In this article, we will cover and discuss becoming a loan officer with your own independent branch with NEXA Mortgage, LLC. If you would have told me 2 years ago that I would be studying to becoming a loan officer, I would have chuckled and thought you were crazy. Now fast forward to today and I am about 24 hours away from going to take my NMLS SAFE MLO National Test w/ UST.

>Becoming a loan officer is similar to opening your own business. If you decide you want your own practice as a doctor, lawyer, and accountant, you need to have your own office and cover your own business expenses. All loan officers at NEXA Mortgage, LLC has the opportunity to become an independent loan officer branch manager with their own P and L which we will explain in later paragraphs. We will go over the various career options we have for you.

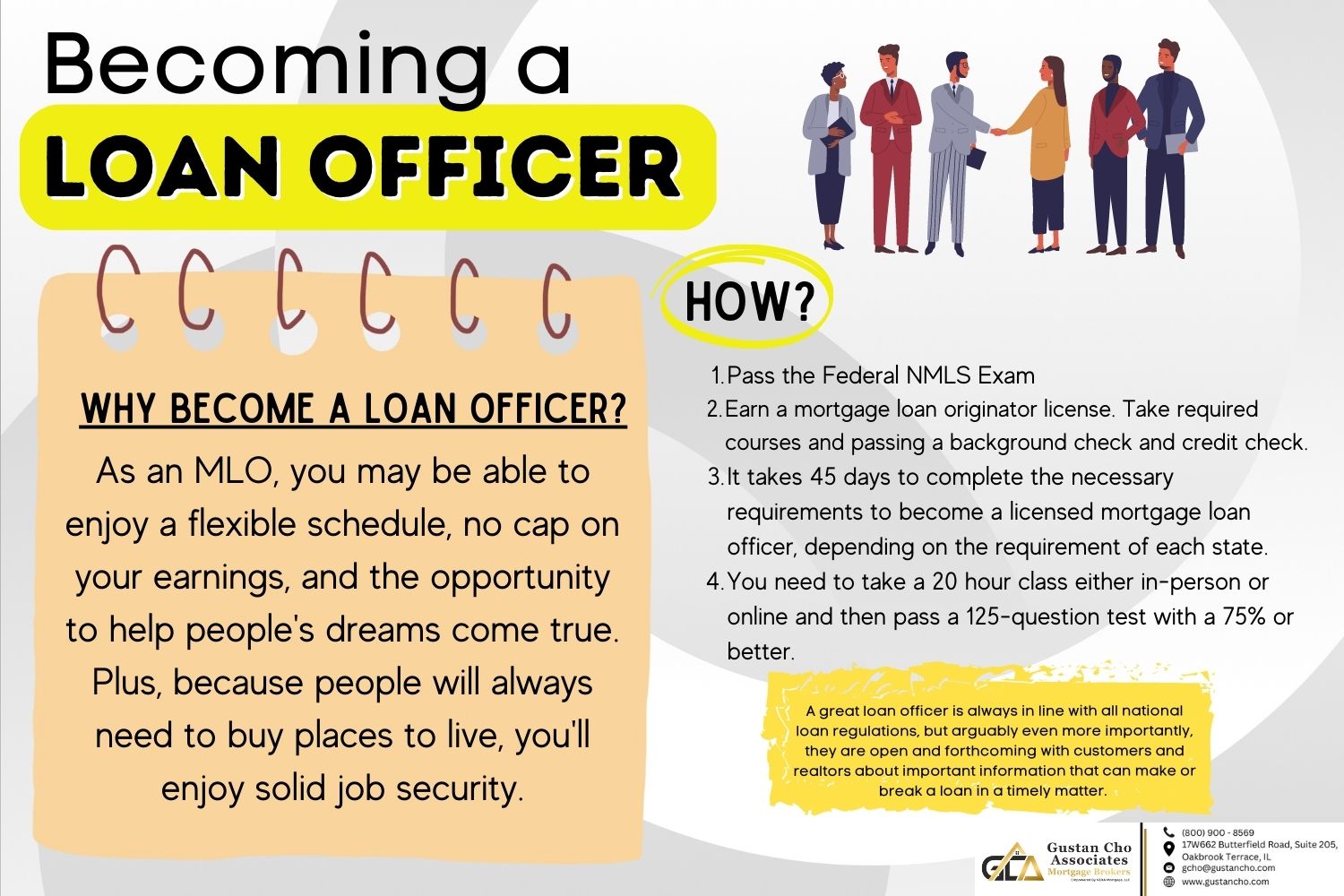

Is Becoming a Loan Officer For a Career Worth It?

I have come a long way in a short time. I have been following the blogs at Gustan Cho Associates and its subsidiary sister sites such as Gustan Cho Associates Mortgage Group, Non-QM Mortgage Brokers, Mortgage Lenders For Bad Credit, FHA Bad Credit Lenders, Best VA Mortgage Loans, Jumbo Mortgage Loan Options, and Preferred Mortgage Rates. The wealth of information I learned was priceless over the years.

Becoming a loan officer at Gustan Cho Associates is energizing, learn a lot, never a dull minute, and everyone has the opportunity to make six or even seven figure income. It does take time to get started in the mortgage business as a licensed mortgage loan originator.

Is Taking and Passing The Federal NMLS Exam Becoming a Loan Officer Hard?

All I can tell you about passing the NMLS exam and the pre-licensing course to become a licensed mortgage loan originator is not easy but not impossible. You do have to study and study hard. I am going to give you insight into why I am taking this route. A little background on me, I have been in car sales and auto finance by trade for over 20+ years of experience. I have held numerous management roles along the way.

I have worked for some of the biggest auto dealerships and other small “mom and pop” buy here pay here lots. The goal has always been the same, to challenge myself and give everything 100%. In this article, I will be covering and discussing what made me become a loan officer at Gustan Cho Associates and my due diligence process in making a decision why Gustan Cho Associates Mortgage Group was the employer of choice for my next career move as a licensed NMLS mortgage loan originator.

How Do MLOs Start Out?

When I was stuck in a rut trying to get pre-approval from lenders to purchase a new home under the FHA Back to Work Loan Program, there was 1 person who went above and beyond to get me pre-approved and in my new home.

His name is Gustan Cho of Gustan Cho Associates. He took the best care of me and was available at any time of the day I needed him.

How Long Does It Take To Become a Mortgage Loan Officer?

Being an accountant by trade, I know I was probably a big pain given my nonstop emails and calls due to the fact I researched this program, knew the numbers, and how I would get approved for a loan. Once we closed on my loan, Gustan Cho and I got on a 60+ minute phone call where Gus told me he thought I had what it takes to cut it as a mortgage loan officer.

I was a very detailed person who handled client interaction very professionally. I personally had the desire to help people just as Gus had taken care of me. Our conversation always stuck in the back of my mind, but in moving to my new phone and life going 100 mph, it was the 4th quarter of 2015 and nothing had progressed. This is when I came to the conclusion that I needed to dedicate myself to this before time completely passed me by….

Pulling The Trigger In Becoming a Loan Officer

In March 2022, I had a heart-to-heart sit-down job interview with Gustan Cho, the National Managing Director of Gustan Cho Associates. It did not take me long to do the interview working with Gustan Cho Associates was for me. Fate brought me here. I knew it was time for me to get this done. I began to start my new career training process.

To become a loan officer you need to take a 20 hr class either in-person or online and then pass a 125-question test with a 75% or better. I found a 20-hour class I could do online and at my own pace with Mortgage Educators. After 2 weeks time, it was 3 days before Christmas and I had completed the course. Now it was time for me to begin my study preparation for the test. To date, I have completed about 1,400+ questions and am averaging 83% which is good enough to pass.

Excitement About Becoming a Loan Officer

Becoming a loan officer is more than just inputting borrower’s info into a computer and spitting out a loan, anyone can do this with 800 credit scores and plenty of cash reserves. My focus is just the opposite and that is I want to help people who may have come across some hard times and are back on their feet. These people, just like myself deserved a 2nd chance and I want to take care of them. My feeling is that I have lived through tough times.

What Makes a Successful Mortgage Loan Officer?

I can have an instant connection with potential borrowers I may come across. I feel this will give them the comfort they are looking for after getting turned away by the big banks. If I can help just 1 person,

My job will be complete, but my goal is to help hundreds of people make their dreams come true. I can rest easy at night knowing I am producing some good in this world we live in. Now all I have to do is pass the test!