In this blog, we will discuss and cover condotel financing mortgage guidelines.

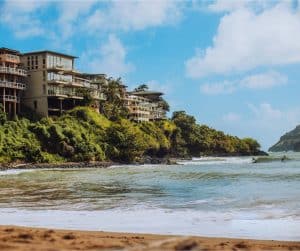

Condotels are condominium units that are within a condo hotel. Condo hotel unit owners can enjoy their condominium units during the year and rent the condotel when not in use.

Most condo hotel complex has a homeowners association. The condotel homeowners association can rent the condotel condominium when the condotel is not in use for a percentage of the daily rent. Condotel units are classified as non-warrantable condos. Non-warrantable condos mean it is not eligible for Fannie Mae and Freddie Mac financing.

How Did The Condo Hotel Concept Start?

In the context of Condotel Financing Mortgage Guidelines, the concept of condotels originated as a funding method for hotel companies to finance new hotel projects. Typically, constructing a hotel involves substantial costs.

However, condotel owners adopt a unique approach by selling hotel rooms and suites similar to houses in a housing development. This strategy allows hotel companies to raise funds for construction while providing buyers with the amenities and luxury of a hotel without the need to vacate the premises weekly.

Condo Hotel Building Association

The management company of a Condo Hotel oversees the rental and upkeep of the Condo Hotel unit, earning a portion of the income. Numerous Condo Hotel owners have their mortgage and costs offset by the rental income from their units. Some Condotel owners generate positive cash flow annually and enjoy residing in their units. Condotels are deemed lucrative investments, and this article will delve into the eligibility criteria for Condotel Financing Mortgage Guidelines.

What Are Non-QM Mortgage Loans?

Condotel buyers and homeowners can access non-QM loans and alternative mortgage programs. The condo hotel management team handles maintenance, rentals, and upkeep, earning a portion of rental income. This article delves into Condotel Financing Mortgage Guidelines, covering condotel loans and their associated requirements. Click here for apply for Non-Qm mortgage Loans

Downturn Of Condo Hotel Market After The 2008 Housing Crisis

Condotel unit values plummeted during the real estate, banking, credit, and financial collapse of 2008. However, condotels have seen a steady increase in value, and this year, condotel units have skyrocketed to double-digit increases in some areas of Florida. One of the main factors why condotel units have not kept up with other property appreciation.

This is due to the fact that condotel financing has come to an abrupt halt after the real estate and financial collapse of 2008.

Demise Of Condotel Financing After Real Estate Meltdown

Before the real estate market crash, many banks and mortgage bankers offered financing options for condotels. However, nowadays, many owners of condotel units have taken out loans from big banks such as Wells Fargo, Chase, Citibank, and Bank of America, as well as local, regional, and national banks, but at high interest rates.

However, these banks and lenders will not consider refinancing condotel units as part of Condotel Financing Mortgage Guidelines. This stance remains unchanged, regardless of timely payments or other asset accounts held with the institution.

The Best Condotel Mortgage Lenders

Gustan Cho Associates specializes in Condotel Financing Mortgage Guidelines in the United States. They assist first-time homebuyers, vacation home/second home condotel buyers, and investors interested in purchasing multiple condotel units for their investment portfolio.

Primary and Second Home Condotel Financing Mortgage Guidelines

If you’re seeking Condotel Financing Mortgage Guidelines, you’ve come to the right place. Gustan Cho Associates offers a range of condotel mortgage options, including a 30-year portfolio loan available as a 3/1 ARM, 5/1 ARM, or 7/1 ARM.

The initial rates are fixed for the first 3, 5, or 7 years, after which they adjust annually based on the Cost Maturity Index (CMT) plus a 3.0% fixed margin rate. It’s important to note that the adjustment rate cannot fall below the starter rate, which is determined by current market conditions and will be confirmed upon locking the condotel financing mortgage.

What is Bank Financing in Condo?

Bank financing in condos refers to obtaining a mortgage loan from a traditional bank or financial institution to purchase a condominium unit. This type of financing involves several key considerations.

The bank must typically approve the condo project, ensuring it meets certain criteria, such as financial stability and insurance coverage. Borrowers should be prepared for a higher down payment requirement than single-family homes, often ranging from 3% to 20% or more.

Interest rates on condo loans are influenced by factors like credit score and loan program, with borrowers having options such as fixed-rate or adjustable-rate mortgages. The underwriting process for condo loans is thorough, assessing credit history, income, debt-to-income ratio, and employment stability.

Additionally, banks consider HOA fees and special assessments and require an appraisal to determine the property’s value. Borrowers should also budget for closing costs, including loan origination fees and title insurance. Navigating bank financing for condos requires attention to detail and collaboration with lenders and real estate professionals.

Loan To Value Guidelines on Condotel Financing

The loan-to-value (LTV) ratio for condotel financing mortgage loans allows up to 75% LTV on purchases and refinances. Cash-out refinance condotel mortgage loans also have a maximum LTV of 75%. It’s important to note that this 75% LTV applies specifically to primary homes, second homes, and investment properties.

Investors with two or more properties are categorized as investors. The LTV cap is now set at 60% for investment condotel financing. These changes represent an increase from the previous caps of 75% LTV for primary, second, and vacation homes and 60% LTV for investment condotels.

Speak With Our Loan Officer for Mortgage Loans

Condotel Financing Credit Requirements

To meet the Mortgage Guidelines for Condotel Financing, a FICO score of at least 680 is required and exhibit one year’s worth of reserves, which can include pension funds, investment accounts, or documented assets, for both their primary residence and for the purchase of the Condotel.

Additionally, a maximum back-end debt ratio of 40% is required. If the borrower lacks sufficient wage income, alternative income sources can be considered, such as using the asset depletion program, where a portion of the borrower’s assets can be utilized for income qualification purposes.

Condo Hotel Building Guidelines

To meet Condotel Financing Mortgage Guidelines, the condo-hotel complex must be free of major building or structural issues and not be financially distressed. Additionally, any structures or buildings related to the condo hotel must not be under bankruptcy protection or involved in significant pending litigation.

Those interested in purchasing a condotel unit that meets these guidelines should contact us at Gustan Cho Associates. You can call us at 800-900-8569 or text us for a quicker response. Alternatively, you can email us at alex@gustancho.com . Our team is available seven days a week, including evenings, weekends, and holidays, to assist you.

Warrantable Condo Versus Condotel Mortgage Guidelines

Condotel Financing Mortgage Guidelines are experiencing a resurgence, along with NON-QM Loans. A Condo-Hotel refers to a Condominium within a Hotel Complex, overseen by the Condo Hotel Complex Homeowners Association (HOA) managing all condotel units.

Condotel owners enjoy the luxury of owning and occupying their units during vacations, with the added benefit of renting out their Condo-Hotel units when not for personal use.

Condo Hotel Concept Versus Warrantable Condominium Complex

To grasp the condotel concept fully, it’s crucial to grasp some basics of real estate operations. Hotels are familiar to most people, where owners or businesses rent rooms for a fee. Condotel Unit Owners can reside in Condotels as their primary residences. This understanding lays the foundation for comprehending Condotel Financing Mortgage Guidelines.

Condo Hotel Unit As Primary Or Second Home

Meanwhile, condos are generally sold as homes or second homes. Buying a condo is like buying a house. The owner does not pay rent to anyone. The intention behind the condotel is to mix these two forms of real estate to make something that is the best of both worlds. They have all the luxury of a hotel, but the buyer owns them outright.

What Are NON-QM Loans?

NON-QM Loans are portfolio loans that are also called non-conforming loans. Bank Statement Mortgages for self-employed borrowers are considered NON-QM Loans. Condo Hotel Unit Buyers and NON-WARRANTABLE Condominium Buyers who cannot show income or are self-employed can qualify for 12 months or 24 months of banks statements loans. Mortgage rates are higher and a 20% down payment is required. Speak With Our Loan Officer for Non-Qm Mortgage Loans

Condo Hotel Ownership

Owning a condotel gives the buyer all the perks of staying in a hotel of the same brand. So the buyer gets room service, maid service, and a concierge. He or she also has use of all the hotel amenities like the pool and fitness center.

What is Condotel Investment?

A condotel investment involves owning a condominium unit that is managed and operated like a hotel, offering amenities and services to guests. By renting out their units, investors can earn income while offering travelers hotel-like experiences. This allows them to benefit from the property’s appeal to renters looking for a temporary home away from home.

While condotel investments can provide a source of passive income and potential for profit, they also come with risks such as market fluctuations, financing challenges, and regulatory considerations. Investors should conduct thorough research, evaluate market demand, understand legal aspects, and consider factors like location and management reputation before pursuing a condotel investment opportunity.

Risks with Condo Hotel Investments

There are some drawbacks to this sort of investment. No one can guarantee that the owner will make money through the rental process. After buying the room, paying any maintenance fees, and giving the hotel its percentage of the rental, there may be little money left. Also, local laws may prohibit the owner from living in the hotel for more than a certain number of days every year.

Qualifying For Condotel Financing Mortgage Guidelines

Word is out that Condotel mortgage loans are back in full force in the United States, especially in Florida, California, Texas, Georgia, Illinois, Michigan, Ohio, Kentucky, Colorado, New Jersey, Pennsylvania, and Mississippi. Florida condotel loans have been next to non-existent since the real estate and credit meltdown of 2008.

Most folks who own Condotels in Georgia, Texas, Colorado, Kentucky, Mississippi, New Jersey, Pennsylvania, Ohio, Michigan, California, Florida, and Illinois and have condotel loans have been stuck with their high-interest condotel mortgage loans

The majority of Florida Condotel unit owners and Illinois Condotel unit owners who have Condotel mortgages have their interest rates north of 8%. Many have been fruitlessly trying to refinance their Condotel loans over the past several years to no avail. No worries. I can help any Condotel unit owners refinance their Condo Hotel Loans

How To Qualify For Condotel Financing Mortgage Guidelines

As for those folks who dreamed of owning a Condotel unit for the past several years, they are in luck. Most folks who have been interested in buying a Condotel unit have given up due to Condotel financing being non-existent. Most Condotel unit sellers would not even entertain a Condotel purchase offer unless it was cash. Well, now that is not the case anymore. Condotel Financing is back and strong.

Qualify for Condotel financing Mortgage Loans

Condo Hotel Loans Available In All 50 States

I get dozens of Condotel financing inquiries each day from all over the United States and even out of the country. The problem I am running into now is that even though the Condo Hotel complex and the borrower are pre-approved for a Condotel loan, the sellers and selling real estate agents have a hard time believing that the potential Condotel buyer has secured pre-approval.

In almost all of the cases, I need to either speak to the Condotel seller or the selling agent and confirm that the potential borrower has been pre-approved for a Condotel mortgage loan.

Condotel Financing on Adjustable Rate Mortgages

Condo Hotel Loans are portfolio loans and are offered as 3/1 ARM, 5/1 ARM, and 7/1 ARM products. Condotel mortgage loans are amortized over 30 years and there are no prepayment penalties. There are lending guidelines and reserve requirements.

Investment Condo Hotel Loans

For condotel unit buyers who do not qualify due to poor credit or not enough income, there are alternative financing available. The team at Gustan Cho Associates now offers condotel mortgage loans for investment home buyers. We are correspondent lenders with investors who are the largest and most reputable private money lenders in the United States.

Investment Condo Hotel Loans require a 60% loan to value. Closing is normally done in 3 weeks or less. Condotel Buyers who have any questions on Condotel mortgage loans, please feel free to contact Gustan Cho at 800-900-8569 or text us for a faster response. Or email Gustan Cho Associates at gcho@gustancho.com.

Related> Condo Hotel Mortgage Lender

Condotel Mortgage Loan Programs And Lending Guidelines

A condotel unit is a condominium unit within a hotel complex which are individually owned by private owners. For example, a large 20-story hotel can have three floors of condominium units reserved for private individual owners. These condominium units are called condotels or condo hotel units. A condotel unit owner has full ownership of the individual condotel unit.

However, the condotel unit owner needs to abide by the rules of the condo hotel homeowners association. Condotel units used to be extremely popular prior to the 2008 Real Estate and Credit Collapse. After the 2008 Real Estate and Mortgage Meltdown, condotel financing became extinct.

Can Condotel Units Be Financed?

Most condotel unit buyers could only purchase condotel units with cash only. This was because there was no condotel financing available. The great news is that condotel financing is back. However, not too many folks know about condotel financing. Many condotel unit sellers are leery if a potential condotel buyer has a pre-approval letter.

Gustan Cho Associates Mortgage Group offers various Condotel Mortgage Loan Programs.

Rates And Terms On Condotel Mortgage Loans

Condotel financing is portfolio loans. Portfolio loans are loans that lenders keep on their books. Lenders do not sell them on the secondary market. Prior to the 2008 Real Estate and Credit Collapse, many banks and mortgage companies offered financing on condotel units with 30-year fixed rate condotel loans or 15-year fixed rate condotel loans.

Unfortunately, there are no more 15-Year or 30-year fixed rate condotel financing loans available in today’s market. This is because condotel loans are non-conforming loans. Cannot be sold to the secondary market or to Fannie Mae and/or Freddie Mac.

Condotel Financing Mortgage Options

Condotel mortgage loans are 30-year adjustable-rate mortgages, also called ARMs. Adjustable Rate Mortgages are 30-year loans. They are fixed for a certain period and after that certain fixed-rate period is over, the mortgage rates will adjust. Will adjust every year for the duration of the 30-year condotel loan term. These loans are not balloon mortgages.

Balloon mortgages expire at a certain amount of time and need to either be paid off in full or need to be refinanced. Condotel unit owners do not have to worry about refinancing. Mortgage rates may adjust every year after the fixed-rate period is over.

Fixed-Rate Versus ARMs on Condotel Mortgages

Adjustable Rate Mortgages are 30-year mortgage loans. It has an initial fixed-rate period and after that fixed-rate period is over, the mortgage rates can adjust every year for the duration of the 30-year loan term. The adjustment of the mortgage rates after the fixed-rate period is over is based on the index and margin.

The margin is constant and the index is based on the one-year treasuries, which are the Cost Maturity Treasuries, often referred to as CMT. Currently, the one-year treasuries are almost at zero. The CMT is viewed as the most conservative index. We offer the 3/1 ARM, 5/1 ARM, and 7/1 ARM.

How Do Adjustable Rate Mortgages Work?

How these adjustable-rate mortgages work is as follows:

- Let’s say that the starter rate on a 3/1 ARM is 4.5%

- This means that the condotel unit borrower will have a 4.5% fixed rate for the first three years of their condotel loan

- Starting year number 4, the mortgage rates will adjust every year based on the one-year treasuries, CMT, plus the margin, which is currently at 3%

- The margin will remain constant for the 30-year loan term

- How the new rates work starting year number 4 is by adding the index to the margin and that will yield the new mortgage rate on the condotel loan

- However, the new rate cannot be lower than the starter rate which was 4.5%

- Our condotel portfolio investor realizes that since the index is based on the CMT that the newly adjusted rate will be lower than the starter rate of 4.5%

- If based on today’s CMT, the new rate on year #4 when it adjusts, it will be slightly above 3.0%

- 3.0% is lower than the starter rate of 4.5% so the newly adjusted rate on year #4 will be 4.5% since the new rate cannot be lower than the starter rate

The U.S. one-year treasuries need to go over 1.5% in order for the new rate to be over the starter rate of 4.5%.

Cap On Adjustable Rate Mortgage Programs

The 2/2/6 is the cap to our Adjustable Rate Mortgage Programs. The best way to explain how this works is by example. For example, let’s say you’re doing a loan on a 5/1 arm program with a Start Rate of 4.50%. This would be fixed at 4.50% for the first 5 years. After the 5-year fixed period, the initial adjustment CANNOT increase by more than 2.0%, putting the max rate at the adjustment period at 6.5%. There are the first 2 on 2/2/6

Now, thereafter each year, the rate CAN NOT increase by more than 2.0%, with a max lifetime cap of 6.0%. This is displayed by the second 2 and the 6 is the last digit on the 2/2/6. Meaning, that after the 5 year period, if the rate were to increase each year by 2.0%, then it would take 3 years for the cap of 6.0% to be reached, putting the maximum rate at 10.50%. Click here to find a lender for Mortgage Loans

Condotel Loan Versus Non-Warrantable Condo Financing

A Condotel is a condominium unit in a hotel and it is extremely popular in Florida. Many lenders have ceased lending on condo hotel units after the real estate and credit collapse of 2008. Condotel Financing and Non-Warrantable Loan Programs are one of my areas of specialty in the mortgage business. Condotel financing mortgage guidelines on condotel and non-warrantable condos are similar.

Condotel mortgage programs are portfolio loan programs that have been booming in the past year. Most condotel buyers and realtors in the United States have been having a hard time finding lenders that specialize in condo hotel unit financing. In the following paragraphs, we will cover and discuss Condotel Loan And Non-Warrantable Condo Financing.

Primary And Second Condotel Condominium Financing

Our new condotel program guidelines are now offering up to a 75% loan to value on primary, second homes, and vacation homes for condotel purchase loans, condotel refinance loans, and condotel cashout refinance loans. Our previous minimum loan to value on the purchase, refinance, and cashout refinance condotel loans were set at 70%. This extra increase 5% increase on condotel loans will open up doors to more condotel loan borrowers

Condotel Loan Update On Investment Condotel Units

There are separate condotel financing mortgage guidelines for investment condo hotel condominium units. For condotel borrowers who have investment condotels and not second or vacation home condotel units, our previous maximum investment condotel purchase loan and investment refinance/cashout condotel program had a maximum cap of 50% loan to value.

The great news is that we have increased the loan to value cap to 60% loan to value from 50% loan to value on investment condotel mortgage programs.

How Do I Qualify For A Condotel Loan?

There are two phases in our Approval Process. The first is that the condo-hotel project needs to be qualified. There is a one-page condotel questionnaire form that needs to be completed by the Homeowners Association Manager. The purpose of this questionnaire is to make sure that the subject Condo Hotel has no structural issues, or building code violations, and is in decent financial shape.

If the Condo Hotel project has major structural building code violations or is under bankruptcy, the Condo Hotel unit will not qualify. This condotel questionnaire will get reviewed and approved within 24 hours of submission of the condotel questionnaire form.

Can You Mortgage Something You Do Not Own?

No, you generally cannot mortgage something that you do not own. A loan secured by real estate property, such as a house or land, is called a mortgage. The borrower (mortgagor) pledges the property as collateral to the lender (mortgagee) until the loan is fully repaid. This means the borrower must have legal ownership or a significant legal interest in the property to obtain a mortgage.

Attempting to mortgage something you do not own or have legal rights to can lead to legal issues and is considered fraudulent. Mortgage lenders typically require proof of ownership or legal rights to the property before approving a mortgage application. This ensures the property can be used as collateral to secure the loan.

In real estate transactions, it’s essential for all parties involved to verify ownership rights and legal standing before initiating mortgage arrangements or any financial transactions related to the property.

New Updates On Condotel Guidelines

The second phase is that the borrower needs to be qualified. This is done by borrowers applying online here at www.gustancho.com and clicking the APPLY NOW icon on the top right of this website. It is the 1003 mortgage application. I will then review the application and run a credit check. The minimum credit score required is 680 FICO, max 40% debt to income ratio. Reserves for both the borrower’s main residence as well as the subject condotel unit.

Condotel Financing Mortgage Guidelines and Eligibility Requirements

Most condotel financing mortgage guidelines by condotel portfolio lenders are similar. There are two different types of condotel financing mortgage guidelines: The condotel financing mortgage guidelines of the borrower and the condotel financing mortgage guidelines of the condo hotel complex.

The condotel unit needs to have a functional kitchen and at least one bedroom and be at least 500 square feet. Most condotel mortgage loans range between $100,000 to $3,000,000. Most condotel loans close in less than 30 days from the date we receive the condotel borrower’s signed application. Required documents such as two years of tax returns, recent paycheck stubs, two months’ bank statements, and other income/asset documentation need to be provided.

FAQs: Condotel Financing Mortgage Guidelines

1. What is a condotel, and how does condotel financing work? A condotel is a condo unit within a hotel complex. Condotel financing allows buying these units with mortgage loans, subject to credit score, debt-to-income ratio, and property criteria.

2. What are the key qualification requirements for condotel financing? Minimum credit score of 680 FICO, max 40% debt-to-income ratio, and adequate reserves. The condo unit must meet specific criteria.

3. Can investors obtain condotel financing for investment properties? Yes, investors can get condotel financing, but terms may vary for investment properties compared to primary or second homes.

4. How do adjustable-rate mortgage (ARM) programs work for condotel financing? ARMs in condotel financing have fixed-rate periods followed by adjustable rates based on an index like the Cost Maturity Index (CMT) plus a margin.

5. Are there specific lenders specializing in condotel financing? Yes, there are lenders specializing in condotel financing. Borrowers should research reputable lenders familiar with condotel mortgage guidelines.

Related> Florida Condo Hotel Mortgage Lender

Interested in r/t refi on non warrantable, high rise, investment condo. $1.25M value, $625k loan amount2..

Hello Vivian, I have niche programs for self-employed and for nationals no income verification to purchase non-warrantable properties and condotels.

Good afternoon,

I am a recently divorced mother of two young girls. I am trying to figure out where to start with fixing my credit report so I can qualify for a mortgage and buy a house for my daughters and I. I have looked into financial counseling, financial advising, credit repair, and I am currently enrolled in a debt settlement program. It is the third debt settlement program I have tried. The debt settlement programs have completely destroyed my credit score. While it wasn’t stellar before I started with the settlement programs, my score was about 640 in January 2020. Now, it is about 420, with a ton of collections, charge offs….I want to work on fixing my report solely to buy a house, and I don’t know where to start. The only reason the debt became a problem was because my ex husband left it all with me during the divorce. It was not all my debt but was in my name. I’m not sure what to work on first.

I make a really good salary, so I do have that going for me. If your company is licensed in Alabama, and you’d be willing to help me figure out what I need to do, I would be forever grateful. I’d even pay you for it. I am a financial idiot and have no idea.

Thank you in advance for your help.

I have been renting for years, and want to purchase my own home. I currently pay 1095.00 in monthly rent, any assistance from you company would be greatly appreciated.

This is a really wonderful post. I would definitely recommend it to others. My credit score is 582 I was trying to get a loan thru the loan depot but I have child support arrears now I pay them weekly they were 60000 in 2017 now they are at 13000 I really need help to get a loan to buy my first home

Hello Ellie. I have niche NIV (No Income Verification) programs for self-employed AND Foreign Nationals with untouchable pricing for Condotels. That’s factual; not a pitch.

Looking to pre qualify for a home loan for approximately $2,000,000 with 5% down & bank statements.

I’m currently in chapter 13, I’ve been in for 2 years paying directly monthly on time. looking for fha loan.

I really appreciate it because this is helpful and knowledgeable.Would like to know what the criteria is for chapter 7 discharged 05/09/2021

I currently have a FHA mortgage loan and would like to refinance to VA loan. I am veteran and have VA home loan ability. I am currently in Chapter 13 but my home loan is not part of the chapter 13. So I have been paying the home mortgage payments directly and not chapter 13 trustee. I will be completed with my chapter 13 requirement by Dec 2021. Is this possible or do I need to wait till my chapter 13 is completed?

Hi Gustan –

My name is Bill Kennedy and I located you via your website blog!

A little about me. I am a current Sr. Software Executive that is extremely successful! Due to my success, I have had the opportunity to invest in real estate.

I really would like to go full-time into real estate and would like to get licensed as an MLO in addition to continuing to invest. I understand if I take the class independently, I would need to find a sponsor before having my license issued.

I’d love to connect with you regarding working for your firm. Essentially, I am looking to establish sponsorship prior to me investing in this new journey.

Feel free to reach me on my cell below or let me know the best time to give you a ping! I am currently located in Austin, TX on CDT.

I look forward to connecting with you.

With Gratitude,

You don’t need a sponsor to get licensed. Go to http://www.loanofficerschool.com and talk to David Reinholtz. He will guide you through the licensing process