Homebuyers can use the all-new Tennessee Mortgage Calculator to compute their estimated mortgage payment with PITI, PMI, MIP, HOA, and the best part of it all, their front-end and back-end debt-to-income ratios. Gustan Cho Associates has developed a unique, user-friendly Tennessee Mortgage Calculator, unlike any other online mortgage loan house calculator. Homebuyers will no longer have to contact their loan officers every time they need to figure out if they go over their debt-to-income ratio when shopping for homes with higher property taxes.

- Conv

- FHA

- VA

- Jum/Non

- USDA

Are Online Mortgage Calculators Accurate?

Most online mortgage approval calculators only compute the principal and interest portion of the monthly mortgage payment. They do not compute the rest of the components required to get an accurate monthly mortgage payment. The Tennessee Mortgage Calculator calculates every component needed to get the most accurate monthly mortgage payment for any homebuyer to rest assured they will not get any surprise when it comes to how much they need to pay for their mortgage payment.

Low Down Payment? First-Time Buyer? Find the Best Mortgage Options in Tennessee

Apply Online And Get recommendations From Loan Experts

Tennessee Mortgage Calculator With Debt-to-Income Ratio

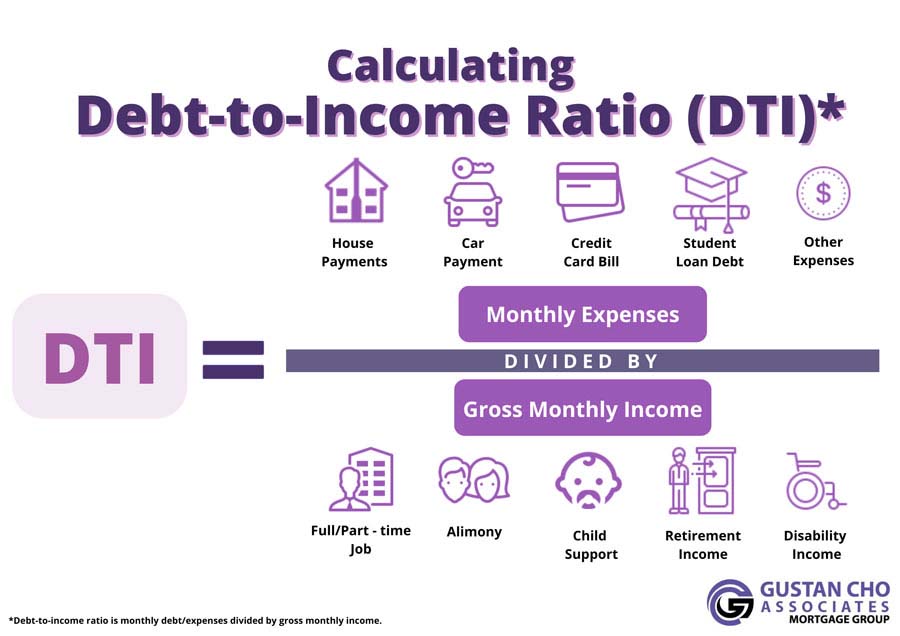

The Tennessee Mortgage Calculator also has the debt-to-income ratio mortgage calculator as part of the main calculator. After getting the housing mortgage payment, in two more easy steps, users can calculate their front-end and back-end debt-to-income ratio. All mortgage loan programs have their own debt-to-income ratio requirements. Below are the bullet points on debt-to-income ratio caps on conventional loans, FHA loans, VA home loans, USDA loans, jumbo mortgages, and non-QM loans:

- On conventional loans, the maximum debt-to-income ratio is 45 to 50% DTI.

- There is no maximum front-end debt-to-income ratio on conventional loans.

- FHA loans have a maximum of 46.9% front-end and 56.9% back-end debt-to-income ratio for borrowers with at least 580 credit scores.

- Debt-to-income ratio requirements on FHA loans for borrowers with under 580 credit scores are 31% front-end and 43% back-end DTI.

- FHA manual underwriting debt-to-income ratio caps are 31% front-end and 43% back-end with no compensating factor

- 37% front-end and 47% back-end DTI with one compensating factor

- 40% front-end and 50% back-end debt-to-income ratio with two compensating factors.

- USDA DTI requirements are 29% front-end and 41% back-end.

- The Veterans Administration has no maximum debt-to-income ratio with an approved/eligible per AUS.

VA Loan Debt-To-Income Ratio Manual Underwriting Guidelines

VA manual underwriting debt-to-income ratio caps are 31% front-end and 43% back-end with no compensating factor

- 37% front-end and 47% back-end DTI with one compensating factor

- 40% front-end and 50% back-end debt-to-income ratio with two compensating factors.

- The debt-to-income ratio caps on jumbo mortgages and non-QM loans are up to the individual mortgage lender.

- Most lenders will cap the debt-to-income ratio at 40% to 50% DTI on jumbo loans.

- Most non-QM lenders will cap DTI at a 50% debt-to-income ratio on non-QM loans.

Users of the Tennessee Mortgage Calculator can now compute their own debt-to-income ratio when they shop for homes. Home shoppers no longer have to keep on contacting their loan officer every time they see a home they like and see if they meet the DTI guidelines of the loan program they are applying for.

What Is The Formula for Calculating Monthly Mortgage Payment?

One of the most frequently asked questions we often get at Gustan Cho Associates is, what is the formula for calculating monthly mortgage payments? Using the Tennessee Mortgage Calculator, it is just a matter of entering the numbers into the required fields. First, select the loan program: Conventional, FHA, VA, Jumbo, or Non-QM. Then enter the purchase price followed by the down payment. Enter the interest rate.

Check off the term of the loan amortization schedule (most borrowers will choose the 30-year fixed-rate mortgage). You will then get the principal and interest portion of your monthly payment. Continue and enter the property tax and homeowners insurance information.

If your property has homeowners association dues (HOA dues), enter that number in the HOA box. The PMI and MIP will automatically populate unless you want to manually enter it. You will not get the estimated monthly mortgage payment. This number will consist of PITI, PMI, MIP, and HOA. Next, we will show you how your front-end and back-end debt-to-income ratios are calculated.

FHA, VA, or Conventional? Find the Best Mortgage Loan for You in Tennessee

Apply Online And Get Pre-Qualified for a Mortgage

Tennessee Mortgage Calculator: Debt-to-Income Ratio

If you have child support and/or alimony, those need to be included. Payment plans to the IRS and/or judgment creditors need to be included. Minimum student loan debts need to be included.

Once you have the total of all minimum monthly debt payments, enter that number in the box. The final step is to enter your monthly gross pre-tax income in the box that says Gross Income per Month or Gross Income per Year. Once that number is entered, you will get your front-end and back-end debt-to-income ratio. Figuring out how much house you can buy in Tennessee requires looking at your financial situation, including your income, current debt obligations, and homeownership costs. In addition to payment of principal, interest, taxes, and insurance (PITI), costs include private mortgage insurance (PMI), mortgage insurance premiums (MIP), homeowners association (HOA) fees, and the debt-to-income (DTI) ratio.

Advanced Online Mortgage Calculators

In case additional spending scenarios are needed, these potential homebuyers are assisted by advanced mortgage calculators that can incorporate those extra costs related to transactions:

The Tennessee Mortgage Calculator

The tool allows you to calculate your estimated mortgage payment. It includes PITI, PMI, MIP, and HOA fees and incorporates both front-end and back-end DTI ratios. The calculator has all the parameters, so you will not lose anything in analyzing the affordability issue.

What Makes the Tennessee Mortgage Calculator Unique

The Tennessee mortgage calculator considers your monthly expenditures for the return on your mortgage. Common expenditures like PIM, homeowners insurance, taxes, interest, etc., are also considered. The figure is broken down, which helps understand the financial estimating commitment.

Using Debt-to-Income Ratios

DTI ratio is one of the lenders’ most basic measures to estimate how much you can borrow. Which relates how much debt you have serviced every month to how much you earn monthly. Having an appropriate DTI ratio is important, as it can affect loan approval and make it difficult to manage monthly payments. With the help of the Debt to Income Ratios Tennessee Mortgage Calculator, it is possible to measure your DTI with other factors like PITI, PMI, and HOA fees.

Other Factors to Think About

Tennessee is a magnet for new residents because of its strong economy and lack of a state income tax, in addition to affordable housing, high-quality school systems, ample job opportunities, stunning scenery, charming weather, great people, and low living expenses. When buying a house, it is crucial to consider all possible costs so that you do not overspend and remain financially stable in the long run.

These in-depth calculators and knowledge of various expenditures associated with owning a house will help you make informed choices about the Tennessee housing market.

Your Tennessee Homeownership Journey Starts Here

Talk to a Loan Expert & Find the Best Mortgage for You

Frequently Asked Questions About Tennessee Mortgage Calculator:

Q: What is the Tennessee Mortgage Calculator?

A: The Tennessee Mortgage Calculator is a user-friendly tool for estimating your monthly mortgage payment, factoring in property taxes, homeowners insurance, PMI, and HOA fees.

Q: How does the Tennessee Mortgage Calculator Help with the Debt-to-Income Ratio?

A: It calculates both your front-end and back-end debt-to-income (DTI) ratios so you can see if you qualify for a mortgage before applying.

Q: Does the Tennessee Mortgage Calculator Include Property Taxes and Insurance?

A: Yes! Unlike most online calculators, it factors property taxes, homeowners insurance, and even HOA fees to give you the most accurate payment estimate.

Q: Can I Use the Tennessee Mortgage Calculator to Check if I Qualify for a Mortgage?

A: Yes! The calculator helps you see if your DTI ratio meets loan requirements by entering your income and monthly debts.

Q: Does the Tennessee Mortgage Calculator Work for FHA, VA, and Conventional Loans?

A: Yes! It works for all loan types, including FHA, VA, conventional, jumbo, and non-QM loans.

Q: Is the Tennessee Mortgage Calculator Free to Use?

A: Yes! It’s free and available online for anyone looking to estimate their mortgage payments.

Q: Can I Use the Tennessee Mortgage Calculator to Compare Different Home Prices?

A: Absolutely! You can change the home price, down payment, and interest rate to see how they impact your monthly payment.

Q: Does the Tennessee Mortgage Calculator Show PMI and MIP Costs?

A: Yes! The calculator will automatically include private mortgage insurance (PMI) or mortgage insurance premiums (MIP) if your loan requires them.

Q: How Accurate is the Tennessee Mortgage Calculator?

A: It’s one of the most accurate mortgage calculators available. It includes all the key costs lenders use to determine your monthly payment.

Q: Can I Use the Tennessee Mortgage Calculator if I’m a First-Time Homebuyer?

A: Yes! Knowing your budget is important whether you’re buying a home for the first time or have done it before. This understanding helps you see what you can afford when looking for houses.