Portfolio Loans for Foreign Nationals (2026)

Yes—foreign nationals can buy U.S. real estate without U.S. citizenship, a green card, or a U.S. credit score using portfolio (non-QM) foreign national mortgage programs. These loans are designed for international buyers who may not have a Social Security number or traditional U.S. income documentation.

Most foreign national programs focus on down payment, verified assets, and documented cash flow (often via bank statements), not a U.S. FICO score. Depending on the lender and property type, many buyers can finance primary residences, second homes, and investment properties, including select condos and condotels.

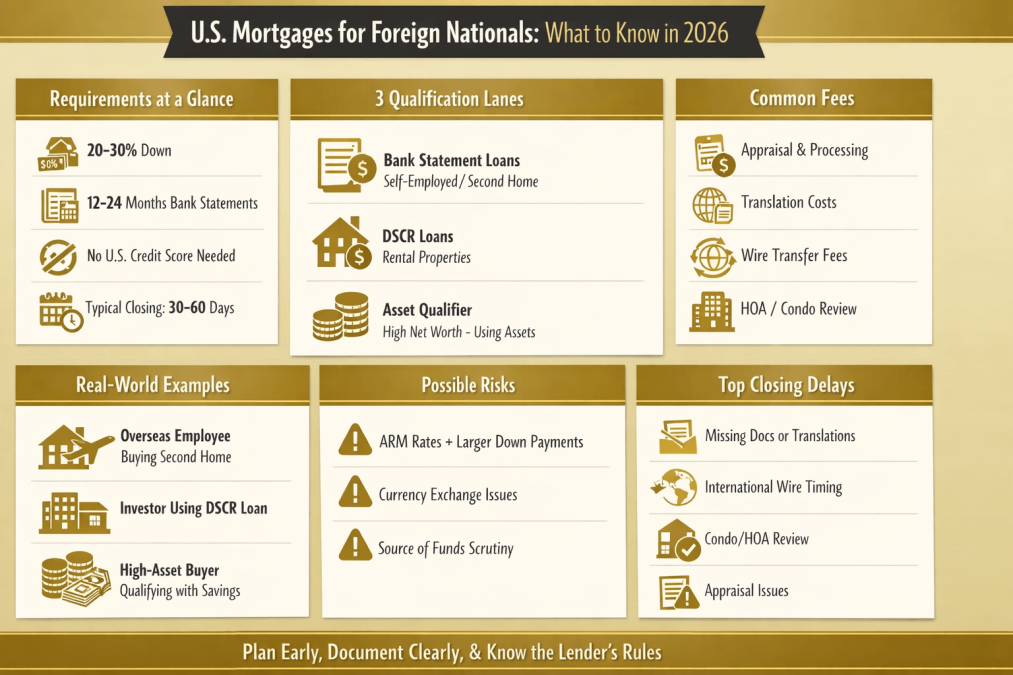

Typical Starting Point (varies by lender/program):

- Down payment: often 20%–30% (higher for larger loans, unique properties, or higher-risk profiles)

- Reserves: often 6–12 months (PITI + HOA if applicable)

- Timeline: typically 30–60 days (international docs/translations can push toward the longer end)

- Documentation: passport + bank statements + proof of funds (some programs accept foreign credit letters or alternative tradelines)

Want to know what you qualify for? The fastest path is matching your profile to the right lane: Bank Statement, DSCR (rental properties), or Asset-Qualifier.

Key Takeaways

- No U.S. credit score? Still possible. Many programs use bank statements, reserves, and foreign credit references instead of FICO.

- You don’t need to be a U.S. citizen to own property. In most cases, foreign buyers can legally purchase U.S. real estate.

- Program fit depends on your goal:

- Buying a second home → often bank statement or asset-qualifier

- Buying a rental property → often DSCR using rental cash flow

- Bigger down payments usually mean better options. Higher equity and more substantial reserves can improve pricing and approvals.

- Most delays are document-related. Translation, source-of-funds, wire timing, condo review, and entity paperwork are commonly the causes of slow closings.

What You’ll Learn in This Guide

In this 2026 guide, you’ll learn:

- What portfolio loans for foreign nationals are, and how they differ from conventional mortgages

- The most common qualification paths (bank statements, DSCR, asset-qualifier)

- Typical down payment, reserve, and documentation expectations (and what can change them)

- What property types are often eligible (primary, second homes, investment, select condos/condotels)

- How lenders evaluate you without U.S. credit (foreign credit letters, alternative tradelines, assets/cash flow)

- A realistic timeline to close and the top reasons foreign national loans get delayed

- A step-by-step checklist to get pre-approved faster and avoid surprises

Simple Glossary: What These Loan Terms Really Mean (Foreign Nationals)

If you’re seeing a lot of labels—portfolio, foreign national, non-QM, DSCR, bank statement, asset depletion—you’re not alone. These are not separate “loan types” competing with each other. Think of them as different ways lenders describe the same mortgage, depending on who you are and how you qualify.

Portfolio Loan

A mortgage that the lender keeps in its own portfolio instead of selling to Fannie Mae or Freddie Mac. Because the lender keeps it, they can be more flexible with guidelines.

Foreign National Program

This describes the borrower profile: a buyer who is not a U.S. citizen and typically does not have a green card. Many foreign national programs do not require a U.S. credit score or Social Security number (requirements vary by lender).

Non-QM (Non-Qualified Mortgage)

This describes the underwriting style, not the borrower. Non-QM loans don’t follow standard “qualified mortgage” rules and often allow alternative documentation (common in foreign national lending).

Non-Conforming Loan

A broad label for loans that don’t meet conventional (Fannie/Freddie) guidelines. Many portfolio and Non-QM loans are non-conforming.

How You Qualify (the “Documentation Lane”)

These terms describe what the lender uses to approve you:

- Bank Statement Loan: Qualify using 12–24 months of bank statements instead of W-2s/pay stubs.

- DSCR Loan (for Investment Properties): Qualify using the property’s rental income vs. expenses, not your personal income.

- Asset Depletion / Asset Qualifier: Qualify using documented assets (savings/investments) converted into an “income” calculation.

“No-Doc” (Use Carefully)

This usually doesn’t mean “no documents at all.” It typically means limited income documentation, but lenders still verify identity, assets, down payment, and reserves. (Programs and definitions vary widely.)

Bottom line: A foreign national can get a portfolio/non-QM loan, and approval is usually based on a qualification method such as bank statements, DSCR, or assets.

What Are Portfolio Loans for Foreign Nationals?

Portfolio loans are mortgages that lenders keep within their organization rather than selling to other investors. Since they don’t have to follow the strict rules set by Fannie Mae or Freddie Mac, they tend to be more flexible with their requirements. These loans are also known as non-conforming or non-QM (non-qualified mortgage).

Purchasing a home in the United States as a foreign national might seem challenging, especially when you don’t have an established U.S. credit score.

The American dream of homeownership remains accessible to international buyers through specialized financing programs and alternative lending solutions designed specifically for foreign nationals. Portfolio loans for foreign nationals are specifically built for non-U.S. citizens without a green card. You don’t need a Social Security number, U.S. credit score, or permanent residency. These loans allow you to finance real estate using alternative documentation and proof of funds.

Requirements at a Glance: Foreign National Portfolio Loans (2026)

Foreign national portfolio loans are built for non-U.S. citizens who may not have a U.S. credit score, Social Security number, or traditional U.S. income documents. While every lender’s program differs, here are the most common requirements you should expect.

Eligibility Basics

Most foreign national programs are designed for borrowers who:

- Are not U.S. citizens and typically do not have a green card

- May live overseas or be in the U.S. on a visa (varies by program)

- Have limited or no U.S. credit history

Down Payment and Loan-to-Value (Typical Ranges)

- Typical down payment: 20%–30%

- Higher down payments may apply for:

- Luxury/high-balance loans

- Condotels / non-warrantable condos

- Higher-risk profiles or limited documentation

- Typical maximum financing: up to ~70%–80% LTV depending on program, property type, and reserves

Note: Exact LTV and down payment requirements vary by lender and property type.

Reserves (Cash After Closing)

Many programs require verified reserves, often:

- 6–12 months of reserves (commonly measured as PITI = principal, interest, taxes, insurance)

- If the property has HOA dues, reserves may be calculated using PITI + HOA

Credit Verification (When There’s No U.S. Credit Score)

You may not need a U.S. FICO score. Instead, lenders may review:

- Foreign credit report (when available), or

- Bank reference letter/proof of international payment history, or

- Alternative tradelines (ex, housing payment history, utilities, etc.—varies by lender)

Documentation Options (How You Qualify)

Foreign national programs commonly use one of these “lanes”:

- Bank Statement Loans: typically 12–24 months of bank statements to document cash flow

- DSCR Loans (Investment Properties): approval based on the property’s rental income vs. housing payment

- Asset Qualifier / Asset Depletion: approval based on verified liquid assets instead of employment income

Property Types That May Be Eligible

Depending on lender guidelines, foreign nationals may finance:

- Single-family homes

- Townhomes

- Condos (including some non-warrantable condos)

- 2–4 unit properties (program-dependent)

- Second homes/vacation homes

- Investment rental properties

- Condotels (only with select lenders and often with larger down payments)

Typical Loan Terms

Because these loans are portfolio/non-QM, many programs offer:

- Adjustable-rate mortgages (ARMs) such as 3/1, 5/1, 7/1

- 30-year amortization is common

- Interest-only options may be available in select cases

- Fixed-rate options exist in some programs, but are less common

Timeline to Close

- Typical closing timeframe: 30–60 days

- Deals trend closer to 45–60 days when documents require:

- Translation/certification

- Overseas verification

- Condo/condotel review

- Entity (LLC/corporate) ownership documentation

Documents You’ll Usually Need

Most lenders ask for:

- Passport (and visa if applicable)

- Bank statements (foreign and/or U.S.)

- Verification of available funds for the down payment and closing expenses.

- Source of funds documentation (where the money came from)

- Bank reference letter (often requested)

- Purchase contract (once you’re under contract)

Choose the Right Program: 3 Qualification Lanes for Foreign Nationals (2026)

Foreign national “portfolio loans” aren’t one single loan—most approvals fall into one of three qualification lanes. Pick the lane that matches how you earn money and what you’re buying.

Lane 1: Bank Statement Loan

Best for:

- Foreign nationals who are self-employed, business owners, contractors, or professionals paid outside the standard U.S. payroll system

- Buyers purchasing a second home or primary residence (and sometimes an investment, depending on the lender)

- Borrowers with strong cash flow but limited traditional income documentation

Key documents (typical):

- 12–24 months bank statements (foreign and/or U.S.)

- Passport + visa (if applicable)

- Proof of funds for down payment + reserves

- Source of funds documentation (wires, transfers, savings history)

- Business documentation may be requested (varies by lender)

Pros:

- Uses real cash flow instead of W-2s/pay stubs

- Often works well when there’s no U.S. credit score

- Flexible for entrepreneurs and international income structures

Cons:

- Lender may “expense” deposits, reducing qualifying income

- Requires clean, consistent deposits and strong documentation

- Rates/down payment requirements can be higher than conforming loans

Lane 2: DSCR Loan (Debt Service Coverage Ratio) — Investment Properties

Best for:

- Foreign nationals buying rental or investment property

- Investors who want approval based mainly on the property’s rental performance, not personal income

- Buyers building a U.S. portfolio without U.S. tax returns or W-2s

Key documents (typical):

- Passport + visa (if applicable)

- Proof of down payment + reserves + source of funds

- Purchase contract + appraisal (often includes rent schedule)

- Lease agreement (if already rented) or market rent analysis

- Entity docs (if buying in an LLC—program dependent)

Pros:

- Personal income may not be required (program-specific)

- Clear fit for rental homes—qualification is property-driven

- Often simpler underwriting for investors with strong reserves

Cons:

- DSCR must meet a minimum ratio (varies by lender)

- Some property types/condos can be tougher to qualify for

- Down payment/reserve requirements may be higher than bank statement programs

Lane 3: Asset Qualifier / Asset Depletion Loan

Best for:

- High-net-worth foreign nationals with substantial liquid assets

- Retirees or investors with strong savings but uneven or hard-to-document income

- Buyers who want to qualify using assets rather than employment

Key documents (typical):

- Recent asset statements (bank, brokerage, retirement—eligible assets vary)

- Passport + visa (if applicable)

- Proof of funds for down payment + reserves

- Source of funds documentation

- Additional documentation for large transfers (especially cross-border)

Pros:

- Can qualify without traditional employment income

- Strong option when income is complex (business distributions, investments, multiple countries)

- Often works well for larger loan amounts when assets are substantial

Cons:

- Not all assets count (retirement accounts may be discounted)

- Larger down payments and reserve expectations are common

- Can require more documentation for asset verification and transfers

Buy a Home in the U.S. With Confidence

Our Foreign National mortgage programs make it easy for international buyers to invest in U.S. real estate.

Real-World Examples: How Foreign Nationals Get Approved (2026)

These quick examples show how foreign national portfolio loans work in real life—what lenders typically focus on, which “lane” fits best, and what documentation usually matters most.

Example #1: Overseas W-2 Employee Buying a U.S. Second Home

Scenario:

A salaried employee working overseas (not on U.S. payroll) wants to buy a vacation/second home in Florida.

Best-fit lane: Bank Statement (or foreign income documentation, depending on lender)

What the lender typically looks for:

- A strong, consistent deposit pattern that supports the proposed housing payment

- Down payment + reserves verified and sourced (especially if funds are transferred internationally)

- Clean documentation of employment/income (even if not U.S.-based)

Docs commonly requested:

- Passport (and visa if applicable)

- 12–24 months bank statements (foreign and/or U.S.)

- Employment letter and/or pay documentation from overseas employer (varies)

- Proof of funds for down payment + 6–12 months reserves

- Explanation/source of funds for any large transfers or recent deposits

Why this works:

Even without a U.S. credit score, the lender can document stability through cash flow, reserves, and verifiable employment—especially when the borrower has strong liquidity and a clean banking history.

Example #2: Investor Buying a Rental Property Using DSCR

Scenario:

A foreign national living abroad wants to buy a single-family rental property in Texas as an investment.

Best-fit lane: DSCR (Debt Service Coverage Ratio)

What the lender typically looks for:

- Whether the property’s market rent can reasonably cover the monthly housing payment

- Strong liquidity: down payment + reserves

- Property type and marketability (some condos/unique properties require a higher down)

Docs commonly requested:

- Passport (and visa if applicable)

- Proof of down payment + reserves + source of funds

- Purchase contract

- Appraisal with market rent analysis (or lease if already rented)

- Proof of landlord experience (sometimes requested, program-specific)

Why this works:

DSCR loans are designed for investors because approval is driven more by the property’s rent potential than by personal income documentation—ideal for foreign nationals building U.S. rental portfolios.

Example #3: High-Net-Worth Buyer Using Assets to Qualify

Scenario:

A high-net-worth foreign national wants to buy a U.S. property but has complex income (investments, dividends, business ownership across multiple countries). They prefer not to document income traditionally.

Best-fit lane: Asset Qualifier / Asset Depletion

What the lender typically looks for:

- Sufficient eligible liquid assets to support the mortgage payment using an “asset-to-income” calculation

- Strong reserve position after closing

- Clear sourcing and verification of funds, especially for cross-border transfers

Docs commonly requested:

- Passport (and visa if applicable)

- Recent statements for bank/brokerage/eligible investment accounts

- Proof of down payment + reserves

- Source of funds documentation for large deposits or transferred assets

- Additional verification for foreign-held accounts (varies by lender)

Why this works:

For borrowers with significant liquidity, asset qualifier programs can approve based on verified assets rather than relying on standard income documentation—often a better fit when income is variable or international.

Pro Tip: Use These Examples to Pick Your Best Lane

- Second home / personal use: Bank statements often fit best

- Rental property: DSCR is usually the cleanest route

- High assets, messy income: Asset qualifier/depletion can simplify approval

Looking for Flexible Financing? Portfolio Loans Could Be the Perfect Solution!

Foreign nationals face unique challenges when purchasing U.S. real estate, primarily due to the absence of domestic credit history. Traditional lenders typically rely on FICO scores to assess borrower risk, but international buyers often arrive in the United States without this crucial financial documentation.

The key to success lies in understanding that lenders have developed sophisticated systems to assess foreign nationals’ financial stability without relying solely on U.S. credit scores.

These alternative evaluation methods consider international credit histories, employment verification, asset documentation, and other financial indicators that demonstrate your ability to repay mortgage obligations. Fortunately, the mortgage industry has evolved to accommodate foreign nationals through innovative lending programs that evaluate creditworthiness using alternative methods. Contact us today to learn how a portfolio loan can work for your unique financial situation.

Who Qualifies for Portfolio Loans for Foreign Nationals?

To be eligible for these loans, you must meet the definition of a foreign national. That typically means:

- You are a citizen of another country

- You do not have a green card

- You are not a permanent U.S. resident

- You may or may not have a U.S. visa or work permit

Borrowers may be:

- International business owners

- Professionals on work visas

- Non-residents investing in U.S. real estate

- People with limited or no U.S. credit history

How Much Can Foreign Nationals Borrow?

Foreign nationals can borrow money for homes, but the amounts vary. Most loans available to them are between $100,000 and $3 million. If someone wants to borrow more than $1 million, they will likely need to make a larger down payment and show they have extra savings.

For loans up to $1 million, the borrower usually has to put down 20% to 25% of the home’s price. The down payment is higher for loans over $1 million, usually between 30% and 40%. The amount that can be borrowed also depends on the person’s credit score and their savings, with a maximum borrowing value of up to 80% of the home’s price.

Asset-Based Lending Solutions

Asset-based mortgages offer another viable path for foreign nationals seeking U.S. home purchases. These programs evaluate your total assets, including international real estate holdings, investment portfolios, business ownership, and liquid savings accounts.

Lenders calculate debt-to-income ratios using your documented assets rather than traditional employment income verification.

This financing approach particularly benefits wealthy foreign nationals who may have substantial assets but limited U.S. employment history. Asset-based lending typically requires larger down payments, often 25-40% of the property value, but provides flexibility in qualification criteria that traditional mortgages cannot match.

Property Types Eligible for Foreign National Financing

Foreign nationals can finance many kinds of real estate in the U.S., including:

- Single-family homes

- Townhomes

- Condominiums (including non-warrantable condos)

- Condotels

- 2–4 unit properties

- Second homes and vacation homes

- Investment rental properties

Portfolio loans for foreign nationals include properties that conventional lenders won’t finance, like condotels and non-warrantable condos.

Secure Your U.S. Property Investment

Whether for a vacation home, rental, or permanent residence, our Foreign National programs are designed to fit your needs.

What Kind of Loan Terms Are Available?

Foreign National Mortgage Programs

Specialized foreign national mortgage programs cater specifically to international buyers without U.S. credit histories. These lenders understand the unique circumstances surrounding foreign national home purchases and have developed streamlined processes to evaluate international financial documents.

Program requirements typically include proof of foreign credit history, employment verification from your home country, and substantial down payments ranging from 20-30%.

Some lenders accept alternative credit documentation, such as utility bills, rental payments, and international loan histories, to build a comprehensive financial profile. Since these are non-conforming loans, most portfolio loans come with adjustable-rate mortgage (ARM) terms such as:

- 3/1 ARM

- 5/1 ARM

- 7/1 ARM

These terms typically include:

- 30-year amortization

- Interest-only options

- Competitive rates based on risk level, property type, and LTV

Fixed-rate loans may be available in limited situations, but are not common for foreign national loans.

Required Documents for Foreign Nationals

Documentation Requirements for Foreign Nationals

Success in securing financing without a U.S. credit score depends heavily on comprehensive documentation. Foreign nationals must provide translated financial statements, including bank records, investment account summaries, and employment verification letters. All documents require certified translations into English, performed by qualified translation services.

Essential Financial Documents

Property tax records, international mortgage statements, and business financial statements help establish your financial responsibility and payment history.

Many lenders also request explanation letters detailing your employment history, income sources, and reasons for purchasing U.S. real estate.

One of the biggest benefits of portfolio loans for foreign nationals is the reduced paperwork. You’ll still need to show you have the funds to close and repay the loan, but it’s easier than conventional loans.

Typical documents include:

- Copy of valid visa and passport (if applicable)

- Proof of income or employment from your home country

- International or U.S. bank statements

- Letter of reference from a foreign bank

- Down payment and reserve documentation

In some cases, foreign credit reports or letters of good standing may be accepted in place of a U.S. credit score.

Need a Mortgage as a Non-Permanent U.S. Wage Earner? Non-QM Loans Can Help!

Reach out now to learn more about how we can help you secure the financing you need, regardless of your residency status.

Fees, Risks, and What to Expect

Foreign national portfolio loans can be a strong solution, but they’re not the same as a standard U.S. conventional mortgage. Knowing the common fees and risks upfront helps you avoid surprises and keeps your purchase contract on track.

Standard Fees to Plan For (Typical)

- Down payment + reserves: Most programs require a larger down payment and verified cash reserves compared to conventional loans.

- Appraisal fee: Required on nearly every mortgage; unique properties (condos/condotels/2–4 units) can cost more.

- Lender/processing/underwriting fees: Vary by lender and program (portfolio/non-QM lenders can differ widely).

- Title and escrow/settlement costs: Paid to third parties to close the transaction; varies by state.

- Translation and document certification: If documents are issued outside the U.S., certified translations may be required.

- Wire/transfer costs: International transfers can add bank fees and timing delays (especially around weekends/holidays).

- Insurance and escrow setup: Homeowners insurance is required; some loans escrow taxes/insurance, others may not.

- HOA/condo review costs (if applicable): Condo/condotel reviews can add extra steps and fees.

Tip: Ask for a written fee estimate early so you can compare lenders and avoid last-minute cost surprises.

Risks to Understand Before You Apply

1) Rates and terms can be different than conventional loans

Many foreign national programs are portfolio/non-QM, so pricing can be higher, and ARM terms are more common. Your rate and terms typically depend on the down payment, reserves, property type, and the strength of your documentation.

2) Currency movement and cross-border transfers

If your funds are held in another currency, exchange-rate changes can affect:

- Your available down payment at the time you wire funds

- Whether you still meet reserve requirements after conversion

3) “Source of funds” and large deposits scrutiny

Lenders must verify the source of your funds. Large recent deposits, crypto conversions, business transfers, or gifted funds can trigger extra documentation requests.

4) Condo/condotel eligibility risk

Condos—especially non-warrantable condos and condotels—can be eligible with specific lenders, but they often require:

- Higher down payments

- More reserves

- Extra project review

- If the building doesn’t meet a lender’s criteria, you may need to switch programs/lenders.

5) Documentation and identity verification requirements vary

Some lenders require certain visa types or additional verification steps. Requirements can differ significantly between programs, so pre-approval with the right lender matters.

What Can Delay Closing (and How to Avoid It)

Most foreign national loans close in 30–60 days, but these are the most common reasons deals get pushed to 45–60+ days.

Top closing delays

- Missing or inconsistent bank statements (pages omitted, unclear account ownership, irregular deposits)

- Certified translations not ready (or not accepted by lender)

- Source-of-funds documentation gaps (large deposits, multiple transfers, recent account openings)

- International wire timing (cutoff times, intermediary banks, weekend/holiday delays)

- Condo/condotel review (HOA docs, project approval, litigation, or budget concerns)

- Entity/LLC purchase documentation (operating agreement, ownership verification, EIN setup, foreign entity paperwork)

- Appraisal issues (low value, property condition, comps, or rental income support for DSCR loans)

- Insurance delays (difficulty placing coverage, high-risk areas, flood zones, or condo master policy issues)

- Time zone lag (slow turnaround when documents/signatures must come from overseas parties)

Fast-track checklist (simple)

To keep your timeline tight, try to:

- Provide complete bank statements (all pages) early

- Prepare translations before underwriting requests them

- Avoid unexplained large deposits for 60–90 days if possible (or document them clearly)

- Keep funds in stable accounts and be ready to document transfer trails

- If buying a condo/condotel, request HOA docs immediately after contract acceptance

How Long Does It Take to Close a Foreign National Mortgage?

Getting a mortgage as a foreign national involves some important timing, especially when closing the loan. The time it takes to close a loan depends on the lender you choose. Usually, most portfolio loans for foreign nationals close in about 30 to 60 days.

Having all your documents sorted and ready to go when you start your application helps make the closing process smoother and faster.

Being proactive and quick to respond to your lender’s requests for information or extra paperwork can also help speed things along. The more prepared you are and the faster you can provide what they need, the better chance you’ll have for a timely closing.

Identity and Legal Documentation

Foreign nationals must provide valid passport documentation, visa status verification, and proof of legal presence in the United States. Some lenders accept temporary visa holders, while others require permanent resident status or specific visa classifications. Understanding these requirements early in the process prevents delays during mortgage underwriting.

Additional documentation may include marriage certificates for joint applications, power of attorney documents for representatives handling transactions, and corporate documentation for business entity purchases. Working with experienced immigration attorneys ensures proper documentation preparation and submission.

How Foreign Nationals Secure U.S. Mortgages Without U.S. Credit

Having no U.S. credit doesn’t mean no chance at a mortgage. Foreign nationals looking to purchase U.S. properties can leverage a range of options.

Many lenders consider international credit reports, proof of prompt international payments, bank statements, and sizable down payments.

Programs that state income and verify assets through documents empower buyers to qualify despite the credit gap. Gustan Cho Associates recommends that buyers prepare documents to streamline the approval process.

What a Foreign National Loan Is

A foreign national loan is a mortgage made for non-U.S. citizens living overseas who wish to buy real estate in the U.S. Because many of these buyers lack a Social Security number, a U.S. credit score, or standard income documents, lenders have created these special mortgage options.

Why Credit Scores Aren’t a Roadblock

In the U.S., mortgage lenders usually pull a credit report from one of the big three—Experian, Equifax, or TransUnion. Foreign buyers usually lack these reports, so lenders skip the hassle. Instead, they look at:

- International credit letters.

- Recent bank statements from home or U.S. accounts.

- Proof of income and assets from banks around the world.

Reasons Foreign Buyers Love U.S. Real Estate

- Skip U.S. credit checks: Use standard documents instead.

- Pick from everything: Houses, condos, or rental properties, you choose.

- A solid U.S. market: Values usually increase, and many tenants want to rent.

- Spread your wealth: Own real estate far away from home for extra safety.

Challenges and How Gustan Cho Associates Solves Them

Common Hurdles

- The loan decision cannot rely on a U.S. credit score.

- Upfront costs can feel higher due to big down payment percentages.

- Documents come from overseas and need to be translated and verified.

Our Solutions

Gustan Cho Associates does not add extra rules that slow you down. Instead, we connect you to wholesale lenders that tailor foreign national loan programs. Whether you want a rental property or a vacation getaway doesn’t matter. We clear the paperwork and close your loan quickly.

Flexible Loans for Foreign Nationals

No U.S. credit history? No problem. We specialize in Foreign National loans with simplified guidelines.

Why Work with Gustan Cho Associates?

At Gustan Cho Associates, we specialize in non-QM mortgage loans and tough financing cases, including portfolio loans for foreign nationals. Our team:

- Works with over 280 wholesale lending partners

- Has zero lender overlays on government loans

- Offers custom loan solutions for non-U.S. residents

- Provides fast pre-approvals and expert guidance

- Can help you finance primary, second homes, or investment properties

We make the loan process simple, even for buyers outside the U.S.

How to Apply for a Portfolio Loan as a Foreign National

Here’s a quick overview of the steps to get approved:

- Speak with a loan expert to go over your goals and residency status

- Submit basic documents (passport, income, proof of funds)

- Get matched with the best portfolio loan options

- Get pre-approved with your estimated rate and terms

- Find your property and submit a purchase contract

- Finalize your loan and close in 30 to 60 days

Our team at Gustan Cho Associates is available seven days a week, including evenings and holidays, to help you get started.

Establishing U.S. Credit Presence

Foreign nationals can simultaneously build U.S. credit while pursuing home purchases through strategic financial planning. Opening secured credit cards, establishing banking relationships with major financial institutions, and maintaining consistent payment histories create positive credit indicators that benefit future financing needs.

Some foreign nationals choose to delay home purchases for 6-12 months while establishing basic U.S. credit profiles. This approach can result in better interest rates and expanded lending options, though it requires patience and strategic financial management during the credit-building period.

Buy U.S. Property with Confidence

You don’t need to be a U.S. citizen or a permanent resident to buy a property in the U.S. If you’re a foreign national, you can check out portfolio loans that offer flexible options, reasonable rates, and support from our expert team nationwide. Whether you’re looking to grab a vacation home, move for a job, or expand your real estate investments, Gustan Cho Associates is here to help make it all happen.

Credit Growth After Buying

When foreign nationals start paying their new mortgage on time, they quickly create a good U.S. credit record. Each monthly payment gets reported to the main credit bureaus, laying the groundwork for better opportunities, like refinancing, buying more homes, or getting help for a business.

Many homebuyers find that owning a home builds their credit history faster than opening a few credit cards or taking out a small personal loan. A mortgage shows a long-term money plan and a track record of paying on time, two things that credit scores look for above all else.

Choosing the Right Rate

Interest When There’s No U.S. Score

Mortgages for foreign nationals without U.S. credit scores usually have a rate of 0.5% to 2.0% higher than the best available loans. Lenders see less predictable risk, so they ask for a small premium.

Still, some specialist lenders offer reasonably priced loans once they grasp the buyer’s situation and the wider market.

The amount of extra charged varies. A large down payment, strong asset proofs, and solid personal finances mean a lower interest rate. On the other hand, thin paperwork or weaker profiles may lead to the top side of that range.

Loan Term Flexibility

Foreign nationals wanting to buy property in the U.S. have several mortgage terms. They can choose a fixed-rate loan for 30 years, a 15-year mortgage with extra payments to pay it off quicker, or an adjustable-rate mortgage that changes with market rates.

Most buyers find shorter terms come with lower interest rates, which means higher monthly payments—something some foreign nationals try to keep as low as possible.

Many lenders let buyers pay just interest for the first five to ten years to keep cash flow steady. The loan balance stays the same during this time, freeing up money for other expenses. This can greatly help foreign nationals build a U.S. credit score. It’s especially valuable for buyers who expect their earnings to grow or their property investments to increase before the interest-only period ends.

Tax Implications and Considerations

Foreign nationals who buy real estate in the U.S. need to grasp the tax obligations of the purchase. Property taxes, any income tax on rental income, and possible estate taxes can change financing choices and how long someone wants to keep a property.

It’s smart to understand these before closing a purchase and to keep them in mind for the entire time the property is owned.

Many buyers contact tax pros who focus on international real estate to comply with the law and keep costs down. These specialists can help structure the purchase to meet both U.S. and home-country tax rules while avoiding surprises.

Estate Planning Considerations

When foreign nationals buy U.S. real estate, they may face estate taxes that their home countries do not impose. Careful planning using trusts and international tax treaties helps lower these taxes and provides clear guidelines for passing wealth to heirs.

Some buyers hold U.S. properties via foreign corporations or international trusts. This move may seem complicated, but it can cut taxes and let owners manage their properties with less hassle. Still, these strategies need skilled legal and tax advice to work properly.

Working with Specialized Lenders

Choosing the Right Lender

A foreign buyer’s success largely hinges on picking a lender specializing in international transactions. These banks and credit unions know exactly what documents to ask for, work with translation services, and use underwriting systems tailored for buyers from abroad. Such lenders also offer multilingual teams, educational guides, and loan officers who understand foreign credit profiles and income types. Their support can speed up the entire process, reduce mistakes, and boost the likelihood of approval.

Loan Processing Timelines

Expect a foreign national mortgage to close about 45 to 60 days, longer than the 30 to 45 days standard for U.S. citizens. The extra time covers document translations, the bank double-checking international income, and a focused underwriting review.

Planning ahead for processing times keeps purchase contracts on track and ensures every deal closes smoothly. Many experienced foreign buyers start mortgage pre-approval six months or more before finding the right property. This way, they avoid last-minute pressure when bidding on hot-market deals.

Homeownership Made Possible for Foreign Nationals

At Gustan Cho Associates, we simplify the mortgage process for international buyers. No overlays, no unnecessary hurdles — just real solutions.

Market Opportunities and Property Types

Investment Property Advantages

Foreign nationals see strong investment potential across U.S. real estate, especially in fast-growing metros with steady rental demand. Such properties create cash flow right away and also appreciate over time. Attractive mortgage rates for foreign clients, especially with 30%-40% down, further enhance returns.

Most buyers choose investment property because it requires no immediate visa or residency choice and helps spread risk in an international portfolio. Rental payments often cover mortgage costs and, over time, provide a useful U.S. credit history when managing the asset well.

Primary Residence Benefits

Buying a home as a primary residence brings several upsides, including more predictable costs, stronger ties to a U.S. community, and a potential boost for U.S. visa applications or green card petitions. Many immigration lawyers advise clients to show property ownership as one sign of long-term intent.

Across the financing landscape, primary homes normally get slightly better rates and, in some cases, access to special mortgage products for foreign buyers. While finding the right neighborhood can be complex, the long-term use, stability, and stronger immigrant credibility often outweigh the effort.

Success Strategies for Foreign Nationals

Assemble a Focused Professional Team

A foreign national needs a dedicated team to buy a home in the U.S. successfully. Your team should include a real estate agent who knows international clients, an international mortgage broker, a qualified attorney, and a tax advisor. Each expert tackles a part of the deal that international buyers often find tricky, so no detail is overlooked.

Bringing everyone together early lets you create a complete home purchase strategy, gather the right paperwork, and manage the transaction in one coordinated effort. The fees you pay for these specialists might seem high, but they are often cheaper than the mistakes that can happen in a complicated cross-border deal.

Connect the Purchase with Your Bigger Goals

Look at the home purchase as one piece of a larger planning puzzle. This means considering how owning property affects future visas, tax bills, estate plans, and investment options. Having the right advisors at the start guarantees that everything fits together.

Gustan Cho Associates is a nationwide mortgage broker licensed in 48 states. Our team specializes in helping borrowers other lenders deny.

With no overlays and a wide range of foreign national programs, we can help you purchase your U.S. home or investment property—even with no U.S. credit score. The most successful foreign buyers in the U.S. don’t see real estate as a one-off deal. They often treat it as the start of a larger investment path in America. This planning mindset helps them make the move work to their long-term advantage, while keeping red tape to a minimum.

Leverage Specialized Financing to Build Credit

Buying property in the U.S. as a foreign national without a U.S. credit score is entirely possible. It requires targeted financing options and advanced planning. The main ingredients for success are learning what financing solutions exist, preparing a complete set of financial documents, and working with a team that specializes in serving international buyers.

The U.S. housing market is rolling out the welcome mat for international buyers by offering smart, flexible loans. These programs look at how well you manage money instead of relying on a single credit score.

With the right steps and expert help, owning a U.S. home can be yours, regardless of your credit. Thinking about buying property in the U.S. as a foreign national? Reach out to our expert team now. We’ll create a financing plan built for your situation and investment dreams. Let’s make that American dream of homeownership come true together!

Ready to Get Pre-Approved?

Call us at 800-900-8569 or email gcho@gustancho.com. Prefer to text? Text us for a faster response.

We can help you achieve your U.S. real estate goals with portfolio loans for foreign nationals. These loans are now available in 48 states, Washington D.C., Puerto Rico, and the U.S. Virgin Islands.

Frequently Asked Questions About Portfolio Loans for Foreign Nationals:

Can a Foreign National Get a 30-Year Fixed Mortgage in the U.S.?

Sometimes, yes—some foreign national/Non-QM lenders offer 30-year fixed options, while others steer borrowers to ARMs depending on risk, property type, and down payment. Don’t assume fixed-rate is unavailable; it’s program- and lender-specific.

Can I Buy a Primary Residence in the U.S. as a Foreign National?

It depends on the lender and your residency/visa profile. Many foreign national programs are marketed for second homes and investment properties, while some lenders/programs allow primary residences. If a lender restricts the program to non-owner-occupied or second homes, you’ll need a different lender/product.

Do I Need a Social Security Number or ITIN to Qualify?

Often, no SSN is required for foreign national programs, but some lenders may request an ITIN depending on how the loan is structured and whether you’ll be filing U.S. taxes (for example, rental income). Requirements vary by lender—so it’s best to match the program to your documentation.

Can a Foreign National Buy Using an LLC (or Corporation)?

In many cases, yes—select lenders allow foreign nationals to purchase investment properties using a U.S.-formed LLC, but entity vesting can add documentation requirements and can limit lender options. Always confirm LLC eligibility before you write your offer.

What Documents Do Foreign Nationals Usually Need for a U.S. Mortgage?

Most lenders start with identity and ability to fund: passport/visa, bank statements, proof of down payment/reserves, and sometimes foreign residency/visa documentation. If documents are not in English, lenders may require translation help.

What Delays Foreign National Mortgage Closings the Most?

The most significant delays usually come from international documentation and money movement—especially large wires from abroad that trigger source-of-funds review, as well as translation/certification and verification timelines. Planning transfers early and keeping a clean paper trail helps a lot.

This blog about “Foreign Nationals: Buy U.S. Homes with No Credit Score” was updated on February 25th, 2026.

Ready to Secure a Portfolio Loan for Your Investment Property? Let Us Help!

Reach out now to discuss how a portfolio loan can help you meet your financial goals.

Hello I been trying to do non QM cash out refinance but no company will give me a chance I had good credit at one point but lost my job and had to file chapter 7 bankruptcy but I been out over two years now discharged

I haven’t made payments in a couple years beaver of lien on house I really need to do no QM big bank won’t touch me

Please email us your contact information at gcho@gustancho.com.