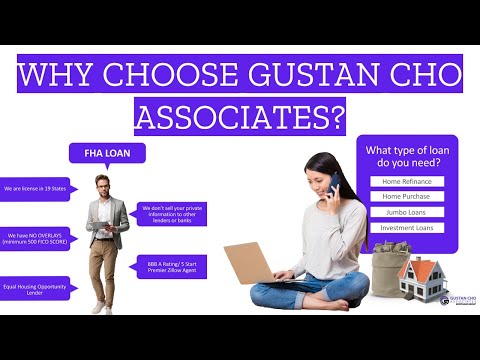

Gustan Cho Associates Mortgage Lenders Licensed in 48 States, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands

Consider using this if you need to provide more context on why you do what you do. Be engaging. Focus on delivering value to your visitors. The team at Gustan Cho Associates has a national reputation for being a one-stop mortgage shop for owner-occupant primary home loans, second homes, investment properties, small and large businesses, and commercial properties, we have it all.has the mortgage loan options suited for you. We have the states, We have the mortgage products, and we have the lowest rates.

Looking For That Mortgage Loan Program Not Available at Other Lenders?

What type of mortgage loan are your looking for?

Purchase, Refinance, Cash Out Refinance, FHA Loan, VA Loan, USDA Loan, Conventional Loan, Jumbo Loan, Non-QM Loan, Investment Loan, SBA Loan, Equipment Financing, HELOC, and Alternative Financing?

The team at Gustan Cho Associates has a national reputation for being a one-stop mortgage shop for owner-occupant primary home loans, second homes, investment properties, small and large businesses, and commercial properties, we have it all.

Over 80% of our clients are borrowers who could not qualify at other lenders either due to the lender having overlays on government and conventional loans, or because the lender did not have the mortgage loan program the borrower was looking for.

Gustan Cho Associates has a national reputation for not just offering traditional government and conventional loans with no overlays at competitive rates but also offering hundreds of non-QM and alternative mortgage loan programs. If there is a mortgage loan program in today’s market, Gustan Cho Associates has it !! We help our borrowers with Love !!!

Our Team is available 7 days a week, evenings, weekends, and holidays!!!

Call Us Today At (800) 900-8569 or Complete The Enquiry Form

The team at Gustan Cho Associates are experts in helping Veterans on VA Loans with 500 FICO.

Our Team supports our Military And Veterans for their service. We are forever grateful to you!!!

To all of our Military And Veterans, out there…..We respectfully salute you….. We thank you for your bravery, service and immense Sacrifices. Today and every day, We appreciate you for your Bravery, Courage, Dedication, Hard Work to our country in keeping us safe. And thanks to the military families for their Support, Resilience, Courage, And Sacrifices. As one of America’s Veterans, You are the pride and joy of your community and our country.