Use our Virginia Mortgage Calculator for the most accurate monthly housing payment, which includes the principal, interest, taxes, homeowners insurance (PITI), private mortgage insurance, and/or mortgage insurance premium (PMI and/or MIP) and homeowners association dues (HOA dues). Besides the PITI, PMI/MIP, and HOA dues, the Virginia Mortgage Calculator can be used to calculate your front-end and back-end debt-to-income ratios. Now, how cool is that!!! Property taxes can make a deal or break it for homebuyers with high debt-to-income ratios due to the large variance depending on the house.

- Conv

- FHA

- VA

- Jum/Non

- USDA

To estimate how property taxes affect the monthly housing costs, especially in Virginia, the Virginia Mortgage Calculator best suits homebuyers.

That being said, here is how these features can be especially helpful:

- PITI (Principal, Interest, Taxes, Insurance): Considering all these factors accurately estimates future monthly mortgage payments, which is critical for a buyer.

- PMI/MIP: Understanding the cost of mortgage insurance is critical for buyers who cannot make a down payment of 20% of the home’s price.

- The PMI on conventional loans and MIP on FHA loans help budget these additional costs until at least 20% equity in the home is achieved.

- HOA Dues: For buyers purchasing properties in planned communities or condominiums where HOA dues are mandatory, factoring them in is essential as they considerably increase monthly expenses.

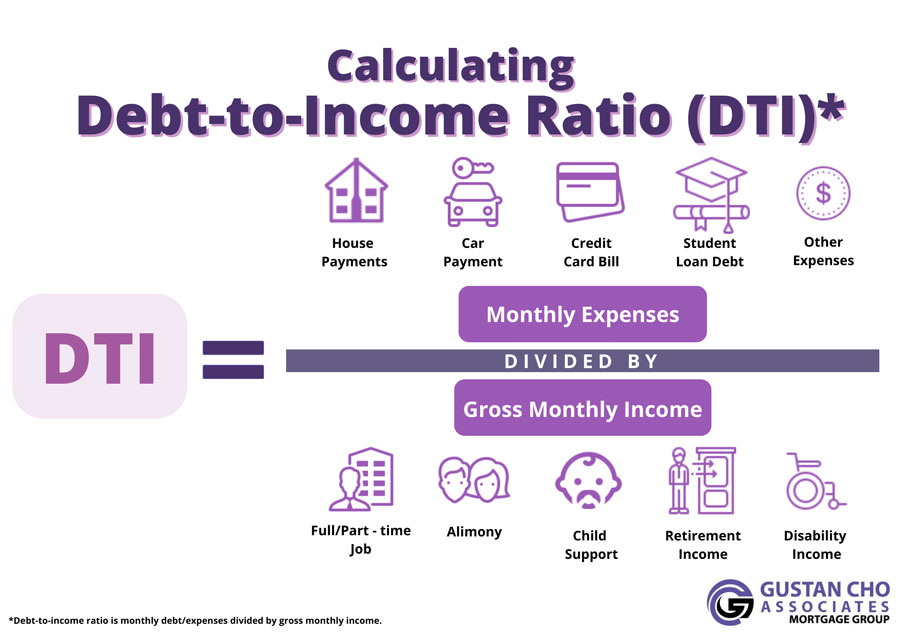

- Debt-to-Income Ratios: Knowing how to compute front-end (housing costs ratio) and back-end (total debt ratio) amortization debt ratios is beneficial to a buyer.

- It allows them to determine whether they qualify for mortgage approval, which, in most cases, is pegged with a front-end ratio lower than 28% and a back-end ratio of 36% or lower.

- However, some programs have more lenient limits.

- Property Taxes: As you have indicated, Virginia taxes are jurisdictionally sensitive and range widely based on the property’s location and value.

- This variability can pose serious affordability challenges to buyers with higher debt ratios.

- Estimating your property tax liability can change the scope of what type of affordable home.

The Virginia mortgage calculator helps users estimate costs and make decisions regarding the financing of a house in Virginia. This is an essential tool for prospective home buyers, as it ensures they are not caught off-guard by unexpected expenses.

Your Dream Home in Virginia Is Within Reach

Apply Online And Get recommendations From Loan Experts

Users of The Virginia Mortgage Calculator Can Compute DTI in Seconds

You no longer have to contact your loan officer every time you look at a house that interests you to see if you still meet the debt-to-income ratio agency mortgage guidelines. You can literally compute all the components of your housing payment and your front-end and back-end debt-to-income ratio in a matter of seconds. No BS. The Virginia Mortgage Calculator is self-explanatory, and I am sure all users can figure this out. All you need to do is start by entering the particular mortgage loan program on top of the mortgage calculator: Conventional, FHA, VA, Jumbo, or Non-QM home loans. We will walk through step-by-step instructions on using the Virginia Mortgage Calculator powered by Gustan Cho Associates.

About the Virginia Mortgage Calculator with PITI, PMI, MIP, and HOA

Homebuyers and homeowners in Virginia can calculate how much their TOTAL monthly mortgage payment will be with PMI, property tax, insurance, and HOA using the Gustan Cho Associates Virginia Mortgage Calculator. Unlike most online mortgage calculators, the Virginia Mortgage Calculator will compute all components of your monthly mortgage payment depending on the particular mortgage loan program. Every mortgage loan program has its own private mortgage insurance and/or mortgage insurance premium, down payment requirements, and debt-to-income ratio guidelines. We have preprogrammed the mortgage calculator to compute conventional loans, FHA home loans, VA mortgages, jumbo loans, and non-QM loans.

Compute Your Monthly Mortgage Payment and DTI In a Few Simple Steps

Launched by GCA Mortgage Group, the Virginia Mortgage Calculator is the best mortgage calculator for users who want a user-friendly mortgage calculator with accurate, data-driven results. There may be other mortgage calculators, but none in Virginia as user-friendly and as accurate as the Virginia Mortgage Calculator powered by GCA Mortgage Group. The Virginia Mortgage Calculator is even used by other loan officers across the nation, and it has been a major hit. For the most accurate results for borrowers to calculate mortgage payments when shopping for homes or planning to refinance, check out the Gustan Cho Associates Virginia Mortgage Calculator. Our borrowers love it, and you will too.

How To Use the Virginia Mortgage Calculator

Use our Virginia Mortgage Calculator for the most accurate monthly housing payment. Below are the step-by-step instructions on how to use the Virginia Mortgage Calculator. The calculator is user-friendly and simple to use. If you have any questions, please contact us at gcho@gustancho.com or at rates@gustancho.com. Enter all data required for housing payment and debt-to-income ratio:

- The first step is to select the loan program on top of the mortgage calculator: Conventional, FHA, VA, Jumbo, or Non-QM mortgages

- Enter the home purchase price, down payment, interest rate, and loan amortization term

- You will get the principal and interest portion as a subtotal

- Continue by entering the property tax information, homeowners insurance premium, and homeowners association dues

- Do not worry about the private mortgage insurance, mortgage insurance premium, and/or VA funding fee: This will auto-populate unless you want to enter the data manually

You will not get the total monthly mortgage payments of your mortgage with all the components.

How To Calculate Your Front-End and Back-End DTI

Move over to the debt-to-income ratio mortgage calculator portion. The monthly mortgage payment will automatically populate to the debt-to-income ratio mortgage calculator. In two simple steps, you will compute your front-end and back-end debt-to-income ratio. Below are the simple steps to compute your debt-to-income ratio using the DTI Virginia Mortgage Calculator:

- Add the sum of all monthly minimum payments from all bills and enter it into the box that says Minimum Monthly Payments

- The monthly bills included for debt-to-income calculations are auto payments, student loans, credit card minimum payments, and any other debts that report to the credit bureaus

- Nontraditional credit tradeline bills such as Utility bills, cellular and landline, internet, cable, personal insurance, school/college, and other bills that do not report to the three credit bureaus are not used for debt-to-income ratio calculations by mortgage underwriters

- Enter your monthly and/or yearly gross income into the box that states Gross Income Per Month or Gross Income Per Year

Your front-end and back-end debt-to-income ratios will populate.

Frequently Asked Questions About Virginia Mortgage Calculator:

Q: What is the Virginia Mortgage Calculator?

A: The Virginia Mortgage Calculator assists prospective homeowners in estimating their monthly mortgage costs, encompassing principal, interest, taxes, insurance, and homeowners association fees.

Q: How Does the Virginia Mortgage Calculator Help with Budgeting?

A: It shows your total monthly payment so you know what to expect before buying a home. It also calculates debt-to-income (DTI) ratios to help you determine whether you qualify for a loan.

Q: Does the Virginia Mortgage Calculator Include Property Taxes?

A: Yes, it factors in Virginia property taxes, which vary by location, so you get an accurate estimate of your total mortgage cost.

Q: Can I Use the Virginia Mortgage Calculator to Check if I Qualify for a Loan?

A: Yes! The calculator computes your front-end and back-end DTI ratios, which lenders use to decide if you qualify for a mortgage.

Q: Does the Virginia Mortgage Calculator Work for All Loan Types?

A: Yes, it works for Conventional, FHA, VA, Jumbo, and non-QM loans, each with its own down payment and mortgage insurance requirements.

Q: What is PMI/MIP, and does the Calculator Include it?

A: PMI (Private Mortgage Insurance) and MIP (Mortgage Insurance Premium) are extra costs if you don’t put 20% down. The Virginia Mortgage Calculator automatically includes them in your monthly payment.

Q: Can the Virginia Mortgage Calculator Help if I’m Buying a Condo?

A: Yes! It includes HOA dues, common in condos and townhomes, so you get the full picture of your monthly costs.

Q: How do I Use the Virginia Mortgage Calculator?

A: Just enter your home price, down payment, loan type, interest rate, property taxes, and insurance, and it will calculate your total monthly payment instantly.

Q: Do I Need to Manually Enter PMI/MIP and Other Fees?

A: No, the Virginia Mortgage Calculator is pre-programmed to automatically calculate PMI, MIP, and VA funding fees, but you can adjust them if needed.

Q: Where Can I Access the Virginia Mortgage Calculator?

A: It’s free to use on the Gustan Cho Associates website and a great tool for homebuyers and homeowners looking to refinance.

FHA, VA, or Conventional? Find the Best Home Loan for You in Virginia

Apply Online And Get recommendations From Loan Experts