Washington Mortgage Calculator

Homebuyers in Washington state can easily compute their true most accurate monthly mortgage payment and front-end and back-end debt-to-income ratio using the Washington Mortgage Calculator powered by Gustan Cho Associates. After realizing there is no online home loan calculator that gives an accurate monthly mortgage payment, the team at Gustan Cho Associates decided to develop its own online Washington Mortgage Calculator with PITI, PMI, MIP, HOA, and DTI. It took many months and countless hours to perfect the Washington Mortgage Calculator with the DTI mortgage calculator for our clients and loan officers. Once launched, it was a hit.

- Conv

- FHA

- VA

- Jum/Non

- USDA

The Best Washington Mortgage Calculator For Being Fast and Accurate

Many loan officers in the mortgage industry, real estate agents, and attorneys asked us if they could use the Washington Mortgage Calculator for their businesses. We are more than happy to share our Washington Mortgage Calculator with other mortgage advisors, realtors, and attorneys. We will even go further and white label the Best Washington Mortgage Calculator at no charge. The team at GCA Mortgage Group is very proud of the outcome of the Washington Mortgage Calculator and the debt-to-income ratio mortgage calculator.

Looking to Buy a Home in Washington?

Apply Now And Get recommendations From Loan Experts

Calculating My Estimated Monthly Mortgage Payment in Washington?

The Washington Mortgage Calculator calculates the monthly mortgage payment with every component from the mortgage loan program the user selects. The calculator has been programmed to populate private mortgage insurance on conventional loans. The conventional loan private mortgage insurance is required for homebuyers with less than 20% equity in the home. The PMI has been averaged, so it is not 100% accurate but rather an estimation by taking the national average. John Strange, a senior loan officer at Gustan Cho Associates, says the following about the Washington Mortgage Calculator:

If you have a more accurate private mortgage insurance factor or number, you can manually enter the PMI. FHA upfront and annual mortgage insurance premium, and VA funding fee for exempt users, first-time veterans, and second-time users of VA loans.

The one-time FHA Mortgage Insurance Premium on FHA loans has been populated and added to the loan balance. The annual FHA mortgage insurance premium has been programmed based on the down payment, loan balance, and term of the loan. The VA funding fee on VA loans has been populated on the VA mortgage calculator. All debt-to-income ratio agency guidelines have been programmed in the Washington Mortgage Calculator.

How To Get Pre-Approved With The Best Washington Mortgage Lenders

There are two types of mortgage guidelines. Agency mortgage guidelines of Fannie Mae, HUD, USDA, and VA and overlays by mortgage lenders. Lender overlays are additional mortgage guidelines on top of the minimum agency guidelines. The best Washington mortgage lenders are lenders with no overlays on government and conventional loans. If you deal with a Washington mortgage lender with no overlays on debt-to-income ratios, all you need to worry about is the agency guidelines of HUD, VA, USDA, Fannie Mae, and/or Freddie Mac. Below are the agency guidelines of HUD, VA, USDA, Fannie Mae, and Freddie Mac:

- HUD allows up to 46.9% front-end and 56.9% back-end on FHA loans for borrowers with at least a 580 FICO score

- VA does not have DTI maximums as long as the borrower can get an approve/eligible per automated underwriting system (AUS)

- USDA has a 29% front-end and 41% back-end debt-to-income ratio

- Fannie Mae and Freddie Mac have a maximum 45% to 50% back-end debt-to-income ratio cap

- Fannie Mae and Freddie Mac do not have a maximum front-end debt-to-income ratio cap

How To Use The Best Washington Mortgage Calculator

First, check the loan program on the top of the calculator you are applying for. Enter the purchase price, down payment, interest rate, and loan term. You will get the principal and interest portion of your monthly mortgage payment. Next, enter the property tax and homeowners insurance information. Enter the homeowners association dues if it applies to the subject property. You will not have the total monthly mortgage payment. The components making the monthly mortgage payment will be listed below. Next, we can move on to computing your debt-to-income ratio.

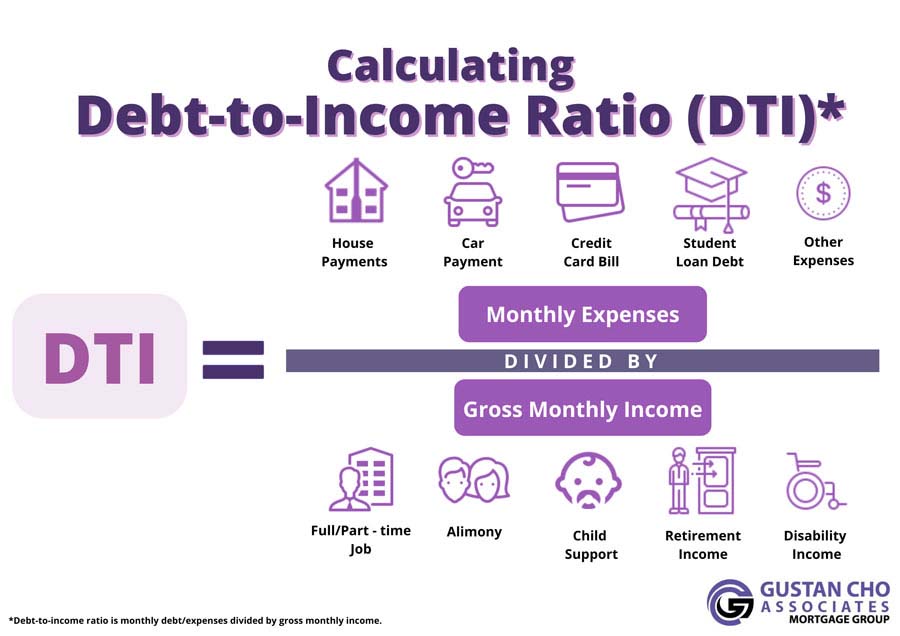

How To Calculate Your Front-End and Back-End Debt-To-Income Ratio

Move over to the debt-to-income ratio mortgage calculator. You will be so surprised by how easy it is to get your front-end and back-end debt-to-income ratio. The monthly housing mortgage payment will move over to the DTI side of the mortgage calculator, and you will see it on the top box. The next step is to enter the minimum monthly debt payments on the box labeled. This is done by adding all of the minimum monthly payments you have that are from traditional creditors. Dale Elenteny, a senior loan officer at GCA Mortgage Group, says the following about the Washington Mortgage Calculator:

Traditional creditors are creditors who report your payment history on all credit bureaus. Non-traditional credit tradelines do not count for DTI calculations by mortgage underwriters. Once you have the total, enter the sum in the box that states minimum monthly debt payments.

The final step is to enter your monthly and/or yearly gross income in the box that says Monthly or Yearly Income. The income needs to be the gross income before any taxes and/or other deductions get taken out. You will now have the results of your front-end and back-end debt-to-income ratios.

Washington Mortgage Calculator Powered by Gustan Cho Associates: Your Ultimate Guide to Home Loan Approval

Simplify homeownership with the Washington Mortgage Calculator powered by Gustan Cho Associates. Learn how the Washington Mortgage Calculator helps homebuyers estimate mortgage payments, manage debt-to-income ratios, and get approved for a mortgage loan in Washington.

Helping Washington Homebuyers Make Smart Financial Decisions

- Buying a home in Washington is an exciting journey, but with rising home prices, budgeting is more important than ever. At Gustan Cho Associates, we continuously innovate to simplify the home loan process and help our clients make informed financial decisions. Our Washington Mortgage Calculator is a state-of-the-art tool that enables homebuyers to accurately estimate their mortgage payments and determine their loan eligibility based on debt-to-income (DTI) ratios.

This comprehensive guide will cover:

- How to use the Washington Mortgage Calculator

- What factors impact your mortgage payment?

- How to get approved for a mortgage in Washington

- Why budgeting and DTI ratios matter for home loans

- Steps to qualify for the best mortgage rates

Whether you’re a first-time homebuyer or a seasoned homeowner, this guide will help you understand everything about mortgage budgeting and approval in Washington.

What Is the Washington Mortgage Calculator?

The Washington Mortgage Calculator by Gustan Cho Associates is a powerful online tool designed to help homebuyers calculate their total monthly mortgage payment. Unlike basic calculators, ours includes:

- Principal and Interest (P&I)

- Property Taxes

- Homeowners Insurance (HOI)

- Private Mortgage Insurance (PMI) (if required)

- Homeowners Association (HOA) Fees

- Debt-to-Income (DTI) Ratio Analysis

By using the Washington Mortgage Calculator, homebuyers can get an accurate estimate of their mortgage payment and stay within a comfortable budget.

Why Is the Washington Mortgage Calculator Unique?

At Gustan Cho Associates, we strive to provide innovative mortgage tools that go beyond basic calculations. Our calculator includes a DTI ratio feature, allowing you to check whether you meet lender requirements for mortgage approval.

Key Benefits of the Washington Mortgage Calculator:

- Accurate & Real-Time Mortgage Payment Estimates

- Includes All Mortgage Costs (PITIA)

- Debt-to-Income (DTI) Ratio Analysis

- Helps You Stay Within Budget

- User-Friendly on Desktop & Mobile

How to Use the Washington Mortgage Calculator

Using our mortgage calculator is quick and easy. Follow these simple steps to estimate your total mortgage payment:

Step-by-Step Guide

- Enter the Home Price: Input the purchase price of the home you’re considering.

- Adjust Your Down Payment Choose how much you plan to put down (3.5% for FHA loans, 5% for conventional, or 0% for VA loans).

- Select Your Loan Term Choose between 15-year, 20-year, or 30-year fixed-rate mortgages.

- Enter the interest rate. Use the current market rate or estimate based on your credit score.

- Include Property Tax and Insurance Costs. These vary by county in Washington and affect affordability.

- Add Homeowners Association (HOA) Fees—If applicable, enter your HOA dues.

- Check Your Debt-to-Income (DTI) Ratio: Input your monthly debts (credit cards, car loans, student loans) to determine if you qualify.

Once all details are entered, the calculator will display your estimated monthly mortgage payment and DTI ratio, helping you understand affordability and loan eligibility.

How to Get Approved for a Mortgage in Washington

Step 1: Understanding the Mortgage Qualification Process

Getting approved for a home loan in Washington involves the following key steps:

1. Check Your Credit Score

- Conventional loans: Minimum 620 credit score

- FHA loans: Minimum 580 credit score (500 with a higher down payment)

- VA and USDA loans: More flexible credit requirements

2. Evaluate Your Debt-to-Income (DTI) Ratio

- Most lenders prefer a DTI ratio of 43% or lower.

- FHA loans allow DTI ratios up to 57% in some cases.

- Use the Washington Mortgage Calculator to check your DTI.

3. Save for a Down Payment

- Conventional loans: 3%-5% down

- FHA loans: 3.5% down

- VA & USDA loans: 0% down

4. Gather Required Documentation

- Two years of tax returns

- Recent pay stubs & W-2s

- Bank statements (to verify down payment funds)

- Proof of employment

5. Choose the Right Mortgage Loan Program

- Conventional Loan: Best for borrowers with good credit and stable income.

- FHA Loan: Ideal for first-time buyers and low-credit borrowers.

- VA Loan: Available for veterans & active-duty military.

- USDA Loan: For homebuyers in eligible rural areas.

6. Get Pre-Approved

- A pre-approval letter strengthens your offer and makes you a competitive buyer in Washington’s housing market.

Why Budgeting Is Critical for Washington Homebuyers

Rising Home Prices in Washington

- Median home price in Washington (2025): $550,000

- Increase from 2022: 18%

- Average mortgage rate: 6.5%

With home prices on the rise, it’s essential to budget properly before purchasing a home.

Understanding PITIA: Your Total Mortgage Payment

Your mortgage payment includes more than just principal and interest. You must also account for:

- Property Taxes: Varies by county within the state of Washington

- Homeowners Insurance: Required for all mortgage loans.

- Private Mortgage Insurance (PMI): Required for down payments under 20%.

- HOA Fees: Must be factored in if applicable.

By using the Washington Mortgage Calculator, you can ensure affordability and avoid financial stress.

Use the Washington Mortgage Calculator to Plan Your Home Purchase

The Washington Mortgage Calculator by Gustan Cho Associates is an essential tool for homebuyers looking to accurately estimate mortgage payments and qualify for a home loan. By calculating your total mortgage payment and DTI ratio, you can confidently move forward in your home-buying journey.

- Accurate Payment Estimates

- Helps You Stay Within Budget

- Determines Loan Eligibility

- Simplifies the Mortgage Process

Ready to buy a home in Washington? Use the Washington Mortgage Calculator today and start planning for your dream home!

Frequently Asked Questions (FAQs)

How accurate is the Washington Mortgage Calculator?

- Our calculator provides real-time, highly accurate estimates, but final mortgage approval depends on lender guidelines.

Can I qualify for a mortgage with a high DTI ratio?

- FHA loans allow higher DTI ratios (up to 57%), while conventional loans typically cap at 43%.

What’s included in my total mortgage payment?

- Your payment includes principal, interest, taxes, insurance, PMI, and HOA dues (if applicable).