In this article, we will be discussing and covering Portfolio Loan Programs such as no income documentation and asset depletion mortgages. Portfolio Loan Programs are becoming increasingly popular. Borrowers who cannot meet the agency guidelines on government and conventional loans can often turn to portfolio loans. Gustan Cho Associates is a national mortgage company licensed in multiple states with a reputation of not having any lender overlays on government and conventional loans. However, Gustan Cho Associates are experts in helping borrowers with portfolio loan programs.

Non-conforming Alternative and Portfolio Loan Programs

Portfolio loans are nonconforming alternative financing mortgage programs for owner-occupant, second homes, and investment properties. One of the most popular portfolio loan programs that are gaining popularity is our Asset Depletion Mortgage Program. Gustan Cho Associates has multiple wholesale lending partners for asset depletion mortgages. Asset depletion loans benefit retirees and others who have substantial assets to use their assets versus qualified income in order to determine qualified income when applying for a mortgage.

Asset-Depletion Mortgages With No Income Documentation Requirements

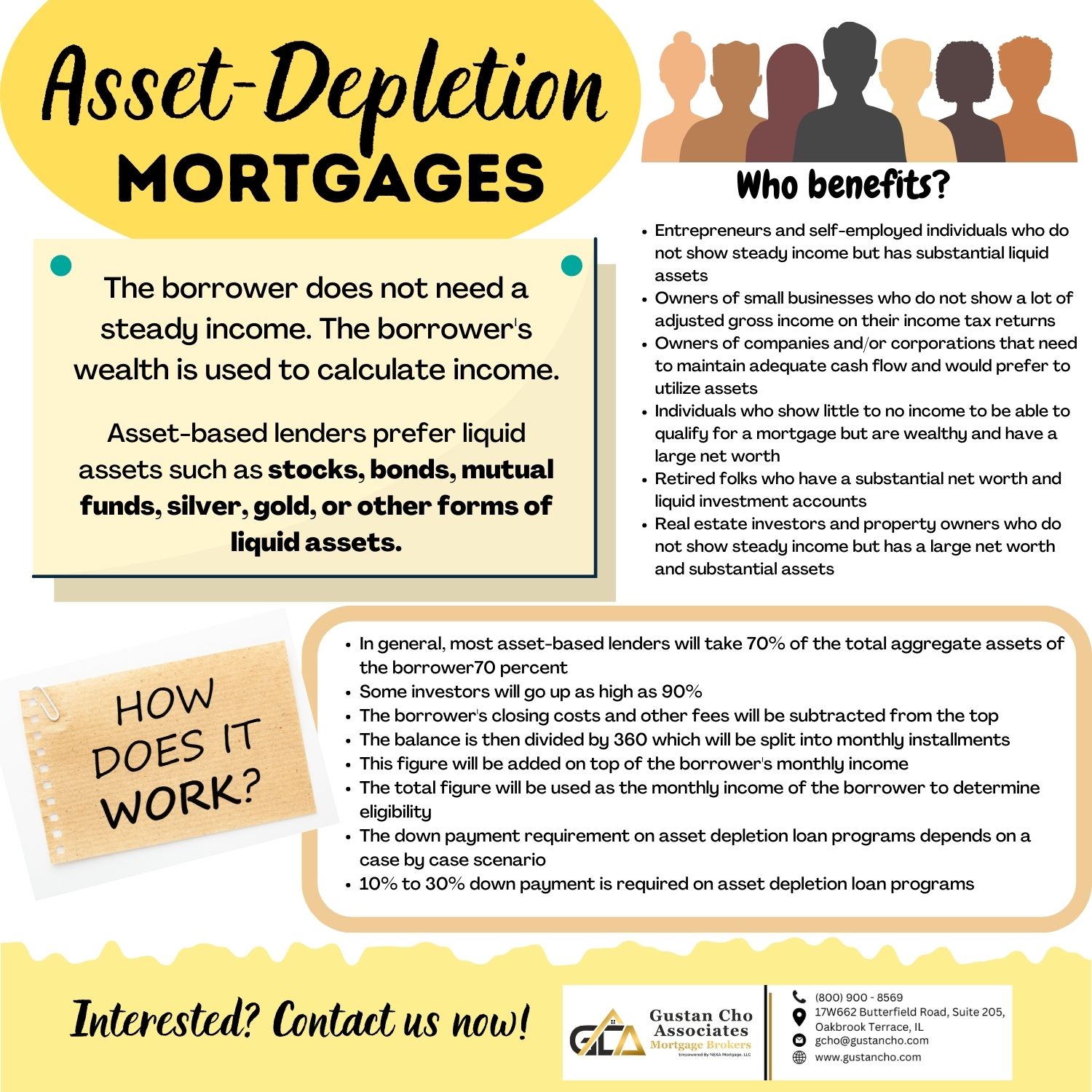

Lenders use the borrower’s assets to lend money to qualified borrowers on real estate transactions. Asset-based lenders prefer liquid assets such as stocks, bonds, mutual funds, silver, gold, or other forms of liquid assets. Asset Depletion Portfolio Loan Programs benefit homebuyers who have strong assets but are light on a steady income. There are various different types of asset-based portfolio loan programs. Asset-based mortgages are often referred to as Asset Based Lending where the borrower does not need a steady income. The borrower’s wealth is used to calculate income.

Borrowers Who Benefit From Asset Based Lending

Asset-based lending is not for everyone:

- Asset depletion portfolio loan programs are ideal for investors who do not have a traditional steady income stream

- To be eligible for asset-based lending, the borrower needs to have substantial liquid assets

Who Benefits From Asset-Depletion Mortgages

The following type of borrowers can greatly benefit from asset depletion portfolio loan programs at Gustan Cho Associates:

- Entrepreneurs and self-employed individuals who do not show steady income but has substantial liquid assets

- Owners of small businesses who do not show a lot of adjusted gross income on their income tax returns

- Owners of companies and/or corporations that need to maintain adequate cash flow and would prefer to utilize assets

- Individuals who show little to no income to be able to qualify for a mortgage but are wealthy and have a large net worth

- Retired folks who have a substantial net worth and liquid investment accounts

- Real estate investors and property owners who do not show steady income but has a large net worth and substantial assets

Only liquid assets can be used on asset-based lending. 100% of liquid assets can be used. Liquid assets are funds in cash, personal and business bank accounts, bank certificate of deposits, and money accounts. 70% of stock and bond investment accounts. Only 70% is used due to market volatility in the stock and bond markets. 60% of retirement accounts can be used.

The Asset Depletion Portfolio Loan Programs And How It Works

Asset depletion portfolio loan programs use the borrower’s assets as collateral versus the borrower’s income. Asset-based lending allows the lender to deplete the borrower’s assets and count those funds in lieu of traditional income for the term of the loan.

In general, the following terms below are used in qualifying borrowers of asset-based lending:

- In general, most asset-based lenders will take 70% of the total aggregate assets of the borrower70 percent

- Some investors will go up as high as 90%

- The borrower’s closing costs and other fees will be subtracted from the top

- The balance is then divided by 360 which will be split into monthly installments

- This figure will be added on top of the borrower’s monthly income

- The total figure will be used as the monthly income of the borrower to determine eligibility

- The down payment requirement on asset depletion loan programs depends on a case by case scenario

- 10% to 30% down payment is required on asset depletion loan programs

Income tax returns are not required on asset-based lending programs. There are different types of asset-based lending. Please contact us at Gustan Cho Associates to go over the various asset depletion loan programs we have to offer.

Other Asset Based Lending Programs

Our investor’s asset depletion program is used to establish monthly income for borrowers who need additional income to qualify for a home mortgage based on their liquid assets (can use retirement assets if the borrower is over 59 ½). The automated calculator uses a 4% rate of return on the assets PLUS a depletion amount based on the borrower’s age and the social security administration’s life expectancy. Assets are used at 100% face value including retirement accounts (retirement only used if the borrower is age 59 ½ or older). Loan sizes as large as $3 million and as small as $100K allowed. Up to 75% LTV for owner-occupied and 2nd homes including non-warrantable condos, Co-ops, Condotels, and cash out. Investment properties allowed up to 60% LTV.

Investor Portfolio Loan Programs

Investor allows up to 10 financed units and 15 total REOs including cash-out loans. Assets are used at 100% face value with no reduction for stocks, bonds, mutual funds, or other publicly traded accounts. Cash-out can be used as income on a case-by-case basis. No rate adjustments apply to the program, but the maximum LTV is 75%. Only one appraisal is required regardless of the loan amount or cash out. Asset depletion can be used in conjunction with all other income sources such as W-2, self-employed, pension, social security, or rental income. (can’t be used in conjunction with dividend/interest income for same assets).

Types of Properties Eligible For Portfolio Loan Programs

All specialty programs can be used in conjunction with asset depletion and all collateral types are allowed i.e.: Multi-Family, Hobby farms/ acreage, Work Visa/Expat, No Credit / Limited Credit, 2-4 family, Non-warrantable condos, Co-op, Condotels, NOO cash out, etc.

Assets must be held in the US account.

- REITs, Hedge Funds, Venture Capital, Notes Payable, or other private investments typically cannot be used

- Funds inside an annuity and cash value or life insurance cannot be used

- Trust assets can be used if the borrower has 100% unrestricted access to the funds and all trust documents and asset statements are provided

- Accounts shared by borrower and co-borrower can be used using the elder borrower’s age

- Reserves are not deducted from the assets when populating the calculator, but down payment or cash to close needed are deducted

Maximum Debt To Income Ratio is capped at 40% DTI:

- 75% LTV up to $1 million loan amount with reduced LTV’s up to $3 million

30-year amortization - No prepayment penalty

- 2/2/6 caps, 1-year CMT Index, 3.0% Margin, Floor= Note Rate

- Escrows required

Again, Gustan Cho Associates offers multiple asset-based lending programs. Please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com to go over the various different asset depletion loan programs that best benefit you.

Nonconforming Portfolio Loan Programs On Co-Ops, Condotels, And Non-Warrantable Condos

Gustan Cho Associates can lend on co-ops, non-warrantable condos, and condotels:

- Portfolio Loan Program sizes of condotel and non-warrantable condominiums as large as $3 million and as small as $100K allowed

- Up to 80% LTV for owner-occupied and 2nd homes (condotel max LTV is 75%)

- 75% Loan To Value cash out for owner-occupied and 2nd homes

- Investment properties: allowed at up to 60% LTV

- We allow up to 10 financed units and 15 total REOs including cash-out loans

- A limited review of the co-op or condo

- Typically only co-op or condo cert. and the master insurance policy is required

- $75k on a case by case basis with additional rate adjustments

Our investor prefers the same building comparable on appraisals:

- Only one appraisal is required regardless of the loan amount

- For all files, including co-ops, we can use a broker or borrower’s attorney for the closing and title work

- Typically only one stock cert, one lease, and one security instrument are needed for co-ops

- All specialty programs can be used in conjunction with co-ops, non-warrantable condos, and condotels

- Asset Depletion, Work Visa/Expat, No Credit / Limited Credit, Foreign National, NOO cash out, etc.

- Up to 6% of seller’s concessions allowed for closing costs including upfront HOA dues

Two-week rush closings are available.

Minimum Requirements And Guidelines For Portfolio Loan Programs

Condotel units and/or non-warrantable condominium units need to be a minimum of 500 square feet.

- Must have at least one separate bedroom and a full kitchen

- No studios or kitchenettes allowed

- Large flip tax allowed case by case

- No deed restriction is allowed on the subject property

- No pending litigation involving structural or construction items allowed

- Litigation for other reasons can be reviewed case by case, typically at a reduced LTV

- Escrows required

Must have 100% replacement coverage or agreed amount endorsement if co-insurance is present.

Terms Of Condotel And Non-Warrantable Portfolio Loan Programs

The maximum debt to income ratio of the borrower cannot exceed 40% DTI. 80% LTV up to $1 million loan amount with reduced LTV’s up to $3 million. 30-year amortization term. No prepayment penalty on all portfolio loan programs. 2/2/6 caps, 1-year CMT Index, 3.0% Margin, Floor= Note Rate. Escrows required.

Foreign National Loan Programs

Foreign Nationals who are buying a vacation home or investment property in the US. They may not have any U.S. credit or low scores due to limited US credit. US Citizens or Green Card holders living and earning income abroad with no recent or limited US credit, or a low score due to a lack of credit. 50% LTV program. Some exceptions to 65% LTV for citizens of the UK, Canada, and Australia with a foreign credit report, provided that they are buying a second home in a resort area as a true vacation home. 12 months PITI reserves for all properties owned in all countries for loan amounts up to $1 million. Max Debt To Income Ratio is 40% DTI.

Other Requirement For Foreign National Portfolio Loan Program

Gustan Cho Associates doesn’t require a foreign credit report, alternate tradelines, or require VORs. Our investor will consider using foreign assets for down payment AND reserves including foreign retirement funds. But funds for closing must be moved to the US prior to the funding date. Foreign assets used for reserves do not need to be moved to the US. Cash our refinances are allowed with no title seasoning. Assets used for the purchase less than 6 months prior to the application date are sourced and seasoned 60 days. All collateral types are allowed including non-warrantable condos, condotels, co-ops, Jumbo & Super Jumbo. Loan amounts from $100K to $3 million.

Foreign National Borrower Requirements

The borrower must obtain a social security number or individual tax identification number (ITIN) prior to closing. Exceptions apply if we have evidence the ITIN application has been sent to the IRS by a US-based CPA or attorney. We can provide a pre-approval letter to the CPA or attorney for the expedition as well as attorney resources. A passport or visa allowing entry into the US is required. This is a full documentation loan in terms of income, assets, deposits, etc. Income needs to be documented on foreign tax returns, W-2 equivalents, etc. CPA letters are not allowed. 2nd homes need to be in a resort area. Homes in metropolitan areas will usually be called an investment. Typically, to call it a 2nd home, we don’t want them to own any other properties in the US. The money for the down payment & closing costs needs to be moved to the US account before closing. Deposits must be sourced.

Borrowers Credit And Debt Profile Requirements

All foreign debts including any PITI info need to be added to 1003 shown in USD equivalent. All income, assets, and PITI info must be translated by a US-based certified translation company. Any US citizen or US Permanent Resident (Greed Cardholder) living abroad must have filed the previous year’s US tax returns while living outside the US. Any US-based certified translation company can be used. Maximum Debt To Income Ratios cannot be greater than 40% Debt To Income Ratio. 50% LTV up to$3 million loan amount. 30-year amortization. No prepayment penalty. 2/2/6 caps, 1-year CMT Index, 3.0% Margin, Floor= Note Rate. Escrows required

Non-QM Loans One Day Out Of Bankruptcy And Foreclosure

Gustan Cho Associates now offers homebuyers to qualify for Non-QM loans one day out of bankruptcy and/or foreclosure with a 30% down payment. There are no waiting period requirements to qualify for a home mortgage one day out of bankruptcy and/or a housing event. Non-QM loans are for owner-occupant primary home mortgages, second homes, and investment properties.