Mortgage borrowers can now use the Oklahoma Mortgage Calculator by powered by Gustan Cho Associates and get the most accurate online mortgage calculator in the nation. The Oklahoma Mortgage Calculator is different than any other online mortgage calculator in the market because it gives you all the components of the mortgage payment. Most online mortgage calculators will only just give you principal and interest and do not have any regard for the other components of the mortgage payment.

- Conv

- FHA

- VA

- Jum/Non

- USDA

Using other online mortgage calculators will not give you the full, accurate mortgage payment for you to compute whether you can afford the house or calculate your front-end and back-end debt-to-income ratio. Gustan Cho Associates has developed and launched the Oklahoma Mortgage Calculator with PITI, PMI, MIP, HOA, and DTI. The Oklahoma Mortgage Calculator is the most powerful and accurate online Oklahoma Mortgage Calculator in the nation, with thousands of users who are using it as their mortgage calculator of choice due to the accuracy and how easy it is to use. To make calculation easy and convenient for users, Gustan Cho Associates added a feature bonus by adding the DTI Oklahoma Mortgage Calculator so users can compute their front-end and back-end DTI in seconds.

Surging Rent Prices motivate Home Purchases in Oklahoma

Oklahoma, like the rest of the nation, which is experiencing a housing boom like never before, has had home values surging double digits for the past several years with no signs of even the slightest housing market correction. Home prices in Oklahoma are still skyrocketing double digits despite the uncertain volatile stock market, out-of-control inflation, surging mortgage rates, pandemic fears by the Biden Administration, and soaring gas prices. The FEDs are increasing interest rates, and the uncertainty in the economy is not making the slightest dent in the housing market. Actually, there are more homebuyers now than ever in Oklahoma history because landlords are spiking rents like never before. It is definitely a seller’s market. There is more demand for homes in Oklahoma than inventory.

Oklahoma Mortgage Calculator With PITI, PMI, MIP, and HOA

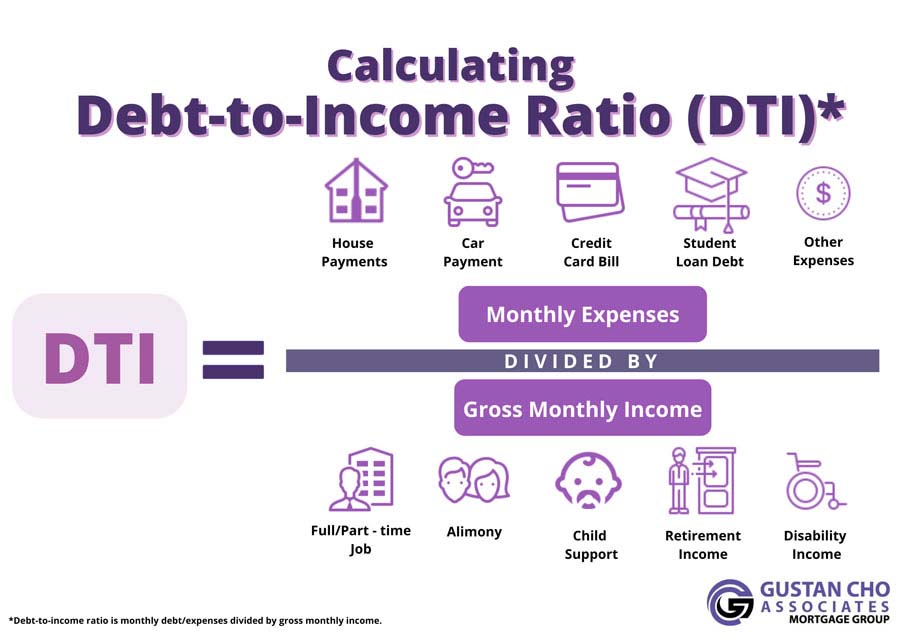

Debt-to-income ratios is one of the most important factors determining your qualification for a mortgage loan program. Every loan program has its own front-end and back-end debt-to-income requirements. When shopping for homes, homebuyers will run into homes with different types of property taxes. It is not the amount of loan balance that makes you qualify for a mortgage. It is the combination of the loan balance, property tax, insurance premium, private mortgage insurance, mortgage insurance premium, and homeowners insurance that determines the ability to repay the housing payment. Therefore, a homebuyer with lower property taxes can qualify for a large-priced home versus a lower-priced home with high property taxes. When shopping for a home, homebuyers can figure out whether or not they will be able to meet the loan program DTI guidelines on their own instead of calling their loan officer every time they see a home they like.

Calculate Your Debt-to-Income Ratio Using The DTI Oklahoma Mortgage Calculator

You can compute your total monthly mortgage payments with all the components in seconds by entering some key data into the Oklahoma Mortgage Calculator. Within seconds, you will get your monthly mortgage payment on the property information you entered on the particular mortgage loan program.

Here are the steps to calculate debt-to-income ratios:

- The monthly payment will transfer to the debt-to-income ratio mortgage calculator on the first box on top

- Total the sum of all monthly minimum payments from all bills of creditors that report on the credit bureaus

- Examples of monthly bills included for debt-to-income calculations are auto payments, student loans, credit card minimum payments, and any other debts that report to the credit bureaus

- You do not have to include non-traditional credit tradelines such as utility bills, cellular and landline, internet, cable, personal insurance, school/college, and other bills that could potentially report to the credit bureaus

- Enter the total monthly bills into the box that says Minimum Monthly Bill Payments

- The last and final step is to enter your monthly gross salary/wages before taxes are taken out into the box that says Monthly or Yearly Income

- Your front-end and back-end debt-to-income ratio will populate

Below the front-end and back-end debt-to-income ratio, you will see the front-end and back-end debt-to-income ratio agency guidelines of the mortgage loan program you entered. The front-end debt-to-income ratio is calculated by adding your monthly mortgage payment to your monthly gross income. The back-end debt-to-income ratio is calculated by adding the monthly mortgage payments PLUS the sum of all minimum monthly payments and dividing it by your gross monthly income. This gives your back-end debt-to-income ratio. The lower the DTI of the borrower, the less risk the lender has to take. Therefore, lower risk means lower rewards for the lender.

Oklahoma Mortgage Calculator Powered by Gustan Cho Associates: Your Ultimate Guide to Home Loan Approval

Simplify Homeownership with the Oklahoma Mortgage Calculator by Gustan Cho Associates. Learn how the Oklahoma Mortgage Calculator by Gustan Cho Associates helps homebuyers estimate mortgage payments, manage debt-to-income ratios, and get approved for a mortgage loan in Oklahoma.

Helping Oklahoma Homebuyers Make Smart Financial Decisions

Buying a home in Oklahoma is an exciting journey, but with rising home prices, budgeting is more important than ever. At Gustan Cho Associates, we continuously innovate to simplify the home loan process and help our clients make informed financial decisions. Our Oklahoma Mortgage Calculator is a state-of-the-art tool that enables homebuyers to accurately estimate their mortgage payments and determine their loan eligibility based on debt-to-income (DTI) ratios. This comprehensive guide will cover:

- How to use the Oklahoma Mortgage Calculator

- What factors impact your mortgage payment?

- How to get approved for a mortgage in Oklahoma

- Why budgeting and DTI ratios matter for home loans

- Steps to qualify for the best mortgage rates

Whether you’re a first-time homebuyer or a seasoned homeowner, this guide will help you understand everything about mortgage budgeting and approval in Oklahoma.

What Is the Oklahoma Mortgage Calculator?

The Oklahoma Mortgage Calculator by Gustan Cho Associates is a powerful online tool designed to help homebuyers calculate their total monthly mortgage payment. Unlike basic calculators, ours includes:

- Principal and Interest (P&I)

- Property Taxes

- Homeowners Insurance (HOI)

- Private Mortgage Insurance (PMI) (if required)

- Homeowners Association (HOA) Fees

- Debt-to-Income (DTI) Ratio Analysis

By using the Oklahoma Mortgage Calculator, homebuyers can get an accurate estimate of their mortgage payment and stay within a comfortable budget.

Why Is the Oklahoma Mortgage Calculator Unique?

- At Gustan Cho Associates, we strive to provide innovative mortgage tools that go beyond basic calculations. Our calculator includes a DTI ratio feature, allowing you to check whether you meet lender requirements for mortgage approval.

Key Benefits of the Oklahoma Mortgage Calculator

- Accurate & Real-Time Mortgage Payment Estimates

- Includes All Mortgage Costs (PITIA)

- Debt-to-Income (DTI) Ratio Analysis

- Helps You Stay Within Budget

- User-Friendly on Desktop & Mobile

How to Use the Oklahoma Mortgage Calculator

Using our mortgage calculator is quick and easy. Follow these simple steps to estimate your total mortgage payment:

Step-by-Step Guide

- Enter the Home Price: Input the purchase price of the home you’re considering

- Adjust Your Down Payment Choose how much you plan to put down (3.5% for FHA loans, 5% for conventional, or 0% for VA loans).

- Select Your Loan Term Choose between 15-year, 20-year, or 30-year fixed-rate mortgages.

- Enter the interest rate. Use the current market rate or estimate based on your credit score.

- Include Property Tax and Insurance Costs. These vary by county in Oklahoma and affect affordability.

- Add Homeowners Association (HOA) Fees—If applicable, enter your HOA dues.

- Check Your Debt-to-Income (DTI) Ratio: Input your monthly debts (credit cards, car loans, student loans) to determine if you qualify.

Once all details are entered, the calculator will display your estimated monthly mortgage payment and DTI ratio, helping you understand affordability and loan eligibility.

How to Get Approved for a Mortgage in Oklahoma

Step 1: Understanding the Mortgage Qualification Process

Getting approved for a home loan in Oklahoma involves the following key steps:

Check Your Credit Score

- Conventional loans: Minimum 620 credit score

- FHA loans: Minimum 580 credit score (500 with a higher down payment)

- VA and USDA loans: More flexible credit requirements

Evaluate Your Debt-to-Income (DTI) Ratio

- Most lenders prefer a DTI ratio of 45% or lower.

- FHA loans allow DTI ratios up to 46.9% front-end and 56.9% back end in some cases.

- Use the Oklahoma Mortgage Calculator to check your DTI.

Save for a Down Payment

- Conventional loans: 3%-5% down

- FHA loans: 3.5% down

- VA & USDA loans: 0% down

Gather Required Documentation

- Two years of tax returns

- Recent pay stubs & W-2s

- Bank statements (to verify down payment funds)

- Proof of employment

Choose the Right Mortgage Loan Program

- Conventional Loan: Best for borrowers with good credit and stable income.

- FHA Loan: Ideal for first-time buyers and low-credit borrowers.

- VA Loan: Available for veterans & active-duty military.

- USDA Loan: For homebuyers in eligible rural areas.

Get Pre-Approved

- A pre-approval letter strengthens your offer and makes you a competitive buyer in Oklahoma’s housing market.

Why Budgeting Is Critical for Oklahoma Homebuyers

Rising Home Prices in Oklahoma

- Median home price in Oklahoma (2025): $275,000

- Increase from 2022: 14%

- Average mortgage rate: 6.5%

With home prices on the rise, it’s essential to budget properly before purchasing a home.

Understanding PITIA: Your Total Mortgage Payment

Your mortgage payment includes more than just principal and interest. You must also account for:

- Property Taxes: Varies by county in Oklahoma.

- Homeowners Insurance: Required for all mortgage loans.

- Private Mortgage Insurance (PMI): Required for down payments under 20%.

- HOA Fees: Must be factored in if applicable.

By using the Oklahoma Mortgage Calculator, you can ensure affordability and avoid financial stress.

Use the Oklahoma Mortgage Calculator to Plan Your Home Purchase

The Oklahoma Mortgage Calculator by Gustan Cho Associates is an essential tool for homebuyers looking to accurately estimate mortgage payments and qualify for a home loan. By calculating your total mortgage payment and DTI ratio, you can confidently move forward in your home-buying journey.

- Accurate Payment Estimates

- Helps You Stay Within Budget

- Determines Loan Eligibility

- Simplifies the Mortgage Process

Ready to buy a home in Oklahoma? Use the Oklahoma Mortgage Calculator today and start planning for your dream home!

Frequently Asked Questions (FAQs)

How accurate is the Oklahoma Mortgage Calculator?

- Our calculator provides real-time, highly accurate estimates, but final mortgage approval depends on lender guidelines.

Can I qualify for a mortgage with a high DTI ratio?

- FHA loans allow higher DTI ratios (up to 57%), while conventional loans typically cap at 43%.

What’s included in my total mortgage payment?

- Your payment includes principal, interest, taxes, insurance, PMI, and HOA dues (if applicable).

Refinance Your Oklahoma Home & Lower Your Monthly Payment

Apply Now And Get recommendations From Loan Experts