USDA loans offer 100% financing (no down payment) for eligible buyers purchasing in USDA-approved rural and select suburban areas. This guide breaks down the real USDA home loan requirements—income limits, credit/DTI guidelines, property rules, and the USDA eligibility map—so you can quickly tell if you qualify and what to do next.

Quick USDA Eligibility Checklist

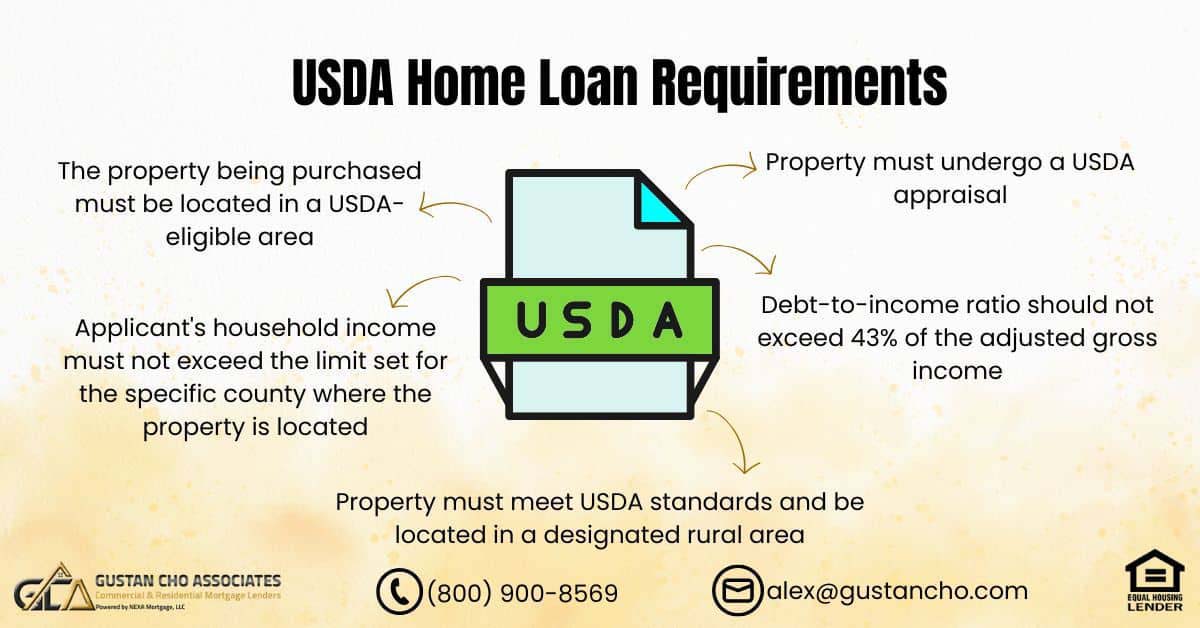

- Location: Home must be in a USDA-eligible area (confirm with the map using the exact address).

- Household income: Typically must be at or below 115% of the area median income (AMI) (includes income from household members, even if not on the loan).

- Occupancy: Must be your primary residence (no vacation or investment properties).

- Credit & payment history: Clean recent payment history helps; many lenders prefer 640+ for streamlined approvals (lower may be possible with manual review).

- Debt-to-income (DTI): Common baseline target is ~29% housing / ~41% total, with flexibility possible depending on the file/AUS.

- Property condition: Must meet basic safety, soundness, and habitability standards.

Not sure if the home or your income qualifies? We’ll verify the address, run household income correctly, and pre-qualify you based on true USDA home loan requirements (no extra overlays).

No Down Payment Doesn’t Mean “No Costs” — Here’s How USDA Really Works

No Down Payment (USDA program feature)

USDA loans offer 100% financing, which means you don’t need a down payment to buy a home—if the property is USDA-eligible and you meet income and USDA home loan requirements.

Closing Costs Still Exist

Even with no down payment, you’ll still have standard purchase costs, including lender fees, title/escrow, appraisal, prepaid taxes/insurance, and recording fees. These costs vary by state, loan size, and transaction details.

Ways to Cover Closing Costs (common strategies)

You may be able to reduce—or even eliminate—out-of-pocket closing costs using one (or a combination) of these options:

Seller concessions (seller-paid closing costs): The seller can agree to pay some of your closing costs as part of the purchase contract.

-

- Typical range: often 2%–6% of the purchase price, depending on the market and how the deal is structured.

- Important: seller concessions must be allowed under program rules and supported by the contract.

Lender credit (pricing credit): A lender credit is when the bank helps cover some of your closing costs, but the tradeoff is that your interest rate goes up a bit.

- This can help buyers who are short on cash to close.

- The tradeoff is usually a higher monthly payment over time versus paying costs up front.

Gift funds (when allowed): In some cases, eligible gift funds may be used to help cover closing costs, provided they meet the documentation requirements.

Limits and What Borrowers Should Expect

- USDA = no down payment, but not automatically “no closing costs.”

- The goal is to structure the purchase so that your cash to close is minimal, using seller concessions and/or lender credits when possible.

- We’ll run side-by-side options so you can choose: a lower rate (pay some costs) vs. a higher rate (lender credit).

USDA Home Loan Requirements For Eligible Properties

Based on the USDA home loan requirements, the property must be in a USDA-designated area. Applicants for USDA loans must meet specific eligibility criteria, including qualifying for the loan, meeting minimum credit score requirements, and adhering to maximum front-end and back-end debt-to-income ratio caps.

Discover comprehensive USDA home loan requirements for 2025. Learn about eligibility, income limits, property requirements, and how to qualify for 100% financing through Gustan Cho Associates.

Notably, USDA home loan guidelines distinguish themselves from other loan programs by incorporating a maximum household income limit. The household income cap is determined based on the median income of the area and the number of individuals in the household.

What are the USDA loan requirements?

Income limits, rural location, and credit flexibility make USDA unique.

Ready to Buy a Home with No Down Payment?

Contact us today to learn how you can qualify for 100% financing and make homeownership a reality. The USDA loan program operates through two primary channels: direct loans issued by the USDA and guaranteed loans provided by approved lenders.

Most borrowers work with approved lenders who offer USDA-guaranteed loans, which provide more flexibility and faster processing times compared to direct USDA loans.

The property must be located in a USDA-eligible area, which includes rural communities and certain suburban areas. The USDA defines eligible areas based on population density and proximity to metropolitan centers. Generally, areas with populations under 35,000 residents qualify, though some exceptions exist for communities with populations up to 50,000 in certain circumstances.

USDA Home Loan Requirements on Household Income

USDA home loan requirements include specific rules regarding household income. When a married applicant takes on a mortgage loan individually, their spouse’s income is still considered part of the household income, even if the spouse is not listed on the mortgage note. The highest income limit for a household changes based on the county where the property is.

The USDA has some rules regarding debt-to-income ratios to keep things affordable. They cap the front-end ratio at 28%, while the back-end can’t go over 41%.

USDA home loan requirements and guidelines help both lenders and borrowers determine whether the loan makes sense. So, if you’re thinking about applying for a USDA home loan, it’s good to know how they calculate household income (including your spouse’s income) and the debt-to-income limits to make sure you meet USDA home loan requirements.

How Much Do I Need To Buy a House With a USDA Loan

Buying a home at the end of 2026 is tough because the Federal Reserve has raised interest rates six times, raising mortgage costs. Generally, buyers need a down payment unless they’re veterans. However, the USDA home loan program is a good option since it doesn’t require a down payment.

Gustan Cho Associates maintains relationships with multiple USDA-approved lenders, allowing us to help borrowers find the most competitive terms and suitable loan programs for their needs.

Our services include pre-qualification, application assistance, documentation guidance, and ongoing support throughout the approval process. We help borrowers understand their options and make informed decisions about their home financing.

Can I Buy a Home With No Down Payment and No Closing Costs With a USDA Loan?

The purpose behind the rate hikes is evident and focused on addressing inflation, but the outcomes differ significantly. Numerous clients face challenges in securing a down payment for buying a home.

Gustan Cho Associates specializes in USDA home loans and maintains extensive experience helping borrowers navigate the application process successfully. Our team understands the unique requirements and challenges associated with USDA financing.

Additionally, one must consider the extra expenses associated with closing. With USDA home loan requirements, it’s possible to receive a seller concession or lender credit of up to 6% to offset closing costs when purchasing a home. We work with borrowers throughout the entire process, from initial consultation through closing, ensuring they understand USDA home loan requirements and receive personalized guidance tailored to their specific situations.

What Area Are USDA Home Loans Eligible?

USDA home loan requirements cover financing options available in rural areas and are administered by the United States Department of Agriculture. In this blog, we will delve into the specifics of USDA mortgages, outline fundamental eligibility criteria, and provide guidance on applying for a USDA loan through Gustan Cho Associates.

A notable advantage of USDA loans is the absence of a mandatory down payment. There is no requirement for a down payment on USDA loans, so the qualification standards are more stringent than conventional or FHA loans.

It is essential to enlighten our readers that the United States Department of Agriculture extends its influence beyond being solely a food and safety organization. While USDA cuts of meat and USDA-certified organic produce are commonly encountered in grocery stores, information on USDA mortgage loans may not be as readily apparent.

USDA Loans Versus Conventional Loans

USDA home loan requirements are less widely embraced than conventional or FHA mortgage lending options; however, they present a viable route to achieving home ownership. The primary objective of USDA is to assist families in rural areas in becoming homeowners. This program is designed for low to moderate-income families seeking to purchase a home.

USDA home loan requirements come with competitive interest rates, contributing to a more affordable homebuying process for individuals with lower to moderate incomes in specified rural areas.

Like a VA mortgage loan, the United States Department of Agriculture directly supports the mortgage, paralleling the support provided by the United States Department of Veteran Affairs. Thanks to this backing from the federal government, mortgage lenders typically extend more competitive interest rates than conventional financing.

USDA Home Loan Requirements on Eligible Properties and Areas

USDA home loan requirements dictate that eligible areas for USDA loans are specifically designated as rural by the United States Department of Agriculture. The Department of Agriculture targets these areas to facilitate homeownership opportunities for families with lower to moderate incomes.

The United States Department of Agriculture mortgage department provides a user-friendly interactive eligibility map, ensuring easy verification of a property’s eligibility for USDA financing.

You can access the map through this link. Input the full address to determine if the property falls within the designated area. Even if the home is in a designated region, USDA strongly recommends contacting them directly for verification. While the interactive map is valuable, it may not only be 100% accurate sometimes.

USDA Eligible Areas (Map, Population, “Rural/Suburban”)

USDA Baseline (program rule):

The home must be in a USDA-eligible area, generally rural and some suburban locations. Eligibility is determined by the USDA and can change over time as communities grow.

Common Lender Practice:

Lenders typically rely on the USDA eligibility map as a first step, but they may request extra verification if the address is near eligibility boundaries or if map updates are pending.

No-Overlay Note (Gustan Cho Associates):

We’ll verify the property using the USDA tools early in the process and flag any boundary or eligibility concerns before you spend time and money on a contract.

USDA Home Loan Requirements on Occupancy and Household Income

USDA home loan requirements include meeting the residency and income criteria. To qualify for a USDA loan, one must be either a legal resident of the United States, a non-citizen national, or a permanent resident alien. For detailed information regarding residency qualifications, please get in touch with Gustan Cho Associates. Income limits are crucial in determining eligibility for a USDA mortgage loan.

Borrowers can verify property eligibility using the USDA’s online property eligibility map, which provides real-time information about qualifying locations. It’s important to note that eligibility can change over time as communities grow and demographic patterns shift.

Since USDA loans are designed for low to moderate-income families, your mortgage lender will verify your adjusted gross income. Your adjusted gross income must be at most 115% of the median income in your area. The USDA website provides a user-friendly income eligibility tool, allowing you to easily check the median income in the location where you plan to purchase a home.

Household Income Limits (115% AMI) + Who Counts

USDA Baseline (program rule):

USDA Guaranteed loans generally require total household income to be at or below 115% of the Area Median Income (AMI) for the property’s location. Household income can include income from household members, even if they are not on the mortgage note, depending on the household’s occupancy and composition.

Common Lender Practice:

Most lenders will require documentation to verify household income eligibility. They may ask for additional clarification when income is variable (overtime/bonus/commission), when a spouse is in the household, or when other adults reside in the home.

No-Overlay Note (Gustan Cho Associates):

We help you calculate household income up front to prevent surprises later, and we’ll show you the documentation needed to support eligibility based on USDA’s household-income method.

USDA Mortgage Underwriting Guidelines on USDA Loans

When looking into a USDA home loan, it’s important to know the specific requirements. A big thing to keep in mind is having a solid payment history. While one or two late payments might not kick you out of the running, USDA loans have pretty strict rules about your credit profile. You’ll also need a steady income to prove you can handle the mortgage payments. So, keeping your payment history in good shape is important if you’re thinking about applying for a USDA home loan.

Can I get approved with low credit?

Yes—USDA loans are flexible and we follow true guidelines with no overlays.

Ready to Secure Your USDA Home Loan?

With no down payment and low rates, a USDA loan can help you buy your dream home. Contact us today to explore your USDA loan options and get pre-approved!

USDA loans have specific income requirements that vary by location and household size. The borrower’s household income cannot exceed 115% of the area median income (AMI) for the specific geographic location.

This requirement ensures the program serves moderate to low-income families as intended by the legislation. Income calculations include all household members’ earnings, including wages, self-employment income, retirement benefits, and other regular income sources. The USDA considers gross income before taxes and deductions when determining eligibility. Some areas with higher costs of living may have adjusted income limits that allow for higher qualifying incomes.

USDA Home Loan Requirements on Debt-To-Income Ratio

Many clients ask if there are debt-to-income requirements with USDA mortgage lending. The short answer is yes. Your debt-to-income ratio is a qualifying factor for a USDA mortgage loan.

While the USDA doesn’t establish a minimum credit score requirement, most approved lenders require a credit score of at least 640 for streamlined processing.

Borrowers with credit scores below 640 may still qualify but will undergo additional underwriting scrutiny and manual processing. The general recommendation is your debt-to-income ratio should not exceed 43% of your adjusted gross income. While it is possible to go above this number, it will all be part of the automated underwriting system to see if you qualify for a USDA mortgage loan.

How To Calculated Your Debt-To-Income Ratio For USDA Loans

Gustan Cho Associates offers an easy-to-use mortgage calculator to help you estimate your front and back-end debt-to-income ratios. GCA’s user-friendly mortgage calculator will give you an estimate on your mortgage payment.

Thousands of viewers use the GCA mortgage calculator. The GCA mortgage calculator</a is used by loan officers, realtors, and borrowers throughout the real estate industry.

For any questions on utilizing our state-of-the-art mortgage calculator, don’t hesitate to contact us at Gustan Cho Associates at (800) 900-8569 today. Text us for a faster response. The USDA mortgage calculator gives you a field where you can enter other liabilities such as your credit card payments, auto loan payments, student loans, and any other debt you may have reported to your credit report.

Do Lenders Have Different USDA Home Loan Requirements

If you have less-than-perfect credit or high debt-to-income ratios, you must work with a highly skilled mortgage team who knows the ins and outs of USDA home loan requirements. Not all lenders have the same lending requirements on USDA loans.

Manufactured homes must be permanently affixed to a foundation and classified as real estate rather than personal property. The home must also meet HUD standards and local building codes.

Condominiums must be located in USDA-approved projects or individual units in projects that meet specific criteria. The credit history evaluation focuses on payment patterns, debt management, and overall creditworthiness. Lenders examine the borrower’s credit report for late payments, collections, bankruptcies, foreclosures, and other derogatory marks that might indicate financial instability.

USDA Home Loan Requirements on Credit Scores

The Automated Underwriting System (AUS) is a tool utilized by lenders to evaluate a borrower’s financial data and decide if they qualify for a loan. Basically, it examines your application details—like your credit score, income, and debts—to quickly determine whether you can handle the loan payments.

Regarding USDA loans, the automated underwriting system usually wants a credit score of 640 or higher for your application to get the green light. But don’t worry if your score is below that—you might still be able to snag a USDA mortgage.

Your credit score is important, but it’s not the only thing that matters in the loan decision process. If you’re confused about your credit score or want tips on boosting it, professionals like Gustan Cho Associates can give you solid advice and help you figure out what you need to qualify for a home loan.

Credit Score Requirements (USDA)

USDA Baseline (program rule):

USDA guidelines focus on the ability to repay and overall credit history. The program itself doesn’t publish one universal minimum score for every scenario, and approvals are based on the total file.

Common Lender Practice:

Many USDA-approved lenders use 640+ as a “streamlined” benchmark (often tied to automated underwriting and internal processing). Below 640 may still be possible, but it typically requires more documentation and closer underwriting review.

No-Overlay Note (Gustan Cho Associates):

We work with USDA-approved lenders and focus on the actual USDA eligibility and compensating factors (payment history, reserves, stable income). If one lender can’t approve due to internal requirements, we’ll help you explore other USDA options where available.

USDA Loans For Bad Credit

We have seen every credit score from the mid-400s to the mid-800s. There are many little things you can do to raise your credit score. Our team is here to offer our professional advice.

While we usually do not recommend credit repair, we are always willing to advise you on raising your credit scores. Borrowers with bad credit can qualify for USDA loans.

Typically, if you have bad credit and lower credit scores, you will need to show other compensating factors. Example of compensating factors are on-time payment history, additional assets in the bank, longevity on your job, and high residual income..

Perks To a USDA Home Loan

In our opinion, the number one perk to a USDA loan is the no down payment requirement. In the economic condition the United States is currently in, saving money is harder than ever. With inflation higher than in decades, many Americans are burning through their savings just to make ends meet.

The property must have adequate access via public or private roads and access to safe drinking water and sewage disposal systems.

Properties on wells and septic systems are acceptable if they meet local health department standards and pass required inspections. The property must meet basic safety, security, and structural integrity standards. USDA loans require a professional appraisal that includes a property inspection to ensure the home meets these standards. Common issues that must be addressed include electrical problems, plumbing deficiencies, heating system malfunctions, and structural concerns.

USDA Home Loan Requirements on Down Payment

Since a USDA loan does not require a down payment and allows the seller to pay closing costs, purchasing a home with little or even no money out of pocket is possible. A USDA mortgage loan will allow the seller to pay up to 6% of the purchase price towards seller-paid closing costs.

While we do not require a copy of the home inspection, you want to make sure the property you are purchasing will pass a USDA appraisal.

If you find a home for $300,000, and the seller can pay up to $18,000 in closing costs. It is unlikely the closing cost will be that high, so in theory, you will not need to bring any money out of pocket if you can negotiate seller-paid closing costs into your contract.

USDA Home Loan Requirements on Mortgage Insurance

With USDA mortgage loans, there are two important fees: the upfront guarantee fee and the annual guarantee fee. The upfront fee is easy—it’s just 1% of your loan amount. So, if your loan is $250,000, that upfront fee would be $2,500, which gets added to your total loan amount.

While USDA loans are designed for residential properties, they can include some acreage. Generally, properties with up to 10 acres are acceptable, provided the land is typical for the area and the home represents the property’s primary value. Larger acreage may be acceptable in certain circumstances if it doesn’t suggest commercial agricultural use.

The acreage should be reasonably sized for a residential property in the specific location and not indicate that the property will be used for farming or other commercial purposes that would disqualify it from the program. As for the annual fee, it’s 0.35% of your loan. For that same $250,000 loan, you’re looking at an annual fee of about $875. To simplify budgeting, just set aside roughly $73 each month to cover that fee. Be sure to factor that into your monthly mortgage payment alongside the principal and interest.

USDA Home Appraisal

Appraisal – Similar to most mortgage programs available, USDA loans require an appraisal conducted by a third party before an underwriter may approve the loan. A USDA appraisal is slightly different from a conventional appraisal.

A USDA appraisal will also include a well and septic report to verify the systems are working correctly and meet USDA home loan requirements.

Since the USDA appraisal is more in-depth than a conventional appraisal, it is usually in your best interest to complete a home inspection at the beginning of your home-buying process. For more information on the USDA appraisal process or the difference between a home appraisal and a home inspection, please reach out to Gustan Cho Associates today.

USDA Versus Conventional Home Appraisal

With a conventional appraisal, the mortgage lender is looking for the home’s value and not much more. That way, a lender can make their decision on how much they can lend you. With a USDA mortgage loan, the lender is looking for the value of the home along with condition of the property. Security, safety, and habitability are the three factors USDA home appraisers look for.

Who helps with USDA loans nationwide?

Gustan Cho Associates specializes in USDA approvals with no overlays.

Home Inspection Versus Home Appraisal

Once pre-approved, borrowers can begin searching for properties in USDA-eligible areas. Real estate agents familiar with USDA loans can provide valuable assistance in identifying suitable properties and navigating the purchase process.

The purchase contract should include appropriate contingencies for USDA loan approval and property appraisal.

Sellers should understand that USDA loans may take slightly longer to close than conventional financing due to additional regulatory requirements. A home inspection and an appraisal are two different processes that help determine a home’s condition and value.

Home Inspection

Getting a home inspection isn’t something lenders or the USDA require, but it’s definitely a smart move for homebuyers. Basically, a home inspector closely examines how the house is holding up. They check things like plumbing issues, electrical safety, and whether the structure is sound. This gives buyers a better idea of the property’s overall condition and what repairs might be on the horizon.

Home Appraisal

When lenders need to determine a home’s worth, they hire an appraiser. The appraiser examines the property to establish a fair market value, which is important for the lender to decide how much cash to lend.

The appraisal also ensures that the house meets certain standards and is in decent shape. The appraiser checks out different parts of the home, like the HVAC system and the roof, and any visible issues, like broken windows or holes in the walls.

In summary, a home inspection looks for issues and repairs. In contrast, a home appraisal evaluates the home’s market value and ensures it meets lending standards.

Want to Buy a Home in a USDA-Eligible Area?

Get in touch today to find out if you qualify and start the process of buying your home.

The geographic restrictions can limit housing options for some borrowers, particularly those working in urban areas. Many suburban communities within commuting distance of major cities qualify for USDA financing.

Borrowers should research eligible areas early in the home search process and consider communities that offer reasonable commutes to employment centers. Working with knowledgeable real estate agents familiar with USDA-eligible areas can expand available options.

What Is The Mortgage Process for Getting Approved For a USDA Loan

Applying for a USDA loan with Gustan Cho Associates is easier than ever. As mentioned above, you must work with a loan officer familiar with this program, or the process will be a nightmare. Our team of highly skilled loan officers is up to date on all USDA home loan requirements.

The mortgage process of USDA loans differs than other loan programs because the lender underwrites the file and after the lender approves the file, the file needs to be underwritten again by the USDA.

After reviewing your upfront qualifications with a one-on-one mortgage consultation, you will be paired with a licensed loan officer in your state. Your licensed loan officer will send you an online application link. Since the beginning of the COVID-19 pandemic, many Americans have decided to move out of large cities and into more rural areas.

USDA Loan Timeline + Common Conditions (Double Underwriting Explained)

Why the USDA Can Take Longer Than FHA/Conventional?

USDA loans are typically reviewed twice—first by the lender, then by USDA (or the state USDA Rural Development office) for the final commitment.

Typical Timeline (Most USDA Purchases)

1) Pre-Approval (1–3 days)

You apply, upload documents, and we run an AUS/initial review to determine eligibility and affordability.

2) Lender Underwriting (7–14 days)

Your lender underwriter verifies income, assets, credit, and the purchase contract.

Once conditions are satisfied, the file is marked “lender clear to close” (or “ready for USDA submission”).

3) USDA Final Review (2–10 business days in many areas)

USDA performs the final program compliance review and issues the final commitment.

Important: USDA review time varies by region, volume, and staffing—some locations move faster, others slower.

4) Closing (1–3 days after USDA commitment)

After the USDA commitment is received, closing is scheduled with the title/escrow company.

Real-world expectation: Many USDA loans close in 30–45 days, but timelines can extend if USDA turn times are longer or if the file needs corrections.

What Can Delay USDA Review (Most Common)

- Address/property eligibility issues (map shows eligible, but USDA flags it, or boundaries have recently changed)

- Income limit/household income questions (missing household member income, variable income, overtime/bonus, non-borrowing spouse income)

- Documentation gaps (missing pages, outdated paystubs/bank statements, unsigned forms)

- Credit or liability questions (undisclosed debts, new accounts, disputed tradelines, significant payment changes)

- Appraisal/condition items (required repairs for safety/soundness/habitability; well/septic requirements where applicable)

- Contract errors (seller concessions wording, incorrect names, missing addenda, non-standard terms)

Documents That Most Often Trigger Conditions

Income & Employment

- Recent pay stubs and W-2s (and/or tax returns for self-employed)

- Verification of employment (VOE)

- Documentation for overtime/bonus/commission to prove it’s stable

Assets & Bank Activity

- Most recent bank statements (all pages)

- Documentation for large deposits and transfers

- Proof of earnest money and source of funds (if applicable)

Household Income Eligibility

- Income for household members as required under USDA rules (even if not on the loan)

- Proof of child support/alimony received or paid (when applicable)

Property & Contract

- Fully executed purchase contract + addenda

- Appraisal and any repair proof (if required)

- HOA/condo docs when applicable

- Well/septic documentation when applicable in your area

How to Avoid Delays

- Confirm the exact address on the USDA eligibility map early

- Upload documents as complete PDFs (all pages) and keep them current

- Disclose all household income sources up front

- Avoid opening new debt or changing jobs during underwriting

How Can I Qualify and Get Pre-Approved For a USDA Loan

This online application is easy to navigate and will gather the required information to start the process. This application link will ask you for details surrounding your current residence, employment for the previous two years, income and asset information, and other items based on your application.

Documents Required To Process USDA Loans

After filling out the online application, you can access a secure portal. In this portal, you can upload your income and asset documents. Once your loan officer receives everything they need, they will start the pre-approval process.

Remember that USDA mortgages have a few extra qualifications and undergo two underwriting processes, so they might take longer.

Even though you won’t need to make a down payment, you’ll still need to cover the closing costs unless the seller can cover those for you. One of the biggest challenges of buying a home is saving for that down payment, so going with a USDA loan can help you skip that step.

USDA Home Loan Requirements Checklist

To make things easier and reduce any stress about the requirements for a USDA home loan, here’s a simple checklist of documents you’ll likely need:

- Pay stubs

- W2s

- Tax returns

- Bank statements

- Asset documentation

Having these documents ready can help the process go more smoothly and quickly.

Getting Approved With The Best Lender For a USDA Loan

Now that you understand the basics of USDA lending and how to apply with our team, we encourage you to apply today. We strongly encourage you to search the USDA eligibility map to ensure you are looking in a USDA-eligible area. Not every lender offers USDA mortgage loans; more importantly, not every loan officer knows the qualifications.

If you have any questions about USDA Home Loan Requirements, please contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

We Approve Borrowers Others Deny

No overlays, no extra rules—just true USDA guidelines.

USDA Home Loan Requirements

Discover the USDA home loan requirements for 2025 with Gustan Cho Associates. Learn eligibility, income limits, property criteria, and more to secure your dream home with a USDA loan.

USDA home loans—administered by the U.S. Department of Agriculture—stand out for buyers looking to purchase in rural and suburban areas, and they come with a fantastic perk: no down payment.

They help spread homeownership more evenly across America, especially in the quieter, less crowded parts of the country. Offered by Gustan Cho Associates, we walk buyers step by step through the USDA loan journey, making sure you know all the eligibility, income limits, and property rules you’ll need to get the home you’ve always wanted. This 2025 guide boils it all down to the essentials.

What Are USDA Home Loans?

USDA home loans, sometimes called USDA Rural Development Loans, serve one clear, important goal: help low-to-moderate-income families buy a home when other financing options seem out of reach.

Managed by the USDA’s Rural Housing Service, they provide the big advantage of 100% funding, which means you can buy a home without any down payment, and more of your income can go toward buying the home, making it a favorite for first-time buyers and anyone who hasn’t managed to save a big down payment yet.

Types of USDA Home Loans

The USDA has several loan programs, each serving a unique need.

- USDA Direct Loans: These loans target low-income families.

- The USDA provides the money, and borrowers receive payment assistance, making homeownership easier on the budget.

- USDA Guaranteed Loans: A USDA guarantee helps approved lenders, like Gustan Cho Associates, offer loans to a wider income range.

- They come with more flexible terms.

- USDA Home Repair Loans and Grants: These loans or grants help existing homeowners fix or upgrade their houses, focusing on safety and accessibility.

For USDA Guaranteed Loans, Gustan Cho Associates offers personalized help, guiding borrowers step-by-step from start to finish.

USDA Home Loan Eligibility Requirements

USDA home loans require borrowers to meet guidelines on income, credit, work history, and where the property is located. Let’s look at the main requirements you’ll need to remember.

Income Limits for USDA Loans

USDA loans are meant for families with low-to-moderate income. To determine who can apply, the USDA sets income limits tied to the local median income and adjusts the number of people in the house. Here’s what to know for 2025:

- Household Income Caps: A family’s income can’t exceed 115% of the median for the county.

- So, if a family of four lives in a rural area with a median income of $80,000, the total income can be as high as $92,000 and still qualify for a USDA loan.

- Income Verification: When a lender, like Gustan Cho Associates, processes the loan, it checks pay stubs, tax returns, and other documents to ensure the income matches USDA rules.

Suppose you’re unsure whether you fit the USDA limits. In that case, Gustan Cho Associates can review your finances quickly and check the specific limits that apply where you live.

Credit Score Requirements

USDA loans come with flexible rules, but your credit report still matters:

- Minimum Credit Score: Gustan Cho Associates and most lenders look for a credit score of 620 or higher for USDA Guaranteed Loans.

- People with slight drop-offs might still get approved if they provide more documents or show other strengths, like always paying bills on time.

Credit History

A good credit history helps most when it’s clean, so no recent bankruptcies, foreclosures, or big late payments on your record. If you do have those past bumps, don’t worry. Gustan Cho Associates can guide you toward loan options that may still fit.

Debt-to-Income Ratio (DTI)

Your DTI determines your debt-to-income ratio to ensure you can afford a mortgage.

- DTI Limits: USDA usually caps DTI at 41%.

- With a solid credit score or hearty savings, lenders may stretch that to 43%.

- How DTI is Figured: We take all monthly payments—spending your mortgage, current credit cards, car loans—and divide by your gross monthly income.

- Gustan Cho Associates can tally and sharpen that DTI before you borrow.

Employment and Income Stability

Your job and paycheck need to be steady to land USDA loan approval.

- Job History: We’d like two years in the same company or field.

- Valid Income: USDA accepts steady paychecks, self-employed income, and qualifying benefits, as long as the pay can be backed up with documents.

Citizenship and Residency

You must fall into certain citizenship circles to qualify for a USDA loan.

- Eligible Status: A borrower can be a U.S. citizen, a U.S non-citizen national, or a permitted permanent resident.

Property Eligibility for USDA Loans

To get a USDA loan, you must follow specific rules for your property.

Rural Area Requirements

USDA loans focus on homes in eligible rural or suburban areas:

- Where It Counts: USDA labels “rural” as places with 35,000 people or fewer.

- You’ll also find plenty of suburban spots close to big cities on the list.

- For a quick check, the USDA’s online Property Eligibility Map has you covered.

- Get Expert Help: The Gustan Cho Associates team will double-check your dream address.

- We’ll ensure it’s on the eligible list so you don’t encounter surprises later.

Property Condition and Standards

USDA wants homes that are safe and in good shape:

- Must Pass the Safety Test: Your new place has to be structurally sound.

- If it needs big repairs, that’s a no-go.

- An appraisal will look for safety issues, and that appraisal must back up USDA’s minimum property requirements.

- What Types of Homes Work: You can buy single-family homes, condos, townhomes, and manufactured homes—if the last one is permanently attached to land.

- All of them must follow USDA rules to be fine for your loan.

USDA Loan Benefits with Gustan Cho Associates

Working with Gustan Cho Associates for a USDA loan comes with plenty of perks:

- No Down Payment: You finance 100% of the home’s price so you can move into your new home without a hefty down payment.

- Low Interest Rates: Rates for USDA loans tend to be lower than those for many other loan types, which means your monthly payment stays manageable.

- Flexible Credit Guidelines: Even if your credit isn’t perfect, Gustan Cho Associates can help, because our lenders look beyond the score.

- Low Mortgage Insurance: USDA mortgage insurance is more affordable than you might think.

- Just 1% of the loan amount upfront and 0.35% yearly.

How to Apply for a USDA Loan with Gustan Cho Associates

Getting a USDA loan with us is easy and quick:

- Pre-Qualification: Give us a call so we can check your income, credit, and finances.

- You’ll know immediately if you qualify, and we’ll send a pre-qual letter.

- Find an Eligible Property: Look for homes in USDA-approved zones with your agent.

- Submit Documentation: Send in pay stubs, tax returns, and other income papers so our team can prepare your file for underwriting.

- Appraisal and Approval: A USDA-approved appraiser will check the home’s value, and then the loan will get the final stamp of approval.

- Closing: You’ll sign the closing docs, get the keys, and start making memories in your new home!

- You can count on our expert loan officers to keep everything moving smoothly from the first call to closing day.

- We love making the entire USDA loan journey easy and stress-free!

USDA Home Loan FAQs

What’s The Lowest Credit Score I Can Have to Get a USDA Loan?

- We usually look for 620 at Gustan Cho Associates.

- However, if your score is lower, you may still qualify if you have strong compensating factors.

Can I Buy a Vacation house Hith a USDA Loan?

- USDA funds must only be used for your main home, so we can’t finance vacation rentals or investment properties with these loans.

How Do I Check if The House I Want is USDA-Eligible?

- Head to the USDA’s Property Eligibility Map online, or call the team at Gustan Cho Associates, and we’ll confirm it’s a match.

Does USDA Limit How Much I Can Earn to Get Approved?

- Your total household income can’t exceed 115% of the local median.

- We’ll run the numbers to make sure you’re still in the clear!

What Types of Homes Can I Buy With a USDA Loan?

- You can apply for a single-family home, condo, townhome, or certain manufactured homes, as long as they meet USDA location and condition standards.

How Long is The USDA Loan Approval Process?

- Typically, we’ll have you clear to close between 30 and 45 days.

- Gustan Cho Associates pulls out all the stops to speed your approval!

For step-by-step help with USDA home loan requirements, contact Gustan Cho Associates. Our team is about getting you into your new home by giving clear advice and the best loan options. Don’t wait—let’s make your dream of homeownership a reality together!

FAQ – USDA Home Loan Requirements

What Credit Score Do You Need for a USDA Loan?

USDA’s Guaranteed Loan program doesn’t set one universal minimum score in the program description, but borrowers must show they can manage debt responsibly.

In practice, many lenders prefer around 640 for streamlined processing, while lower scores may require more documentation and closer underwriting review.

What are the Income Limits for a USDA Loan?

If you want a USDA Guaranteed loan, your household income must usually be at or below 115% of the area’s median income (AMI). This limit can change based on where you live and the number of people in your household.

USDA provides tools to check both income eligibility and property eligibility online.

How do I Know if a Home is in a USDA-Eligible Area?

The fastest way is to use the USDA’s online eligibility site and enter the full property address to confirm it’s in an eligible rural/suburban area.

Eligibility can change as areas grow, so it’s smart to confirm the exact address early.

What Debt-to-Income Ratio (DTI) is Allowed for a USDA Loan?

USDA underwriting looks at whether the payment is affordable based on your full profile. Many lenders target DTI around the low-40% range or below for best approval odds, and higher DTIs may be possible depending on AUS results and compensating factors.

Can You Get a USDA Loan with No Down Payment and No Closing Costs?

USDA loans offer 100% financing (no down payment), but closing costs still exist (title/escrow, lender fees, appraisal, prepaids).

Some buyers reduce cash-to-close using seller concessions (when allowed) and/or lender credits (often in exchange for a slightly higher rate).

What Can Disqualify You from a USDA Loan?

Common issues include:

- Household income above the limit for the area

- Property not in a USDA-eligible location

- The home does not meet minimum condition standards at appraisal (safety/soundness concerns)

- Credit history showing unresolved major derogatory issues or inability to manage debt (case-by-case)

This blog about “USDA Home Loan Requirements: Get Answers in 5 Minutes” was updated on February 17th, 2026.

Thinking About Buying a Home with a USDA Loan?

Contact us now to learn how you can qualify and start your path to homeownership.