In this article, we will cover FHA appraisal guidelines and property checklists for 2023 on FHA loans. We will cover the FHA appraisal guidelines and requirements and compare them to conventional loan appraisals and note the major differences.

Many sellers and realtors prefer selling their homes to buyers who have conventional versus FHA loans. In the following paragraphs, we will cover FHA appraisal guidelines on FHA home loans.

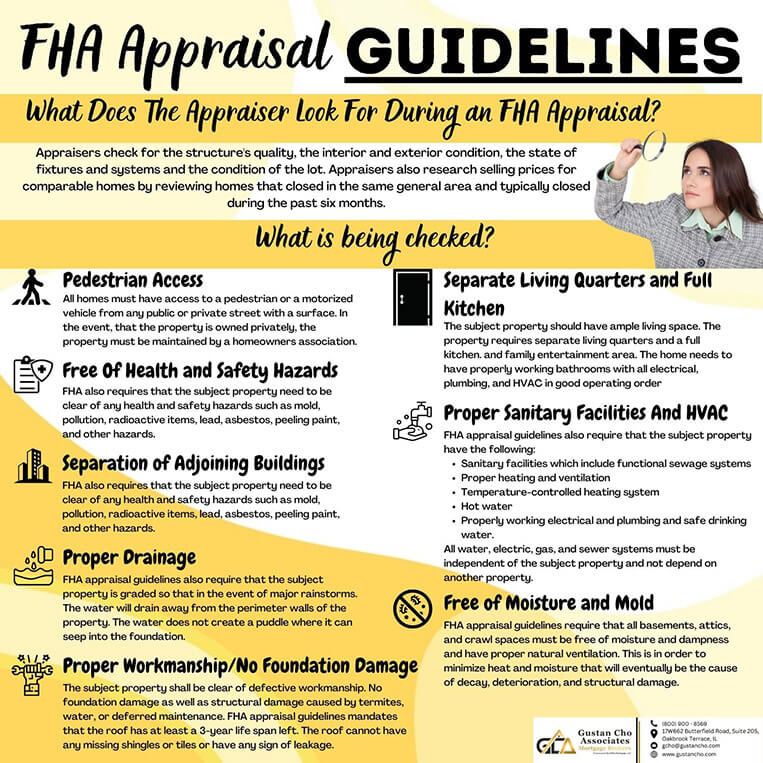

What Does The Appraiser Look For During an FHA Appraisal?

In the past, FHA appraisal guidelines were much stricter than conventional loan appraisals. However, nowadays, FHA appraisals and conventional appraisals are similar. There are more checklists on FHA appraisals than there are on conventional appraisals.

The Federal Housing Administration will not insure a residential home that does not meet the basic safety requirement of their FHA appraisal guidelines. In this article, we will cover and discuss Appraisal Guidelines On FHA loans versus Conventional guidelines.

Basic Minimum FHA Appraisal Guidelines

The comparison between conventional versus FHA appraisals is not that much different. If the house is not safe with broken glass and peeling paint, the appraiser will fail the conventional loan appraisal as well. FHA appraisals used to be much more strict back in the day.

If the appraiser fails an FHA appraisal, the appraiser will note it on his report and the buyer has the chance to get it fixed for a reinspection. An FHA-insured residential home must be habitable and in-live in conditions with no building or code violations. The property must have accessibility. Cannot have the encumbrance of an adjoining property via public ways. In the event, that the residential property is not directly accessible by public ways, there needs to be an easement with the property providing direct access.

Pedestrian Access FHA Appraisal Guidelines

All homes must have access to a pedestrian or a motorized vehicle from any public or private street with a surface. In the event, that the property is owned privately, the property must be maintained by a homeowners association.

Or by an agreement with other private homeowners.

Free Of Health and Safety Hazards FHA Appraisal Guidelines

FHA also requires that the subject property need to be clear of any health and safety hazards such as mold, pollution, radioactive items, lead, asbestos, peeling paint, and other hazards.

Hazards also include faulty wiring, electrical, plumbing, and heating and air conditioning systems that are visibly noticeable to the FHA appraisal during an inspection. In the event, that the FHA appraiser finds such hazards on the subject property, the violation in question needs to be corrected and a re-inspection needs to be scheduled.

Separation of Adjoining Buildings

FHA appraisal guidelines also mandate that the subject property’s structures be separated from the adjoining buildings via a wall that is of full height.

In the event, that the wall is an outermost exterior wall, appraisal guidelines mandate that there should be ample space in between the buildings. The reason is so that it has enough clearance to be able to perform wall maintenance if required to do so.

Proper Drainage

FHA appraisal guidelines also require that the subject property is graded so that in the event of major rainstorms.

The water will drain away from the perimeter walls of the property. The water does not create a puddle where it can seep into the foundation

Proper Workmanship and No Foundation Damage

HUD guidelines also require that the subject property be clear of defective workmanship. No foundation damage as well as structural damage caused by termites, water, or deferred maintenance.

FHA appraisal guidelines mandates that the roof has at least a 3-year life span left. The roof cannot have any missing shingles or tiles or have any sign of leakage.

Separate Living Quarters and Full Kitchen

HUD guidelines also require that the subject property has ample living space. The property requires separate living quarters and a full kitchen. and family entertainment area.

The home needs to have properly working bathrooms with all electrical, plumbing, and HVAC in good operating order

Proper Sanitary Facilities And HVAC

FHA appraisal guidelines also require that the subject property have the following:

- Sanitary facilities which include functional sewage systems

- Proper heating and ventilation

- Temperature-controlled heating system

- Hot water

- Properly working electrical and plumbing and safe drinking water.

All water, electric, gas, and sewer systems must be independent of the subject property and not depend on another property.

Free of Moisture and Mold

All crawl spaces need to be easily accessible and clear of debris. These are just a few of FHA appraisal guidelines and in a way, it is a good thing. Conventional appraisal guidelines are similar to FHA appraisal guidelines. There is no lender that will approve a mortgage loan in the event that the appraisal report comes back with defective items on the property.

Transferring From one FHA Lender To Another FHA Lender

FHA Appraisals can transfer from one lender to another lender. In general, a home buyer cannot change a conventional loan appraisal to an FHA appraisal but if a conventional loan goes from a Conventional to FHA, it can easily be converted. An FHA appraisal can be transferred to any loan program such as conventional and non-QM loans. However, that is not the case with a conventional loan appraisal.

Related> Can I Transfer A FHA Appraisal Transfer From One Lender To Another