Homebuyers in Oregon can now accurately calculate their total housing payment using the Oregon Mortgage Calculator with PITI, PMI, and HOA powered by Gustan Cho Associates. Oregon has one of the highest home prices in the nation. The state is drawing in a lot of new families from other states due to the beautiful landscape, great weather, strong economy, and ample land. Many Californians are migrating to Oregon due to lower home prices, less congestion, low crime rates, and fewer regulations than California.

- Conv

- FHA

- VA

- Jum/Non

- USDA

John Strange, a senior loan officer and an associate contributing editor at GCA Forums, says the following about the reason the Oregon Mortgage Calculator was created.

The main reason the team at Gustan Cho Associates designed and developed the Oregon Mortgage Calculator was that there was a need for an online home loan mortgage calculator that was accurate with the monthly mortgage payment with all components.

There was not a single online mortgage approval calculator that was accurate. Most online calculators only gave you the principal and interest portion of the monthly mortgage payment. There are four to eight components that make up the total mortgage payment. The missing components from online mortgage calculators have a big impact on getting the accurate monthly mortgage payment on a new home purchase.

Oregon Mortgage Calculator: Components of The Monthly Mortgage Payment

Most online calculators did not factor in the upfront FHA mortgage insurance premium or the VA funding fee to the balance of the loan, so the figure was right off the bat wrong. Again, other online home loan calculators normally do not even compute the private mortgage insurance or annual mortgage insurance premium. How about the property taxes and insurance? We hardly found an online mortgage calculator with property insurance and homeowners insurance calculations. How about the loan program? FHA has an upfront mortgage insurance premium that needs to be added to the balance of the loan. VA has a VA funding fee that needs to be added on top of the VA mortgage loan balance. With Gustan Cho Associates Oregon Mortgage Calculator, all of these components are part of computing your total monthly mortgage payment.

Qualify for a Home Loan in Oregon

Apply Online And Get Pre-Qualified for a Mortgage Today

How Property Tax Affects Buying Power and DTI

Property taxes can make a big portion of your monthly mortgage payment. Homeowners insurance can add a substantial portion to your house payment as well. We are not done yet. How about homeowners association dues (HOAs)? Aren’t HOA dues part of your monthly mortgage payment? The reason Gustan Cho Associates decided to create the Oregon Mortgage Calculator with PITI, PMI, MIP, and HOA is that there was not a calculator that had the most accurate numbers for borrowers. Most mortgage calculators just had principal and interest and not tax and insurance. Most mortgage calculators did not have mortgage insurance. Therefore, it was worthless. The Oregon Mortgage Calculator has everything you need to calculate your monthly mortgage payment.

What Is The Breakdown of The Monthly Payment on a Home Mortgage?

Unlike other online mortgage calculators, which only have the principal and interest portion of the mortgage payment, the Gustan Cho Associates Oregon Mortgage Calculator has all the components of the monthly mortgage payments on a home mortgage. The Oregon Mortgage Calculator powered by Gustan Cho Associates is different than the competition, says Dale Elenteny:

The Oregon Mortgage Calculator has the PITI, PMI, MIP, and HOA components to give you the most accurate monthly mortgage payment for your proposed home purchase. No other mortgage calculator comes close. It is so easy to use. All the boxes that need entry are marked and easy to see.

You will not just get the principal and interest like the competition. You will get the full monthly mortgage payment and a breakdown of every component of the monthly mortgage payment. Gustan Cho Associates Oregon Mortgage Calculator was designed, developed, and tested by an actual experienced loan officer at Gustan Cho Associates. Our developers consist of actual licensed loan officers and the technical and engineering team who worked side by side. It takes minutes to get your monthly payment.

How To Compute Your PITI, PMI, MIP, and HOA Using the Oregon Mortgage Calculator

Just enter the loan program you are applying for on top of the mortgage calculator. Then enter the purchase price, the down payment, the interest rate, and the term of the mortgage loan. It is self-explanatory and user-friendly. The principal and interest will populate first. Then enter your property tax and homeowners insurance information in the respective boxes. The final entry will be homeowners association dues for homebuyers who have HOA dues. You will get the full monthly mortgage payments, which consist of PITI, PMI, MIP, and HOA. Below the payment, you will see the breakdown of the mortgage payment: PITI, PMI, MIP, and HOA. Next, we will show you how to calculate the front-end and back-end debt-to-income ratios and the parameters needed for the mortgage loan program you are applying for.

How To Calculate DTI Using The Oregon Mortgage Calculator

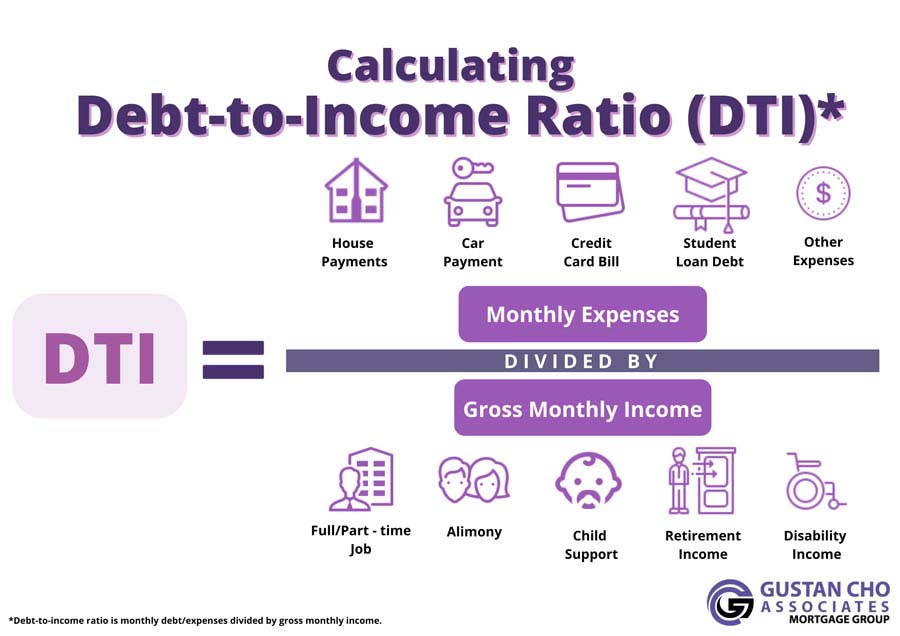

Every mortgage loan program has its own front-end and back-end debt-to-income ratio requirements. The debt-to-income ratio on each loan program is different. Most mortgage lenders have their own lender overlays called lender overlays. Lender overlays are higher lending requirements than the agency mortgage guidelines. Here are the steps to calculate debt-to-income ratios using the Debt-to-Income Ratio Oregon Mortgage Calculator:

- The monthly mortgage payment will populate in the first box

- Enter the sum of all monthly minimum payments from all bills

- Examples of monthly bills included for debt-to-income calculations are home mortgage payments, auto payments, student loans, credit card minimum payments, and any other debts that report to the credit bureaus

- Do not include non-traditional credit tradelines

- Non-traditional credit tradelines are creditors that do not report to the credit bureaus, such as utility bills, cellular and landline, internet, cable, personal insurance, school/college, and other bills that do not report to the credit bureaus

- Enter the total in the box that says Monthly Minimum Debt Payments

- Finally, enter the monthly or yearly income on the box that says Monthly or Annual Income

- You now have the front-end and back-end debt-to-income ratio

Below the front-end and back-end DTI, you will get the maximum DTI allowed on the loan program you checked off.

FHA, VA, or Conventional? See Which Mortgage Option is Best for You in Oregon!

Apply Online And Get Pre-Approved for a Mortgage Today

Broad Overview of Oregon Mortgage Calculator

Reason: To estimate the total housing payment together with several components, Gustan Cho Associates have developed their very own Oregon Mortgage Calculator designed for home buyers that includes:

- PITI (Principal, Interest, Taxes, Insurance)

- PMI (Private Mortgage Insurance)

- HOA (Homeowners Association fees)

Contextual Issues of the Housing Market:

- Oregon is among the states with the highest home prices.

- The state attracts new families because of its beautiful scenic view, favorable weather, strong economy, and land.

- Many Californians migrate to Oregon for many reasons, such as lower home prices, less congestion, reduced crime rates, and fewer regulations.

Demand for Exacting Calculators:

John Strange, a senior loan officer at Gustan Cho Associates and an Associate Contributing Editor at GCA Forums, has noted many defaults in standard online calculators, which usually only calculate the principal and interest portion of the loan. The Oregon Mortgage Calculator has solved this gap by offering the necessary components to view the monthly mortgage payment comprehensively.

This tool is important to Oregon prospective home buyers in forming their financial picture regarding the obligations incurred when buying a house. You will not find any other online mortgage calculator than the Oregon Mortgage Calculator that gives you the most accurate monthly mortgage payment with PITI portion, property tax, homeowners insurance, homeowners association fee if applicable, and private mortgage insurance premium or mortgage insurance premium. Plus, the Oregon Mortgage Calculator is so user friendly and easy for anyone to use.

Buying a Home in Oregon? Learn the Income & Credit Requirements to Qualify

Apply Online And alk to a Loan Expert Today

Frequently Asked Questions About Oregon Mortgage Calculator:

Q: What is the Oregon Mortgage Calculator?

A: The Oregon mortgage calculator is an easy online tool that helps homebuyers estimate their monthly payments, including principal, interest, taxes, insurance, and HOA fees.

Q: How is the Oregon Mortgage Calculator Different from Other Calculators?

A: In contrast to most online calculators that display only principal and interest, the Oregon mortgage calculator considers all expenses, including property taxes, homeowners insurance, private mortgage insurance (PMI), and HOA fees.

Q: Can I Use the Oregon Mortgage Calculator to Estimate My Total Home Payment?

A: Yes! The Oregon mortgage calculator gives you a full breakdown of your monthly mortgage payment so you know exactly what to expect before buying a home.

Q: Does the Oregon Mortgage Calculator Work for FHA and VA Loans?

A: Yes, it includes FHA mortgage insurance premiums and VA funding fees, making it accurate for all loan types.

Q: How do I Use the Oregon Mortgage Calculator?

A: Just enter your loan details—home price, down payment, interest rate, loan term, property tax, and insurance—and the calculator will show your monthly payment.

Q: Can the Oregon Mortgage Calculator Help Me Check if I Qualify for a Mortgage?

A: Yes! It also calculates your debt-to-income ratio (DTI) to help determine if you meet lender requirements for a mortgage.

Q: Does the Calculator Include Property Taxes and Homeowners Insurance?

A: Yes, the Oregon mortgage calculator factors in property taxes and homeowners insurance, which are important parts of your monthly payment.

Q: Why Should I Use the Oregon Mortgage Calculator Before Buying a Home?

A: It helps you plan your budget so you won’t be surprised by hidden costs like property taxes, HOA fees, and mortgage insurance.

Q: Can I Use the Oregon Mortgage Calculator to Refinance?

A: Yes! If you’re considering refinancing, the calculator can estimate your new monthly payment based on a lower interest rate or loan balance.

Where Can I Find the Oregon Mortgage Calculator?

A: You can access the Oregon mortgage calculator on the Gustan Cho Associates website to estimate your mortgage payment quickly.

This blog about “Oregon Mortgage Calculator With Taxes, PMI, HOA and DTI”e was updated on February 13th, 2025.