We will discuss and cover owner-occupant multi-family mortgage guidelines on two to four units. Any property between one to four units is considered residential properties homes. First-time homebuyers with goals of investing in real estate can start by buying a two-to-four-unit multi-family home as their first home.

Homebuyers can purchase an owner-occupant two-to-four unit multi-family home and live in one and rent out the rest of the units for rental income.

One of the great benefits of buying a two to four-unit multi-family home with an FHA loan is you only need to come up with a 3.5% down payment. This a great opportunity for homebuyers of two to four-unit multi-family property homes to have rental income. HUD, the parent of FHA, requires buyers of multi-family homes to occupy one of the units as their primary residence.

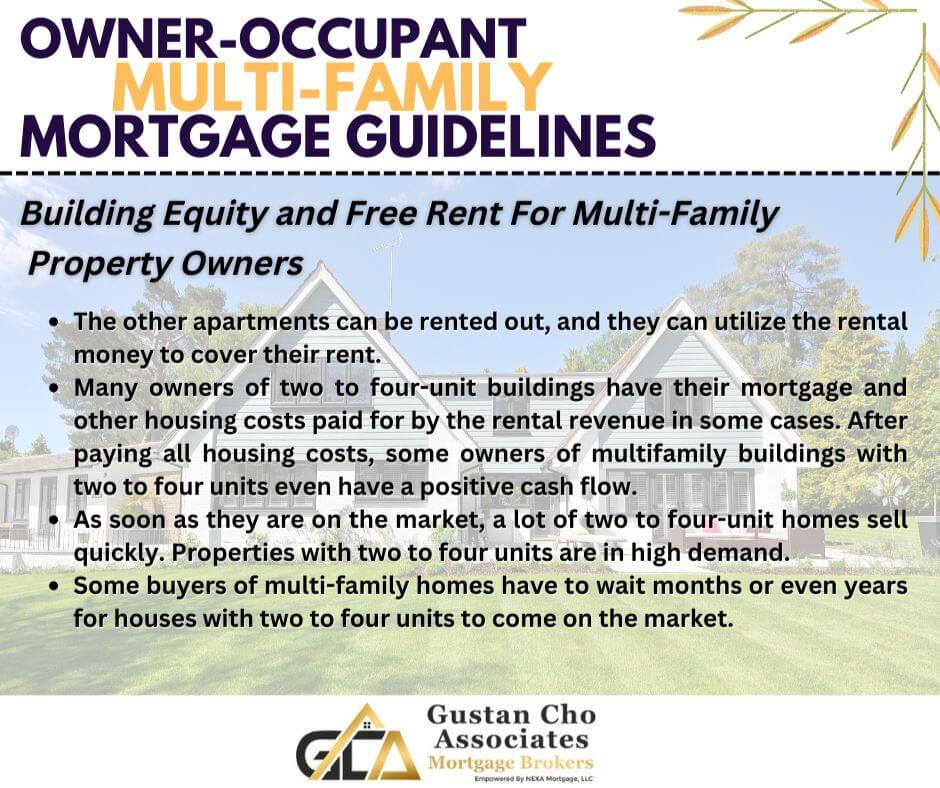

Building Equity and Free Rent For Multi-Family Property Owners

They can rent out the other units and use the rental income to pay their housing payments. There are instances where many owners of two to four-unit properties have their rental income pay for their mortgage and all other housing expenses.

Some owner-occupant primary homeowners of multi-unit properties are living rent-free. Some 2 to 4-unit multi-family owners even have positive cash flow after paying all housing expenses.

Many two to four-unit properties are selling fast when it hits the market. Two to four-unit properties are in major demand. Some multi-family unit homebuyers wait months or years for two to four-unit properties to hit the real estate market. Click here to get more about multi-family unit properties

Can I Qualify With No Landlord Experience?

Any multi-family unit property with less than four units is considered a residential home and is eligible for FHA financing. No rental experience is required to qualify for an owner-occupant two to four-unit multi-family building. Homebuyers and first-time buyers can qualify for owner-occupant financing on one to four-unit properties.

Government and Conventional loans have their own Owner-Occupant Multi-Family Mortgage Guidelines. Mortgage Guidelines will dictate the minimum down payment requirements. Mortgage Guidelines will also dictate whether or not borrowers can use potential rental income as qualified income.

Multi-Family Mortgage Guidelines Depends On Loan Program

Most buyers purchase two to four-unit residential buildings as rental properties. However, per Owner-Occupant Multi-Family Mortgage Guidelines, homebuyers can qualify for owner-occupant financing if they live in one of the units as their primary residence. Multi-Family Mortgage Guidelines are dependent on the loan program borrowers choose. There are Multi-Family Mortgage Guidelines and Lender Overlays. All lenders need to meet Owner-Occupant Multi-Family Mortgage Guidelines. However, it is up to an individual lender to have higher lending requirements.

What Are Lender Overlays?

These higher mortgage requirements above and beyond Owner-Occupant Multi-Family Mortgage Guidelines are called lender overlays. Gustan Cho Associates Mortgage Group has no lender overlays on government and conventional loans. Government Loans are FHA, VA, and USDA Loans. Fannie Mae and Freddie Mac Guidelines apply to conventional loans.

Owner-Occupant Multi-Family Mortgage Guidelines On Down Payment Requirements

Down payment requirements on owner-occupant financing are much lower than on investment properties. HUD, the parent of FHA, requires a 3.5% down payment on one to four-unit owner-occupant properties. All government loans are for owner-occupant financing. Per Fannie Mae-Freddie Mac Owner-Occupant Multi-Family Mortgage Guidelines,

Fannie Mae Down Payment Guidelines on Multi-Family Homes

Conventional Loans require a 15% down payment on two-unit properties. Fannie Mae-Freddie Mac allows investment property financing on conventional loans. Conventional Loans require a 25% down payment on an investment property 2 to 4-unit financing. VA Loans allows 100% financing on one to four-unit owner-occupant properties. Apply for Fannie Mae down payment on Multi-Family Homes

Down Payment Guidelines on USDA Loans

USDA Loans do not require any down payment like VA loans. Homebuyers can qualify for USDA on one-unit properties only with no down payment. However, borrowers need to meet USDA Mortgage Guidelines and the property needs to be in a USDA-designated area. USDA does not allow two to four-unit financing.

HUD Owner-Occupant Multi-Unit Mortgage Guidelines

HUD, the parent of FHA, requires an a3.5% down payment on all one to four-unit properties. FHA allows 85% of potential rental income to be used as qualified income on debt-to-income ratio calculations.

FHA loans come with stipulations when it comes to financing for multi-units. Potential rental income is derived from the home appraiser.

Two-unit properties require one month of reserves. Three to four units will require three months of reserves. One month of reserves includes principal, interest, taxes, and insurance. It is often referred to as PITI.

Owner-Occupant Multi-Family Guidelines On Conventional Loans

Freddie Mac Home Possible Conventional Loan Programs allow a 5% down payment on multi-family property financing. Freddie Mac Home Possible loan programs program allows as little as 5% for the down payment for 2-4 units with no income restrictions. Freddie Mac requires a 15% down payment on two-unit owner-occupant home purchases.

3 to 4 units require a 20% down payment. 2 to 4 unit non-owner occupant investment properties require a 25% down payment. Freddie Mac allows up to 75% LTV on cash-out refinance on owner-occupant properties. Investment properties cash-out Freddie Guidelines allow up to 70% loan-to-value.

Down Payment Requirement On Conforming Loans

Fannie Mae’s primary owner-occupant multi-family mortgage guidelines require a 15% down payment on two to four-unit multi-family homes. For those who want to put less down, it is best to see if they qualify for an FHA loan with a 3.5% down payment. 3 to 4 units require a 25% down payment. Investment properties require a 25% down payment on 2 to 4 units.

Homebuyers who intend to purchase 2 to 4-unit multi-family residential homes and do not intend on living there and renting out all of the four units would not qualify for the FHA multifamily loans.

Fannie Mae owner-occupant multi-family mortgage guidelines on cash-out refinance on 2 to 4-unit homes allow up to 75% LTV. 2 to 4-unit investment properties allow up to 70% LTV. Homebuyers can purchase two to four-unit multi-family homes with no money down and 100% financing with VA loans.

Choosing A Lender With No Overlays

Borrowers needing to qualify for owner-occupant multi-family mortgage loans with a national mortgage company licensed in multiple states with no lender overlays on 2 to 4 units can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com.

Gustan Cho Associates is a national mortgage company licensed in multiple states with no overlays on government and conventional loans. Gustan Cho Associates also offer non-QM, mortgage one day out of bankruptcy, bank statement loans, asset-depletion mortgages, P and L stated income loans, and alternative financing mortgage programs.

We are proud to have a national reputation as a one-stop lending shop for owner-occupant homes, second homes, investment properties, and commercial loans. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays. Click here to find a lender with no overlay

Multi-Family Residential Property Mortgage Loans

HUD allows 2 to 4 Unit Multi-Family Residential Property Mortgage Loans with 3.5% down. However, it only applies to owner-occupant multi-family residential property homes. It cannot be second homes or investment properties. Homebuyers can purchase 2 to 4-unit multi-family residential property homes with FHA loans.

HUD allows owner-occupant home buyers to purchase 2 to 4 Unit Multi-Family Residential Property Mortgage Loans in Illinois with a 3.5% down payment. One of the units needs to be the primary home of the multi-family property owner. The remainder residential units can be rented out. The following paragraphs will discuss and cover the guidelines for 2 to 4-unit multi-family homes.

Any residential multi-family residential property under HUD Guidelines is a two- to four-unit, zoned residential with no commercial space. If a property has commercial space, it is classified as mix-use, and would not be eligible for FHA loans.

FAQs Owner-Occupant Multi-Family Mortgage Guidelines

FAQ on 2 To 4 Unit Mortgage Loans: A common question I get asked by multi-family residential home buyers is if they need to be full-time occupants of the property. The answer to that question is a definite yes. HUD requires that the owner need to occupy the 2 to 4-unit property for at least a year.

The mission of HUD, the parent of FHA, is to make housing affordable to all Americans with less-than-perfect credit, higher debt-to-income ratios, and low down payments. They are only available to owner-occupied residential units, not second homes or investment properties.

After one year, the multi-family property owner can qualify for another owner-occupant Conventional loan. But cannot be a multi-family residential home. A multi-family residential homeowner can qualify for another owner-occupant home in one year. But needs to be a single-family home. A single-family homeowner cannot qualify for a multi-family residential property as a primary residence.

Using Rental Income On Proposed Multi-Family 2-4 Unit Mortgage Loans

The great news for two to four-unit home buyers is that they can live in one of the units and rent out the remaining units. HUD allows 85% of the potential rental income on the rental units to be used as qualified income when lenders calculate borrowers’ debt-to-income ratios.

Borrowers buying a two-to-four unit multi-family home can use potential rental income if the appraiser lists the market potential income on the appraisal report. The potential rental income can be used for debt-to-income ratio calculations.

The home appraiser provides the potential rental income figure. Home buyers of multi-unit properties who intend on living in one of the apartments and renting the other units out for at least a year. It is allowed if homeowners intend to vacate the property and convert all of them as rental units.

HUD Occupancy Owner-Occupant Multi-Family Mortgage Guidelines

HUD requires owners of multi-unit properties to live in one of the units for at least one year. Circumstances change, and HUD realizes that if the property vacates the multi-unit before the one year, that will be fine. The four-unit multi-family homeowner might decide to move out of the multi-family residential property due to needing more space.

Owner-occupant owners of two-to-four unit multi-family homes can be eligible to qualify for another owner-occupant home and keep the multi-unit as a rental if they need a single-family home due to an expanding family.

If so, they can qualify for another owner-occupant conventional mortgage. Borrowers will not violate the conditions of HUD if they need to move out of their multi-family residential property after they purchase due to them needing more space due to having a new baby on the way or other extenuating circumstances.

Fannie Mae Multi-Family Home Down Payment Guidelines

Buying a multi-family home with only 3.5% down is a great way of being a homeowner and a property investor at the same time. The rental units in multi-family homes can be used to qualify for an income. A 15% down payment for conventional loans is required for an owner-occupant two- to four-unit multi-family loan. 15% down payment for conventional loan required for owner-occupant 2 to 4 unit loans

Frequently Asked Questions (FAQs)

- What is an owner-occupant multi-family mortgage?

An owner-occupant multi-family mortgage is a loan specifically designed for individuals who intend to live in one of the units of a multi-family property while renting out the others. - How many units are typically allowed in an owner-occupant multi-family property?

Owner-occupant multi-family mortgages are typically available for properties with up to four units. - What are the benefits of obtaining an owner-occupant multi-family mortgage?

Benefits include potential rental income to offset mortgage costs, building equity through property appreciation, and tax benefits like claiming deductions for mortgage interest and property taxes can be advantageous. - What are the requirements to qualify for an owner-occupant multi-family mortgage?

Criteria can fluctuate among lenders but typically involve maintaining a favorable credit score, stable income, a sufficient down payment (usually around 3-5% of the purchase price), and meeting debt-to-income ratio guidelines. - Can I use rental income from other units to qualify for the loan?

Yes, lenders may consider some of the rental income from other units to help qualify for the loan. However, this varies by lender and depends on the property’s rental history and market conditions. - Do I need to live in one of the units permanently?

Yes, owner-occupant multi-family mortgages typically require the borrower to occupy one of the units as their primary residence for a specified period, usually at least one year. - Are there any restrictions on renting out the other units?

Some lenders may restrict renting out other units, such as requiring long-term leases or prohibiting short-term rentals like Airbnb. It’s essential to clarify these restrictions with your lender. - Can I use an owner-occupant multi-family mortgage for investment purposes only?

No, these mortgages are specifically designed for owner-occupants intending to live in one of the units. Using the property solely for investment purposes may require a different type of loan. - Are there any special considerations for property maintenance and management?

As the owner-occupant, you’re responsible for maintaining the property and managing tenant relations. Budgeting for maintenance expenses is essential, as well as being prepared to address any issues promptly. - Can I refinance an owner-occupant multi-family mortgage if I no longer intend to live in one of the units?

Refinancing options may vary, but if you no longer occupy one of the units, you may need to refinance to a different type of loan, such as an investment property mortgage.

Borrowers of 2 to 4-unit multi-family properties require principal, interest, taxes, and income reserves. Buyers of multi-family homes can contact us at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com. We are available evenings, weekends, and holidays seven days a week. Speak With Our Loan Officer for Mortgage Loans

Hi Gustan

I spoke with you and your associates about 8 months ago regarding getting pre-qualified for a VA loan in the state of Tennessee. At the time, my credit report showed some missed payments over the last 12 months due to some private student loans that were inaccurately labeled on credit report.

We should be at a point now where we have nothing missed or later over the last 12 months.

My income is about 110k. I have been with my current company for about 6 years. I have (4) charge off’s on my credit report that goes back to 2016/ 2017

My wife makes about 85k but she just started a new job. same field that she has been working in for many years.

Looking to see if you think you can help us get a pre-qualification letter so that we can make an offer sometime in the Nov -Dec timeframe

Kevin Pendergast