In this blog, we will cover how unreimbursed business expenses affect qualified income for a mortgage. Unreimbursed business expenses only affect borrowers who must turn in their federal income tax returns. Turning in federal income tax returns is necessary for unreimbursed business expenses to matter. The days of no-doc mortgages and state-income mortgage loans have been long gone after the 2008 financial crisis and are now back. However, no-doc loans, 1099-income-only mortgages, W2-income-only mortgages, and no-ratio mortgage loans require a 10% to 40% down payment. Homebuyers with only a 3% to 5% down payment will need to qualify for full-doc mortgage loans, which means two years of income tax returns. In the following paragraphs, we will cover how unreimbursed expenses affect mortgage loans.

No-Income Documentation Mortgage Loans

There are other loan programs that unreimbursed business expenses do not affect qualified income to get mortgage approval. Unreimbursed business expenses affect borrowers who need to turn in their federal income tax returns. However, W2-income-income only mortgages, 1099-income-only mortgages, stated-income loans, DSCR loans, and no-ratio mortgage loans does not affect unreimbursed business expenses because tax returns are not required.

Gustan Cho Associates has government and conventional W2 Income Only Mortgages. So that you know, no Tax Returns are not required. We also have bank statement mortgage loans for self-employed borrowers. Again no tax returns are required. However, if you own rental properties or have 1099 income along with W-2 income, income tax returns are required. We will discuss qualifying for a mortgage with unreimbursed expenses on this blog.

Home Loan With Bad Credit

Borrowers can have low credit scores and prior bad credit and qualify for a mortgage: With documented income, borrowers can qualify for a mortgage loan. Home Buyers with perfect credit but no income cannot qualify for a home loan. Income is the most important factor for anyone who needs a mortgage. Income needs to be documented and cannot be cash income. It is much easier to qualify income for a W-2 wage earner than a self-employed or 1099 wage earner. This is because most self-employed or 1099 wage earners deduct business expenses on their tax returns.

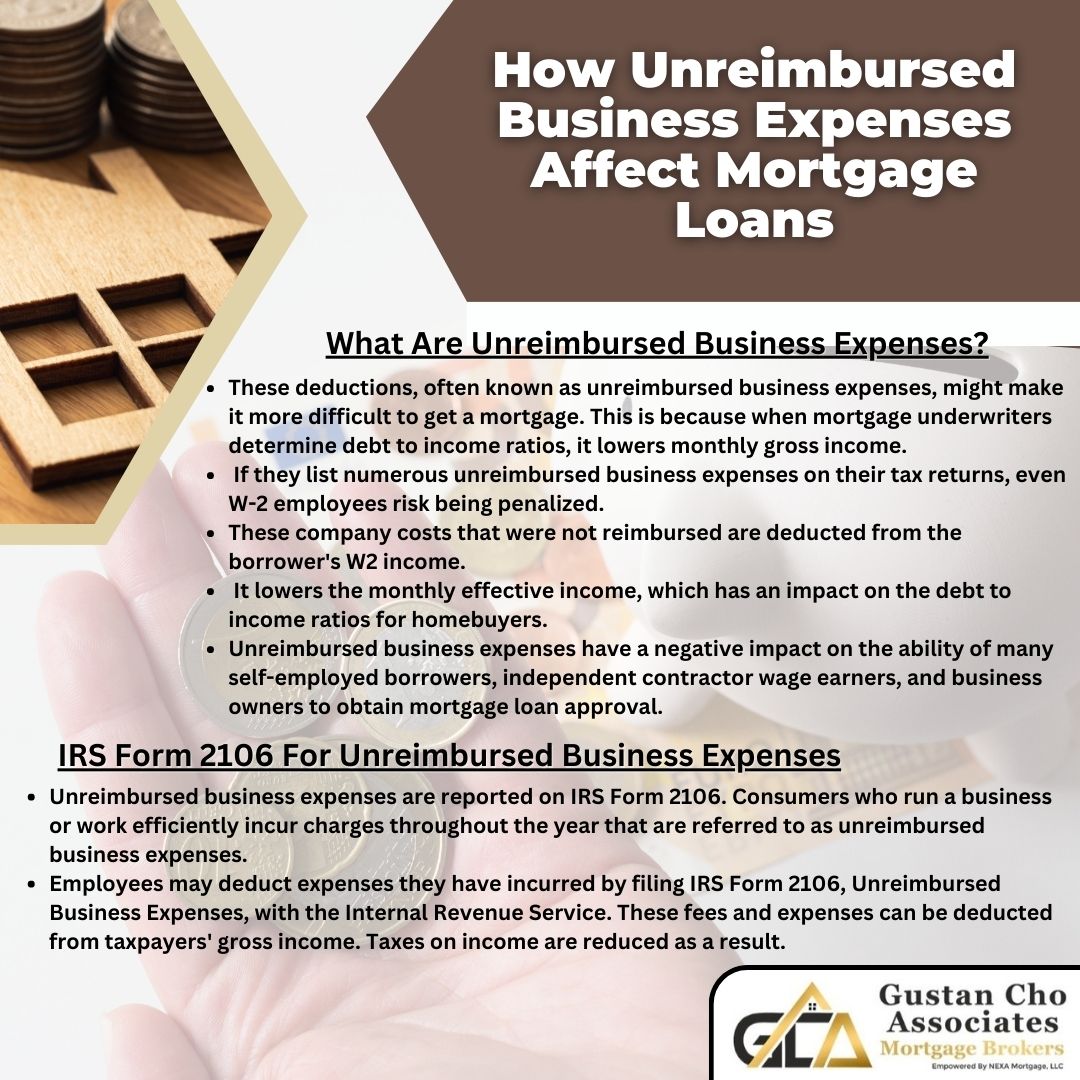

What Are Unreimbursed Business Expenses

Those deductions, often referred to as unreimbursed business expenses can hurt qualifying for a mortgage. This is because it reduces monthly gross income when mortgage underwriters calculate debt to income ratios. Even W-2 employees can get stung if they claim a lot of unreimbursed business expenses on their tax returns.

Those unreimbursed business expenses are offset from the borrower’s W2 income. It reduces the monthly effective income which means that the home buyer’s debt to income ratios is affected. Many self-employed borrowers, independent contractor wage earners, and business owners are affected in getting a mortgage loan approval due to unreimbursed business expenses.

IRS Form 2106 For Unreimbursed Business Expenses

IRS Form 2106 is unreimbursed business expenses. Unreimbursed business expenses are costs consumers have incurred during the year to run a business or to effectively earn income from their job. The Internal Revenue Service allows workers to write off expenses they have incurred on IRS Form 2106 Unreimbursed business expenses. Taxpayers can offset these costs and expenses from gross income. This saves money in income taxes.

Tax Payers can claim unreimbursed business expenses for expenses they use on the job or to do their job. This can be claimed where an employer does not reimburse employees for expenses if they are a W-2 income wage earner. For self-employed wage earners, any expenses they incur to do the job can be written off on IRS Form 2106.

Types of Borrowers Affected Getting a Mortgage Due To Unreimbursed Business Expenses

There are certain type of borrowers who get affected from getting a mortgage loan approval due to unreimbursed business expenses. Let’s take a case scenario how unreimbursed business expenses affect certain type of borrowers from qualifying for a mortgage loan. For example, below, we will go over a real case scenario where a homebuyer gets affected from qualifying for a mortgage due to unreimbursed business expenses.

- Profession for this case scenario is a carpenter

- All the tools, equipment, can be expensed off on IRS Form 2106

- The carpenter will pay income taxes on income less unreimbursed business expenses

This is a great tool to minimize paying income taxes for self-employed wage earners. Normally backfires when applying for a mortgage loan. This is because it will hurt debt-to-income ratios due to not declaring all of the income.

How Unreimbursed Business Expenses Affects Mortgage Qualification

Utilizing unreimbursed business expenses can be a deal-breaker for homebuyers qualifying for a mortgage. This is because these business expenses will cap the borrowing power from the home buyer. Qualifying income is reduced. We will continue with the case scenario to illustrate how one can get affected from qualifying for a mortgage due to unreimbursed business expenses:

- Make $120,000

- that translates into $10,000 per month before pre-tax

- if the taxpayer were to write off $24,000 in unreimbursed business expenses incurred from employment, income

- this will be cut by every dollar they did not pay income taxes

- makes qualifying for a higher loan amount

- adjusted gross monthly income is now able to use is $8,000

- which is $10,000 gross income less the $2,000 in unreimbursed business expenses

How Mortgage Underwriters Calculate Qualified Income

Many mortgage loan originators do not look at the borrower’s tax returns carefully when qualifying and just go off the W-2s. Most W-2 employees do not claim a substantial amount on IRS Form 2106. But for those mortgage applications that do, the unreimbursed expenses can pose a serious problem during the qualification process. It’s best to analyze borrowers overall net adjusted gross income. Look at the borrower’s income tax returns very carefully at the initial state of the application process.

How Underwriters Analyze IRS Form 2106 Unreimbursed Business Expenses

Mortgage underwriters will ask for two years of income tax returns from borrowers to determine unreimbursed expenses. The way mortgage underwriters calculate unreimbursed expenses is by looking that the IRS Form 2106, unreimbursed business expenses, for the past 24 months. They will average the 24 months to yield a net monthly amount which is then subtracted by the borrower’s gross monthly income.

In the event, if the unreimbursed expenses were just taken only in the most recent last two years, the liability is averaged over 12 months and not 24 months. There are cases where a mortgage underwriter can exempt the unreimbursed expenses. This can be done if it was a one-time occurrence for just that particular year. If a borrower can write a detailed letter of explanation detailing the reason for the expenses that were written off.

Case Scenario of Unreimbursed Business Expenses

In this section, we will go over a case scenario to help our viewers better understand how unreimbursed business expenses work. Mortgage lenders will calculate income a certain way and used qualified income. If a borrower wrote off a substantial amount of unreimbursed expenses on their IRS Form 2106 two years ago. But the borrower did not have a lot of unreimbursed business expenses the most current year, the unreimbursed business income of the prior year can be deducted and not used due to a one off extenuating circumstances which will not happen again.

How Do Mortgage Underwriters View Declining Income on Income Tax Returns

There are times when borrowers can have a year with declining income. If there is a good reason why the borrower had a one off year but other years had consistent income, the year with the low income can be exempt from mortgage calculation. The reason for the decline in income was because he was temporarily transferred to another branch of his company due to a one time emergency.

The reason why a certain year’s income can be exempt from income calculation as for this example is because the company was acquiring a new branch that was not part of the scope of work of the borrower. The employer can state the reason that his income was low one year and not expected to ever be low again in writing. Then this borrower can probably get his unreimbursed expenses exempted. The mortgage underwriter will use it as a one-time deduction and will take that deduction and add it back to the borrower’s income.

W2-Income-Only Mortgage Loan Program

I can now offer W-2 income wage earners who have substantial unreimbursed expenses on their tax returns where no income tax returns are required. To qualify, you need to be a W-2 income wage earner and cannot have more than 25% of W-2 income as commission or bonus. This special mortgage loan program is available for W-2 wage earners only.

The W2-income-only mortgage can benefit any W-2 wage earner who has substantial write-offs on their IRS Form 2106. FHA, VA, and Conventional loans have W2-Income-Only Mortgage Loan Programs. Gustan Cho Associates offers bank statement mortgage loans for self-employed borrowers as well as dozens of other non-QM and alternative loan programs.

Getting Approved With The Best Lender For No-Documentation Mortgage Loans

Gustan Cho Associates has a national reputation of being a one-stop mortgage shop. This is due to not just offering government and conventional loans with no lender overlays, but having every non-QM loan program that is available in the market. No income tax returns are required. Contact us at Gustan Cho Associates Mortgage Group at 800-900-8569 or text us for a faster response for more details. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.

Related> Amending tax returns to qualify for a mortgage

Related> Factors that affect pre-approval

Home buyers who have a lot of unreimbursed business expenses on their income tax returns can potentially qualify for W2 INCOME ONLY MORTGAGE LOANS where income tax returns are not required.