Steps to Getting a Mortgage Loan Approved in West Virginia

Like any other state, acquiring a mortgage loan in West Virginia has its steps and factors to remember. Knowing these steps can assist future homebuyers in completing the loan process easily.

- Conv

- FHA

- VA

- Jum/Non

- USDA

Types of Mortgages

Conventional Loans:

- Require a good credit score, approximately $500, and a 3% to 20% down payment.

FHA Loans:

- Accessible for people with a lower credit score as The Federal Housing Administration backs them.

- They also require a minimum 3.5% down payment.

VA Loans:

- These are given to veterans and currently serving military members.

- Require no down payment and provide favorable terms.

USDA Loans:

- Aimed towards lower to medium-income families.

- It is designed for home buyers for families living in rural areas and requires no down payment.

Looking to Buy a Home in West Virginia?

Apply Online And Get Pre-Approved for a Mortgage Today

Preparing for Mortgage Application

Credit Score:

- Try to check and improve your score, as lenders prefer a score over 620 for conventional loans.

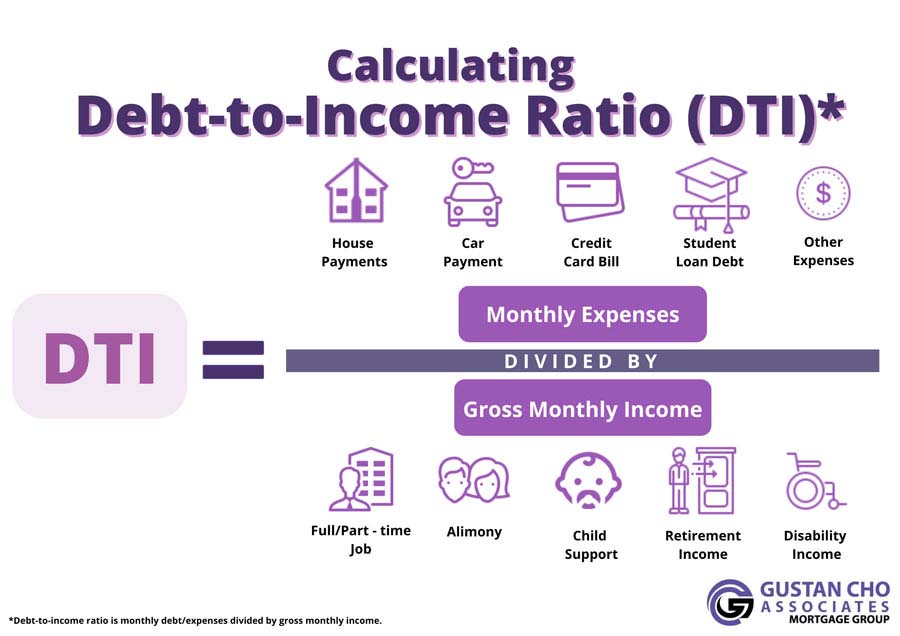

Debt to Income Ratio Using the West Virginia Mortgage Calculator:

- Find out your ideal DTI ratio, which should be lower than 43%. Your monthly debt payments divided by your total monthly income is what DTI is.

Documentation:

- Collect necessary financial documents such as proof of income (W-2s, pay stubs), tax returns, bank statements, and other pertinent financial documentation.

Guidelines Before Signing the Contract

Pre-Approval Application:

To obtain pre-approval from a particular financial institution, you must fill out a form indicating the maximum amount a lender can offer you.

Credit Check: A lender will verify your credit history through a report to determine if you qualify for a loan.

Loan Estimate:

- Once pre-approved, you will receive a Loan Estimate outlining the loan’s costs, fees, and terms.

Choosing a Lender

Research Lenders:

- Filter lenders based on the interest rate, commission, and feedback from previous clients to ensure they meet your preferred criteria.

Ask Questions:

- Find out how long the lender has been dealing with West Virginia mortgages, what the local market is like, and if they offer specific programs.

Finalizing the Mortgage

Home Appraisal:

- Once your offer on the house is accepted, an appraisal will be needed to determine its value.

Underwriting:

- The lender analyzes your request and the home provided to approve the loan.

Closing:

- The approved loan includes a meeting where you must endorse documents, pay the associated fees, and take ownership of the mortgage.

Introducing the West Virginia Mortgage Calculator

Gustan Cho Associates has designed an innovative mortgage calculator that enables West Virginians to plan their purchases more easily.

Important Elements of the West Virginia Mortgage Calculator

Calculation of Total Mortgage Payments

Breakdown of PITIA:

This particular calculator allows users to estimate their total payment on a mortgage, which, amongst other factors, includes:

For Principal and Interest:

- The amount set aside for the loan payment.

Property Taxes:

- The approximate value of yearly taxes prorated monthly.

Homeowners Insurance:

- Monthly payment to secure the house against losses.

Homeowners Association Dues:

- Additional payment if the house is part of an association.

Feature of Debt to Income Ratio

Integration of DTI:

- The device has an incorporated feature that works with your debt-to-income ratio, keeping you at a comfortable value while qualifying for a mortgage.

Assist in Budgeting:

- By properly entering existing debts and income, users can analyze how much debt they can take while remaining financially reasonable.

Your West Virginia Homeownership Journey Starts Here

Apply Online And Get recommendations From Loan Experts

Interface That Is Friendly To Users

Convenient to Use:

- Users can input relevant financial information, such as how much they need to borrow, the interest charge, and the loan duration, and instantaneously receive calculations.

Instructional Aids:

- The device is accompanied by aids that help explain each part of the mortgage payment and budgeting, which makes it easier for the user.

Significance Of Budgeting

Notice on Increased Costs:

- With the home cost surge in West Virginia, knowing the total mortgage amount is very important in planning your budget.

- The mortgage calculator allows users to plan out their long-term financial objectives regarding their mortgage.

The West Virginia Mortgage Calculator works perfectly with the financial planning calculator. Its ability to help gauge total mortgage payments alongside the user’s income further aids in proper mortgage planning throughout these economically unstable times. Proper knowledge of the mortgage process and this calculator can help many West Virginians purchase their desired homes without spending beyond their budget.

Homebuyers can now compute their monthly mortgage payment as well as the front-end and back-end debt-to-income ratio using the West Virginia Mortgage Calculator powered by Gustan Cho Associates. Have you tried dozens of online mortgage calculators and found they were not accurate? Do you have to go through multiple tasks to get the true, most accurate monthly mortgage payment? Do you need to contact your loan officer every time you look at a house with higher property taxes to see if you still meet the debt-to-income ratio for the loan program you are applying for? The problem is SOLVED!!! The team at Gustan Cho Associates has developed the ultimate online mortgage calculator for West Virginia homebuyers. Use our DTI West Virginia Mortgage Calculator for the most accurate monthly housing payment. Unlike most online mortgage calculators, West Virginia gives you the most accurate monthly payment for your mortgage.

Are Online Mortgage Calculators Accurate?

Other online mortgage calculators will only give you the principal and interest components of the monthly mortgage payments. There are four to eight components that are on a mortgage payment for complete accuracy. What good is just having two out of the many components to have the true cost of your monthly mortgage payment? The West Virginia mortgage calculator will give the user the PITI, PMI, and/or MIP, HOA, and DTI. Users of the VA loan calculator will have their VA funding fee populated as part of the calculation. The debt-to-income ratio mortgage calculator feature was added for users to compute their front-end and back-end debt-to-income ratio so they know if they meet the parameters of the loan program they are applying for. Choices of the loan program are on top of the calculator and are as follows: Conventional, FHA, VA, Jumbo, and Non-QM mortgages.

West Virginia Mortgage Calculator With The Bonus DTI Feature

Every mortgage loan program has its own front-end and back-end debt-to-income ratio guidelines. With the West Virginia mortgage calculator, you no longer have to worry about whether your mortgage payment is correct. The mortgage calculator will compute all the components that consist of your home loan. In a matter of seconds, you will not only get the most accurate monthly mortgage payment, but you will also get your front-end and back-end debt-to-income ratio. Start by choosing the loan program (Conventional, FHA, VA, Jumbo, or Non-QM), followed by entering all the numbers on the boxes that ask for information. Enter All Data Required For Housing payment and debt-to-income ratio. In a matter of seconds, users will get their front-end and back-end debt-to-income ratios.

Homebuyers In West Virginia Can Calculate Monthly Mortgage Payment with PITI, PMI, HOA, and DTI

Homebuyers in West Virginia have the DTI West Virginia Mortgage Calculator, powered by Gustan Cho Associates, right at their fingertips to calculate how much a monthly mortgage payment will be with PMI, property tax, insurance, homeowners insurance, and the HOA by using the West Virginia Mortgage Calculator. Launched by Gustan Cho Associates, the West Virginia Mortgage Calculator is the best West Virginia Mortgage Calculator for users who want a user-friendly mortgage calculator with accurate data and easy-to-understand inputs. So many of our borrowers have been turned down by other lending institutions due to bankruptcy, high debt-to-income ratios, late payments in the past 12 months, and other credit challenges. Our borrowers are pleasantly surprised to find out when they work with Gustan Cho Associates that we more often than not can get their home loans approved through one of our 280-plus lenders in our wholesale lender portfolio.