Mortgage borrowers can now get the most accurate, user-friendly online Ohio Mortgage Calculator powered by Gustan Cho Associates with PITI, PMI, MIP, and HOA. The Ohio Mortgage Calculator is different than any other online mortgage approval calculator. Most online mortgage calculators only give the principal and interest payment components of the monthly mortgage payment. However, the Ohio mortgage calculator powered by Gustan Cho Associates gives you the PITI, PMI, and HOA.

- Conv

- FHA

- VA

- Jum/Non

- USDA

Are online mortgage calculators accurate?

According to the senior developer of the best Ohio mortgage calculator, he led the design team of Gustan Cho Associates Ohio Mortgage Calculator with the DTI feature due to the following reason: The total, complete estimated monthly mortgage payment is one of the most important factors for homebuyers shopping for a home. John Strange, a senior loan officer at GCA Mortgage Group, says the following about the Ohio Mortgage Calculator:

Relying on inaccurate online mortgage calculators can be and is misleading and not right. Many online mortgage calculators will not even factor in the type of mortgage loan program. The Ohio Mortgage Calculator is hands down different than the competition.

For example, conventional loans with under 20% down payment and/or 80% loan-to-value require private mortgage insurance. PMI is not even factored in for most online mortgage calculators. FHA has a one-time 1.75% upfront and 0.55% annual mortgage insurance premium on all 30-year fixed-rate mortgages that most home loan calculators on the internet have total disregard for. VA loans has an upfront VA funding fee that needs to get added to the balance of the loan and be part of the monthly mortgage payment. With the best-mortgage calculator powered by Gustan Cho Associates, you do not have to worry about getting a partial housing monthly payment. You will get the full PITI, PMI, MIP, and HOA.

Features of Gustan Cho Associates Ohio Mortgage Calculator

Gustan Cho Associates home loan calculator hands down gives you the most accurate monthly mortgage payment than any other online house loan calculator. The Gustan Cho Associates calculator not only gives you all the components of the monthly mortgage payment, but it will also give you the front-end and back-end debt-to-income ratio. Most online mortgage calculators are not accurate due to the fact they only give you the principal and interest and not the taxes, insurance, PMI, MIP, and HOA. The Ohio Mortgage Calculator is the only online calculator that gives you a choice of five different loan programs with an estimated monthly mortgage payment that consists of PITI, PMI, MIP, and HOA.

Components of the Monthly Mortgage Payment

There are four to eight components to a monthly mortgage payment. Here are the components that make up the estimated monthly mortgage payment:

- Principal: The portion of the mortgage payment that goes to pay down the mortgage loan balance

- Interest: The component of the monthly mortgage payment that is an expense and cost of borrowing the home loan

- Taxes: The estimated annual property taxes, which are divided by 12 months and included as part of the mortgage payment

- Insurance: Hazard homeowners insurance is required by the lender to protect the mortgage lender’s interests in the event of fire or destruction to the home

- PMI: Private mortgage insurance on conventional loans is required by borrowers with less than 20% equity paid for by the homeowner for the benefit of the lender in the event the borrower defaults

- Mortgage Insurance Premium

Are online mortgage calculators accurate?

Why are online mortgage calculators not accurate? Very easy. Most online mortgage calculators only compute principal and interest. That is IT. What good are principal and interest if you are not getting all the components of your mortgage payments? Gustan Cho Associates Ohio Mortgage Calculator gives it all. All the components of your mortgage payment are computed with absolute accuracy. The Ohio Mortgage Calculator will also calculate your front-end and back-end debt-to-income ratio. No other online calculator will calculate your DTI. The debt-to-income ratio calculator powered by Gustan Cho Associates is a major hit not just among borrowers but loan officers and our preferred referred realtor partners at Gustan Cho Associates.

How To Compute Your Estimated Monthly Mortgage Payment With Gustan Cho Associates Ohio Mortgage Calculator

Select the mortgage loan program from the following choices: conventional, FHA, VA, jumbo, and/or non-QM. Next, enter the home purchase price. Then enter the down payment and mortgage interest rate. Enter the loan term/amortization schedule. You will now get the principal and interest portion of your monthly mortgage payment. Continue by entering your property tax and homeowners insurance information. Finally, enter the homeowners association dues if it applies to you. You will not get your estimated monthly mortgage payment. Below the monthly payment, you will see the breakdown of your mortgage payment by seeing the PITI, PMI, MIP, and HOA.

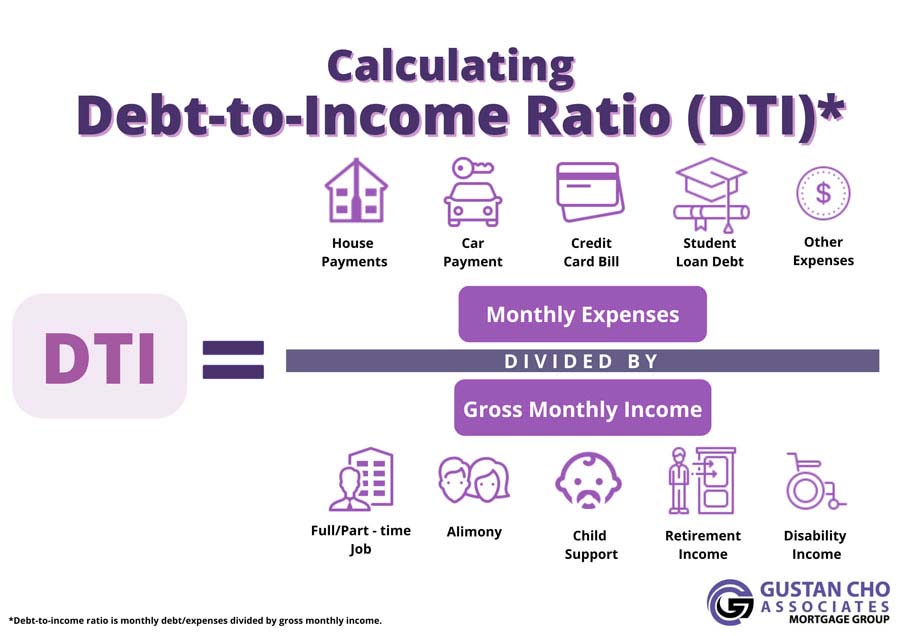

Debt-To-Income Ratio With The Ohio Mortgage Calculator

Total the sum of all monthly minimum payments from all bills and enter it in the box that states Minimum Monthly Debt Payments. Examples of monthly bills included for debt-to-income calculations are auto payments, student loans, credit card minimum payments, and any other debts that report to the credit bureaus. Utility bills, cellular and landline, internet, cable, personal insurance, school/college, and other bills that could potentially report to the credit bureaus. Then enter your monthly gross income in the box that says monthly or yearly income. You now have your front-end and back-end debt-to-income ratio.

First-Time Homebuyer in Ohio? Find the Best Loan Options for You

Apply Now And Get recommendations From Loan Experts

Ohio Mortgage Calculator Powered by Gustan Cho Associates: Simplifying Every Step of Your Home Loan Journey

Apply for pre-approval today using the Ohio Mortgage Calculator from Gustan Cho Associates. Find out how the Ohio Mortgage Calculator from Gustan Cho Associates assists homebuyers in calculating their mortgage payments, considering business debt-to-income ratios, and obtaining mortgage approval in the state of Ohio.

Understanding How You Get Approved for A Mortgage in Ohio

Acquiring a house in Ohio is a great step forward in life, but you need to plan ahead because prices are increasing. Here at Gustan Cho Associates, we aim to make the experience of obtaining a home loan as simple and straightforward as possible, which is why we created the Ohio Mortgage Calculator, one of the most advanced tools available for homebuyers seeking to know the total cost of their mortgage payments and if they qualify for a loan or not.

By the end of this article, you will:

- Understand all the steps involved in getting approved for a mortgage in Ohio.

- Know how to navigate the Ohio Mortgage Calculator.

- Understand the importance of debt-to-income (DTI) ratios in mortgage approval.

- Learn the components of your monthly mortgage payment.

- Determine what you need to do to get the lowest mortgage rates in Ohio.

- Realtors and homeowners will benefit from this guide regardless if you’re looking to buy your first home or refinance an existing loan.

What is the Ohio Mortgage Calculator?

- Gustan Cho Associates has an Ohio mortgage calculator that is unique from any other mortgage tool calculators. It integrates all major costs of homeownership, such as principal and interest (P&I), property taxes, homeowners insurance (HOI), private mortgage insurance (PMI), debt to income (DTI) ratio analysis, and even homeowners association (HOA) fees for the most accurate estimates.

- Contrary to other basic calculators that only feature monthly payments with the home price.

- Our Ohio Mortgage Calculator attempts to help homebuyers stay on budget while getting a mortgage with the utmost ease.

Why is the Ohio Mortgage Calculator Different?

- The aviation industry is always changing, and with that change come different ways to enhance the experience of obtaining a home loan.

- At Gustan Cho Associates, we make sure to provide the most advanced technology.

- Understanding the DTI ratio will allow homebuyers to know if they meet the requirements set by lenders to receive mortgage loans.

Key Benefits of the Ohio Mortgage Calculator

- Analyzed and provided payment estimates in real-time.

- Provided all costs associated with the mortgage, including payment, interest , taxes, insurance, and association dues (PITIA).

- Analyzed the debt-to-income (DTI) ratio.

- Sticks meticulously to the appropriate budget.

- Acceptable use on mobile and desktop.

How to use the Ohio Mortgage Calculator

Follow these easy and convenient steps to use the Ohio Mortgage Calculator and accurately estimate your monthly mortgage payments. Step-by-step instructions

- Input the home estimate: Type the price you are willing to pay for the house into the calculator.

- Revise Your Initial Payment: Decide on the amount you will pay up front (3.5% for FHA loans, 5% for conventional, or 0% for VA loans).

- Choose Your Loan Duration: Pick either a 15-year, 20-year, or 30-year fixed mortgage.

- Input Interest Rate: Enter the current market interest rate or estimate based off of your credit score.

- Add property tax and insurance expenses: These costs differ within Ohio and impact affordability.

- Add Homeowners Association (HOA) Fees If you are part of an HOA, please input your fees.

- Confirm Your Debt-to-Income (DTI) Ratio: Enter the outstanding debts that you expect to pay during the month (credit cards, car loans, student loans) to see if you meet the DTI ratio requirements.

Once all these details have been filled, the calculator will provide an estimated monthly mortgage payment along with a DTI ratio to give an insight into affordability and loan eligibility.

Secured a Mortgage in Ohio: A Five-Step Guide

First Steps: How a Mortgage is Processed and What Techniques Will Help in Getting Approved. These are the steps a borrower must take to get a home loan in Ohio, starting with analyzing their credit score.

Review Your Credit Score

- Conventional loans: Must have a minimum score of 620

- HOA loans: Minimum score of 580 (down payment at 500)

- Veterans and USDA loans: considered more forgiving for having a credit score.

Analyze Your Debt-to-Income (DTI) ratio

The suggested ratio by lenders is 45% or lower.

- FHA loans allow for cases up to a DTI ratio of 46.9% front end and 56.9% back end.

- Check your DTI using the Ohio Mortgage Calculator.

Start Saving for a Down Payment

- Conventional loans: 3%-5% down payment.

- FHA loans: 3.5%.

- USDA and VA loans: 0%.

Collect Necessary Proofs

- Last two years of tax returns

- Income pay stubs and W2s

- Bank statements to confirm funds for down payment

- Proof of employment

Pick the Appropriate Mortgage Loan Program

- Convetional Loan: Most fit for borrowers with good credit and stable income.

- FHA Loan: Most trusted for first-loan purchasers and low credit scorers.

- VA Loan: For veterans and active-stance military.

- USDA Loan: For individuals meeting criteria and residing in rural regions.

Begin With Getting Pre-Approved

A pre-approval letter in hand makes you a competitive buyer and strengthens your offer in Ohio’s housing market.

Why Budgeting Is Important for Ohio Homebuyers

- Home Prices Increasing in Ohio

- Home price in Ohio (2025): $265,000

- Increased by 12% since 2022

- Mortgage average of 6.5%

- Home prices increasing means you need to budget accordingly before getting a house.

Understanding PITIA

Everything You Need to Know About Your Mortgage Payment: With a mortgage, you do not only pay for principal and interest; with a mortgage payment, you also have to include:

- Your property taxes: This differs from county to county in Ohio.

- Homeowner’s insurance: needed for any mortgage loan.

- Private Mortgage Insurance (PMI) is obligatory for all downpayments below 20%.

- Homeowner’s Association Fees: These have to be included if they exist.

- Affordability and financial strain can be avoided by using the Ohio mortgage calculator.

Plan Your Home Purchase With Ohio Mortgage Calculator

If you are looking forward to buying a home and need to estimate mortgage payments and qualify for a home loan, there is no better tool than the Ohio Mortgage Calculator by Gustan Cho Associates. It allows you to calculate the sum of your total mortgage payment and DTI ratio, giving you the necessary assurance to confidently purchase a property.

- Reliable Payment Estimates

- Stay Under Budget

- Calculates Your Loan Qualifications

- Eases the Mortgage Process

Planning to buy a home in Ohio? Start using the Ohio Mortgage Calculator now and prepare to purchase your dream home!

Frequently Asked Questions (FAQs)

How precise is the Ohio Mortgage Calculator?

- Our calculator strives to provide estimates in real-time accurately; however, the final mortgage approval still relies on the lender’s guidance.

Can I get a mortgage if I have a high DTI ratio?

- FHA loans give the most freedom, with a 57% DTI cap, whereas conventional loans usually max at 43%.

What is included in my mortgage payment?

- Your payment contains the principal, interest, taxes, insurance, PMI, and if applicable, HOA fees.