If you’re trying to qualify for a mortgage—or trying to get the lowest possible rate—your mortgage credit score matters a lot. It can affect whether you’re approved, how much you’ll need for a down payment, and how expensive your monthly payment will be over the life of the loan.

Here’s the part most buyers don’t realize: the score you see in a credit app is often not the exact score a mortgage lender uses. For many conventional loans sold to Fannie Mae and Freddie Mac, lenders have traditionally pulled a Tri-Merge mortgage report and used the “classic” FICO versions tied to each bureau (not “Vantage 2”). Fannie Mae, for example, lists these classic FICO versions as Equifax Beacon 5.0, Experian/Fair Isaac Risk Model V2, and TransUnion FICO Risk Score Classic 04.

The system is changing, too. The Federal Housing Finance Agency (FHFA) has approved the use of updated credit score models for the government-sponsored enterprises (GSEs), such as FICO 10T and VantageScore 4.0. This is all part of their effort to update credit scores, and they’re rolling out the changes in stages.

What should you do with that information? Keep it simple: ask your loan officer which score model(s) they’re using for your mortgage program, and focus on improving the factors that move mortgage scores the fastest—especially credit card utilization, payment history, and errors on your reports.

In this guide, we’ll walk you through the most effective, mortgage-specific steps to increase your FICO (or mortgage credit) scores fast—so you can qualify, strengthen your approval, and price into better rates.

How To Increase FICO Fast To Qualify For a Mortgage

All mortgage loan programs have a minimum credit score requirement to qualify for their mortgage loan program. Besides meeting the minimum credit score requirement to meet the lending requirements, your credit score is the largest factor in pricing mortgage rates.

The higher your credit scores, the lower your rates on a mortgage loan. Getting a high mortgage rate due to a low credit score can cost you tens of thousands in interest expenses over the mortgage loan term.

Maximizing your credit scores before applying for a mortgage loan is best and highly recommended. Gustan Cho Associates team has helped thousands of homebuyers maximize their credit scores before formally applying for a mortgage loan. There are some quick fixes on how to increase FICO fast to qualify for a mortgage so you can get the best rates.

Is It Possible To Improve Your FICO Credit Scores?

Your FICO credit scores fluctuate depending on how you use your revolving credit tradelines. If you maximize your credit cards, your credit scores will decrease. Your credit scores will increase if you pay down your revolving accounts to under a 10% utilization ratio.

You can increase your credit scores substantially through the step-by-step instructions of this guide on how to increase FICO to qualify for a mortgage.

Buying a house should be carefully thought out and planned. The first thing you should do is consult with a loan officer. The loan officer will advise you to maximize your credit scores by following simple steps. The next section will cover how to increase your FICO fast to qualify for a mortgage with the lowest possible mortgage rate.

Ready to Boost Your FICO Score and Qualify for a Mortgage?

Contact us today to learn strategies to quickly increase your credit score and get one step closer to homeownership.

Find actionable techniques on how to increase FICO scores for a mortgage. Understand useful methods on how to raise your credit score fast, receive favorable terms on loans, improve your overall financial situation, and enhance loan rates for mortgages in 2025.

Why Learning How to Increase FICO Scores Matters for Your Mortgage Dreams.

With the housing market today, acquiring a mortgage does not just mean identifying the right property—special attention has to be paid to the conditions, too. Fundamental to this process is your FICO score. It is a three-digit number that lenders use to determine your creditworthiness.

The Importance of Having a Good Credit Score in The Mortgage Process

Given the stakes, the reasons for increasing FICO scores for a mortgage are a common concern. A FICO score above the threshold can mean lower interest rates, a smaller down payment, and a speedy loan approval. In this anthology, the author focuses on actionable steps on how to increase FICO scores for those wishing to buy a home. We will detail the basics as well as long-term strategies for those whose current score is within the fair range or for those who would need a rapid boost to enter excellent territory. By the conclusion of this guide, you will have the bright FICO score you need to fulfill your mortgage ambitions.

Understanding Your FICO Score: The First Step on How to Increase FICO for Mortgage Prospects.

Before actually figuring out how to increase FICO scores, it is important to understand what this score is all about. FICO scores range from 300 to 850 and are the most popular scores that mortgage lenders use.

Fair Isaac Corporation develops them. Unlike other scores, FICO scores focus on the most important aspects for long-term lending, such as payment history and debt ratios.

FICO scores usually need to be 620 for conventional loans, but if you want the best rates, aim for 740. A 740 score can also save you thousands over the lifetime of the loan.

Key Influencers of Your FICO Score and Why They Matter For Mortgage Eligibility

Your FICO score is calculated using five different components, and it is not a random figure. The most important factor in how to increase FICO is your payment history. This accounts for 35 percent of the score.

Failing to pay creditors, or paying late, can cause your score to be hurt for 7 years, which greatly complicates mortgage loan approvals.

Credit utilization (30%) is the proportion of your available credit you are using. Anything above 30 percent can be detrimental for lenders looking to offer you a mortgage.

How Do You Create and Develop a Strong Credit Profile

Maintaining credit card accounts for a long time helps in improving FICO Scores. Hence, the Length of credit history accounts for 15% of the credit score. Closing credit card accounts would not be suitable for someone trying to figure out how to increase FICO scores fast.

Do New Credit Inquiries Hurt Your Credit Scores?

New credit inquiries account for 10% of the score, and attempting to get a mortgage can be the sole factor contributing to a FICO score. When building credit, 10% of the score is earned from credit mix, which encourages a mix of revolving and installment loans. Once these factors are understood, learning how to increase FICO is much easier. It will allow smoother transitions in the process of becoming a homeowner.

How Long Does It Take to Increase FICO Credit Scores

FICO scores take time and effort to increase. However, mortgage seekers will appreciate the immense benefits. Therefore, the first course of action is to get free credit reports from AnnualCreditReport.com and check for mistakes or out-of-date information. Even such small things can drastically increase their FICO Scores. From that point, it is best to reach for the targeted steps that are most likely to provide fast results.

Pay Down High-Interest Debt To Lower Utilization and Speed Up FICO Score Increase

A very effective way to increase FICO mortgage scores is by improving credit utilization. You should strive to maintain balances under 30% of your credit limits. For instance, with a credit line of $10,000, you should aim to reduce your balance to under $3,000.

Pay off high-interest cards first, using the debt snowball or avalanche methods. This not only increases your monthly cash flow after your mortgage is taken on, but also shows potential lenders you can manage your expenses.

Most individuals gain 20-50 FICO points after a single billing cycle based on payment utilization, so it’s very important to know how to increase FICO, making it a very important way to increase FICO.

Build a Strong Payment History: The Non-Negotiable Pillar of How to Increase FICO Scores

Paying your bills on time has a huge impact on your credit score, comprising a huge percentage of your FICO score – 35%! This means mastering your payments is a vital part of knowing how to increase FICO.

The targeted and systemized way would be to set all bills on autopay and add all of them to your calendar for manual payments as well.

For credit accounts with payment defaults, settle with lenders on “goodwill adjustments” to remove marks. Paying bills on time for six consecutive months won’t only improve payment history. However, it can also boost your score by 30 points, benefiting your mortgage appeal.

Dispute Errors and Optimize Your Credit Mix in Your Quest to Learn How to Increase FICO

Up to 25% of credit reports contain errors, resulting in a lowered score. Unlike grades on a test, credit reports can and do contain inaccuracies – in wrong personal information, duplicate accounts, fraudulent activity, and others. You can dispute them to Equifax, Experian, and TransUnion. On the other hand, gently overextending your credit mix is vital.

Adding a secured installment loan is a simple solution to the worry of “how to increase FICO scores” in constantly evolving markets.

If and when that time comes, be assured that the lenders will be there to support you on the multitude of responsibilities that come along with owning your own home.

New Lines of Credit Should Be Stopped When Learning How to Increase FICO to Prep for a Mortgage.

New credits a few months before applying for a mortgage is a big no-no. Each hard inquiry can drop a FICO score by 5 to 10 points and stays for 2 years. If rate shopping, try to consolidate inquiries within 14 to 45 days to limit the impact. This results in score preservation, which helps with other things on how to increase FICO.

Using Authorized User and Secured Credit Cards to Increase FICO Score.

If you start with a low baseline, gaining 20 to 100 points in how to increase FICO scores with a bottom line is possible by being an authorized user on a family member’s card with a good history. Secured credit cards are easier through training wheels: you deposit the limit, spend it wisely, and then pay it back.

You gain and build history with no risk, which is perfect for people wanting to learn how to increase their FICO for their first mortgage. Including the negatives when trying to calculate how to improve credit scores for mortgages.

Even the smartest mistakes could sidetrack progress on how to improve FICO scores for mortgages. Closing down old accounts may feel satisfying, but the cutoff date could harm your credit. Exceeding credit limits over the holiday season could reduce your credit score and also affect your ability to get mortgage pre-approvals. Failing to address small ceilings could result in collection agency harassment, and this also doesn’t look good to lenders. In the meantime, increase discipline over these factors, check your score every month, and change your strategy for improving FICO scores to stay on the right track.

Need a Higher Score to Qualify?

Get a custom 30-day plan to increase FICO and strengthen your file.

Expectations on the Timeline: How Long Does it Take to Resolve Steps to FICO Optimization

How to increase FICO scores for a mortgage does pay, but it takes a little longer for the benefit. Rather simple steps like paying down debt do yield results in a much shorter period of time, 30 to 60 days.

At the same time, the consequences of bankruptcies and rebuilders take a much longer time frame, anywhere between 6 and 12 months.

Considering lenders obtain your score a few days before the close date, it would be ideal to optimize your score as close to the close date as possible. In a more rushed scenario, FHA loans are available for those who score lower. It is believed the score can go down to 580. However, it is also believed that more advantageous moves can be made. Given the current situation, the terms can be adjusted as well.

Long-Term Habits To Maintain Your Elevated FICO Score After Getting The Mortgage

Obtaining the mortgage is not the end goal; maintaining the mortgage requires developing the how to increase FICO habits to ensure continued financial wellness. Spend according to finances. Create emergency savings to avoid spirals into debt. Review your reports every year. Your score will increase, and as your equity increases, your score will increase too, making refinancing much cheaper.

Frequently Asked Questions (FAQs) About How to Increase FICO Scores For A Mortgage

What is The Quickest Method to Increase FICO Scores For Mortgage Approval?

- Learning how to increase FICO becomes the easiest when credit utilization is lowered to below 30% and report errors are fixed.

- Scores will go up by 20-50 points for better reports in a month, and will benefit even more when combined with timely payments.

Does Paying Collections Improve How to Increase FICO For a Home Loan?

- Yes, collections are paid, and with it, the negatives are settled.

- Paid collections can improve the FICO score by 50-100 points and can do it in 30-60 days.

- Pay for delete agreements speed up the process of removal from the report.

How Much Does a 50 FICO Increase Affect Interest Rates For My Mortgage?

- FICO increases of 50 points (for instance, a FICO score increase of 680 to 730) would lower mortgage rates by 0.5%, allowing $100+ in savings for a $300,000 loan.

- This demonstrates FICO’s increase in mastery for affordability.

Is It Possible To Go From a Poor FICO Score To a Good FICO Score in 6 Months?

- Of course.

- With committed and timely payments, debt payments, and error resolution, moving from a sub-580 score to a score of 670 is achievable.

- Target areas of high potential, like utilization for faster movement to FICO increase.

Do Student Loans Impact FICO Score For Mortgage Applications?

- Student loans are classified as installment debt, which helps your credit score, especially if paid on time.

- High student loan balances increase your debt-to-income ratio, which is why, during a FICO score increase, your student loans should be prioritized.

How Do I Go About Exceeding My Minimum FICO Score?

- Many people will tell you that you need to possess a 620+ FICO score to qualify for a mortgage; however, this is not the case.

- With 740+, you will receive the best interest rates.

- To exceed this, keep utilization and your credit history low whilst maintaining appropriate FICO score increase activities.

Should I Include Credit Builder Loans in How To Increase FICO For First-Time Homebuyers?

- Yes, they add payment histories without any upfront risk, perfect for thin files, and can add 20-40 points in three months to your mortgage profile.

How Often Should I Track My Progress in How To Increase FICO Scores?

- Track monthly using no-cost platforms, with a premium on not checking too often, as unnecessary inquiries cause dings.

- While underwriting a mortgage, quarterly deep dives are much appreciated.

What If I Can Not Meet The Credit Score Guidelines For a Mortgage?

In this section, we will cover the simple steps of how to increase FICO to qualify for a mortgage. The minimum credit score to qualify for a 3.5% down payment home purchase FHA loan is 580 FICO. What happens if your credit score is under 580 FICO? HUD, the parent of FHA, allow borrowers with under 580 credit scores and down to 500 FICO to be eligible for an FHA loan.

The lowest credit score you can have to qualify for an FHA loan is 500 FICO. However, borrowers with under 580 FICO and down to 500 credit scores require a 10% down payment versus a 3.5% down payment for an FHA loan.

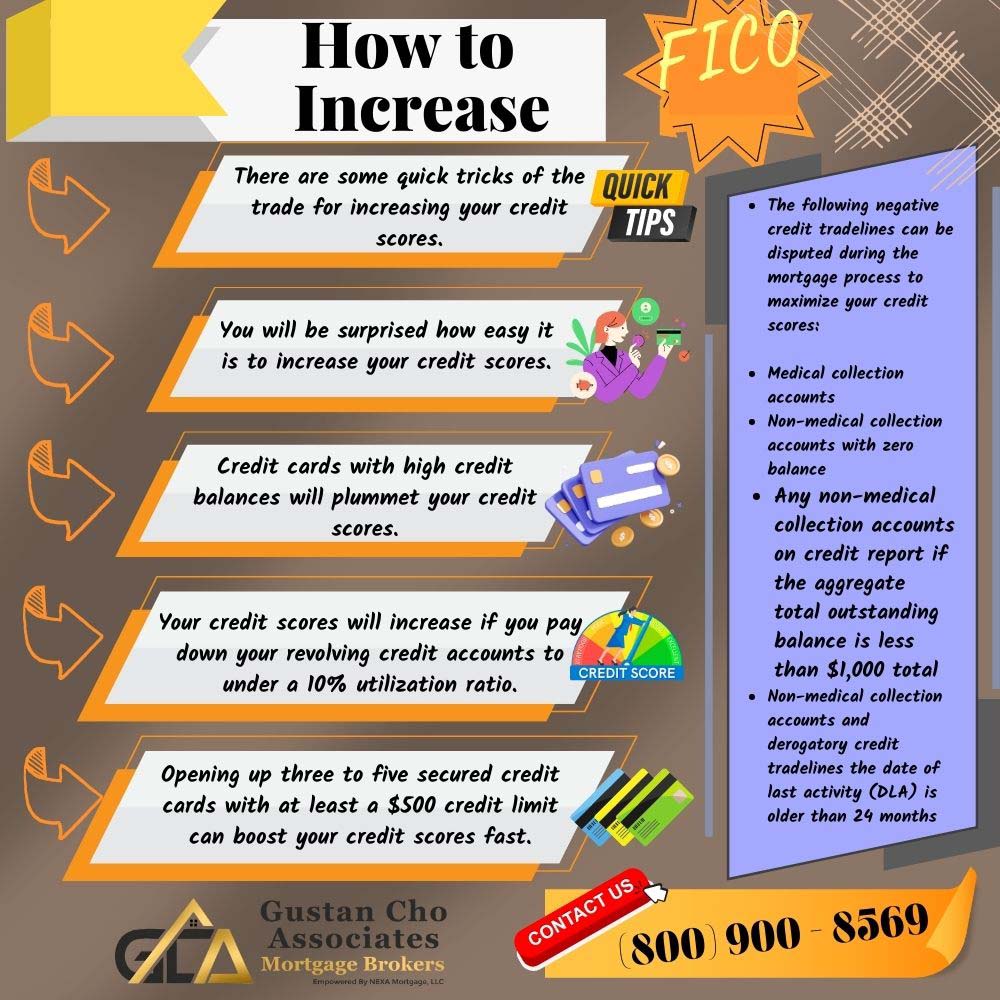

Borrowers with under a 580 FICO credit score need to put a 10% down payment versus a 3.5% down payment if their scores are at 580 FICO or higher. But what if you do not have a 10% down payment? The logical choice is to increase your credit score to a 580 FICO. The team at Gustan Cho Associates can help borrowers boost their credit scores to get to a 580 FICO. There are some quick tricks of the trade for increasing your credit scores. We also have preferred referral credit advisors we refer our borrowers needing a professional to help them with creditors misreporting accurate information or creditors in violation of the Fair Credit Reporting Act.

Steps on How To Increase FICO To Qualify For a Mortgage

In the following sections of this guide on how to increase FICO, we will discuss how to increase FICO to qualify for a mortgage loan. There are a few quick tricks of the trade on boosting your credit scores fast so you can qualify for a mortgage. You do not need to hire expensive credit repair companies to rebuild and boost your credit just by disputing derogatory credit tradelines.

Credit repair through credit disputes is no rocket science. Whatever a credit repair company can do, you can do the same at no cost. We guide our borrowers how to increase FICO credit scores to qualify for a mortgage.

If we suspect the creditor has violated any federal consumer laws, we will address our suspicion with our clients and refer them to a preferred professional who we have worked with closely in the past. You will be surprised how easy it can be to increase your credit scores. You will have low credit scores if you do not have active credit tradelines.

How To Increase FICO By Paying Down Credit Card Balance

Many consumers use credit cards during the holiday season for presents to loved ones. Never apply for a mortgage when you have maxed out credit cards. Credit cards with high credit balances will plummet your credit scores. Credit cards with high balances can easily decrease your credit scores by 100 points on all three credit bureaus.

Always keep your credit card balances below 10% of your credit limit for maximum optimization. Having maximized credit card balances will lower your credit scores.

The good news is by paying down your credit card balances to under a 10% utilization ratio will instantly skyrocket your credit scores. If you are in a rush to submit your mortgage loan application, your loan officer can do a rapid rescore so your credit scores on your credit reports gets updated sooner than its regular cycle that updates.

Lowering Credit Utilization Ratio

Another way how to increase FICO fast to qualify for a mortgage is to pay down your credit card balance to a 10% utilization ratio. High credit card balances will drop your credit scores. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about how to increase FICO scores for a mortgage loan.

Opening up three to five secured credit cards with at least a $500 credit limit can boost your credit scores fast. There are other tools we can recommend our borrowers on how to increase FICO to qualify and get pre-approved for a mortgage.

Paying the credit card balance will instantly boost your credit scores. You can also get non-traditional credit like your utilities, landline, cellular phone, cable, internet provider, and other non-traditional creditors to report with Experian Boost.

Need a Higher FICO Score to Qualify for a Mortgage? We Can Help!

Reach out now for expert tips on how to raise your score fast and get approved for a home loan.

Credit Report Disputes During the Mortgage Process (FHA vs Conventional vs Non-QM)

Credit disputes can be helpful when you’re correcting factual errors—but they can also delay underwriting if they’re left unresolved when your lender pulls credit. The key is knowing which loan program you’re using and how that program treats disputed accounts.

First, a simple rule

Only dispute items that are inaccurate, fraudulent, or incomplete.

Opening disputes to “boost” scores can backfire because some scoring models temporarily ignore disputed derogatory items—and lenders don’t want approvals based on incomplete risk data. FHA specifically notes that disputed accounts are generally not considered in the credit report for risk evaluation.

FHA loans: Disputes Can Trigger Manual Underwriting

For FHA loans run through the TOTAL Scorecard, disputed derogatory credit accounts are defined as:

- disputed charge-offs,

- disputed collections, and

- disputed accounts with late payments in the last 24 months.

If the AUS result is “Accept” and the aggregate balance of disputed derogatory accounts (excluding medical) is:

- Less than $1,000: FHA does not require a downgrade to manual underwrite.

- $1,000 or more: FHA requires a downgrade to manual underwriting.

Important FHA exceptions:

- Medical bills that are being disputed don’t count against the $1,000 limit.

- Identity theft/unauthorized use disputes may be excluded, but the file must include supporting documentation (e.g., a creditor letter, police report, or other appropriate documentation).

Practical takeaway for FHA borrowers:

If you have any disputed collections/charge-offs and you’re close to applying, it’s usually safer to resolve disputes early (or avoid opening new ones), so your file doesn’t get pushed into manual underwriting unexpectedly.

Conventional Loans: Follow AUS Findings (and be Ready to Document)

For conventional loans (Fannie Mae/Freddie Mac), the underwriting system may require the lender to review/investigate disputed accounts, especially when the borrower claims something is inaccurate. Fannie Mae’s guidance says lenders should review disputed information with the borrower and may request the credit reporting company confirm accuracy.

Key points from Fannie Mae:

- If there are multiple disputed tradelines or a dispute on a mortgage tradeline, the lender should obtain the borrower’s correspondence explaining the dispute and what’s being disputed (balance vs. payment history, etc.).

- For DU loans, DU will indicate when the lender must investigate a disputed account to confirm accuracy/completeness.

- For manually underwritten loans with unresolved disputes, Fannie Mae states the lender cannot use the credit score(s) and must rely on traditional credit history instead.

Practical takeaway for Conventional borrowers:

Disputes don’t always “kill” the deal, but they often create extra documentation and can slow approval. If you’re disputing something legitimate, have your paper trail ready (proof it’s not yours, proof of incorrect reporting, etc.).

Non-QM Loans: Lender Rules Vary (But Timing Still Matters)

Most Non-QM investors set their own guidelines. Many are more flexible with disputes than with agency loans, but disputes can still delay payments if the lender needs to confirm the account’s true payment history, balance, or ownership.

Practical takeaway for Non-QM borrowers:

If you’re using bank statements, DSCR, asset-based, or other Non-QM options, ask your loan officer up front:

- “Do you allow open disputes?”

- “Which types (medical, identity theft, charge-offs, late pays)?”

- “Will this affect pricing or require a letter of explanation?”

A Safe “Do This/Don’t Do This” Checklist

Do this:

- Dispute factual errors (wrong balance, wrong late, wrong account owner, identity theft).

- Keep documentation: creditor letters, statements, police/FTC identity theft documents, etc.

- Tell your loan officer before credit is pulled so the strategy matches your loan type.

Don’t do this:

- Don’t open new disputes right before pre-approval “to raise the score.” It can trigger manual underwriting for FHA and additional conditions for conventional.

How To Increase FICO By Disputing Credit Tradelines

If you have medical or non-medical collections with zero balance, you can dispute the credit tradelines to increase your credit scores. Also, if you have collection accounts with an aggregate balance of less than $1,000, you can dispute the derogatory credit tradelines to increase your credit scores. Here is how to dispute derogatory credit tradelines to increase your credit scores:

- Dispute Credit Report Information at Experian.com

- TransUnion Online Service Center | Online Freeze, Dispute, Fraud Alert, Credit Report, and Score

- File a Dispute on Your Equifax Credit Report | Equifax®

Why Are Credit Disputes Not Allowed By Lenders During The Mortgage Process

When a consumer disputes a derogatory credit tradeline, the credit bureaus automatically discount the negative algorithm from the credit scoring formula. Therefore, when the verbiage on the credit report states, Consumer Disputes Creditor Concerning Accuracy, the credit bureaus will not factor the derogatory tradelines on the overall credit score and count the credit disputed tradeline like it does not exist.

Credit disputes will automatically inflate consumer credit scores until the disputed verbiage remains on the credit report. When the consumer retracts the credit disputes, the negative factor gets re-factored in the credit scoring algorithm so the credit scores drops.

When this happens, the consumer credit scores increase because the derogatory credit is not factored in while the tradeline is disputed. Lenders do not want credit disputes during the mortgage process because it artificially inflates a borrower’s credit score. When the consumer removes the credit disputes, the credit scoring formula takes the negative credit tradeline back into the formula, so the credit scores drop again due to the derogatory credit tradeline factor.

How To Increase FICO By Disputing Derogatory Credit Tradelines

One quick way how to increase FICO is to dispute negative exempt credit disputes. Disputing credit tradelines that are exempt from removing active credit disputes should be disputed for maximum credit score boost. The following negative credit tradelines can be disputed during the mortgage process to maximize your credit scores:

- Medical collection accounts

- Non-medical collection accounts with zero balance

- Any non-medical collection accounts on the credit report if the aggregate outstanding balance is less than $1,000.

- Non-medical collection accounts and derogatory credit tradelines, the last activity (DLA) date is over 24 months.

All the above types of derogatory credit tradelines exempt from credit disputes should be disputed to maximize your credit scores.

If you are applying for non-QM loans, all derogatory credit tradelines should be disputed to maximize your credit scores to get the best mortgage rates.

If you have any questions about the content of this guide on how to increase FICO, please get in touch with us at Gustan Cho Associates at (800) 900-8569. Text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

More Frequently Asked Questions About How to Increase FICO:

What is the Fastest Way to Raise My Credit Score?

The quickest “legit” win is usually lowering credit card utilization (paying down revolving balances), especially before the statement closes. Next fastest: fixing reporting errors and making sure every account is paid on time.

How Can I Raise My Score in 30 Days?

Focus on actions that can be reflected by the next reporting cycle: pay down revolving balances, avoid new debt, and ensure no late payments. If there are inaccuracies, dispute them early because investigations can take time.

Can I Raise My Credit Score by 100 Points Overnight?

It’s possible in rare cases (like correcting a major error or paying down maxed cards), but for most people, it takes consistent positive changes over time. Be wary of “overnight” promises.

Does Paying Off Credit Cards Increase My Score?

Often, yes—because it lowers utilization, which is a major score driver. Many borrowers see noticeable movement when they reduce balances and keep them low month to month.

What Credit Utilization Should I Keep for the Best Results?

A common guideline is below 30%, and lower is generally better—especially if you’re prepping for a mortgage. Some people see the most benefit when they keep utilization in the single digits.

Does Paying Collections Improve My Score?

Sometimes. The impact varies based on the scoring model and the specific collection. Paying can help your overall credit health and underwriting story, but score changes aren’t guaranteed—ask the collector what will be reported and get terms in writing.

How Long Does it Take to Build a Good FICO Score?

There’s no single timeline. If your file is thin or you’re rebuilding after negatives, you may see gradual improvement over months as you establish on-time payments and keep balances low.

Do Credit Score Checks Hurt My Score?

Checking your credit score using a consumer app or grabbing your own report usually counts as a soft inquiry, so it won’t hurt your score. Score drops mainly happen due to hard inquiries when you apply for new credit.

How Many Points Does a Late Payment Drop a Score?

It depends on your starting score and overall profile, but late payments can be one of the biggest hits because payment history is heavily weighted. The best move is preventing lates with autopay and reminders.

What Should I Avoid Doing Right Before Applying for a Mortgage?

Avoid opening new accounts, financing big purchases, running up card balances, or missing payments—these can change your score and DTI right when underwriting is evaluating you. If you’re trying how to increase FICO right before pre-approval, keep the plan simple: lower utilization, pay on time, and correct factual errors.

This guide about “How To Increase FICO Scores For a Mortgage” was updated on January 29th, 2026.

Want to Qualify for a Mortgage? Increase Your FICO Score Fast

Get in touch now to discover how we can help you boost your score and secure your home loan.