In this article, we will cover condotel and non-warrantable condo financing guidelines. Condotel and Non-Warrantable Condo Financing are portfolio loans. Portfolio loans are non-conforming loans.

Lenders funding the loan normally hold the loan in their investment portfolio and do not sell it on the secondary mortgage market. Portfolio loans do not follow Fannie Mae and Freddie Mac Agency Mortgage Guidelines. Each portfolio lender has its own mortgage guidelines. In the following paragraphs, we will cover condotel and non-warrantable financing guidelines.

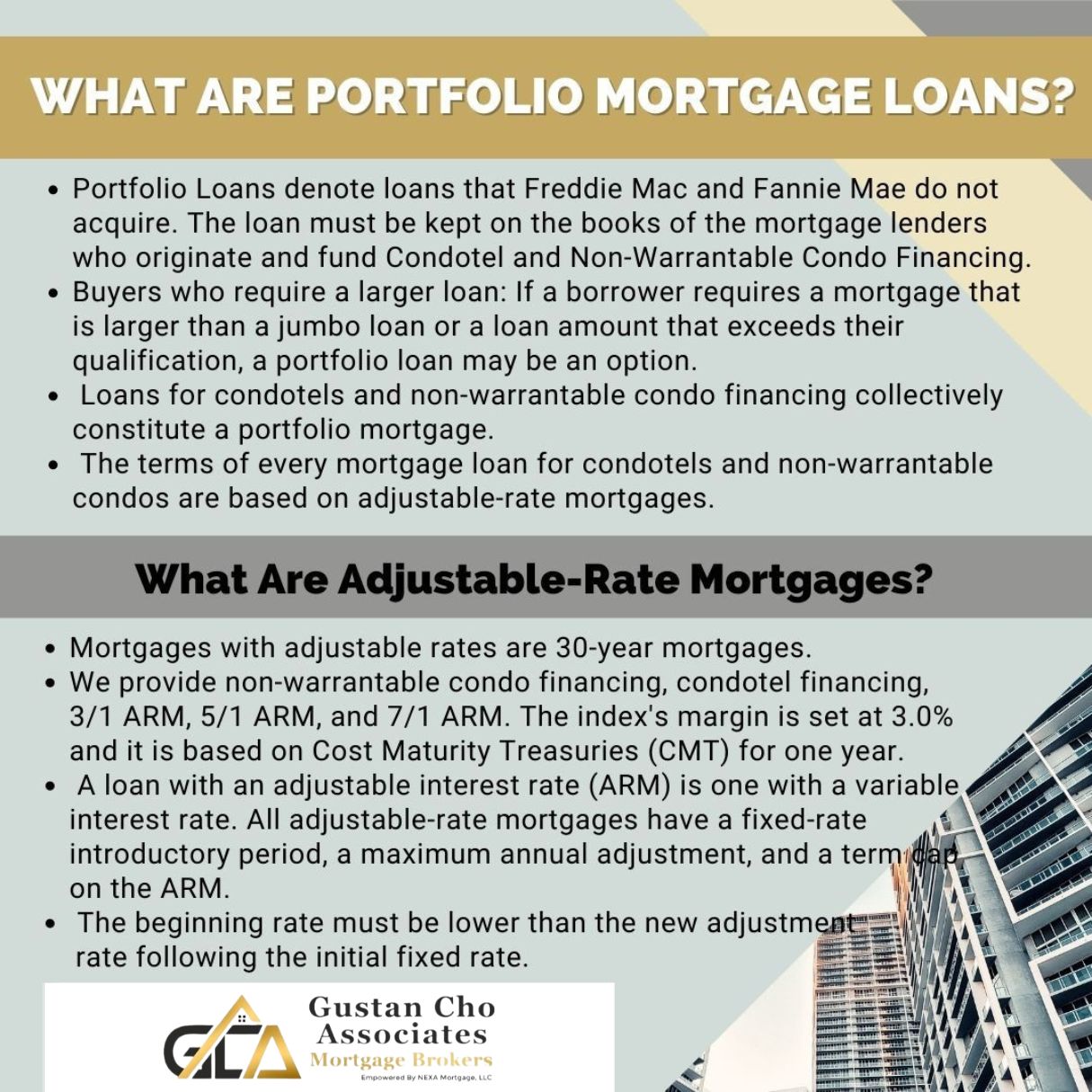

What Are Portfolio Mortgage Loans?

Portfolio Loans mean that Fannie Mae and Freddie Mac do not purchase them. Mortgage lenders who originate and fund the Condotel and Non-Warrantable Condo Financing need to keep the loan on their books.

All Condotel and Non-Warrantable Condo Financing loans are portfolio mortgage loans. All condotel and non-warrantable condo financing mortgage loan terms are based on adjustable-rate mortgages, ARM.

What Are Adjustable-Rate Mortgages?

Adjustable-rate mortgages are 30-year mortgages. We offer 3/1 ARM, 5/1 ARM, 7/1 ARM Condotel, and Non-Warrantable Condo Financing. The index is based on the one-year treasuries, Cost Maturity Treasuries ( CMT ), and the margin is set at 3.0%.

All adjustable-rate mortgages have an initial fixed-rate period, a maximum annual adjustment, and a cap on the ARM over the loan term. The new adjustment rate after the initial fixed rate cannot be lower than the starter rate. This article will cover and discuss the financing options for condotel and non-warrantable condos.

Underwriting Update on Condotel and Non-Warrantable Condo Financing

There are two parts of underwriting a Condotel unit and Non-Warrantable Condo Financing. First, the Condotel or Non-Warrantable Condominium Complex needs to be approved. Our investor does not want any pending large lawsuit against the Condominium Homeowners Association that is structural in nature. Or does not want to approve a condominium complex under bankruptcy or financial stress.

No substantial building violations that involve structural issues. The condominium complex needs sufficient reserves. No more than 10% of the condotel and non-warrantable condominium units can be under foreclosure. No more than 10% of the condotel and non-warrantable condominium owners can default with their homeowners’ association dues.

Condo Unit Requirements

To get a condotel unit or non-warrantable condominium unit approval, the condotel unit or non-warrantable condominium unit needs to be the following:

- at least 500 square feet

- have at least one bedroom

- have a fully functional kitchen

- The minimum loan size for both condotel and non-warrantable financing is $100,000

Condotel Loan Guidelines

To qualify for condotel financing, here are the requirements:

- The minimum down payment is a 25% down payment if the proposed condotel purchase is the borrower’s primary or second home. If the condotel mortgage loan borrower has a primary home, a second home

- If the condotel purchase is the third home, then the subject condotel purchase will be considered an investment condotel purchase.

With investment condotel purchases, a 40% down payment is required.

Non-Warrantable Condominium Guidelines

Non-Warrantable condominiums are condominium complexes where 51% or more of the units are non-owner occupant units and do not meet Fannie Mae and Freddie Mac’s conforming lending guidelines. A 20% down payment is required for non-warrantable condominium purchases as long as it is the borrower’s first or second home. A 40% down payment is required if the non-warrantable condominium is an investment property.

Condotel And Non-Warrantable Condo Financing Borrowers Requirements

To qualify for condotel and non-warrantable condominium financing, the minimum credit score required is 680 credit scores. Condotel and Non-Warrantable Condominium portfolio lenders will require one-year reserves. Reserves required are for every property the borrower owns, including the condotel and non-warrantable condominium purchase. The reserves do not have to be in cash.

It can be in stocks, bonds, and retirement accounts. The maximum debt-to-income ratio allowed is 43% DTI. No bankruptcy, foreclosures, deed-in-lieu of foreclosures, or short sales in the past four years.

Detached condo. New construction. Closing date 3/4/2021.

Just found a collection account on my credit report which is not mine. It dropped my score from 757 to 659 in 1 day. Submitted a dispute to Equifax. Received a letter from the company( Southern California Edison) stating they linked the collection account incorrectly to my name. In this case, can the dispute I made still stop me from getting a mortgage?