In this blog post, we will discuss the concept and procedure of rapid rescore during mortgage process. Consumer credit profiles are reported to the three major credit reporting agencies. Each agency maintains a database of consumers’ data and payment histories and uses unique algorithms to calculate consumer credit scores.

What Are The Lows and Highs of Consumer Credit Scores

Credit scores typically span from a minimum of 300 to a maximum of 850 FICO. While credit bureaus usually require some time to reflect updated and accurate consumer credit information in their systems, there is a quicker alternative for those needing current credit profile updates.

Known as a rapid rescore, this process involves a loan officer facilitating an expedited update of a borrower’s credit profile through a credit service provider such as Credit Plus. Typically completed within three to five business days, a rapid rescore during the mortgage process necessitates that borrowers provide proof and documentation for the credit tradelines they wish to have updated quickly. Talk to our expert for your mortgage and get process

How Credit Bureaus Work

Three principal consumer credit bureaus are Experian, Equifax, and Transunion. Creditors typically report credit history to these agencies once a month. However, updating and reflecting these reports across all three bureaus can take 30 to 45 days. For borrowers in the process of applying for a mortgage who cannot afford to wait up to 45 days for their credit report to update, a mortgage loan originator can facilitate a Rapid Rescore During Mortgage Process. This service is conducted by a rapid rescue vendor. It ensures that necessary updates are reflected in the credit reports within a few days.

Rapid Rescore During Mortgage Process Prior To Pre-Approval

Let’s explore a case study to understand the role and significance of rapid rescore during mortgage process. Consider a borrower with a FICO credit score of 615 and a debt-to-income ratio of 58% seeking to qualify for a mortgage. To be approved for a conventional loan, you’ll typically need a FICO score of at least 620 and a debt-to-income ratio under 50%. This scenario illustrates the importance of rapid rescore in meeting lender requirements and securing mortgage approval.

Making Positive Changes To Credit Report To Qualify For A Mortgage

To improve their debt-to-income ratio and meet the required DTI threshold for a mortgage loan program, borrowers can reduce their credit card balances and other debts. Typically, the credit bureaus can take over 30 days to update and reflect these paid balances in their reports.

If there is an urgent need to expedite this process, a loan officer can initiate a rapid rescore. This method allows the loan officer to update consumer credit tradelines and report them to all three credit bureaus within three to five business days, significantly faster than the usual month-long wait.

This capability is a critical advantage in the Rapid Rescore During Mortgage Process, facilitating quicker loan approvals and potential enhancements in loan conditions.

How Does Rapid Rescore During Mortgage Process Work

During the mortgage process, the mortgage loan originator advises borrowers to reduce the balances on their three maxed-out credit cards to just 10% of their credit limits. This strategy is intended to help their scores exceed the 620 FICO mark. Additionally, by eliminating the minimum monthly payments on these credit cards, borrowers can achieve a debt-to-income ratio of 48%.

Motivated by this advice, borrowers quickly act to pay off the three credit card balances to expedite their mortgage approval and move closer to purchasing their dream home.

Typically, they would have to wait for the next credit reporting period by the three major credit bureaus—a process that could take longer than 45 days—before starting the mortgage application process. A Rapid Rescore during the mortgage process is employed to bypass this lengthy delay.

Utilizing a rapid rescore during mortgage process allows the consumer credit report to be updated in 3 to 5 business days, significantly reducing the waiting period for credit report updates and facilitating a quicker continuation of the mortgage application.

Can You Rush a Rapid Rescore?

Rapid Rescore During Mortgage Process is a service specifically designed to update credit information quickly, which is crucial during time-sensitive scenarios like loan approvals. This service is typically provided by lenders or brokers rather than directly to consumers. It is optimized to be as practical as possible.

Rapid Rescore During Mortgage Process is inherently swift, so it is only sometimes possible to expedite it beyond the standard 3 to 5 business days. However, you can facilitate a smoother and faster rescue process by promptly submitting all necessary documentation and ensuring all the information provided is complete and accurate. This approach can minimize delays caused by verifying information or rectifying discrepancies proactively. Get qualify for your mortgage, click here

Rapid Rescore During Mortgage Process To Expedite Credit Updates

In the scenario described, the issue is resolved through a rapid rescore during mortgage process. Borrowers must collect statements from the three credit card companies proving they have fully cleared their balances. The mortgage loan originator then submits these statements to a rapid rescore vendor, who reports this information to the three major credit reporting agencies.

The credit reports are updated within 3 to 5 business days to reflect the paid-off balances. As a result of the rapid rescore, credit scores typically improve. With these updated scores, borrowers can advance their mortgage loan applications, bringing them closer to securing their dream homes.

How Lenders Use Rapid Rescore

During the mortgage process, Rapid Rescore is a crucial service provided by mortgage lenders to update changes in borrowers’ credit profiles quickly. Normally, updates such as paying down credit card balances take 45 to 60 days to reflect on the reports from the three major credit reporting agencies.

During the mortgage process, Rapid Rescore is a crucial service provided by mortgage lenders to update changes in borrowers’ credit profiles quickly. Normally, updates such as paying down credit card balances take 45 to 60 days to reflect on the reports from the three major credit reporting agencies.

However, by utilizing a Rapid Rescore during mortgage process, a loan officer can have these changes reflected in just three to five days, sometimes even sooner. This expedited approach allows borrowers’ credit scores to be updated much more quickly than the normal billing cycle, ensuring all recent credit information is accounted for promptly.

Reason For Rapid Rescore During Mortgage Process

During the mortgage process, implementing a rapid rescore can be crucial for borrowers who do not meet the minimum credit score requirements.

To qualify for an FHA loan with a 3.5% down payment, borrowers need a minimum credit score 580. However, borrowers with a credit score of 500 to 579 may still be eligible for FHA loans.

Still, they are required by HUD Agency Guidelines to make a larger down payment of 10%. For example, consider a borrower with a credit score of 560 and only a 3.5% down payment available for home purchases. In such situations, utilizing a rapid rescore during the mortgage process is vital to update and potentially improve the borrower’s credit score, ensuring they meet the qualifications for their desired loan terms. Apply for mortgage with bad credit scores

Using The FICO Simulator For Potential Score Improvements

The loan officer does a FICO Simulator on the borrower and sees that paying down three credit cards to a 10% utilizing ratio will increase the borrower’s credit scores by 20 points. A 20-point increase is what the borrower needs. The loan officer instructs the borrower to pay down the three credit cards and get documentation and proof from the credit card company.

Who Does The Rapid Score During Mortgage Process

The loan officer and the mortgage processor can rapid rescore this transaction where the paydown of the credit card balance will be updated at all three credit bureaus. Once the credit bureaus update the borrower’s credit card balances, the loan officer can re-pull credit and the new credit score should be at 580 FICO. Now with the 580 credit score, the borrower can qualify for a 3.5% down payment home purchase FHA loan. This is one of the many reasons why rapid rescoring services are used by loan officers.

Reasons Loan Officers Use Rapid Rescore During Mortgage Process

This is why it is important for borrowers to prepare months ahead prior to qualifying and applying for a mortgage. Credit scores can fluctuate every month. Having low credit card balances is the best method of increasing credit scores. For maximum optimization, consumers should have a 10% or lower credit utilization ratio on all of their credit cards.

How Long Does It Take To Update Credit Profile on Credit Scores

Even if you were to pay down your credit card balance, it will take 45 days or more for the updated balance to be reflected on your credit reports. This is why it is important to prepare for a mortgage months before applying and starting the mortgage process. Rapid rescores are used for accelerating the updated information quicker on consumer credit reports. It is not any form of credit repair. All rapid rescores need supporting documentation and proof.

How Long Does a Rapid Rescore Take?

A rapid credit report update typically takes 3-5 business days, depending on complexity and bureau responsiveness. This process is used to quickly update and correct any inaccuracies in your credit report, which can be useful if you’re in a major financial transaction like securing a mortgage or car loan and need your credit score to reflect the most current information.

Low Credit Card Balances Will Increase Credit Scores

Paying down credit card balances can boost credit scores. Therefore, pay down your credit cards and the loan officer can do a rapid rescore. Within three to five days, the loan officer will re-pull credit and the borrower should have a 620 credit score. Other reasons loan officers do rapid rescores is to improve credit scores to get them the best rates on a refinance.

Again, the loan officer can rescore borrowers after they have paid down their credit cards. Another reason is when the borrower’s debt-to-income ratio is too high. Pay off certain debts like credit cards, installment loans, and/or car loans and the loan officer can do a rapid rescore. Rapid rescores are done to expedite removing and/or fixing errors on consumer credit reports.

What Documents are Needed for a Rapid Rescore?

For a rapid rescore, you must provide specific documentation that verifies any corrections or updates to your credit report. The exact documents required will depend on the nature of the information that needs to be updated. Here are some common types of documentation that might be needed:

- Proof of Payment: If there are discrepancies related to debt payments, such as credit cards or loans, you may need to provide proof of payment. This could include bank statements, payment receipts, or canceled checks.

- Account Statements: Recent account statements that reflect the current status and balances of your accounts are necessary for correcting or updating account balances.

- Letters from Creditors: If there are errors in creditor reporting, such as misreported late payments, you can ask the creditor to provide a letter stating the error and the correct information. This letter should be on the creditor’s letterhead and clearly state that the previous information was reported incorrectly.

- Release of Lien: In cases involving liens or judgments, a release or satisfaction of lien document may be required to show that the debt has been settled and should be removed or updated on your credit report.

- Identity Theft Documentation: If the rescore involves correcting issues from identity theft, you may need to provide a police report or a Federal Trade Commission (FTC) identity report.

- Legal Documents: Relevant legal documents might be required for changes in personal information or to correct misreported legal issues like bankruptcy status.

GatheringIt’s all necessary documentation that, as quickly as possible, facilitates the rapid rescore process. Your lender or financial advisor can assist in identifying exactly which documents are needed based on the specific corrections to be made to your credit report. Click here to get more about Rapid Rescore

Who Pays For Rapid Rescore During Mortgage Process

Only mortgage lenders are allowed to do rapid rescore. Rapid rescores can be quite an expense. It costs $35 per credit tradeline per credit bureau. So, let’s say for a case scenario example a borrower paid off the balance of an American Express credit card so now the balance is zero. To get this rapid rescore done, it is going to cost $105. $35 dollars per credit bureau. There are three credit bureaus. Therefore, it is $35 times three which yields $105. You can do the math where rapid rescores can easily add up. The lender pays for the rapid rescore.

Rapid Rescore During Mortgage Process: Importance of Maximizing Credit Scores Well Ahead of the Start of the Mortgage Process

Depending on the mortgage banker and/or mortgage broker, the rapid rescore can be charged as a closing cost, or in many cases, the loan officer will pick up the tab of the rapid rescore. Remember, there is no free lunch in the mortgage industry. In many instances where mortgage bankers say they will pick up the rapid rescoring costs does not mean it was free.

Rapid Rescore During Mortgage Process: Who Pays For Rapid Rescore Fees

Mortgage bankers will account for the overhead costs such as rapid rescore fees on the mortgage rates they charge. The higher the costs that mortgage bankers cover on the back end, the higher the rates borrowers pay. This is just the way the mortgage industry works.

If you have any questions concerning the contents of this article and/or other mortgage-related topics, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

Mortgage Lender with No Lender Overlays

Homebuyers who need to qualify for FHA, VA, USDA, and Conventional Loans with no lender overlays, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays. Click here to get a mortgage loan with lender with no overlay

Frequently Asked Questions About Rapid Rescore During Mortgage Process And How It Works

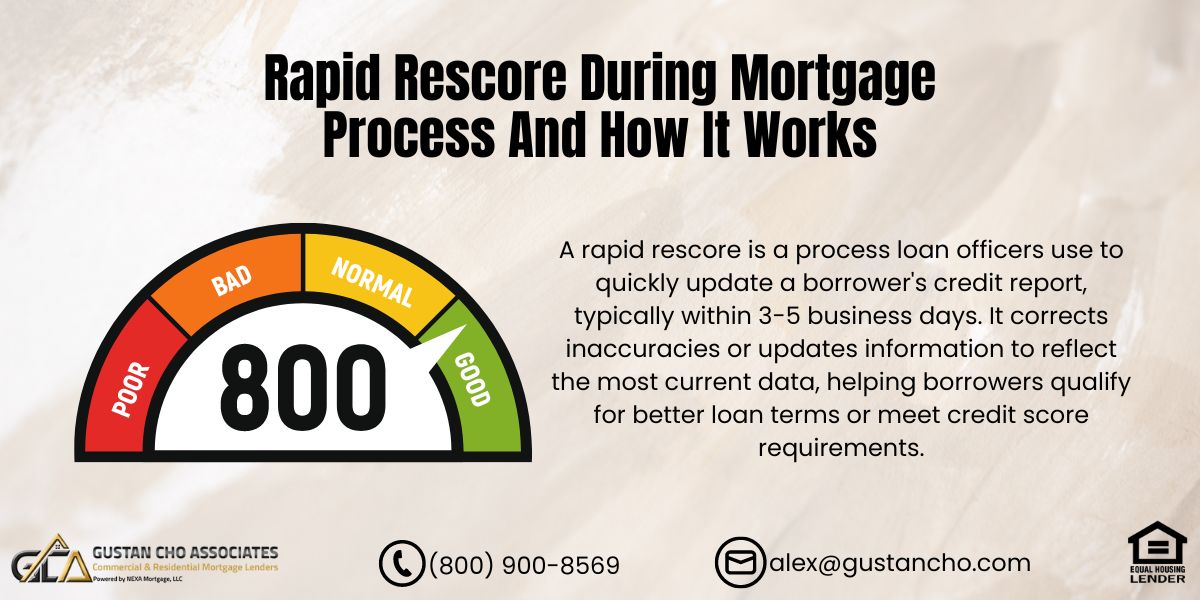

- What is a rapid rescore? A rapid rescore is a process loan officers use to quickly update a borrower’s credit report, typically within 3-5 business days. It corrects inaccuracies or updates information to reflect the most current data, helping borrowers qualify for better loan terms or meet credit score requirements.

- How does the rapid rescue process work? Loan officers can request credit information updates from providers such as Credit Plus. Proof of necessary updates, like paid-off credit balances, is required. The provider verifies and reports the updated information to Experian, Equifax, and TransUnion – the three major credit bureaus.

- Can you rush a rapid rescore? Rapid rescoring is designed to be swift, so it cannot generally be expedited beyond the typical 3-5 business day timeframe. However, borrowers can facilitate a smoother and quicker process by promptly providing all necessary documentation and ensuring accurate information.

- What are the typical highs and lows of consumer credit scores? Consumer credit scores typically range from a low of 300 to a high of 850 FICO. The scores are used by lenders to assess the creditworthiness of borrowers.

- Why is rapid rescore important during the mortgage process? Rapid rescore can be crucial for borrowers needing to quickly improve their credit scores to meet lender requirements, such as minimum score thresholds for mortgage approval. It allows borrowers to update their credit profiles faster than the normal reporting cycle, which can take up to 45 days.

- What documents are needed for a rapid rescore? Documents required may include proof of payment, account statements, letters from creditors correcting misreported information, release of lien documents, identity theft documentation, and other relevant legal documents, depending on the updates needed.

- Who pays for the rapid rescore during the mortgage process? Typically, the mortgage lender covers the cost of rapid rescoring, which can be substantial, especially if multiple credit tradelines need updating across different bureaus. Costs can be included as part of closing expenses or absorbed by the lender, affecting the interest rates offered.

- How do lenders use rapid rescore? Lenders use rapid rescoring to help borrowers update recent changes to their credit profiles, such as paying down balances. This updated information can help improve credit scores quickly, making it easier for borrowers to qualify for loans or get better loan terms.

- What impact do low credit card balances have on credit scores? Maintaining low balances on credit cards is one of the best methods to boost credit scores. A rapid rescore can reflect these paid-down balances, potentially increasing credit scores and improving loan qualification chances.

Contact your loan officer or financial advisor for further information on rapid rescoring and how it can impact your mortgage application.

Related> What Is A Rapid Rescore

Related> Update Your Credit With Rapid Rescore

This blog about Rapid Rescore During Mortgage Process And How It Works was updated on May 3rd, 2024.

I feel so excited working with TOPNOTCHCARE1 a devoted and God fearing credit specialist. My name is Sharon and I live in LA just early last year I had an eviction, bankruptcy, judgment and some couple of late payments on my report and my score was 520. However I searched online for help on a credit forum and I found this specialist that was well spoken on this recommended site Reddit , then I contacted him on TOPNOTCHCARE1 at g m ail dot com. After few info about my report he came through deleting the above mentioned situation and increased my score to 797. Precisely, he told me that my score will never drop till further notice, having him by my side this New Year is a great thing of joy so I recommend him to anyone here who needs his help if you want a good credit report and score.