FHA 203(k) Loan for Fixer-Uppers: Buy + Renovate With One Mortgage (2026 Guide)

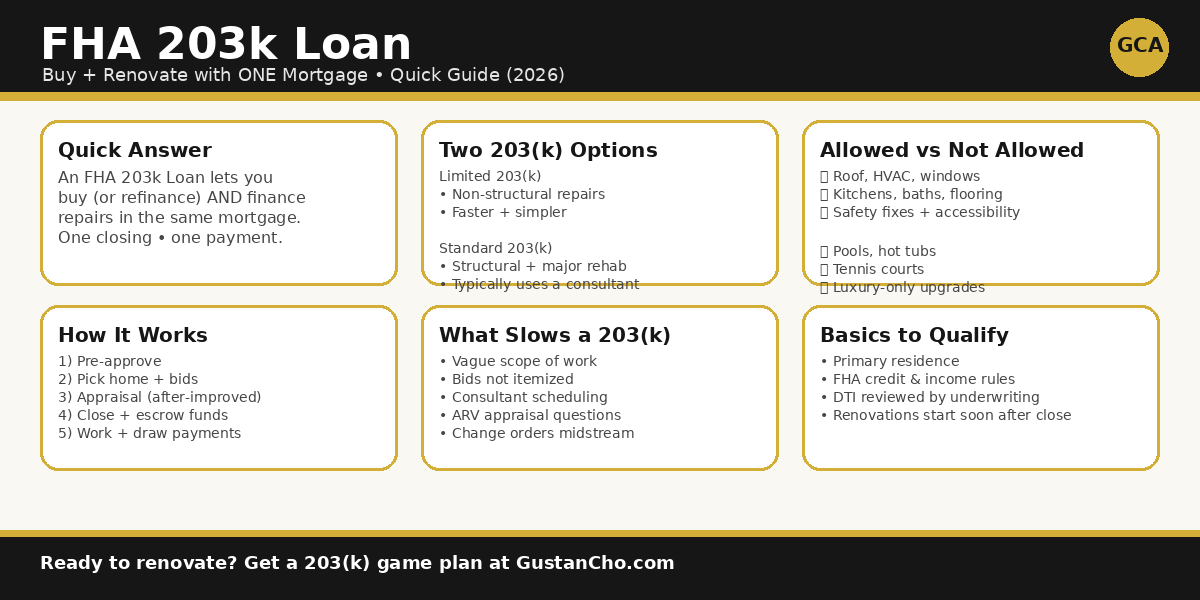

An FHA 203(k) loan lets you buy (or refinance) a home and finance the repairs in the same mortgage—with one closing, one monthly payment, and a low down payment (as little as 3.5% if you qualify). Instead of needing a second loan or paying cash for renovations, the 203(k) rolls your purchase price + renovation budget into one FHA loan based on the home’s after-improved value (what it should be worth when the work is finished).

Who It’s Best For

- Buyers who found a great location, but the home needs updates

- First-time buyers who don’t have extra cash for repairs after closing

- Buyers looking at foreclosures / REOs that won’t qualify for regular financing

- Homeowners who want to refinance and renovate in one transaction

What You’ll Learn in This Guide

By the end of this article, you’ll understand:

- How FHA 203(k) works (and why it’s different from a normal FHA loan)

- The difference between Limited 203(k) vs Standard 203(k) and when each one fits

- What repairs and improvements are allowed (and what’s considered “luxury”)

- How the contractor + draw process works so renovations stay on track

- The main credit score, down payment, and DTI guidelines that lenders look for

- Typical timeline, costs, and fees—and what can be rolled into the loan

- The most common reasons 203(k) loans get delayed—and how to avoid them

Take First Step Toward Making Your Dream A Reality

Apply Now And Get recommendations From Loan Experts

What is an FHA 203k Loan?

The FHA 203k Loan is an FHA-backed mortgage that bundles home financing and repair funds into one loan. Instead of simply buying the home as-is, buyers can borrow the purchase price plus the estimated renovation cost.

FHA 203k loans, renovation loans, FHA 203k requirements, home improvement financing, fixer-upper loans, FHA rehab loans, renovation mortgage

This makes it one of the best tools for getting into a home that needs a little love, because it looks at the home’s future value once the updates are done, and that higher number gives you a bigger loan. Because borrowers only have to put a small down payment down and can have lower credit scores, it works especially well for first-time homebuyers stepping into renovations.

Don’t Let Repairs Stop You From Buying

This guide walks you through how the 203k Loan works, who qualifies for it, what repairs you can pay for, and how the application process looks step by step. Finish it, and you’ll know the facts you need to decide if this loan is the best fit for your renovation dreams.

Even homes that need work can qualify with FHA 203k financing.

Renovate and Buy With One Loan

The FHA 203k Loan lets you purchase and renovate your home with just one mortgage. At Gustan Cho Associates, we make the process simple and stress-free.

Definition and Purpose

In plain terms, the FHA 203k Loan lets you close on a house and pay for upgrades with one mortgage, one set of fees, and one low monthly payment. The FHA 203k loan gives you money for many household upgrades. It pays for big projects, like fixing broken walls, shining up kitchens, adding ramps, and more.

The program is meant to breathe new life into older and neglected properties, especially in neighborhoods with many aging houses.

Instead of waiting years to save for new systems, roofs, or kitchens, buyers can move in, and the renovations can be staged over a few months while the house appreciates. This is a big plus in 2026, as housing markets are tight, and the program helps buyers who can’t tap other sources for cash.

Types of FHA 203k Loans

Under the FHA 203k banner, there are two paths, so you can choose the one that best suits your home’s needs.

Standard 203k Loan

For a Standard FHA 203(k), most lenders typically require a 203(k) consultant (often called a HUD 203(k) consultant) because the project is larger and needs tighter oversight. The consultant helps write a detailed Scope of Work, confirms the repairs meet FHA guidelines, and supports the draw/inspection process so funds are released in stages as work is completed.

For a Limited/Streamline 203(k), a consultant is usually not required since the repairs are simpler and non-structural. In many cases, the lender can manage the paperwork using contractor bids and a basic repair list.

Limited 203k Loan

The Limited 203k, once called the Streamline 203k, is designed for small, cosmetic changes that don’t touch the house frame. Buyers can borrow up to $35,000, including a safety cushion for surprises, and finish the work within six months.

Both 203k options can pay for luxuries like a small deck, though it isn’t the best route for a full pool. The plan always bets on repairs that make the house safer, kinder to the planet, and more comfortable.

Because the repairs are minor, you don’t need a home inspector or consultant. You can paint, swap out appliances, or knock down a non-load-bearing wall hassle-free. No set amount must be spent, but the finished project must be easy to finish in half a year.

How Does an FHA 203k Loan Work?

The FHA 203k Loan is a set of steps, not just a paycheck the day you close. The structure means the repairs happen as promised, keeping the house and the loan in good shape.

The Loan Process, Step-by-Step

- Pre-Approval: Your first step is to chat with a lender who knows 203k—hand over proof of income, your credit score, and a letter from your job.

- The lender runs numbers to determine your borrowing limit.

Find a Property

- Your real estate agent should be a 203k pro so they can show you homes that are old enough (at least one year), are in the right size (1 to 4 living spaces), and can be condos under certain rules.

Hire Professionals

- If you go full Standard 203k, a HUD consultant visits the house to list repairs and ballpark the bill.

- The consultant’s summaries go to your lender.

- You’ll get itemized bids from licensed, insured contractors you choose.

Appraisal

- An FHA appraiser checks the home’s current value and its potential value after the improvements.

- This figure is called the after-repair value, or ARV, and it decides the size of your loan.

Loan Application and Underwriting

- You turn in the loan application, which includes the renovation plans.

- The lender reviews the entire file and makes decisions based on the ARV, so it’s important to have a clear scope of work.

Closing

- Money for the planned repairs is set aside in an escrow account.

- You sign the closing papers, and the deal finalizes, so you can start work on the house immediately.

Renovation Phase

- Approved contractors start the work.

- The escrow account makes milestone payments after inspections.

- This stage can be up to six months.

Final Inspection and Release

- A final walkthrough ensures everything is done.

- Once clear, the inspector releases any leftover repair money, and your loan changes to a standard FHA mortgage.

- From the day you apply to the closing date, it usually takes 45 to 90 days.

- That’s extra time because of the renovation plans.

What Slows a 203(k) Loan Down

- Incomplete or vague Scope of Work: If the repair list isn’t detailed (materials, finishes, quantities, and labor), lenders and appraisers can’t review it cleanly, and the file stalls.

- Contractor bids that don’t match FHA rules: Missing licenses/insurance, lump-sum bids (not itemized), or bids that include non-allowable “luxury” items often require revisions.

- Consultant scheduling delays (Standard 203k): The consultant’s site visit, work write-up, and updates can add time—especially during busy seasons or when changes are requested.

- Appraisal “subject to repairs” issues: The appraiser needs a clear plan to support the improved value. If comps don’t support the ARV or the scope changes, it may trigger a rework or second review.

- Underwriting conditions tied to the renovation budget: Items such as contingency reserves, permits, lead-based paint, structural repairs, or feasibility questions can create additional rounds of conditions.

- Title/insurance/permits not lined up early: Some projects require permits and contractor documentation up front, and delays here can push back closing or the start date.

- Change orders after approval: Switching contractors, changing the scope, or upgrading finishes midstream can require updated bids and re-approval, which slows both closing and draw releases.

Eligible Properties and Improvements

- You can use this loan to buy single-family homes, townhouses, or small multi-unit buildings (four or fewer apartments) that have been lived in for at least a year.

Improvements must boost the home’s value, make it safer, or improve livability, including:

- Adding or changing walls to create a new living space.

- Upgrading kitchens or bathrooms.

- Installing new heating, cooling, or windows to save energy.

- Creating ramps or bathroom bars for easier access.

- Fixing lead paint, mold, or other safety hazards.

- You cannot use the money for luxury projects (like a tennis court) without first getting permission.

FHA 203(k) Repairs: Allowed vs. Not Allowed

✅ Allowed Improvements (common examples)

- Health & safety fixes: mold remediation (when properly addressed), lead-based paint correction, broken stairs/railings, electrical hazards

- Major systems: HVAC replacement, plumbing repairs, electrical upgrades, water heater, septic/well repairs (where permitted)

- Roof + exterior: roof replacement, gutters, siding, windows/doors, insulation, weatherization

- Interior remodels: kitchen and bathroom updates, flooring, drywall, paint, appliances (when part of the rehab)

- Accessibility upgrades: ramps, widened doorways, grab bars, roll-in showers

- Energy-efficiency upgrades: new windows, added insulation, efficient HVAC, sealing/ventilation improvements

- Structural repairs (Standard 203k): foundation repairs, load-bearing wall changes, room additions, major reconstruction (when approved and properly documented)

- Site improvements (when tied to livability): grading/drainage corrections, repairing walkways/steps, addressing water intrusion

❌ Not Allowed (or typically not permitted) “Luxury” Items

- Swimming pools, hot tubs, saunas

- Outdoor kitchens / elaborate fire features

- Tennis courts, basketball courts, putting greens

- High-end “purely cosmetic” upgrades with no functional benefit (examples: premium designer upgrades that don’t improve safety/utility)

⚠️ “It Depends” (often allowed only when it supports function/safety)

- Decks/patios: usually okay if reasonable and improves livability (not a resort-style buildout)

- Landscaping: typically limited to grading/drainage and basic site fixes—not decorative landscaping

- Additions: generally Standard 203k only, must be supported by plans, permits, and appraisal feasibility

- Repairs to detached structures: may be allowed if it supports the home’s function (varies by lender and project)

Rule of thumb: 203(k) is designed for repairs that make the home safe, sound, and livable—not upgrades that are mainly for luxury or entertainment.

Role of Consultants and Contractors

Do You Need a 203(k) Consultant?

For a Standard FHA 203(k) loan, a 203(k) consultant is typically required because the renovation is more complex and the lender needs structured oversight. The consultant helps create (or review) a detailed Scope of Work, confirms the repairs meet FHA 203(k) guidelines, and supports the draw/inspection process so renovation funds are released in stages as work is completed.

For a Limited/Streamline 203(k) loan, a consultant is usually not required since the repairs are smaller and non-structural. In many cases, the lender can approve the project using contractor bids and a simplified repair list.

Important: Requirements can vary by lender and by the complexity of the renovation. Even when not required, some borrowers choose to use a consultant for peace of mind—especially if they’re new to renovation projects.

Contractors: Who Can Do the Work?

203(k) renovations are generally completed by licensed and insured contractors who provide clear, itemized bids. This protects the borrower and the lender by making sure costs, materials, and timelines are documented before closing. During the renovation, funds are typically paid out through draws (milestone payments) after inspections verify progress.

In limited situations, a borrower may be allowed to perform certain work or act as the general contractor, but this is uncommon and depends on lender approval, experience, and the type of repairs.

Do I need two loans for purchase and rehab?

Not at all—FHA 203k combines them into one easy loan.

FHA 203k Loan Requirements in 2026

If you want an FHA 203k loan in 2026, you must clear the usual FHA guidelines plus a few renovation-specific ones.

Credit Score and Down Payment

- The FHA sets a baseline credit score of 500, but most lenders want at least 580 for the 3.5 percent down payment choice.

- A score in the 500 to 579 range calls for a 10 percent down payment.

- That amount is figured on the full loan sum, which covers both the sales price and the improvement funds.

Debt-to-Income Ratio

- Your debt-to-income percentage should stay below 43 percent.

- However, if you have strong compensating factors—like a good credit track record or sizable cash reserves.

- Some lenders may approve with a DTI as high as 56.9 percent.

Employment and Income

You must show two years of stable job history and have proof of income. Acceptable documents for income can include W-2 forms, tax returns, or records for self-employed borrowers. Those self-employed applicants might have to submit extra paperwork to back their income figures.

Property Requirements

To qualify for an FHA 203k loan, the house must appraise at or above the planned loan amount once repairs are done, and it has to meet FHA’s basic property standards. You’ll need to move in within 60 days of closing, and the home must be your main residence.

Benefits of FHA 203k Loans

- Low Down Payment: You can put down just 3.5%, which is affordable for many buyers.

- Flexible Credit: FHA is more forgiving of lower credit scores than conventional loans.

- Single Loan and Payment: You get just one mortgage for purchase and renovations.

- Instant Equity: Completing renovations can boost your home’s value right away.

- Government Support: The FHA guarantee usually means lower interest rates and easier qualifying.

- Flexible Use: The funds can be for buying, refinancing, or even turning a multi-unit property into a primary residence.

- With 2026’s rising renovations and equally rising home values, the FHA 203k loan gives buyers an edge in a competitive market by letting them fix up overlooked homes often for sale at lower prices.

Costs and Fees Associated with FHA 203k Loans

As with most FHA loans, be ready for the upfront mortgage insurance premium of 1.75% and an ongoing annual mortgage insurance premium (MIP) usually 0.55%.

You can expect other typical 203k charges, including:

- Consultant fees for project oversight usually range from $400 to $1,000 for a “Standard” 203k.

- Inspection fees that run $100 to $300 for each construction draw.

- Contingency reserves that set aside 10% to 20% of renovation costs.

- Slightly higher interest rates—about 0.5% to 1% more than the standard FHA quote—because of the additional project risk.

- All these extras can keep your total closing costs in the 2% to 5% range of the final loan amount, and many fees can be included in the loan.

How to Apply for an FHA 203k Loan

- Look for FHA-approved lenders that handle 203k loans.

- Not every FHA lender offers this type.

- Collect the usual documents: your ID, proof of income, recent credit reports, and details about the house you’re buying.

- Start with pre-approval to see how much you can spend.

- Choose a home, and get contractor quotes for the work you want to do.

- Hand in your application along with the contractor plans and quotes.

- Close the loan and begin work on the house.

- Rely on pros who do this all the time to stay on schedule.

- By 2026, companies like Rocket Mortgage plan to use online tools to speed up the loan process.

How Is This Different from a HomeStyle Loan?

After the real estate and credit meltdown 2008, construction and bridge financing became almost non-existent to home buyers and homeowners. HUD’s FHA 203k loan program is an acquisition and renovation program for homebuyers seeking a fixer-upper. This article will discuss and cover the FHA 203k loan program for homebuyers and homeowners of fixer-uppers.

- The FHA 203k has easier credit score rules, but does charge monthly mortgage insurance.

- HomeStyle is for borrowers with conventional loans and has its own guidelines.

To sum up, the FHA 203(k) loan is a smart way to fix up a house and make homeownership a reality in 2026. When you’re ready to start, talk to a lender specializing in FHA loans.

Its low down payment and ability to finance the purchase and repairs make it perfect for buyers on a budget. And the path to a fresh, modern home is right in your hands.

For details that fit your budget, reach out to a mortgage specialist. They’ll help you check if you meet the requirements and guide you through the application step-by-step.

Ready to Renovate and Buy a Home with an FHA 203k Loan?

Please contact us today to learn how to fund your dream home and renovation project with one convenient loan.

Scope of Work You Can Do With the Standard FHA 203k Loan

The full standard FHA 203k Loan has no construction budget limit, and homeowners can do the following:

- room additions

- second-story additions

- structural improvement

- Any project that can be done with a streamlined FHA 203k loan can be done with a full standard FHA 203k loan.

FHA 203k loan mortgage options allow a homebuyer to purchase a fixer-upper and customize it however they want.

Types Of FHA 203k Loan Programs

FHA offers two acquisition and construction mortgage loan programs in one loan and closing. The first is the FHA 203k streamline mortgage loan program. The FHA 203k streamline limits the maximum construction. The rehab loan limit is capped at $35,000.

If you want to turn a 1970s fixer into an energy-efficient, stylish home, the FHA 203k Loan gives you the keys and the cash to do it from the start.

It can be used for non-structural rehabs such as kitchen and bathroom remodeling, new flooring, painting, millwork, mechanical systems, windows, roofing, siding, basement remodeling, attic remodeling, and other non-structural remodeling projects. Structural work is not allowed on streamline 203k loans.

The Full Standard FHA 203k Loan

The second 203k loan program is the Full Standard FHA 203k Loan program. The standard 203k loan has no construction loan limit. However, the acquisition and renovation loan limits are capped at the maximum FHA loan limit for the county.

The completed value needs to be appraised. The 2026 FHA loan limit is capped at $524,225 on single-family homes. The full standard 203k loan program permits structural construction, including room additions, second-floor additions, gut rehabs, and tear-downs.

The Streamline FHA 203k Loan

A home buyer can now purchase a foreclosure, short sale, or REO home that needs minor repairs. The FHA 203k Streamline Purchase loan program enables the home buyer to seek an acquisition and construction mortgage loan simultaneously with one closing.

This program is for home buyers who purchase a home that needs minor repairs, such as kitchen, bathroom, attic, and basement remodeling, new windows, appliances, roofing, flooring, and other non-structural repairs.

The maximum amount of the FHA 203k Streamline purchase loan program is $35,000, which includes costs such as permit fees and reserves associated with the rehab. Luxury items such as pools, tennis courts, and basketball courts are not allowed, nor are room additions and second-floor additions.

Buying Foreclosure or REO With FHA 203k Loan

Homebuyers can get great deals on foreclosure or REO properties. However, many are not financeable because they cannot pass the appraisal inspection. They also need repairs such as new flooring, kitchens, and bathrooms, and many have been occupied by squatters and are not habitable.

Lender Overlays on FHA 203k Loan Programs

Most mortgage lenders who own foreclosures and REOs on their books do not want to spend a dime on rehabbing the property and want to sell it as is. Unfortunately, most of these properties can only be sold to cash buyers. This is because mortgage lenders will not lend to a property that is not habitable.

With a 203k Loan, homebuyers can get great home deals. They can also get the construction money to fix and customize the property the way they want. Most mortgage lenders who own foreclosures and REOs are eager to entertain a 203k Loan-approved homebuyer.

Qualification For FHA 203k Loan

Any home buyer qualifying for the traditional FHA loan program can qualify for the FHA 203k Streamline and Standard 203k mortgage programs. Mortgage rates for the 203k loan programs are typically slightly higher than standard FHA loans. The required appraisal is an as-is property appraisal and an as-complete property appraisal.

The general contractor cannot be a family member and needs to be licensed, insured, and bonded. The general contractor is responsible for the work of all subcontractors. The homeowner has the final say in authorizing the draw for the general contractor.

Down Payment Required on 203k Loans

The FHA 203k mortgage loan applicant needs a 3.5% down payment on the as-completed appraised value. For example, if a home buyer purchases a home for $100,000 and pursues a Full Standard 203k Loan, and the estimated cost of repairs is an additional $100,000, the total cost of the home purchase and rehab is $200,000.

The home buyer is required to have 3.5% of the $200,000, which is a $7,000 down payment. If you currently have a home in need of repairs, we can also refinance your current mortgage loan via an FHA 203k loan so you can update or make a major renovation. Most FHA 203k loans take 45 days to close from when the mortgage application is submitted.

Don’t Let Repairs Hold You Back

Homes needing TLC don’t have to be out of reach. With FHA 203k, you can finance both purchase and repairs in one easy loan.

Closing Costs On 203k Loans

On any home purchase transaction, closing costs will cover any costs and fees associated with the origination of the mortgage loan, as well as third-party charges such as title charges, appraisal fees, inspection fees, attorneys’ fees, homeowners’ insurance fees, recording fees, prepaid, and any other fees and costs.

Most homebuyers do not have to worry about closing costs because they can be covered through a seller’s concession towards a homebuyer’s closing costs or a mortgage lender credit toward homebuyers’ closing costs. Structuring the purchase contract the right way is key when a homebuyer wants to purchase a home through an FHA 203k loan.

FHA 203k Loans Are The Next Best Thing To A Custom-Built Home

The United States Department of Housing and Urban Development is the parent of the Federal Housing Administration, also known as FHA. FHA has created the FHA 203k Loans to promote homeownership in distressed areas. It was also created to help homeowners motivated to purchase distressed properties needing rehab and make them habitable again. Rehabbing vacant homes or homes needing major repairs will also revitalize the neighborhoods. It promotes stability in neighborhoods and also promotes homeownership.

Want to Buy and Renovate a Home with an FHA 203k Loan?

Please don’t hesitate to contact us now to learn how to use this loan for your home purchase or renovation.

Renovate To Your Liking Using FHA 203k Loan Options

You may have found a perfect home, but it only has two bedrooms, and the family needs three. You may have found a perfect home, but it is old and in dire need of major rehab, and you do not have the money after the down payment. All of the above scenarios can be solved by purchasing a home in need of rehab or major construction through HUD’s FHA 203k Loans.

The FHA 203k Loan program is the next best thing to new construction. An FHA 203k loan enables buyers to purchase a home in major need of repairs and customize it the way owners want, including a complete gut rehab. With an FHA 203k Loan, homeowners can turn that old, tired home on a perfect lot into a brand new home customized to the family’s needs.

Benefits of FHA 203k Loan Programs

FHA 203k loans are one of the most popular mortgage loan programs today. They attract not only home buyers seeking a home loan with bad credit but also buyers with stellar credit. Getting a construction or rehab loan from banks and credit unions is almost impossible.

After the real estate and mortgage meltdown of 2008, construction and rehab loans became extinct. Very few banks and lenders offer them. Borrowers need stellar credit and reserves and extremely low debt-to-income ratios. Now, with HUD’s FHA 203k loans, acquisition and rehab loans are extremely easy and streamlined.

What Credit Score do you need for an FHA Loan?

In 2024, lenders usually mandate a credit score of 580 or higher to qualify for a low down payment option on an FHA loan. An FHA loan is still possible for credit scores between 500 and 579, but requires a minimum down payment of 10%.

These are the FHA guidelines; individual lenders may have stricter standards, and some might require a higher credit score. Discover the best loan options by comparing lenders’ requirements with your credit score. Enjoy better terms and rates with a higher score.

What is the Maximum DTI for an FHA Loan?

Lenders typically allow a maximum debt-to-income (DTI) ratio of 43% when applying for an FHA loan. In some cases, lenders may accept a higher DTI ratio of up to 50%, particularly if compensating factors like a good credit score or substantial reserves exist.

Lenders rely on the DTI ratio to evaluate a borrower’s capacity to handle monthly payments and repay debts. It is calculated by dividing the total of all monthly debt payments by the borrower’s gross monthly income.

It’s important to check with specific lenders, as they might have their own requirements or overlays that affect the maximum allowable DTI ratio for FHA loans.

How Long Do I Have To Complete My Renovations Using FHA 203k Loans?

One of the most frequently asked questions about FHA 203k loans is how long a homeowner has to finish their renovations using the loan. All renovations must start within 30 days of closing the 203k loans, and all projects must be finished no later than six months.

For a Standard FHA 203(k), a 203(k) consultant is typically required because the renovation is more complex and the lender needs structured oversight for the scope of work, inspections, and draw payments.

Qualify Today For an FHA 203k Loan.

Buyers of fixer-uppers needing to qualify for an FHA 203k loan, contact us via email, phone, or text. You can email us at Gustan Cho Associates at gcho@gustancho.com. Or you can contact us at 800-900-8569 or text us for a faster response. Borrowers can apply online by clicking on APPLY NOW FOR A FHA 203K LOAN and get pre-approved today for an FHA 203k loan.

Frequently Asked Questions About FHA 203(k) Loans:

What is an FHA 203(k) Loan and How Does it Work?

An FHA 203(k) loan is an FHA-insured mortgage that lets you buy (or refinance) a home and finance renovations in the same loan. The renovation funds are kept in an escrow account. They are released in parts as the work is finished and inspected.

What’s the Difference Between a Limited 203(k) and a Standard 203(k)?

- Limited 203(k): for minor, non-structural repairs with a rehab cap of up to $75,000 (current HUD policy).

- Standard 203(k): for major renovations and structural work; it typically involves more documentation, inspections, and project oversight.

How Much Can You Borrow with an FHA 203(k) Loan?

Your maximum loan amount is based on FHA rules and underwriting. It’s generally tied to the home’s after-improved value (what it should be worth after repairs), subject to FHA mortgage limits and your income/credit approval. The Limited 203(k) portion specifically allows rehab costs up to $75,000 under current HUD guidance.

What Repairs are Allowed with an FHA 203(k)?

203(k) funds are designed for repairs that make the home safe, sound, and livable—such as roof replacement, kitchen/bath remodels, HVAC, plumbing/electrical updates, accessibility improvements, and repairs to health/safety issues. Luxury items are typically not allowed (think pools or similar).

Can I do DIY Work on a 203(k) Loan?

Usually, most 203(k) repairs are expected to be completed by licensed/insured contractors with itemized bids because the lender must verify the scope, costs, and completion for the draw process. Some lenders may allow limited self-help in particular situations, but it’s not common—plan on using pros.

How Long do Repairs Take with an FHA 203(k)?

Timelines vary by project size and lender process. HUD has updated the program to allow more time for completion—up to 12 months for Standard 203(k) and up to 9 months for Limited 203(k).

Ready to Make Your Home Renovation Dreams a Reality with an FHA 203k Loan?

Please reach out today to learn more about how you can finance your home and renovations together.

Do you service standard 203k loans?

Yes, we do FHA 203k Loans. What state are you in? Please email us your contact information at gcho@gustancho.com or call us at 262-716-8151. Text us for a faster response.