In this blog, we will cover and discuss Illinois home purchase mortgage options for homebuyers. Going through the home purchase process can be overwhelming. There are many moving parts to the Illinois home purchase process. No two Illinois home purchase buyers are alike. Some may be first-time homebuyers, others may be self-employed borrowers, others may have bad credit and/or lower credit scores, and others may have a bankruptcy and/or foreclosure. We decided to create the Illinois Home Purchase Mortgage Options Guide to address the top frequently asked questions we get at Gustan Cho Associates. All home purchase transactions require a down payment and closing costs. The only two mortgage loan program that do not require a down payment are VA and USDA loans. The amount of down payment required depends on the type of loan program.

Dowm Payment Requirements on Illinois Home Purchase

Here are the down payment requirements:

- Every loan program has its own down payment requirements:

- FHA requires a 3.5% down payment.

- Fannie Mae and Freddie Mac require a 3% to 5% down payment for conventional loans.

- VA Loans and USDA Loans do not require any down payment on home purchases.

- Gustan Cho Associates offers traditional jumbo mortgages with a 10% down payment with 10% down payment and 660 credit scores at competitive jumbo mortgage rates.

- Most Jumbo Lenders require a 20% down payment.

- Non-QM Loans require a 10% to 20% down payment.

- Investment homes require a 20% down payment.

- Second homes require a 10% down payment.

- Condotel Lenders require a 25% down payment.

- Hard Money Lenders require a 20% plus down payment.

- Flip and Flip and rehab loans require 15% on the property purchase and a 10% down payment on the rehab cost.

Illinois Home Purchase Down Payment Requirements Due To Property Tax Proration Credits.

Property Tax Proration Can Be Used For Down Payment on Illinois Home Purchase

Illinois Home Purchase Down Payment Requirements are different than most other states due to property tax proration credits. Illinois homeowners pay their property taxes in arrears so when a home seller sells their home, they owe one-year property tax proration credits to the home buyer. The great news is that buyers of an Illinois home purchase can use the property tax proration credits towards their down payment and/or closing costs.

Using Property Tax Prorations for Down Payment on Illinois Home Purchase

Here is a case scenario on how buyers on an Illinois Home Purchase can use property tax prorations for their down payment:

Let’s take a scenario where a home buyer purchases a home in Illinois for $100,000 with an FHA Loan:

- Homebuyer needs a 3.5% down payment on an FHA home loan

- Needs to show that they have 3.5% of the $100,000 purchase price or $3,500

- Let’s say the property taxes are $2,000

- Sellers of the property need to credit the home buyer $2,000 in property

- The buyer can use the $2,000 towards the down payment

- Borrowers cannot use seller concessions for the down payment

- But they can use property tax prorations

The net amount the borrower need for cash to close for a down payment is $1,500:

- $3,500 minus $2,000 property tax proration credit yields $1,500

How Much Out of Pocket Do I Need For Closing Costs?

FHA Loan programs are the best loan program for a first-time home buyer who can buy a home due to lax credit and debt-to-income ratio requirements. It makes it possible for every hard-working family to be able to own a home in America. The FHA mortgage program allows for folks with very little money to make the American dream of homeownership come true. All you need as a down payment is 3.5%. There are closing costs that home buyers will need to pay. Closing costs can run into the thousands. Many times, closing costs can surpass the down payment. HUD allows for sellers to contribute to closing costs through sellers’ concessions If buyers are short on closing costs, lenders can give lender credit to borrowers. Homebuyers do not have to come up with any closing costs with a combination of seller concessions and/or lender credit.

FHA Loan Requirements in Illinois

Here Are The FHA Loan Requirements:

- The minimum credit score required for a 3.5% down payment home purchase FHA Loan is 580 FICO

- Borrowers can qualify for FHA Loans under 580 FICO but need a 10% down payment

- Collections and charge-off accounts do not have to be paid to qualify for FHA Loans

- Debt to income ratios can be capped at 46.9% front-end and 56.9% DTI back end to get an approve/eligible per automated underwriting system (AUS)

- 100% gifted funds allowed for the down payment

- Closing costs can be paid by the lender with a lender credit

- Seller concessions up to 6% allowed

- No limit on the amount of non-occupant co-borrowers

- Borrowers who are under Chapter 13 Bankruptcy repayment plan can qualify one year into a Chapter 13 with Trustee Approval

- No waiting period after Chapter 13 Bankruptcy discharged date

- The two-year waiting period after Chapter 7 Bankruptcy discharged date

- The three-year waiting period after the recorded date of foreclosure and/or deed in lieu of foreclosure

The three-year waiting period after a short sale to qualify for FHA Loans.

Using Seller Concessions To Pay Closing Costs on Illinois Home Purchase

A home buyer in Illinois can request a seller concession, also known as a seller contribution, of up to 6% on FHA Loans of the purchase price of the home. Seller Concessions Allowed. Below is the maximum seller’s concession allowed by the home seller:

- FHA Loans 6%

- VA Loans 4%

- USDA Loans 6%

- Conventional Loans 3% for owner-occupied and second homes and 2% for investment properties

- Non-QM Loans allow up to 6% in seller concessions

Type of Costs That Can Be Part of Closing Costs

The seller concession can only be used to cover closing costs and not the down payment. Closing costs consist of third-party charges. Examples of closing costs are the following:

- Title charges

- Tax stamps

- Transfer stamps

- Attorneys fees

- Origination fees

- Inspection fees

- Appraisal fees

- Underwriting fees

- Pre-Paid

- Points to buy down rates

- Other third-party fees charged in order to close the loan

Using Gift Funds For Down Payment on Illinois Home Purchase

Homebuyers can accept 100% down payment assistance from family members and/or relatives on FHA Loans. Down payment assistance is allowed by family only. There are occasions when lenders will accept down payment assistance from a friend who has known the borrower for a least five years.

First-Time Home Buyer Down Payment Assistance Grants

Many local and state agencies run bond programs to generate funds to help individuals and families with a down payment. Contrary to public thinking, these bond issues are not a type of welfare. The government knows that it can be tough to buy that first home, especially on a limited income. Most agencies are income sensitive, but you may be surprised by the high level of acceptable income. The income level is especially high if you have children or dependents. Most agencies also have purchase limits, but they are adjusted to the income qualifications level.

Other Sources For For Down Payment On Illinois Home Purchase

Borrowers can use their 401k and/or retirement accounts for the down payment on a home purchase. Homebuyers with any questions about how much money they need to purchase a home, please contact Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. Gustan Cho Associates Mortgage Group is available 7 days a week, on evenings, and on holidays.

How Much Do I Need To Buy a House in Illinois?

There are two hard costs when buying a home. The down payment and closing costs. Understanding The Down Payment And Closing Costs on home purchases are important. One of the most common first-time homebuyer questions is how much money do I need? Unfortunately, many would-be homebuyers are under the assumption they need a lot of money to purchase a home. Many renters do not realize they do not need a lot of money to purchase a home. That is why Understanding The Down Payment And Closing Costs is very important.

The Difference Between The Down Payment And Closing Costs

The down payment on a home purchase is always fixed. For example, FHA requires a 3.5% down payment on a home purchase to qualify. So, on a $200,000 home purchase, the home buyer needs to come up with 3.5% of the $200,000 purchase price or $7,000. However, closing costs vary depending on the property and the location as well as many other factors. No two borrowers can have the same closing costs. One good news is most home buyers do not have to come up with closing costs. Closing costs can be covered with a seller’s concession and/or lender credit. VA and USDA loans do not require any down payment. VA and USDA loans offer 100% financing. However, all mortgage transactions require closing costs.

How Can I Cover Closing Costs on Illinois Home Purchase?

HUD, the parent of FHA, allows up to 6% of seller concession by the home sellers. Homebuyers cannot use seller concessions for the down payment. Seller concessions can only be used for closing costs only. Common questions by homebuyers are the following:

- What are the differences between the down payment and closing costs?

- When do borrowers have to come up with the closing costs?

- Can closing costs be rolled into the mortgage loan balance?

This is why Understanding Down Payment And Closing Costs On Home Purchase is important for borrowers.

What Is The Loan Estimate?

Understanding Down Payment And Closing Costs On Home Purchase is not difficult. The down payment is very simple. It is a percentage of the purchase price. VA and USDA loans do not require any down payment but they do have closing costs. Federal law states that loan originators need to disclose the cost of originating the loan through the Loan Estimate. The Loan Estimate itemizes the closing costs for borrowers in a simple-to-follow format. The LE (The Loan Estimate) cannot be under-disclosed. What this means is loan officers need to fully disclose any and all closing costs on the Loan Estimate.

Sections Of The Loan Estimate

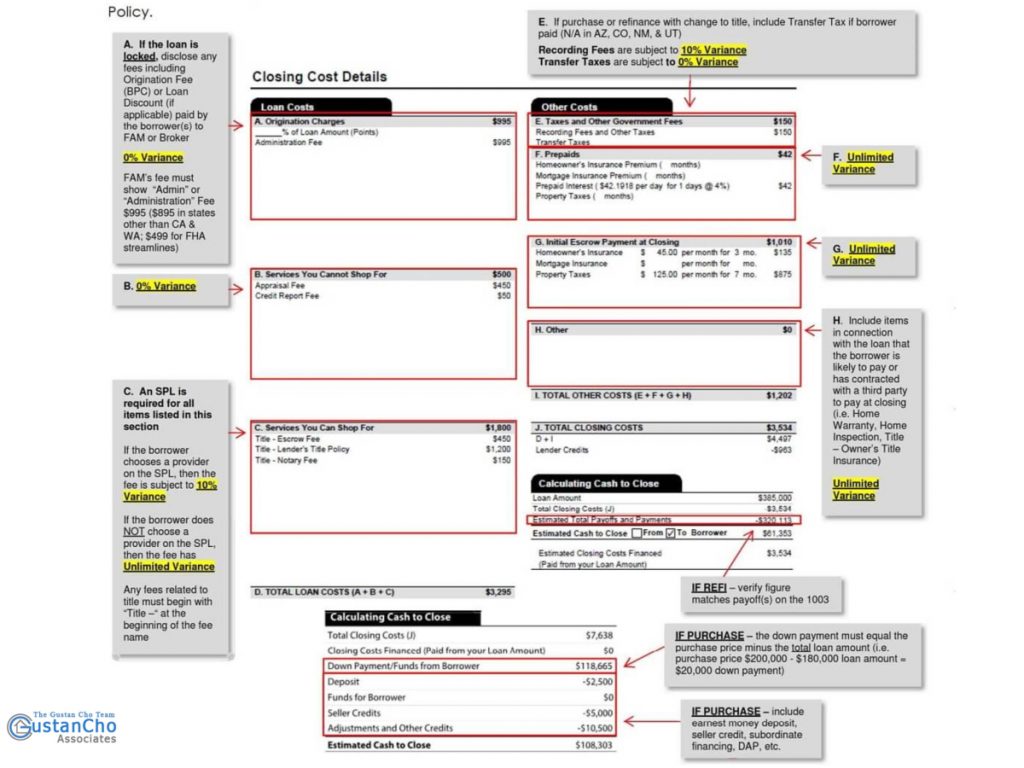

Here are the following sections on the Loan Estimate:

- Section A which is the first section discloses the cost of the loan

- Section B is the second part of the LE which states services consumers cannot shop for

- Section C which is the third part of the LE are services consumers can shop for

- The fourth section discloses the closing cost estimates

- Section 5 discloses the prepaid costs which are the escrow account

- Section 6 itemizes the initial escrow payment at closing

- Section 7 itemizes all other costs

Please review a sample of the Loan Estimate below:

Pre-paid items, also known as “other costs” on your closing disclosure. Closing fees from banks, title companies, attorneys, appraisals and any “fees” that you paid in connection with obtaining your loan which are called “loan costs” on your closing disclosure (CD).

Is The Down Payment And Closing Costs From The Loan Estimate Accurate?

Most borrowers do not want to take the time and analyze and understand their closing costs. They just want to know the bottom line figure on how much money they need to bring to closing.

Mike Gracz, the National Sales Manager at Gustan Cho Associates said the following about Understanding Down Payment And Closing Costs:

In the 1st section “A”, let’s start by examining “Loan Costs” first as they are the actual costs and fees you paid for obtaining your loan. You will incur your first loan cost the moment you pay for a credit report, appraisal or “application fee”. It makes no difference when you pay for any loan costs that are required to fund your mortgage loan. You will still see the complete charges on your final closing disclosure, but they will be distinguished as paid in advance of the close. The loan costs typically paid at closing will consist of bank/lender fees, discount or origination points, any FHA or VA related “up-front” mortgage insurance premium (MIP), title company charges, escrow account, funds and any other 3rd party expenses like a home inspection.

Please study the chart in the previous paragraph.

Closing Costs Borrowers Cannot Shop For Listed On The LE

There are certain costs and fees borrowers cannot shop for. This is listed on the Loan Estimate. Costs such as appraisal fees and credit report costs are costs that consumers cannot shop for. Lenders use an appraisal management service (AMC) when ordering an appraisal. In the past, the lender used to order the appraisal directly from the appraiser. This is no longer allowed due to potential fraud. Credit reporting fees charged to borrowers are the costs credit bureaus charge the lender without a lender markup.

Disclosing Title Charges

Title charges are disclosed in the third section of the Loan Estimate. This section is labeled that these are costs borrowers can shop for. Lenders need to disclose the maximum title charges the borrower will be charged. If the loan officer makes a mistake and lists a cost that is lower than the actual charge, the lender needs to pick up the cost difference. This is why closing costs are overly disclosed.

Mike Gracz of Gustan Cho Associates says the following about Section D of the Loan Estimate:

Section “D” is simply an estimate of the total closing costs you will have to bring to close. It is important to acknowledge that these numbers are not the actual costs, but actually a high estimate. This is done intentionally because the lender may be responsible for any of your costs above the amounts they disclosed to you. Thus, these costs can sometimes be greatly exaggerated. At this point, you can go over the actual fees that can be charged on your loan with your Loan Officer.

Sections E Through J Of The Loan Estimate

Costs such as the following are listed as other costs on the Loan Estimate:

- City, county, and state government recording fees

- Local transfer taxes or stamps

- The initial deposit for your taxes and insurance escrow

- Any owed or due property taxes

- Any other costs for other services like home inspections

- Any other closing costs

The above is referred to as prepaid and/or other closing costs on the Loan Estimate.

Why Is There So Much Closing Costs on an Illinois Home Purchase

In every mortgage transaction, there are closing costs associated with the transaction.

- Whether they are home purchase or refinance mortgage transactions there are always closing costs on mortgage transactions

- Many first-time homebuyers do have a grasp on the down payment required

- Many have a hard time understanding closing costs

- Others have a hard time justifying paying closing costs

Basic What Are Closing Costs On Mortgage Transactions In Illinois

Basically, closing costs on mortgage transactions are any costs that are associated with the origination and closing of a home loan. On a purchase mortgage transaction, closing costs will include both fees and costs of the mortgage loan origination such as the following:

- origination fees

- credit report fees

- pre-paid

- discount points

- as well as the cost of the real estate transaction such as attorney’s fees

- appraisal fees

- home inspection fees

- other inspection fees

- homeowners insurance

Other third-party charges.

How Can I Pay Closing Costs With Seller Concessions

Many homebuyers do not have to worry about closing costs:

- This is because closing costs can be covered by a home seller concession or lender credit

- Closing costs are not as bad as home buyers and/or homeowners refinancing their mortgage may think

It is very manageable and can be covered by mortgage lenders in lieu of slightly higher mortgage rates.

Basic Breakdown Of Closing Costs on Illinois Home Purchase Transactions

Every real estate transaction can have different closing costs.

- There is no set formula such as a set percentage

- For example, if home buyers were to purchase a home for $100,000, then closing costs will not be a set 2% of the purchase price of the home

- Closing costs vary depending on where the property is located at

- It depends on the state and the county the property is located

The two categories of closing costs are the following:

- fees and costs of the mortgage lender

- third party charges and fees

Examples Of Common Closing Costs In Illinois

Here are some basic costs associated with obtaining a mortgage loan. Credit Reporting Fee:

- A credit reporting fee will be charged at closing

- When a mortgage company pulls credit at the time of mortgage application, the lender will not charge the borrower the credit reporting fee upfront

- They will charge the credit reporting fee at closing

- If borrowers do not proceed with the mortgage application and closing process then there are no charges

- The mortgage company needs to absorb the credit reporting fee

Origination Fee:

- Mortgage brokers need to charge a loan origination fee for their services

- Yield Spread Premium is what mortgage brokers make for their commission

- It is often referred to as YSP

- The Yield Spread Premium is part of the origination fee

Attorney Fee:

- In many states like Illinois, both buyers and sellers are represented by real estate attorneys

- Attorneys’ fees are part of the closing costs

- Average real estate attorneys charge around $500 for real estate purchase transactions

Home Inspection Fee:

- The home inspection is not required by lenders

- It is highly recommended for homebuyers in the event if there are hidden issues such as the following:

- mold

- foundation defects

- or other issues that cannot be detected by the average person

Discount Points:

- Discount points are upfront fees paid by borrowers to get lower rates

- Discount points can be paid by a seller concessions

Underwriting Fee:

- Many mortgage lenders charge an underwriting fee

- The average underwriting fee charged is close to $1,000

Recording fees:

- There will be a recording fee charged by the county and/or city or both

Pest Control Fee:

- Pest control inspection fee is optional

- It is up to the homeowner whether or not to hire a pest control inspector or termite inspector unless the lender requires it

Appraisal Fee:

- The appraisal is required on all mortgage loan transaction

- An appraisal needs to be paid by the home buyer

- Appraisals for single-family homes are normally under $500 dollars

Survey Fee:

- Survey fees are part of closing costs

- Either the seller pays for it or the buyer pays for it

- Or sometimes it may be split between the buyer and seller

Title Search Fee:

- A title search fee will be required to do a thorough background check on the title of the property

- This is to make sure there are no liens on the property and the title to the property is not clouded

Title Insurance:

- Title insurance is required to make sure the title is free and clear of any liens

- There are title charges for both the buyer and seller which is part of the closing costs

Closing Cost Credit On Illinois Home Purchase Versus Other States

Illinois home purchase buyers will get a property tax proration credit from the seller. In Illinois, property taxes are paid in arrears. In most cases, they will get a one-year property tax credit that can be used for the down payment on an Illinois home purchase. This can be a substantial amount. However, lenders still want to see homebuyers have the down payment funds as verified funds. There are instances where buying a home in Illinois does not require money out of pocket. In high-taxed counties, homebuyers will use the property tax proration as the down payment and cover the closing costs with seller concession and/or lender credit. As mentioned earlier, closing costs vary depending on the state and county the property is located. The average closing cost is between 2% to 5% of the home purchase price. Seller concessions are allowed where the home seller will pay the buyer’s closing costs. HUD allows up to a 6% seller concession towards buyers closing costs. VA loans allow up to 4% seller concessions towards buyers closing costs. Conventional loans allow up to 3% of home buyers closing costs for primary residences and 2% seller concessions for investment homes.