- Conv

- FHA

- VA

- Jum/Non

- USDA

Puerto Rico Mortgage Calculator With PITI, PMI, MIP, HOA, and DTI

Gustan Cho Associates Puerto Rico mortgage calculator gives you the PITI, PMI, MIP, HOA, and to top it off, the front-end and back-end debt-to-income ratio. The team at Gustan Cho Associates developed the Best Mortgage Calculator due to the fact there was no online calculator that was accurate and gave borrowers all components of the monthly housing payment. Gustan Cho Associates mortgage calculator has five different types of selections:

Gustan Cho Associates Puerto Rico mortgage calculator gives you the PITI, PMI, MIP, HOA, and to top it off, the front-end and back-end debt-to-income ratio. The team at Gustan Cho Associates developed the Best Mortgage Calculator due to the fact there was no online calculator that was accurate and gave borrowers all components of the monthly housing payment. Gustan Cho Associates mortgage calculator has five different types of selections:

- Conventional Loans

- FHA Loans

- VA Loans

- Jumbo Loans

- Non-QM Loans

Why Is Gustan Cho Associates Puerto Rico Mortgage Calculator Different Than Others?

Buying a Home in Puerto Rico?

Get Pre-Approved for a Mortgage TodayOnline Puerto Rico Mortgage Calculator With PITI, PMI, MIP, HOA, and DTI

The Puerto Rico Mortgage Calculator powered by Gustan Cho Associates has the most accurate estimated monthly housing mortgage payment information for its users. This is because it has all the components of what every monthly mortgage payment consists from mortgage servicers which is PITI, PMI, MIP, and HOA. As a convenience for our users, Gustan Cho Associates has added the debt-to-income ratio component of the Puerto Rico Mortgage Calculator.Importance of Having All Components That Make Up The Monthly Housing Mortgage Payment

The significance of encompassing all elements constituting the monthly housing mortgage payment is paramount for several reasons:- Accurate Budgeting: Including all components such as principal, interest, taxes, and insurance (PITI) ensures that borrowers gain a clear understanding of their monthly financial responsibilities. This accuracy aids in effective budgeting and financial planning.

- Comprehensive Financial Assessment: Each mortgage payment component contributes to homeownership’s overall affordability. By considering all aspects, including potential private mortgage insurance (PMI) and homeowners association (HOA) fees, borrowers can conduct a thorough financial assessment to determine if they can comfortably afford the property.

- Avoidance of Surprises: Omitting certain elements from the monthly mortgage payment estimation may lead to unexpected financial burdens for homeowners. For example, paying attention to include property taxes or insurance premiums could result in sufficient funds to cover these expenses when due, leading to financial strain or potential default.

- Qualification for Financing: Lenders typically assess borrowers’ ability to repay a mortgage based on their total housing expenses, including PITI, PMI, and HOA fees. Providing a comprehensive picture of these costs increases borrowers’ chances of qualifying for financing and obtaining favorable loan terms.

- Decision-Making Support: Understanding the complete breakdown of the monthly housing mortgage payment empowers borrowers to make informed decisions regarding their housing options. It allows them to compare different properties, loan options, and budget scenarios to select the most suitable and sustainable choice for their financial circumstances.

- Mitigation of Risks: By considering all components of the mortgage payment, borrowers can better prepare for unforeseen circumstances and mitigate associated risks. For instance, having adequate insurance coverage protects against property damage or loss, while understanding PMI requirements helps borrowers assess the impact of a lower down payment on their long-term financial health.

PMI, MIP, and VA Funding Fee

The private mortgage insurance factor is a rough estimate based on a median of 680 FICO score borrowers with a 5% down payment. It may be wise to contact your loan officer or you can contact us for a more accurate quote on your conventional loan PMI. Everything else on other loan programs should be spot on.The 1.75% FHA upfront mortgage insurance premium is added to the loan balance and is part of the total mortgage payment calculations.The annual FHA 0.85% mortgage insurance premium is populated on Gustan Cho Associates Puerto Rico Mortgage Calculator to give you that exact accurate monthly payment you are looking for. The VA funding fee has been factored on the VA Puerto Rico Mortgage Calculator.

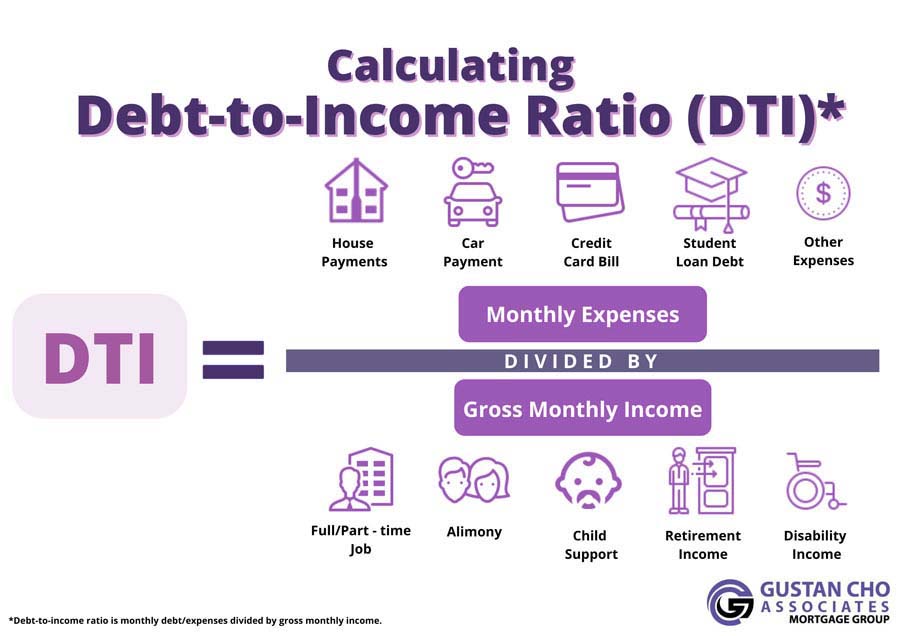

Front and Back-End Debt-To-Income Ratio

The monthly mortgage payment will populate the DTI side of the mortgage loan calculator. Enter all of the minimum monthly debt payments in the box that says Minimum Monthly Debt Payments. Then enter the monthly or yearly income. You now have calculated the front-end and back-end debt-to-income ratio.How To Use The Puerto Rico Mortgage Calculator

Select the loan program. Start by entering the purchase price of the subject property. You then enter the down payment. Enter the mortgage interest rate quoted to you or contact us at rates@gustancho.com for a quote. Enter the term of the loan. This will give you the principal and interest portion of your mortgage payment which most online calculators only give you. However, with Gustan Cho Associates Puerto Rico Mortgage Calculator, you will get all components of the monthly mortgage payment. Continue by entering the property tax and homeowners’ information along with the HOA dues. You now have the complete monthly mortgage payment.Puerto Rico Mortgage Calculator: Your Definitive Online Tool For Financing Homes

Introduction- Getting the right mortgage in Puerto Rico is as easy as using our modern online mortgage calculator.

- Tailored to Puerto Rico’s borrowers, this tool offers a detailed estimation of all necessary costs such as PITI (principal, interest, taxes, and insurance).

- Supplementary PMI (private mortgage insurance).

- HOA fees.

- Even your total DTI (debt-to-income ratio).

- No more spending hours on the phone with your loan officer.

Why Use the Puerto Rico Mortgage Calculator?

Comprehensive Cost Breakdown:

Along with basic figures, our calculator offers comprehensive cost breakdown:- PITI: All parts of your mortgage payment are broken down and clearly explained.

- PMI: Determine if you require private mortgage insurance and if so, how much based on your down payment and credit score.

- HOA Fees: If you are buying a unit in a HOA association community, the calculator calculates the monthly or yearly fees.

- DTI Ratio: Know the amount of money you can spend without going over your budget by understanding your debt-to-income ratio.

Local Market Precision:

- The Puerto Rico mortgage calculator integrates local tax brackets, property insurance, and P.R. relevant specifics.

- This allows you to obtain realistic estimates of homeownership costs on the island.

User Friendly and Accessible:

- You can access the P.R. mortgage calculator from any device thanks to our modern interface and responsive design.

- The only information you need to provide to obtain an instant detailed report of your monthly mortgage breakdown is your home price, down payment, interest rate, and other relevant details.

Time and Cost Savings:

- Get multiple mortgage scenarios within seconds!

- No spreadsheets, consultations, or appointments are needed.

- The Puerto Rico mortgage calculator allows you to manage your finances strategically and ensures you’re able to get the mortgage that best suits your needs.

Looking for the Best Mortgage Rates in Puerto Rico?

Apply Online And Get recommendations From Loan ExpertsHow It Works

Enter Your Home Details.

- Begin with the home’s price, down payment (in dollars or percentage), and choose one of the available loan terms (15, 20, or 30 years).

Input Your Financial Information.

- Provide current interest rate, assumed local property tax, insurance fees, and HOA costs if applicable.

Calculate Your DTI.

- This is where you enter your existing monthly debt payments and income in order to get your debt to income ratio that determines how much mortgage a bank will qualify you for.

- Complete your monthly mortgage payment estimation by clicking the “Calculate” button, and observe how each element affects your total cost through interactive graphs and charts.

Advantages for Puerto Rico’s Current and Future Homeowners:

Budgeting Made Easy:

- Understand all monthly expenses related to owning a house, saving you from unwanted surprises at closing and after.

Better Choices:

- Easily verify different situations with varying interest rates, down payments, and loan durations to determine which mortgage plan works best for you.

Tech-savvy Empowerment:

- You are now able to make financial decisions without having to depend on long exchanges with your loan officer.

- Our calculator gives you the core information you need regarding the finances at a single click.

- Stand and act with certainty.

Designed for Puerto Rico:

- The information is reliable because our calculations are based on actual local data, ensuring Puerto Ricans can accurately estimate the costs for purchasing or refinancing a property.

Mortgage Calculators and Puerto Rico Housing Eligibility

- Mortgage financing is very difficult in Puerto Rico because mortgage companies have an unreasonable credit and income underwriting criteria.

- The Mortgage Corporation Foreclosure Consultants Puerto Rico office has the Puerto Rico Mortgage Calculator which has advanced features for calculating the real costs of home ownership in Puerto Rico.

- The calculator allows the user to estimate PITI payments, PMI, HOA, and most importantly, DTI, helping borrowers make better decisions and avoid financial mistakes.

- Try our wonderful calculator to see how easy and accurate it is and get closer to achieving your dream house in the beautiful island of Puerto Rico.

Frequently Asked Questions (FAQs)

What does PITI stand for in a mortgage calculator?

PITI represents Principal, Interest, Taxes, and Insurance in a mortgage context. It represents the monthly payment, including the loan principal, interest, property taxes, and homeowner’s insurance.

What is PMI, and why is it included in the mortgage calculator?

PMI stands for Private Mortgage Insurance. PMI is generally mandatory for homebuyers putting down below 20% of the home’s purchase price. It serves to safeguard the lender in the event of borrower default on the loan. Including PMI in the mortgage calculator helps borrowers accurately estimate their monthly payments.

Why is HOA included in the mortgage calculator, and what does it cover?

HOA stands for Homeowners Association. It is an organization in a planned community, condominium, or cooperative that creates and enforces rules for the properties within its jurisdiction. HOA fees cover maintenance, amenities, and communal services. Including HOA fees in the mortgage calculator helps buyers assess the total cost of homeownership.

How does the Puerto Rico Mortgage Calculator work?

The Puerto Rico Mortgage Calculator enables homebuyers to approximate their monthly mortgage payments using the loan amount, interest rate, loan term, property taxes, homeowner’s insurance, PMI, and HOA fees. By entering these details into the calculator, users can obtain an approximation of their PITI payment, including PMI and HOA fees.

What factors influence the mortgage payment in Puerto Rico?

Several factors influence the mortgage payment in Puerto Rico, including the loan amount, interest rate, loan term, property taxes, homeowner’s insurance, PMI, and HOA fees. Each component contributes to the monthly payment, which the mortgage calculator helps borrowers estimate.

Are property taxes different in Puerto Rico compared to other locations?

Yes, property taxes in Puerto Rico may differ from those in other locations. The property tax rate in Puerto Rico is typically lower than in many mainland U.S. states. However, homebuyers need to research and understand the specific property tax rates in the areas they are considering.

How can I use the information from the mortgage calculator to budget for homeownership in Puerto Rico?

Homebuyers can use the mortgage calculator to understand their estimated monthly payment, including PITI, PMI, and HOA fees. This information helps them budget effectively for homeownership in Puerto Rico and determine what they can afford based on their financial situation.

Can I customize the inputs in the Puerto Rico Mortgage Calculator?

The Puerto Rico Mortgage Calculator allows users to customize various inputs such as the loan amount, interest rate, loan term, property taxes, homeowner’s insurance, PMI, and HOA fees. By adjusting these parameters, users can see how different scenarios impact their monthly mortgage payments.

Are there any additional costs associated with homeownership in Puerto Rico?

In addition to mortgage payments, homeowners in Puerto Rico may incur additional costs such as maintenance, utilities, and any assessments or fees imposed by the Homeowners Association. It’s essential to consider these expenses when budgeting for homeownership.

How can I access the Puerto Rico Mortgage Calculator?

The Puerto Rico Mortgage Calculator is typically available online through mortgage-related websites, financial institutions, or real estate platforms. Users can input their details and receive an estimate of their monthly mortgage payment, including PITI, PMI, and HOA fees, tailored to the Puerto Rican market.