether a 5 dollar minimum monthly payment or a $900 monthly payment, a 30-day late payment is a late payment. Late payments in the past 12 months can deter you from getting a mortgage loan approval. Set up auto payments for the minimum payment due so you will not overlook the minimum monthly payment to your creditors. To avoid forgetting about making your monthly payments, always set up auto payments on all your credit tradelines, advises Dale Elenteny, a senior loan officer at Gustan Cho Associates

Do not dispute derogatory credit tradelines unless you have documentation the creditor made an error. Do not dispute for disputing, hoping the derogatory credit item will fall off.

Always have auto payments signed up with your credit to deter you from overlooking any debts due, which can be detrimental to obtaining credit, especially qualifying for a home loan with competitive rates. Hopefully, after reading this guide on rebuilding credit for mortgage approval, you will realize how important credit is and commit religiously to practicing the steps in this guide to keep a solid credit profile and high credit scores.

Looking to Buy a Home? Rebuild Your Credit for Mortgage Approval

Don’t let a low credit score hold you back from owning a home. Contact us now for expert advice on how to rebuild your credit and qualify for a mortgage.

Steps How to Rebuild Credit For Mortgage Approval Explained

Lenders use credit scores to determine if borrowers qualify for a mortgage loan program. Every mortgage program has its minimum credit score requirement. Not every lender has the same lending requirements on FHA, VA, USDA, and conventional loans. One lender may require a higher lending requirement over a different lender, explains Alex Carlucci of Gustan Cho Associates.

There are two types of mortgage requirements for government and conventional loans. All mortgage lenders need to have borrowers meet the minimum credit score requirements of the loan program.

Lenders can have higher credit score requirements than the minimum agency mortgage guidelines called lender overlays. You should understand the basic mortgage guidelines of FHA, VA, USDA, Fannie Mae, and Freddie Mac. We have all the guidelines on Gustan Cho Associates for our viewers and borrowers. Not all FHA, VA, USDA, and conventional loan lenders have the same credit requirements. Gustan Cho Associates is one of the very few mortgage companies with no lender overlays on government and conventional loans.

Minimum Credit Score Requirements on Government and Conventional Loans

Government-Back Mortgage Loans

There are three different government loan programs exist FHA, VA, and USDA. Conventional loans are called conforming loans because they must conform to Fannie Mae and Freddie Mac Guidelines. John Strange of Gustan Cho Associates explains what lender overlays are:

Lender overlays are higher lending requirements by each individual lenders that is above and beyond the minimum agency guidelines of HUD, VA, USDA, Fannie Mae, and Freddie Mac.

Mortgage lenders can have higher lending requirements above and beyond the minimum agency mortgage guidelines of FHA, VA, USDA, Fannie Mae, and Freddie Mac. Besides using credit scores to set minimum credit score requirements, lenders use credit scores to price mortgage rates. The lower the credit score, the higher the rate charged by lenders. HUD, the parent of FHA, requires a 580 credit score for homebuyers to qualify for a 3.5% down payment FHA loan.

What Credit Score Is Need To Qualify For a Mortgage

The first mortgage requirement is that all borrowers meet agency mortgage guidelines of FHA, VA, USDA, Fannie Mae, and Freddie Mac. Individual mortgage lenders with higher credit requirements above and beyond the minimum agency mortgage guidelines set the second mortgage lending requirement. The second type of guideline by the individual lender is called lender overlays. Most lenders have lender overlays on government and conventional loans. What to Do When Your Score Drops Significantly:

If your credit score drastically decreases from 760 to 600, and you don’t have enough money to pay off your credit cards below 10% usage, here are some alternatives you can consider.

Want to Buy a House? Rebuild Your Credit to Get Approved for a Mortgage

Reach out now to find out how we can help you take the necessary steps to qualify for a home loan.

How To Rebuild Credit To Qualify For a Mortgage With High Debt-To-Income Ratios

Many borrowers cannot qualify for a mortgage because they have a high debt-to-income ratio. Sometimes, it makes sense to take out a personal unsecured or secured loan with a longer amortization and pay the high monthly payment debts.

Credit Unions are the easiest and fastest of getting a personal loan, credit card, or secured loan. Contact the credit union and talk to them about which credit bureau they use, and what is their income and credit criteria.

Research Credit Union Criteria: Before you apply for any loan, call different credit unions and get some basic information. Some credit unions have a debt-to-income (DTI) ratio limit of 55%, while others have a limit of 35%. Look for a credit union with a high DTI allowance of around 50% and a favorable LTV for cash-out car loans based on your low credit score. Ask them which credit bureau they use, which FICO score they look at, and if they pull reports from all three credit bureaus.

Cash-Out Car Loan

If you have equity in your car, getting fast cash to pay down debt to lower debt-to-income ratios is getting a secured cash-out car loan with a credit union. Most credit unions will give you 80% to 125 loan-to-value on a cash-out refinance auto loan. Applying for Multiple Loans at credit unions is highly recommended:

When you apply for a cash-out car loan, you can also apply for additional credit cards and personal loans from the same credit union. Use these funds to pay off the rest of your credit card balances.

Paying off all your credit balances could increase your credit scores by as much as 140 points. Look for credit unions that offer no-cost auto loans. Car loans are usually easier to get and are processed quickly, often within an hour. Contact different credit unions and ask if they offer cash-out car loans. This means you can get a new car loan larger than what you owe on your current car loan and use the extra money to pay off all your credit card balances. Ensure you keep all your credit card accounts, which may hurt your credit. Due to your credit score of 600, you might be eligible for a cash-out car loan, provided that the loan-to-value (LTV) ratio is below 80%.

Why Apply For a Debt Consolidation Loan at Credit Unions?

Advantages of Credit Unions: Credit unions are organizations owned by their members rather than shareholders, meaning they focus more on serving their members than making profits. Even if you only have a small account with a credit union, you can benefit from their loans with lower interest rates and easier qualification criteria than traditional banks. Be sure to tell the loan officer that you are consolidating your debt and paying off your credit cards, as this will help them exclude those payments from your DTI calculation.

Understanding Loan Parameters

Ensure you understand the information you must request from the credit union. Ask them what LTV they offer for your credit score. For example, if your car is worth $40,000, according to Kelley Blue Book, and you owe $20,000 on your car loan, an 80% LTV loan would give you $32,000.

After paying off your $20,000 car loan balance, you would have only $12,000 left to pay off your credit cards. This would likely increase your credit score by 60 points, as your usage would go down from 100% to below 45%.

Most Credit cards have an interest rate of 30% or higher, with $20,000 in credit card debt and a $600 monthly payment. Most car loans have an interest rate below 7.99% with a 60-month term with a payment of $400. This is a $200 monthly savings, saving $2,400 per year.

Mortgage Approval By New Lender After Loan Denial

Over 80% of our borrowers are folks who could not qualify elsewhere. Gustan Cho Associates is a mortgage advisor licensed in 48 states. We have the states, the mortgage products, and competitive rates. Mike Gracz of Gustan Cho Associates explains why Gustan Cho Associates differs from the competition. No other mortgage lender in the nation has many wholesale mortgage lenders and traditional and non-prime mortgage loan programs than Gustan Cho Associates.

The team at Gustan Cho Associates has a national reputation for being able to do loans other lenders cannot do. Gustan Cho Associates have been called a one-stop mortgage shop by our borrowers and realtor partners.

Borrowers who get an approve/eligible per automated underwriting system (AUS) can get denied by a mortgage lender with lender overlays. If borrowers meet the minimum agency mortgage guidelines but get a mortgage denial, they can choose a lender with no lender overlays to qualify and get approved. By following these tips, you can take control of improving your credit scores on your own and save hundreds of dollars that you would otherwise spend on credit repair services and high credit card interest payments. Remember to be proactive, monitor your credit regularly, and make smart financial decisions to maintain and improve your creditworthiness.

Ready to Buy a Home? Let’s Work on Rebuilding Your Credit First

Contact us today to learn how we can help you rebuild your credit and get approved to buy a house.